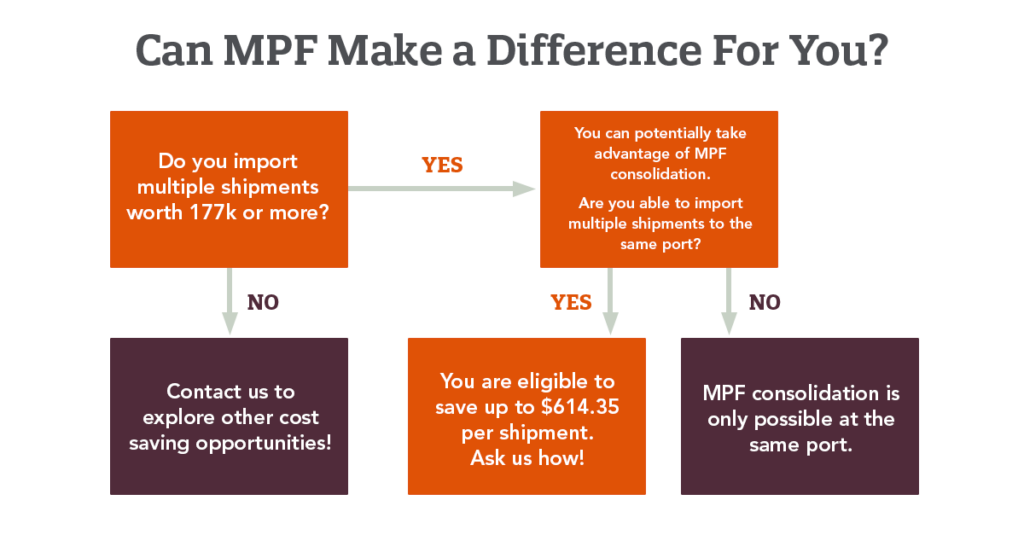

Managing costs is a critical part of the import process. One often overlooked expense is the Merchandise Processing Fee (MPF), a mandatory charge imposed by U.S. Customs and Border Protection (CBP) on imported goods. However, by strategically bundling shipments within the applicable rules, you can significantly reduce these fees and save money.

What Are Merchandise Processing Fees (MPFs)?

Merchandise Processing Fees are fees charged by CBP to cover the cost of processing commercial shipments entering the United States. The fee is calculated as a percentage of the shipment’s value, with a minimum and maximum cap:

- Fee Rate: 0.3464% of the shipment’s value.

- Minimum Fee: $29.67 per shipment.

- Maximum Fee: $614.35 per shipment.

These fees apply to most commercial imports, making them a significant cost factor for businesses that import frequently.

How Bundling Shipments Can Save You Money

One of the most effective ways to reduce MPFs is by bundling shipments. By consolidating multiple items into a single shipment, you can reduce the number of individual MPF charges. Here’s how it works:

- Fewer Shipments, Lower Fees: Each shipment incurs a minimum MPF of $29.67. If you import 10 separate shipments, you’ll pay $296.70 in MPFs alone. By bundling those 10 shipments into one, you’ll pay just one MPF, potentially saving $267.03.

- Maximize the Maximum Cap: If your bundled shipment’s value is high enough to reach the $614.35 MPF cap, you can save even more. For example, a single shipment valued at $1,000,000 will still only incur $614.35 MPF, whereas multiple smaller shipments could result in higher total fees.

- Stay Within Compliance: Bundling must be done within CBP rules. Ensure that all items in the shipment are classified under the same Harmonized Tariff Schedule (HTS) code and are eligible for consolidation.

Tips for Effective Shipment Bundling

- Plan Ahead: Coordinate with your suppliers to consolidate shipments whenever possible.

- Use a Customs Broker: A licensed customs broker can help ensure your shipments are bundled correctly and comply with CBP regulations.

- Leverage Technology: Use inventory management software to track shipments and identify bundling opportunities.

- Understand HTS Codes: Ensure all items in a bundled shipment share the same HTS code to avoid compliance issues.

Frequently Asked Questions (FAQs)

Q: Can I bundle shipments from different suppliers?

A: Yes, as long as the items share the same HTS code and are imported under the same entry.

Q: Are there any downsides to bundling shipments?

A: While bundling can save money, it may lead to longer processing times or storage fees if not managed properly.

Q: How do I calculate MPF for a bundled shipment?

A: Add the total value of all items in the shipment and apply the 0.3464% rate, ensuring it falls within the 29.67 minimum and 614.35 maximum.

Helpful Links: