What’s an Importer to Do About the Chinese (Section 301) Tariffs?

“Knowledge is power.” – Sir Francis Bacon

We couldn’t agree more! Freight is a variable game, but regulatory compliance requires a solid foundation of knowledge and experience. And Shapiro has over a century of that!

- Is your company being affected in some way by the imposition of additional Chinese tariffs under Section 301?

- Will these additional costs cut into your bottom line profitability?

What better time to leverage our vast knowledge and experience than to respond to the rounds of excessive additional Chinese tariffs that have been proposed, that will undoubtedly have a negative impact to your business?

First, Some Background: The Section 301 Tariffs

As you are aware, on July 6, 2018, with the trade war between the US and China looming, the United States Trade Representative (USTR) implemented the imposition of an additional 25% duties on $34 billion on certain Chinese imports that contain “industrially significant technologies,” The finalized list of the 818 products subjected to the new tariffs can be found on the USTR website using this link here.

On June 15, 2018, the USTR subsequently announced a proposed second list of 284 additional subheadings, worth $16 billion, subjected to 25% additional tariffs. The comment period for this list ended July 23, 2018. The finalized list of affected tariffs can be found here. The duties for all but a handful of these tariffs went into effect on August 23rd.

And on July 10th, a third list encompassing 6,031 items, that may be subjected to 10% (or possibly 25%) additional duties and valued at $200 billion, was released. A complete list of the products subjected to the tariffs can be found here on the USTR website. Hearings and the comment period closed on September 6th. It is likely that duties will not go into effect until mid to late September, or later.

What’s an Importer to Do?

- Option 1: File for an Exclusion

You certainly have many justifiable reasons for opposing the tariffs that have been proposed. As an example, up to July 10th, the approach to the 301 tariffs had been to avoid imposing duties on consumer goods. Round 3 changed all of that! While USTR has not yet published anything about the standard that they will use for making an exclusion determination, we believe one of the strongest arguments out there is that the goods are consumer goods. Well, there is a method for fighting back! Please note: At this point, this option is only available for the finalized list (lists 1 and 2).

Shapiro has aligned with a Customs attorney from Thompson Coburn to make the filing process both easy and cost-effective for you. Please reach out to [email protected] for simple-to-use instruction and pricing.

- Option 2: Re-evaluate your Classifications

It is always a good idea to take a second look at how your products are classified— especially with consideration to some binding rulings that are on file. While some classifications are straightforward, others can be very gray. Addressing gray areas can be a difficult exercise; it requires both expert interpretation of the tariff schedule—and oftentimes expert strategies.

Shapiro has a team of licensed tariff experts on staff. Let us review your product classifications to identify associated risks, as well as potential opportunities. Please reach out to [email protected] to get started, and for pricing.

- Option 3: Re-evaluate your Product Designs

Let’s collaborate together! A slight modification to your product may be all that you need in terms of a legal alternative to these unanticipated tariffs. Sometimes all it takes for a tariff adjustment is a very small change in design. Remember, duty rates are determined based on the product’s condition at the time of import. Shapiro has a team of licensed tariff experts on staff. Let us review your product classifications to identify potential opportunities. Please reach out to [email protected] to get started, and for pricing.

- Option 4: Consider Alternate Sourcing

Right now, China is the primary country under “fairness” scrutiny. Certainly, this is subject to change. Is it possible to source your product from another country from which the additional tariffs would not apply?

Shapiro has a team of marketing experts on staff. Let’s discuss your product line and work together to identify other potential sourcing locations. Please reach out to [email protected] to get started, and for pricing.

- Option 5: Consider Drawback

Did you know that commodities subject to Section 301 punitive tariffs remain eligible for duty drawback? While you still are required to outlay a 25% tariff at the time of entry (and while the return will not be immediate), if your company imports and exports, this option may help to mitigate your losses.

Shapiro has a team of licensed tariff experts on staff. Let’s discuss this duty recovery opportunity together. Please reach out to [email protected] to get started, and for pricing.

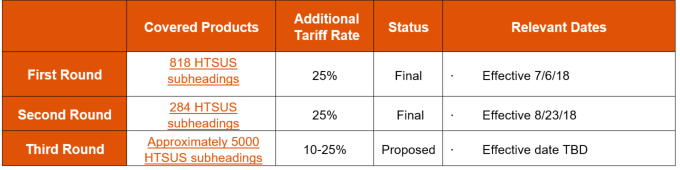

A Quick Section 301 Reference Chart

First round: 818 HTSUS subheadings

Second round: 284 HTSUS subheadings

Third round: Approximately 5000 HTSUS subheadings

In closing, we wholeheartedly agree, knowledge IS power. Shapiro is a powerful partner. Give us a call. We are here to help!