Navigating international trade regulations can be complex, especially when dealing with U.S. Customs and Border Protection requests.

Customs Form 28 (CF-28) can cause anxiety and confusion for importers. However, understanding its purpose and responding accurately can ensure compliance and smooth imports.

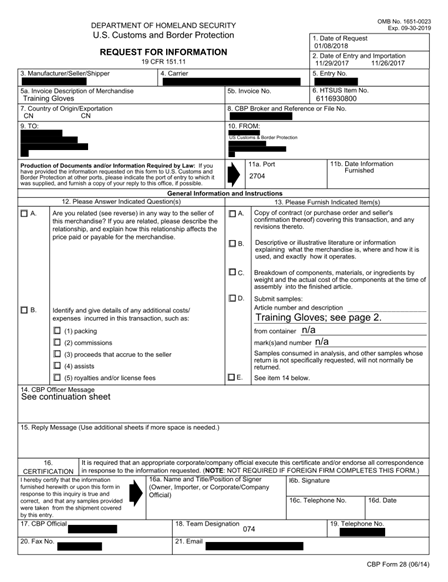

Understanding Customs Form 28 (CF-28)

Customs Form 28 (CF-28) is a request for information issued by U.S. Customs and Border Protection (CBP).

You might receive a CF-28 when the CBP requires additional documentation or clarification on your shipment. These requests often arise during the routine review process of your import entries. The intent is to ensure that all goods comply with U.S. import regulations, duty assessments, and tariff classifications. Addressing a CF-28 promptly and comprehensively can considerably mitigate potential delays and penalties.

Another reason might be when CBP audits your company’s past import activities. Such verification ensures compliance with U.S. regulations and promotes transparency within import operations, affirming your business’s commitment to lawful practices.

Typically, these requests necessitate prompt and detailed responses to avoid delays in your supply chain. Being proactive in your documentation and familiarizing yourself with common CF-28 inquiries can significantly improve your response efficacy, thus minimizing potential disruptions to your business operations. After all, preparation is the key to seamless international trade experiences.

Key Sections of CF-28

Understanding the structure and critical elements of the CF-28 significantly enhances your response strategy. The form comprises several key sections, each demanding precise and well-organized information.

First, there is the “Entry Number” section. This part links the CF-28 to a specific import entry.

Next is the “Description of Goods” section, where you must confirm product details such as model numbers and specifications. Accuracy in this section is crucial for avoiding potential penalties or sanctions.

The “Request for Information” section outlines specific details or documentation the CBP requires. This section may ask for additional invoices, certifications, or detailed explanations to verify compliance with federal regulations. A timely and comprehensive response here can profoundly impact your business’s compliance stature.

By thoroughly understanding and accurately completing these sections, you position yourself for successful customs interactions. This proactive approach not only aids in adhering to regulatory requirements but also reinforces your business’s reputation for diligence and compliance.

The Timeline of a CF-28

Upon receiving Customs Form 28 (CF-28), importers typically have a 30-day window to respond comprehensively. Timeliness is paramount, as a delay could lead to penalties or increased scrutiny. The initial review phase ensues immediately after receipt of the CF-28. This involves gathering and verifying all requested documentation.

Importers should scrutinize details and discrepancies, ensuring all provided information is accurate and aligns with entry records. Subsequent steps include the compilation of supplementary documents, clarifications, and responses to CBP’s pointed inquiries, forming a coherent submission package.

After submission, the Customs and Border Protection (CBP) may take up to several weeks to review the provided materials. During this period, it’s essential for importers to remain available for follow-up questions or additional document requests.

Finally, the CBP will culminate their review by issuing a determination, which will either close the inquiry satisfactorily or indicate further action required. Clear communication and meticulous documentation throughout the process are critical for a favorable outcome.

Steps to Take to Correct the Issue

Upon receiving Customs Form 28 (CF-28), take immediate action by meticulously reviewing the specified points of concern. Swift responses ensure the continuation of smooth import operations.

- Gather and organize all pertinent documentation correlated to the CF-28 inquiries.

- Accurately cross-reference these documents with your original entries to identify any discrepancies.

- Compiling a thorough response requires clear, concise answers and any necessary supporting documentation, ensuring transparency and completeness.

- Submit your well-prepared response within the specified deadline, reinforcing your commitment to compliance and due diligence. Clear and proactive communication is essential to resolving the issue effectively.

Addressing CF-28 Specific Questions

When responding to Customs Form 28 (CF-28), certain specific questions may arise that require detailed, yet concise, answers with an additional emphasis on supporting documentation.

These inquiries could range from classification issues to valuation disputes. Often, questions are centered around the origin of goods, demanding precise (preferably official) documentation to substantiate claims. Other questions might revolve around tariff classifications or discrepancies in reported values, underscoring the need for airtight records.

Remember, every piece of data provided must be verifiable, leaving no room for ambiguity, thus fortifying your position and fostering trust with customs authorities.

Ultimately, the crux of your effort lies in meticulous preparation. Timely, accurate documentation serves as your strongest asset, ensuring that every query is addressed comprehensively and efficiently.