US Alcohol Sales in High Spirits

Supply Chain Reactions

A Condensed Update For American Shippers

Issue Date: June 25, 2020

Quote of the Issue:

“Don’t ever make decisions based on fear. Make decisions based on hope and possibility”

– Michelle Obama

US Alcohol Sales: Wine and Spirits Proving to be “Essential” for Americans

ShapLight Focus: US alcohol sales have been 20% higher or more year-over-year for 8 straight weeks with wine sales topping a 30% increase for 2020

- The USDA’s Farmers to Families Food Box Program has delivered more than 20 million food boxes in support of American farmers and families

- New Zealand, Australia, Singapore, Canada, and Chile have committed to removing existing trade barriers for 120 types of medical supplies to improve cargo flows

- US casual dining coverage has reached 50% with 87% of restaurants open but at diminished capacity

- The US Department of Defense signed a $100M agreement with the US International Development Finance Corporation to subsidize growth in US medical product manufacturing capabilities

- The Small Business Administration is accepting Economic Injury Disaster Loan applications from qualified small businesses and US agricultural enterprises

- As countries grapple with recent failures in the global medical supply chain, the WTO has stressed that importing and foreign sourcing are not the problem; it is the dependence on single suppliers and origins that create the failures

Government Corner: The US Threatens a Second Trade War

ShapLight, Focus: The number of positive COVID tests in CBP now nears 700

- The US has threatened new or increased tariffs on $3.1 billion of European exports, raising some duties to 100% as soon as mid-August; the focus will be primarily on luxury food and wines and spirits from Germany, France, Spain, and the UK; the threat is just the latest chapter of a now 15-year-old World Trade Organization (WTO) battle over subsidies to Airbus by the EU and to Boeing by the US

- The US Environmental Protection Agency (EPA) ordered eCommerce platforms, such as Amazon and eBay, to immediately halt the sale of a range of “pesticide” products, such as “epidemic prevention bleach” and “coronavirus disinfectant”

- Starting July 1st, the USMCA will officially replace NAFTA

- Fish and Wildlife will become mandatory in ACE starting July 6th; this covers 268 tariff codes that may have augmented filing requirements

- The USDA delivered an additional $288 million to the Coronavirus Financial Assistance Program (CFAP); CFAP payments to American farmers have reached over $1 billion

Despite Governmental Aid, Expectations are Bleak for GDP

ShapLight Focus: The global total of COVID-related financial aid for companies and workers has now topped $11 trillion

- The International Monetary Fund (IMF) downgraded their already gloomy outlooks for GDP in 2020; they are now predicting a decline of 5% globally, 8% for the US, and over 11% for the EU and UK

- Total unemployment benefit payments in the US reached almost $23 billion in May; this figure is more than 10 times May 2019 and is an all-time US record

- The Morgan Stanley Capital International’s world index of global stocks is now 7% down since January’s Wuhan lockdown

US Transportation Infrastructure

ShapLight Focus: As of June 12, transportation (excluding airlines) and warehousing firms have received 161,794 Payroll Protection Program loans with a total value of $16.4 billion; this represents less than 5% of the program’s total allocations

- The US DOT has begun funding the Infrastructure for Rebuilding America (INFRA) program; they recently announced that the Port of Houston will receive $79.4 million

- Industrial real estate experts are forecasting an increased demand for warehouse space topping 500 million square feet in the next two years due to the fact that e-commerce fulfillment requires three times the warehouse space of traditional warehousing; 500 million square feet is approximating 14,000 acres or the size of Manhattan

- The Cass Freight Index, a broad indicator of US trucking health, was down over 20% in May 2020 vs. 2019 for both total shipment volume and shipper trucking expenditures

- Trucking data for June, however, shows marked improvements in two key ratios; the loads per truck index is up 38%, and the avg rate per mile is up almost 10%

- Intermodal rail moves continue to be down 12-14% per week, and analysts believe the US rail slow-down will be more persistent than trucking due to the low cost of diesel fuel

- Bucking US trends, The Richmond, VA Marine Terminal has handled 24% more cargo volume in 2020; the growth is attributed to an increase in agricultural trans-loading and food distribution center demand

Shaprio’s Import Ocean Freight Report

India and Pakistan:

ShapLight Focus: US import rates from India sit at 81-84% compared to Asia, and Pakistan rates are just 62-65% on the same scale

- Ocean rates from India to the USEC have been remarkably stable during COVID with a spread of just 6% from high to low since March

- Similarly, ocean rates from Pakistan have shifted just 9% from high to low since February with June levels establishing the low

- Ocean rates to the USWC from both India and Pakistan have been much more volatile, with a 33% increase from India in the last month and a 15% increase from Pakistan over the last six weeks

Continental Europe and the Mediterranean:

ShapLight Focus: While WC and EC rates are currently within 15% for Asia, imports from Europe to the USWC are roughly 40% higher than USEC rates

- In 2019, import rates from Continental Europe varied just 6% from high to low; 2020 has been much more volatile, with a 16% variance from the top to the bottom of the market

- Current average 40’ rates from Northern Europe are $2000 to New York and $3300 to LA

- Rates from the Mediterranean have been gradually descending since March with a July GRI expected to be offset by lower BAF levels

- Current rate levels out of the Mediterranean are about 5-6% lower than Northern Europe’s numbers

Latin America:

ShapLight Focus: Despite our best efforts, there are times when our ShapLight research does not reveal a story; while COVID has wreaked havoc on origin trucking and port operations, the rate picture for Latin America (both coasts) to US (both coasts) has been remarkably flat for several months

- Typical ocean rates from West Coast Latin America: $1550/40’ to either coast

- Typical ocean rates from East Coast Latin America: $1700/40’ to USEC and $2400/40’ to USWC

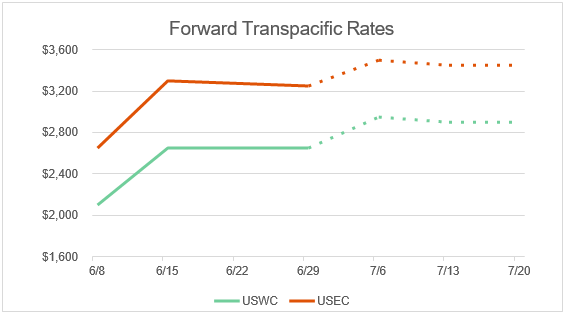

Asia and Transpacific:

ShapLight, Fact of the Week: After rising $1077 in two weeks, the US West Coast (USWC) spot rates from Asia reached a ten-year high of $2755 per FEU

- While June demand still trails 2019 by over 10%, suppressed capacity (primarily in the form of 74 blank sailings in May and June) have allowed carriers to increase rates 184% to the West Coast and 128% to the East Coast since May

- Total US imports from Asia were down 18.3% in March, 1.7% in April, and 18.5% in May

- There is growing tension between BCOs and ocean carriers with the carriers claiming that importer forecasting is uneven and no-show bookings are at all-time highs; for their part BCOs believe that carriers are making excuses for the suppression of supply

- BAF charges will decrease on July 1, while actual reductions vary tremendously by ocean carrier; industry pundits estimate the average savings to be 4% per 40’ to the US East Coast (USEC)

- A whopping nine ocean carriers are now offering “premium” services with faster guaranteed transit times and greater space protection at markedly higher rates

- Despite a decline in blank sailings, the trade expects a GRI of between $200-$300/container on July 1 for both coasts and Chicago

Please note Shapiro’s forecast for future rates on the Transpacific trade:

In a World of Bad News, a Few Silver Linings

ShapLight Focus: As New Yorkers celebrate their phased re-opening, fireworks complaints in the five boroughs have exploded by 40,000%; there have been 11,275 complaints in the first three weeks of June alone!

- US domestic flight searches online are down just over 40% in May-June after having been down 80-95% in March-April

- The IMF has forecasted global GDP growth of over 5% for 2021

- For June to date, $46.7 billion in US high-yield “junk bonds” have been sold, already the highest total in history

- The Senate voted to pass the Great American Outdoors Act, which frees $20 billion for repairs and maintenance of America’s national parks and public lands

- Netflix CEO Reed Hastings and his wife Patty Quillin are gifting $120 million to historically black colleges and universities with the goal of supporting 600 students over the next decade

Shap Fact of the Issue:

US home-buying activity is up 25% in May to June after having been down 21% in April.

The leadership and staff of Shapiro understand the personal and business anxiety each of you is experiencing. We want nothing but safety today and a return to normalcy tomorrow for you and your families. Please reach out to us if you have any questions—or if we can assist you in any way.

Up Next: USTR Announces Additional Duties on French Luxury Goods