The Problem with Ocean Freight and Air Cargo Rates

Supply Chain Reactions

A Condensed Update For American Shippers

Issue Date: January 19, 2022

Quote of the Issue:

“We may have all come on different ships, but we’re in the same boat now.”

– Martin Luther King, Jr.

Adios Coming for the USMCA?

ShapLight Focus: Congress is pressuring the Biden Administration to bolster US-Mexico-Canada Agreement (USMCA) enforcement efforts— especially with Mexico— on labor, agriculture, telecom, energy, environmental initiatives, and services; while these ambitious and wide-ranging efforts could greatly open markets for US companies, they could also easily result in trade retaliation measures

- On January 6th, Lisa Wang began her new position as Assistant Secretary of Commerce for Enforcement and Compliance (E&C); the Department of Commerce commented that the E&C “leverages its expertise in compliance by holding US trading partners accountable to their obligations under existing multilateral, regional, and bilateral trade agreements”

- Many industry insiders see the Wang appointment as a move to improve the US’s effectiveness in the World Trade Organization (WTO), especially as future disputes relate to US-China trade

- The Bureau of Industry and Security (BIS) has suggested new controls on cybersecurity items that impact national security and anti-terrorism efforts including a new license exception; after reading comments submitted from the trade last month, officials have decided to delay the interim final rule until March 7, 2022, to allow the industry sufficient time to comply with the changes

- After a recent White House proclamation, the new World Customs Organization’s (WCO) Harmonized System tariff nomenclature will go into effect on January 27th

Ocean Freight Rates Will Not Abate

ShapLight Focus: After eclipsing an $11,000 per container average for the first time in history, the Freightos Global Container Global Index sits at $9,500 and 170% higher than one year ago

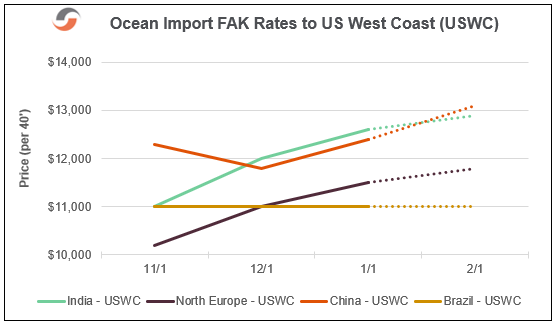

- Though FAK rates have improved, the problem for American importers is that less than 50% of the transpacific ocean market is moving on FAK rates

- When considering premium and co-load options, the average 40’ rate to the USEC is just under $17,000— which is over 200% above last January

- By the same token, USWC rates (per 40’) average a staggering $14,500 and 235% higher

- January’s planned operational blank sailings on the transpacific total just under 120,000 TEUs (20% of nominal total capacity) after December’s 160,000 TEUs (30%); January’s blanks also taper down as the month progresses, ending the month near 10%

- For an industry desperate for good news, the diminishing blanks will only exacerbate US port congestion as dockworkers battle Omicron

- The $4B of merchandise traveling through Ningbo each week seems to be flowing much better than feared, but Omicron outbreaks in Tianjin and New York will certainly hinder efficiencies in those critical operations; after averaging just 1.6 for all of 2021, New York vessel wait times are above 5 days, with as many as 25% of dockworkers calling in sick

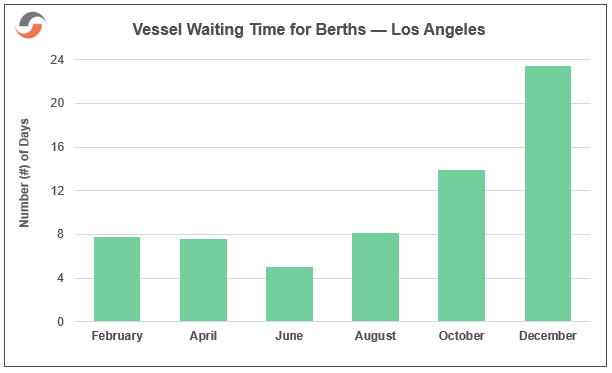

- While we read about landside efficiency improvements in Los Angeles/Long Beach (LA/LB), the average vessel wait time has reached an unbelievable 23.4 days, with over 100 vessels at anchor or at drift in their harbor

International Air Cargo Transits Taking Off

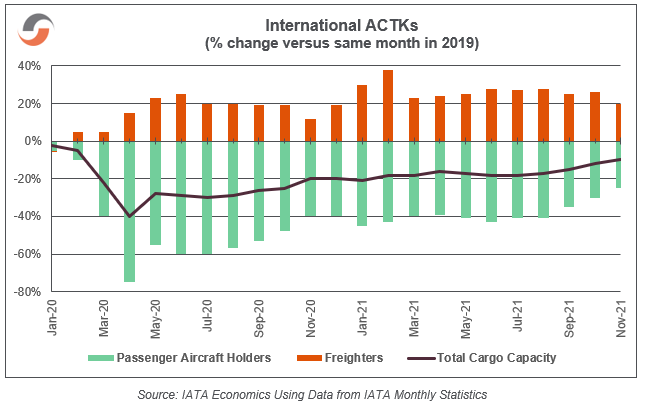

ShapLight Focus: The average transit time for international air cargo is almost 50% longer than pre-pandemic levels due to congestion-related inefficiencies; the industry is suffering from Covid labor shortages, crew quarantines, trucking congestion, insufficient airport storage space, and cargo backlogs from ocean to air conversions

- Though still at the highest volume levels in history, November cargo ton kilometers (CTKs) grew only 3.7% over November 2019; this is the lowest growth rate since January 2021

- The top three airlines for air cargo CTKs in 2021 were (in order): Federal Express, United Parcel Service and Qatar Airways

- The top three airlines for passenger kilometers in 2021 were (in order): American Airlines, China Southern Airlines and Delta Airlines

- Passenger belly space—typically 50% of global cargo capacity—fell to 18% in 2021; total available capacity in the industry was down 13.4%

- Airline load factors for international cargo improved 12.3% for 2021 vs. pre-pandemic standards and eclipsed 64% overall; the Asia Pacific led the pack with 74% efficiency

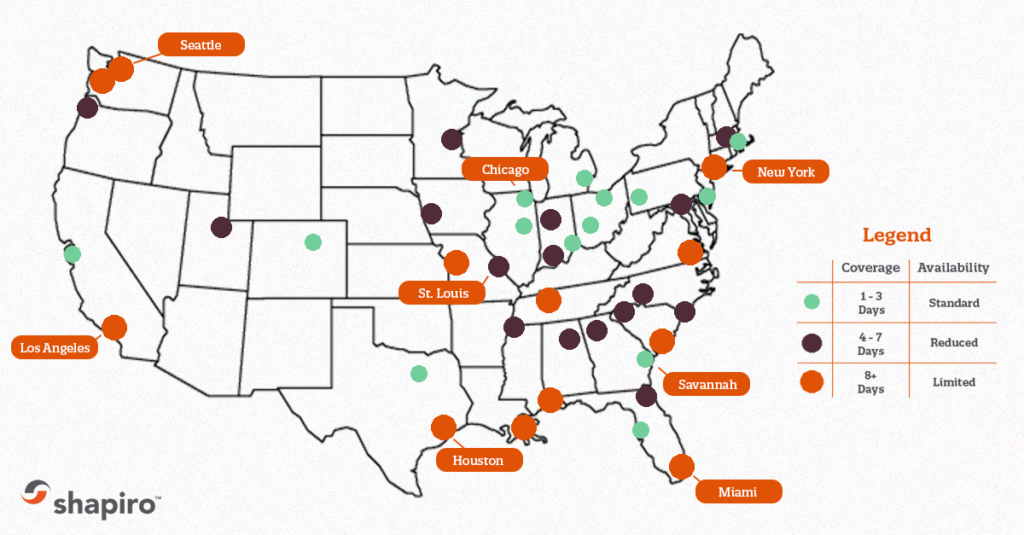

Please note our ‘Orange Crush’ Map of US Drayage Backlogs:

Import Freight Rate Trend Charts

Ocean Import FAK Rates to US West Coast (per 40’):

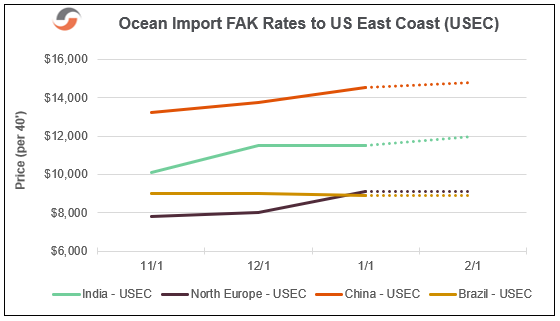

Ocean Import FAK Rates to US East Coast (per 40’):

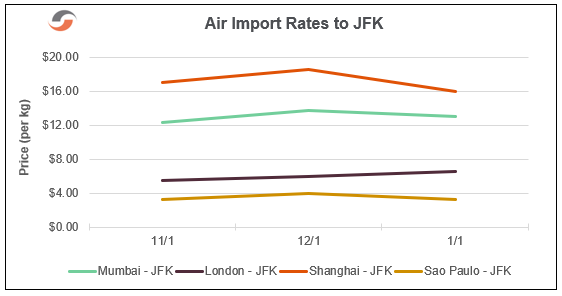

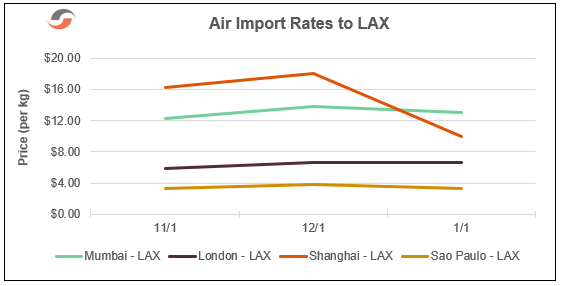

Air Rate Trends

Our Expert Shapinion

‘Twas one more surprising year

It started with anguish and fear.

Vaccines came around

Some freedom re-found

With hope we were then in the clear.

But outbreaks were still to appear

It seemed the end was not quite near.

And ports were locked down

And labor not found

The challenges became severe.

The freight market, a thing to watch

Each day, the rates moved up a notch.

Contracts were worthless

Customers, mirthless

Was tempting to just turn to scotch.

This translates to challenges with freight

Congestion and problems too great.

We fight with the lines

‘Bout the remarkable fines

And we help get customers straight.

Dear ol’ drayage was a nightmare

Confirmed slots do provoke fanfare.

Truckers in a jam

Port turns just a sham

No wheels, no chassis, is this game fair?

Oh, Long Beach, oh, Los Angeles,

New government evangelists.

Boats anchored at bay

Shippers feel dismay

The trade asks, “can’t you handle this?”

Ocean rates more than a new car

Profits flow beyond the cookie jar.

Carriers wealthy

Blank sailings stealthy

Pushing three year deals is too far.

Here’s to a better Twenty-Two

To the madness last year, say “Shoo!”

Demand simmers down

High rates make us frown

The way we were treated pure doo doo.

Shap Fact of the Issue:

In 2020, Americans set a record by giving $471B to many diverse charities. While full data will not be available until April, many financial observers expect the US to shatter this record once all data is collected for 2021.

The leadership and staff of Shapiro understand the personal and business anxiety each of you is experiencing. We want nothing but safety and a return to normalcy for you and your families. Please reach out to us if you have any questions—or if we can assist you in any way.