The Science Behind the Ocean Shipping Alliance

When it comes to ocean freight, it can be easy to observe the competitive nature of shipping rates, service loops and trade lanes and label it market share dog-eat-dog. However, the shifting landscape has affected most ocean carriers in similar ways—which has led to a paradoxical emergence of alliances between carriers.

Shipping alliances are an essential facet of international logistics, promoting efficiency in a complex global trade environment. As these alliances evolve, understanding their background, structure, and implications becomes crucial for stakeholders in the shipping industry.

First, let’s dissect the basic alliance science—or as we like to call it…. Astro-logistics!

Astro-Logistics: The Basic Science Behind the Alliance

What are ocean shipping alliances?

Shipping alliances are collaborations among various shipping lines that enable them to operate collectively on specific routes. By pooling resources, these alliances can optimize vessel usage, reduce costs, and offer more competitive services.

The primary benefits of shipping alliances include stabilized freight rates, increased capacity management, and enhanced operational efficiencies. They enable carriers to share costs, minimize redundancies, and provide customers with a wider range of services.

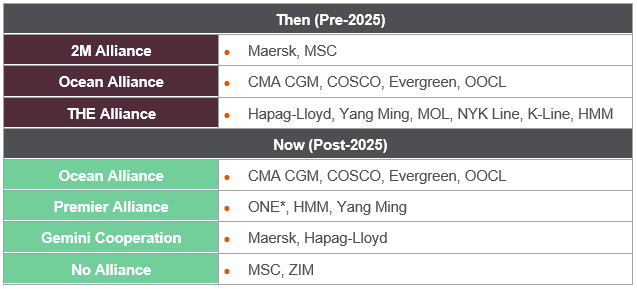

Carrier Compatibility Charts: Then & Now

Here is a “berth chart” containing a brief overview of the recent major shipping alliances from their origins, evolutions, and a brief introduction to the new alliance structures entering the market this year. We will review each one individually in the next section.

*Ocean Network Express (ONE) is a consolidated partnership of K-Line, NYK, and MOL, former members of THE Alliance.

Shipping Alliance Cosmologies: Key Changes in 2025

Now that we’ve laid the foundation, it’s time to align our planets and delve a little deeper. With the 2025-26 contract season on the horizon, it’s important to take the time to retrograde back and refamiliarize yourself with the various shipping alliances between carriers—both past and present. That way, you and your business will be in the right cosmic position, armed with the information and data needed to ensure a diversified and well-rounded variety of options available in the upcoming year.

The Dissolution of the 2M Alliance

The 2M Alliance, formed in 2015 by Mediterranean Shipping Company (MSC) and Maersk, was designed to optimize transpacific shipping routes and facilitate global trade. However, this alliance is set to dissolve in 2025, potentially leading to significant shifts in the market. The dissolution of the 2M Alliance may result in short-term volatility in freight rates. Both MSC and Maersk are likely to establish independent pricing models, influencing the overall market dynamics.

The decision to dissolve the partnership was primarily driven by Maersk’s shift towards an integrated logistics model, which focuses on providing end-to-end supply chain solutions, while MSC is concentrating on expanding its fleet and pursuing independent operations. Additionally, increasing market competition and regulatory scrutiny have prompted carriers to reconsider traditional alliances, favoring more flexible partnerships instead. As a result, both Maersk and MSC now have greater operational flexibility, allowing them to tailor their services without the constraints of an alliance.

Ocean Alliance Remains Unaltered

The Ocean Alliance (OA)—which includes CMA CGM, Evergreen Line, COSCO Shipping and OOCL (a subsidiary of COSCO)—was established in 2017. Last year, it extended its contract agreement through 2027 and then again to 2032. The Ocean Alliance continues to emphasize the Asia-Europe and Trans-Pacific trade lanes, solidifying its presence as a major player in these critical markets.

Members of the alliance are also boosting their fleets and expanding their service offerings, pooling more vessels and enhancing their overall portfolios. This collaboration leads to greater market stability, as shippers can rely on long-term partnerships that offer more predictable rates and routes. Unlike the Gemini Cooperation, Ocean Alliance is increasing their number of direct port calls.

THE Alliance Reemerges as Premier Alliance

Founded in 2017, THE Alliance initially included Hapag-Lloyd, Yang Ming, Hyundai Merchant Marine (HMM), Mitsui O.S.K. Lines (MOL), K-Line and NYK Line. Hapag-Lloyd will exit the alliance in 2025, marking a pivotal change in its structure. While the bulk of the existing membership will remain moving forward, the group will enter the network under a new name in 2025: The Premier Alliance (PA). The newly dubbed Premier Alliance includes Yang Ming, HMM, and Ocean Network Express (O.N.E.)—which combines NYK Line, MOL and K-Line.

The members of the Premier Alliance will focus on major East-West trade routes, linking Asia with the US West Coast, US East Coast, the Mediterranean, Northern Europe, and the Middle East. Additionally, the group announced a slot exchange agreement with MSC for nine Asia-Europe services, as MSC chooses where to operate independently and where to combine forces.

The Debut of Gemini Cooperation

The highly anticipated Gemini Cooperation (GC), set to launch in 2025, forges a new partnership between behemoths Maersk and Hapag-Lloyd. After jumping ship (literally) from their respective alliances, the duo will join forces to address key concerns for global shippers. Their network aims to improve service and transit reliability by using the hub and spoke method to offer better schedule integrity, streamline operations by optimizing port rotations and reduce congestion.

Fewer ports of call also allow the Gemini to emphasize the use of Maersk-owned terminals; this will allow the alliance to mitigate costs while commanding priority loading/unloading services.

Both companies are also heavily investing in digital freight solutions, enhancing cargo tracking and logistics management for a more seamless experience for customers.

The Independents

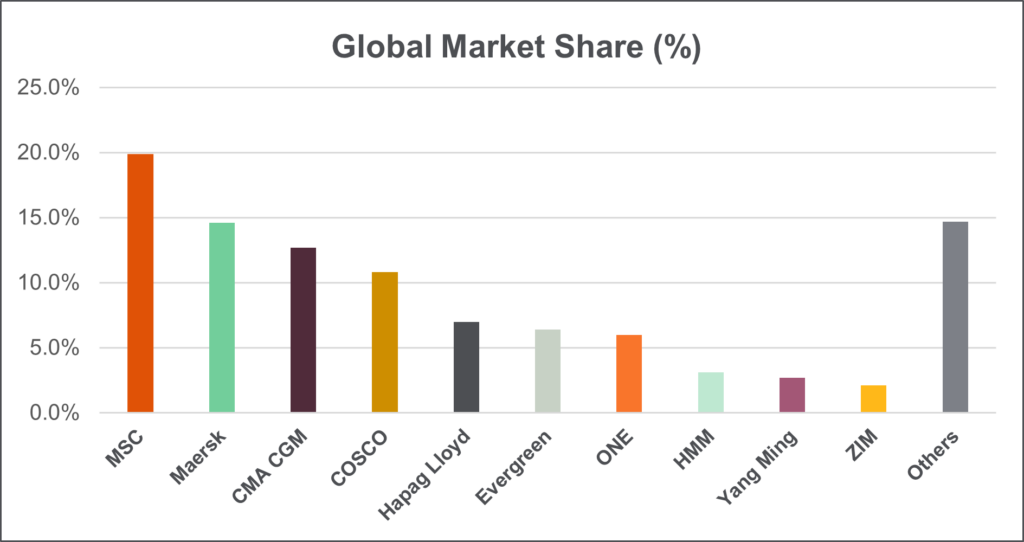

Lastly, MSC, previously part of the 2M Alliance, along with ZIM, will operate independently in 2025. The free agents will offer a new range of market options and ignite the carrier-shipper competition overall. MSC is now the largest carrier on planet Earth; watch out!

Reading Between the Shipping Lines

Now that you know the science behind the alliance, as well as some of the partnership changes set to re-balance the market in 2025—let’s talk about what this might mean for you.

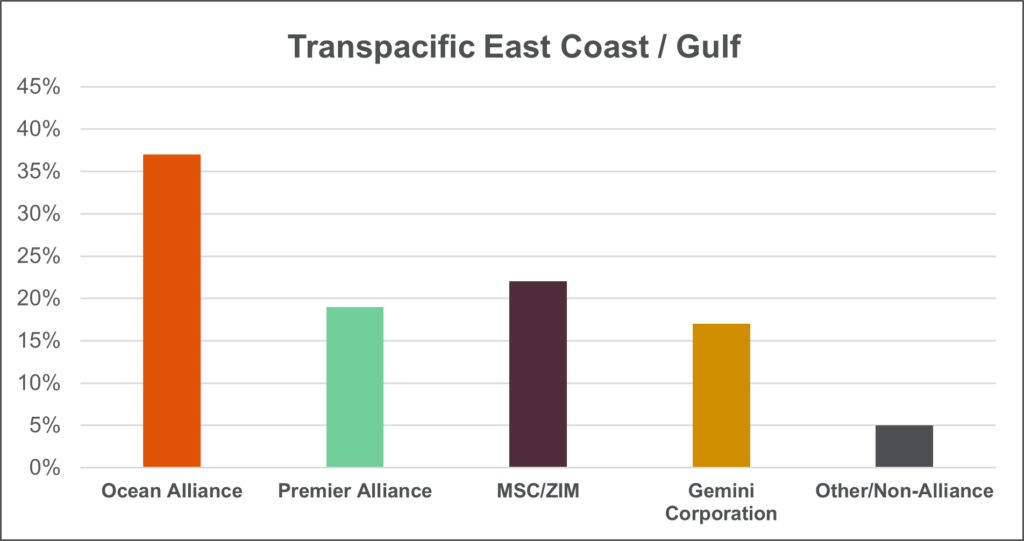

Carrier Constellations: Tracking the Market Shares

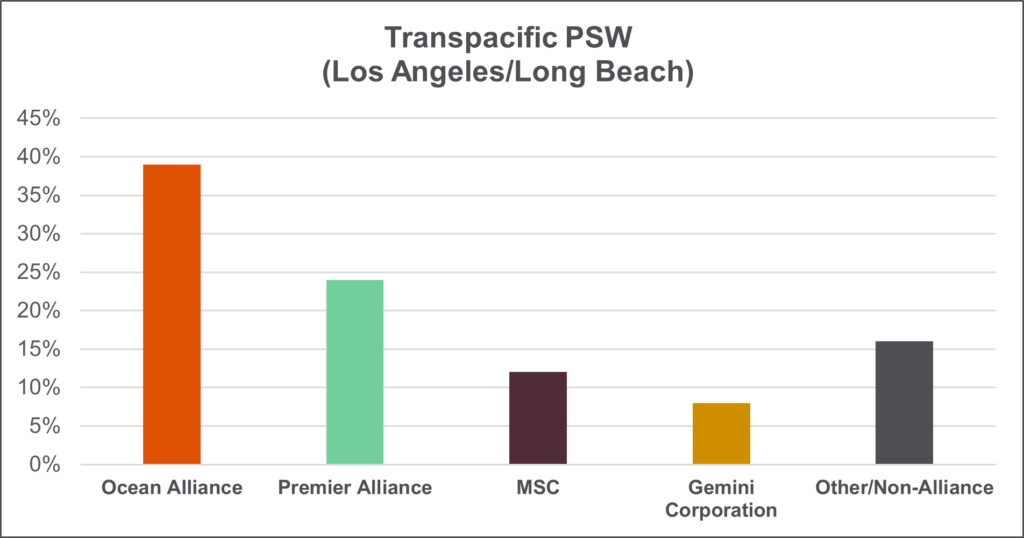

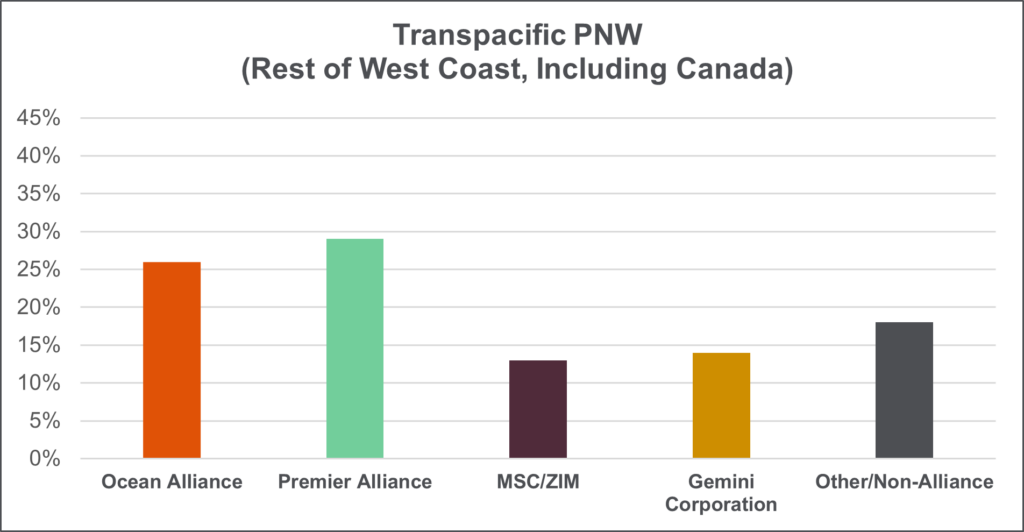

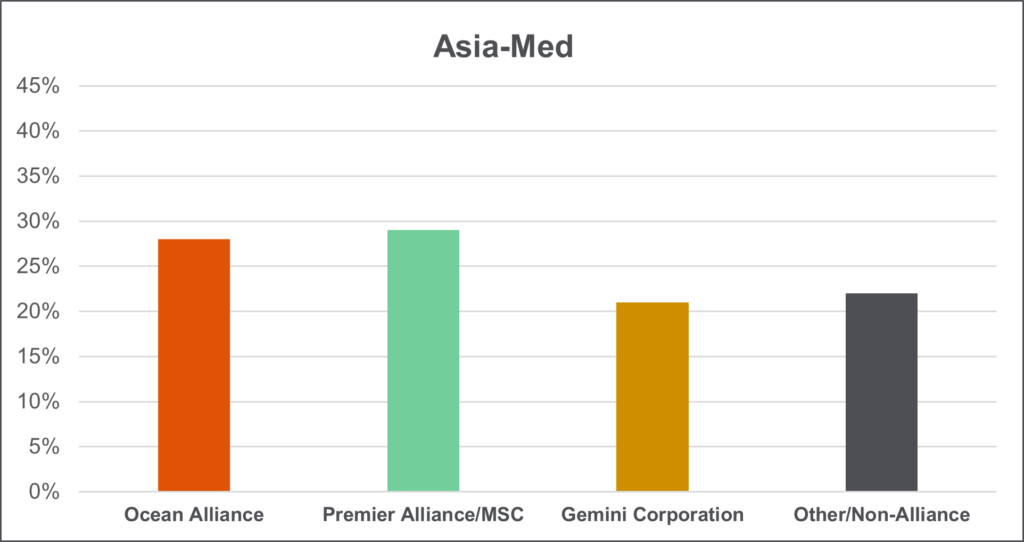

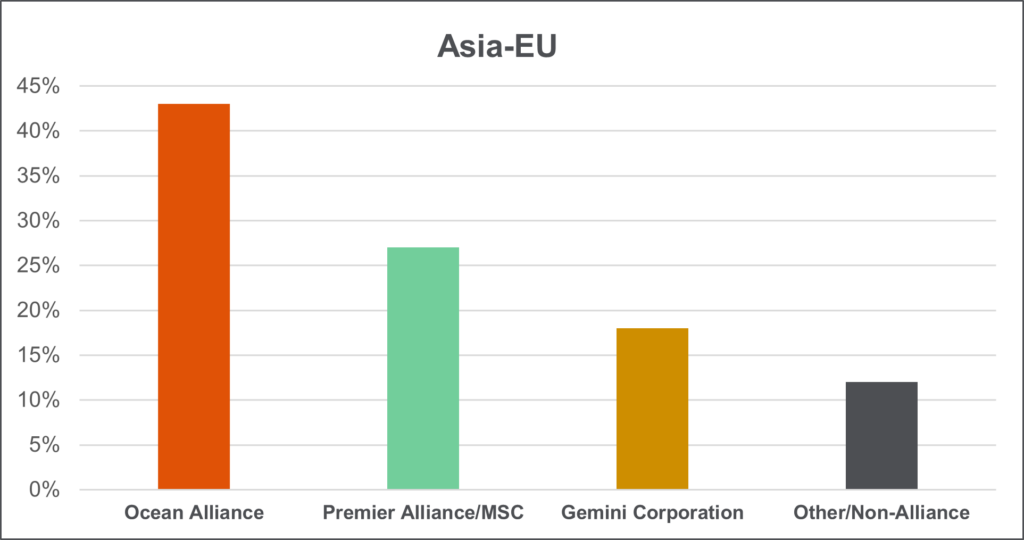

Between the shifting alliance structures and service changes, global supply chains need to take a hard look at the new playing field. We thought it might help to break down the carrier market shares in more relative terms. The following charts depict the market share of each alliance by trade lane.

Alliance Alignment: Signs of the Trade

Finding Your Perfect Contract Match

Matchmaker, matchmaker; make me a [contract] match! Here are a few things to consider when perfecting your contract methodology in the upcoming season:

- Contract Renegotiations. The emergence of new partnerships will necessitate renegotiations of contracts. Shippers may need to explore alternative route options due to increased contract costs, with reports indicating transpacific carrier contracts could rise by up to 20% for 2025-26. This uncertainty might render shippers hesitant to commit, particularly with the looming questions regarding global trade and tariffs.

- Access to All Alliances (and MSC!). With an abundance of capacity from new vessels and the eventual return to Suez use, most pundits expect a buyer’s market in 2025. As Gemini focuses on transit predictability, they are cutting direct service calls. As MSC makes use of their massive collection of vessels, they will likely do the opposite. Our other friends, Premier and Ocean, are well-positioned to offer a solid blend of service versatility and reliability. In today’s game, bigger shippers need to combine BCO contracts with solid NVO options in case the FAK market crashes and in case back-up options are needed in peaks. Smaller shippers can typically gain access to all alliances by choosing the right forwarder/NVO (we know one that starts with the letter S!).

- Leverage Logistics Technology. Alliances like Gemini and Ocean are placing an enhanced emphasis on digitalization and operational efficiency. Supply chain managers should leverage these tech-driven logistics solutions to optimize their operations. Shapiro has spent the greater part of this decade working to enhance our existing logistics technology. After some initial experimentation, we are set to launch our new Shapiro 360 product, to help make our customers’ technological dreams come true.

Avoiding Potential Horror-scopes

In navigating the future of international shipping, staying informed about alliance changes is essential for industry stakeholders. It is prudent to diversify partnerships to ensure that portfolios include multiple carrier contracts, protecting against potential limitations in options—after all, you don’t want to be tied to a single star in a vast constellation of opportunities. Additionally, contract strategy adaptations to incorporate flexible terms will be vital to respond to fluctuating market conditions and prepare shippers for potential rate increases soon. By adopting a proactive approach, companies can align their star carriers to position themselves favorably in a changing global trade environment.

And there you have it…you are officially an Astro-logistics-ist. Congratulations!