Anti-dumping duties (ADD) are tariffs imposed on imported goods that are sold in the U.S. at a price lower than their fair market value. These duties are designed to protect domestic industries from unfair competition caused by foreign manufacturers “dumping” products at artificially low prices.

If you’re an importer, manufacturer, or logistics provider, understanding how anti-dumping laws work is crucial to avoiding unexpected tariffs, ensuring compliance, and minimizing financial risks.

What Are Anti-Dumping Duties and Why Are They Imposed?

Dumping occurs when a foreign company sells a product in another country at a price lower than its domestic market price or production cost. This can undercut local businesses, leading to job losses and business closures in the importing country.

To prevent this, the U.S. Department of Commerce (DOC) and the U.S. International Trade Commission (ITC) investigate alleged dumping cases. If they determine that a foreign company is engaging in dumping and causing material harm to a U.S. industry, they impose anti-dumping duties on those imports.

Key Reasons for Anti-Dumping Duties:

- Protects U.S. manufacturers from unfairly priced imports

- Prevents market manipulation by foreign producers

- Levels the playing field for domestic companies

- Discourages predatory pricing tactics that harm competition

How Are Anti-Dumping Duties Calculated?

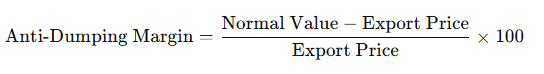

The DOC determines the anti-dumping margin, which is the difference between:

- The normal value (the price of the product in the exporter’s home country)

- The export price (the price at which the product is sold in the U.S.)

Formula for Anti-Dumping Margin:

If the margin is significant, anti-dumping duties equal to that percentage may be imposed on future shipments.

Industries and Products Commonly Affected by Anti-Dumping Duties

Certain industries are more frequently targeted by anti-dumping investigations due to persistent price disparities.

| Industry | Examples of Products with ADD |

| Steel & Metals | Steel Pipes, Aluminum Sheets, Rebar, Wire Rods |

| Chemicals & Pharmaceuticals | Glycine, Ammonium Sulfate, Citric Acid |

| Furniture & Wood Products | Wooden Cabinets, Laminated Wood Flooring |

| Electronics | Solar Panels, LED Lighting |

| Agricultural Products | Honey, Frozen Shrimp, Garlic |

| Textiles & Apparel | Polyester Staple Fiber, Tires |

Examples of Recent ADD Cases:

- Chinese solar panels – Duties imposed due to unfair subsidies and pricing.

- Vietnamese plywood – Higher tariffs enforced to prevent underpricing against U.S. manufacturers.

- Indian stainless steel products – ADD applied to counteract below-cost sales in the U.S.

How Importers Can Avoid Anti-Dumping Duty Risks

Importers must be proactive to avoid unexpected ADD fees and compliance violations. Here’s how:

1. Verify if Your Product Is Subject to ADD

- Check U.S. Customs and Border Protection (CBP) rulings for ADD lists.

- Use the Harmonized Tariff Schedule (HTS) to identify tariff classifications that fall under ADD.

2. Work with Trusted Suppliers

- Source from multiple countries to diversify risks.

- Request detailed pricing data to ensure no underpriced exports.

3. Consider Supply Chain Adjustments

- Ship through countries not subject to ADD (but beware of transshipment violations).

- Modify production to meet value-added transformation rules in different countries.

4. Utilize Tariff Engineering

- Adjust product design or components to fall under different HTS classifications.

- Ensure modifications comply with CBP requirements to avoid ADD application.

5. File for ADD Refunds (If Eligible)

- If you overpaid ADD due to fluctuating rates, consider filing a request for review and refund.

- The DOC conducts annual administrative reviews to adjust duty rates based on actual pricing.

How Anti-Dumping Duties Affect Global Trade

Anti-dumping duties don’t just impact importers and domestic producers—they also create ripple effects across international supply chains.

1. Price Increases for U.S. Businesses & Consumers

- Higher raw material costs (e.g., steel ADD leads to higher prices for auto manufacturers).

- Increased prices on consumer goods (e.g., solar panels, appliances, furniture).

2. Trade Tensions & Retaliatory Tariffs

- Countries subject to ADD often impose retaliatory tariffs on U.S. exports.

- Example: China’s counter-tariffs on U.S. agricultural goods after steel ADD.

3. Supply Chain Shifts & Manufacturing Relocations

- Companies shift production to third countries (e.g., moving factories from China to Vietnam to avoid ADD).

- Some industries reshape sourcing strategies to diversify exposure to ADD risks.