Introduction

Changes continue to be fluent in the export arena with stepped-up enforcement actions in the U.S. This is a guide to help exporters understand their main responsibilities in today’s U.S. regulatory environment. It is our hope that this guide will assist exporters with U.S. government export regulations and what these entail.

Exporter Responsibilities

The Foreign Trade Regulations (FTR) places primary responsibility for compliance of the Electronic Export Information (EEI), formerly known as the Shippers Export Declaration (SED), on the exporter or USPPI (U.S. principal party in interest).

Acting through a forwarding or other agent or delegating or re-delegating authority does not in and of itself relieve exporters of their compliance responsibility – even in a routed transaction. Penalties are being issued for late filing, no filing or inaccuracies with the Electronic Export Information being filed through the Automated Export System (AES) on the ACE (Automated Commercial Environment) platform. Exporters must ensure the information they are providing to their forwarder or filing through AES themselves is timely, accurate, and updated when corrections are received. The following agencies all have access to the export information filed in ACE: U.S. Customs and Border Protection(CBP), the Governments and Trade Management Division (GTMD) of Census, the Bureau of Industry and Security (BIS), the Department of State, Directorate of Defense Trade Controls (DDTC), the Nuclear Regulatory Commission (NRC), The Office of Foreign Assets Control (OFAC), the Department of Justice-Drug Enforcement Agency (DEA), the Department of Agriculture-Agricultural Marketing Service (AMS), the Department of Justice-Bureau of Alcohol, Tobacco, Firearms (ATF), the Environmental Protection Agency (EPA), the Department of Interior-Fish and Wildlife Service (FWS), the Department of Commerce-National Marine Fisheries Service (NMFS) and the Department of Treasury-alcohol and Tobacco Tax and Trade Bureau (TTB). These agencies can identify anomalies with the information filed in AES far easier than ever before.

It is the exporter’s obligation to check all parties in a transaction against the most recent Excluded Parties Lists to avoid penalties for shipping to an entity that cannot receive U.S. exports. There are currently several lists that must be checked for each export transaction. Go to www.Export.Gov for the Consolidated Screening List where you can view each list individually.

With fluid changes in country relationships with the United States and changes to how and what will be controlled, the addition of information now being filed for several partner government agencies (PGAs), along with the dedication of more and more resources focused on export enforcement over the past few years means U.S. exporters have a multitude of reasons to act with care and to implement an export compliance plan.

Many new exporters are arriving on the scene, and it is essential for exporters to review operations to be sure they adhere to all U.S. Export Regulations. All exporters must be informed and comply with all export regulations that govern their products.

Please be sure you are prepared and ready for an export agency to review your documents or ask questions regarding your export transaction. Proper recordkeeping is key to responding to these queries by government agencies. If you need help, please Contact Us for further information and assistance with your exports and export compliance program.

Questions to Ponder

Commodity type(s)? What is the intended use of the commodity? HTS or Schedule B Number(s) for commodity?

When exporting commodities from the United States, you must first classify your article according to the Schedule B or Harmonized Tariff Schedule for reporting to Census.

Additional Schedule B assistance can be obtained from Census by contacting the Commodity Analysis Branch:

Email: [email protected]

Schedule B Help Line

Ph. 1-800-549-0595, Option 2

Fax 301-763-4347

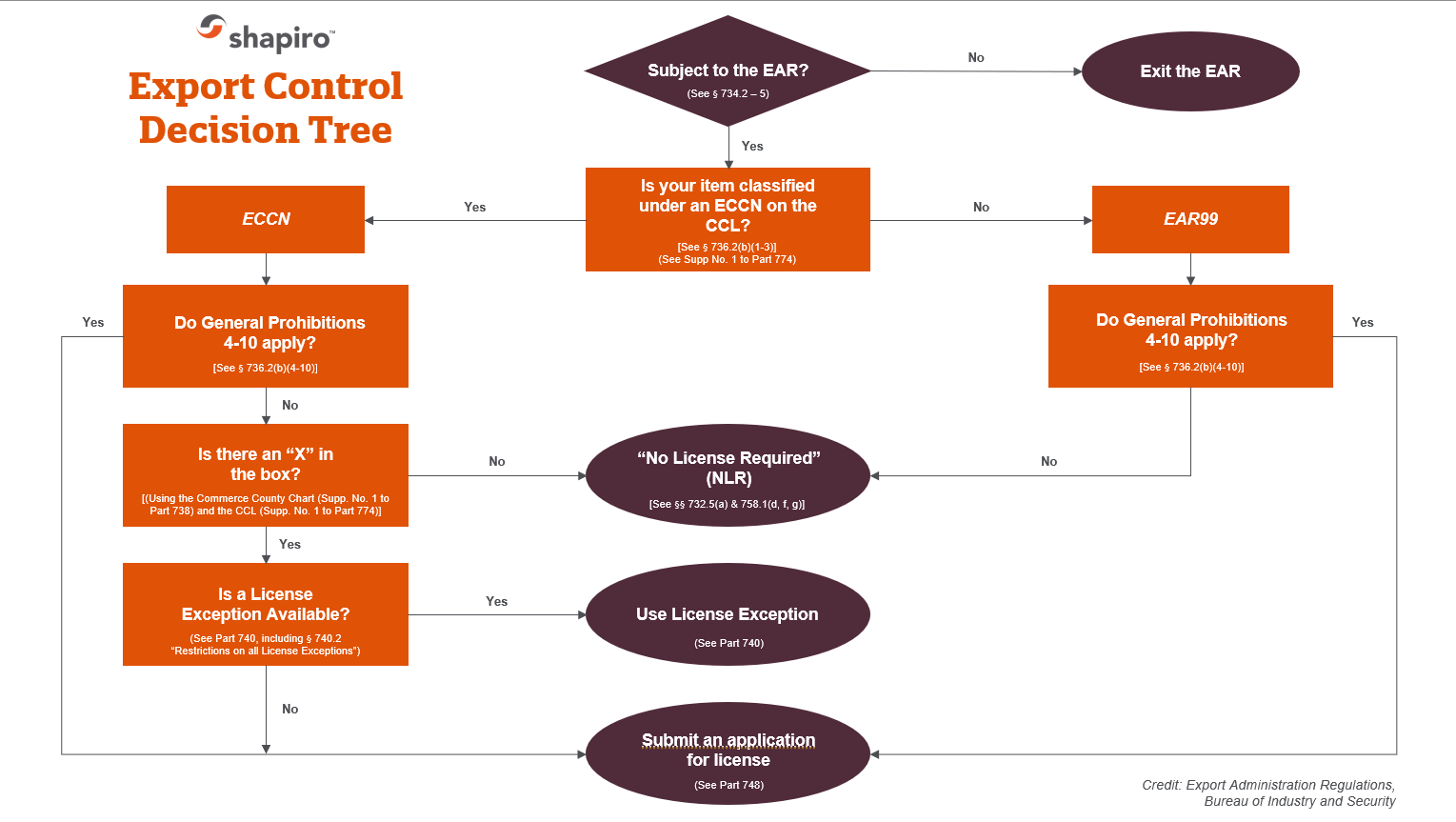

Are any of your commodities listed under the Commerce Control List (CCL)?

If your commodity does come under the CCL, the exporter must provide the Export Commodity Classification Number (ECCN) and must know if a license is required to the export destination, or if an exception can be used for each transaction. Under U.S. law it is the responsibility of the exporter to classify the item(s) and to determine if an export license is required from any United States Government agency.

Please refer to Part 774 (CCL) of the Export Administration Regulations for the Commerce Control List.

For reference consult the: Alphabetical Listing for the Commerce Control List

Please refer to the Bureau of Industry and Security (BIS) Website for more information concerning the Export Control Classification Number (ECCN), licenses, and exceptions.

There is also guidance and a list of Frequently Asked Questions from BIS which may assist you in determining whether your item or transaction requires some type of license, and assistance with regulations and other topics that can be found on the BIS website

The Bureau of Industry and Security (BIS) has an online training room with training videos and support topics on its website with easy to use training modules. We highly recommend these to our exporters. Please keep in mind, the exporter is responsible to be aware of all of the Export Administration Regulations.

If you need assistance from BIS in determining your ECCN number, you can contact BIS through its website using an online form. For counseling assistance by phone, you may contact one of the BIS counselors at 202-482-4811 for Washington, DC or 949-660-0144 for California.

* Please note: phone and email assistance from BIS is not binding, it is used for guidance purposes only. *

SUPPLEMENT NO. 1 TO PART 732 – EXPORT CONTROL DECISION TREE

If you need to obtain a binding classification ruling from the BIS, this must be done electronically through the Simplified Network Application Process Redesign (SNAP-R).

Please contact [email protected] for more information.

Do any of your commodities have military application and fall within the International Traffic In Arms Regulations (ITAR)? Is your commodity referenced on the U.S. Munitions List (USML)?

If your commodity does fall under the ITAR on the United States Munitions List, the exporter must provide the license number, or an ITAR exemption number for each transaction.

Your company must also be registered with the United States Department of State, Directorate of Defense Trade Controls (DDTC) if you manufacture, sell, export, or import items with military application.

If your item is on the USML, additional information will be necessary in order to transmit the required Electronic Export Information (EEI) to the Automated Export System (AES). The Census website covers the eight (8) elements required for AES and a listing of the ITAR exemptions.

The State Department DDTC Response Team field’s basic process and status questions, and assists importers and exporters in identifying what they need to do to get answers to more complex questions involving issues substantively handled by DDTC’s licensing and compliance offices. You can reach the Response Team by telephone at (202) 663-1282, or by e-mail at [email protected].

A list of FAQs from the State Department can be found on the DDTC website. Please refer to the U.S. Department of State web site for more information regarding the ITAR and the United States munitions list and getting started with Defense Trade.

What countries do you export to?

The Office of Foreign Assets Control lists the sanctions and embargoes the U.S. has imposed on certain countries. The exporter must be aware of these country controls.

The U.S. Department of State has a list of country policies and embargoed countries showing which countries may receive defense articles.

BIS has a country guidance section for reference.

What is the end use of your product?

This is a question that concerns the U.S. Government for security, national defense, and anti-terrorism reasons. Some end-uses are prohibited while others may require a license. For example, you may not export to certain entities involved in the proliferation of weapons of mass destruction (e.g., nuclear, biological, chemical) and the missiles to deliver them, without specific authorization, no matter what your item is. For more information on prohibited end uses, please refer to Part 744 of the Export Administration Regulations.

Are you shipping to the Middle East? Do you adhere to the anti-boycott regulations?

Exporters must be aware of the antiboycott laws that were adopted to encourage, and in specified cases, require U.S. firms to refuse to participate in foreign boycotts that the United States does not sanction. They have the effect of preventing U.S. firms from being used to implement foreign policies of other nations which run counter to U.S. foreign policy. Additional information on antiboycott laws, what they cover and what your responsibility is as an exporter can be found on the BIS website.

Recent Examples of Boycott requests can be found on the BIS website.

These types of requests or problematic language are often included in letters of credit. U.S. companies continue to report receiving requests to engage in activities that further or support the boycott of Israel. U.S. companies may receive similar requests in the future. Compliance with such requests may be prohibited by the Export Administration Regulations, and reportable to the Commerce Department. If you have questions about language or activities related to antiboycott compliance, please call (202) 482-2381 and ask for the Duty Officer or you may Email the office of Antiboycott.

Have you checked the current “Red Flag” indicators provided by BIS for things to look for in an export transaction?

Use these Red Flag Indicators as a check list to help identify possible violations of the Export Administration Regulations.

Do you really know your customer?

Use the “Know Your Customer Guidance” provided by the BIS.

BIS has issued guidance on how individuals and firms should act under this knowledge standard. This guidance does not change or revise the EAR, but it assists exporters with their obligations.

Are your commodities considered to be Hazardous for shipping purposes?

Each mode of shipping has specific hazmat regulations. The Federal Aviation Administration has been especially persistent in checking commodities and tracking it back to the exporter to see if the exporter’s staff has current hazmat training. All modes of transportation have increased inspection of hazardous materials.

Do you understand your role as an exporter under the Foreign Trade Regulations? Is your company the USPPI in a routed export transaction?

As an exporter or a company that sells goods and services to foreign entities, you need to understand your role and the role of the forwarder in the export transaction. Take a look at the Frequently Asked Questions from the Foreign Trade Regulations on the Census website regarding the USPPI, the required information for the Electronic Export Information that must be filed through the Automated Export System (AES), the filing time frames and the penalties that are now being issued for late filing, no filing, or inaccuracies on the Electronic Export Information.

For specific questions regarding the Electronic Export Information (EEI) filed through the Automated Export System (AES) or questions regarding your role under the Foreign Trade Administration, you can contact Census by email or by phone at 1-800-549-0595.

Links to U.S. Export Regulations

- The Export Administration Regulations

- The Foreign Trade Regulations

- The International Traffic in Arms Regulations

- Customs Regulations

If you don’t understand all of the information above and feel you need one on one consultation, please contact [email protected].

**This document is intended to highlight some of the major responsibilities exporters have under U.S. Government regulations. This is not all inclusive and depending on the commodity, the exporter may have responsibilities under other U.S. Government agencies, such as FDA, USDA, NRC, DEA, DOJ, etc. Prior to exporting, please be sure to check with any agency that may have jurisdiction over your commodity.

This document does not include Foreign Country of Import information. Laws vary depending on the intended destination of your transaction.

** All transactions and services are subject to and governed by our Terms and Conditions of Service, as may be amended, including a limitation of liability limited to a maximum of $50/entry or shipment. A copy may also be found here, and is available by request at no charge.