Featured Headlines:

The Island of Misfit New Vessels?

The Dali Drama is General but not Average!

Peloton Flexing Its Legal Muscle

Like Deadly Sins, APHIS Faces Impending Seventh Lacey Phase

Guess Who’s Back for Glee and Fun…That’s Right, It’s Section 301!

The Not-So-Sweet 26 Textile Companies Added to the UFLPA Entity List

Trucking Isn’t Smelling the Roses

Dela-Where’s the Expansion Project?

The Island of Misfit New Vessels?

- After a brief, slight post-Chinese New Year (CNY) dip, container spot prices, especially from Asia, have robustly rebounded, reversing the typical post-holiday rate correction.

- Contrary to seasonal expectations, the spot freight rate for shipping a 40 foot-equivalent-unit (FEU) container from Asia to the US West Coast (USWC) increased from $2,300 to $5,200 in ONE month! A stoopid 226% increase!

- Yeah, but those West Coasters are as nutty as peanut butter… surely things are more rational (and less chunky) for the US East Coast! Yeah, nah. We’ve watched average 40’s move from $2800 to $6350, yup that’s a super creamy 227%!

- European and Mediterranean routes from Asia are also feeling the pinch, with dramatic spot freight upswings. Oh, and get this, the normally shy and bashful Asia to Latin America lane is partying like a rock star with double digit demand growth vs last year! This has all eyes on potential equipment shortages at Asian ports!

- Why is this happening and why now? Also, what the heck does the title of the article mean? These are excellent questions, dear impatient reader!

- Inventory Restocking + Tariff Worries + Shockingly Consistent Consumer Demand = YTD Import Demand Uptick of 10% Overall and 20% from Asia. Check!

- Red Sea Rage = African Re-Routes = Effective Global Capacity Decrease of Maybe 10%. Check!

- Over-Steering Capacity with Blank Sailings in Early May = 10-15% Capacity Cull. Rolled Eyes but Check!

- Spoiler Alert… Total New Steamship Capacity Increase YTD = 2.4%. Checkmate?! Check Bounced? Checked off the Boards while Losing Our Teeth??!! How can new capacity increases total just 2.4%?

- Well, we asked, and it has been revealed that all of those shiny new vessels purchased during the time of the wine-soaked splendor of Covid steamship profits are not sitting at anchor in Singapore as many pundits joke… no, they have all been sent to a magical island in the vast archipelago on exotic Indonesia.

- Yes, it’s true. Thousands of beautiful vessels are enjoying facials as they slurp frozen drinks and consider afternoon bridge, tennis, or a gentle game of badminton! This can be the ONLY explanation for such a meager increase in capacity at just the wrong time for shippers, right?! Right?!

The Dali Drama is General but not Average!

- Following the declaration of general average due to the Dali’s tragic mishap in Baltimore’s Harbor, cargo owners are bracing for a complex—and lengthy—legal and financial aftermath.

- The shipowner’s declaration of general average means that all cargo owners share the financial burden of salvage costs. This is a standard maritime practice when extraordinary actions are taken to save a voyage, but it’s leading to claims potentially well above the value of the actual cargo on the Dali.

- Once the Dali is properly moved and the cargo is finally able to be discharged, insurance adjustors will start the detailed process of apportioning salvage costs.

- Shippers may be required to post bonds ranging from 50% to over 100% of their cargo’s value to cover their portion. This is significantly higher than in other recent maritime incidents, like the Ever Given and Ever Forward, where bonds were 25% and 8% respectively.

- Shippers without adequate insurance might consider abandoning their cargo to escape the high cost of bonds though this does not eliminate overall liability.

- The process of settling the general average claims could drag on for years, as seen in past incidents where similar claims have lasted over a decade.

- This event clearly emphasizes the highly critical role of cargo insurance. For perspective, we asked our Sales team to compare the typical shipper’s belief in their cargo coverage vs. the reality. “Wearing a swimsuit in a blizzard” was their immediate reply!

- Please don’t wear a Speedo to a snowstorm, folks! Instead, contact Shapiro’s Freight Experts to ensure that your cargo insurance is up to snuff!

Peloton Flexing Its Legal Muscle

- Peloton has filed a complaint with the Federal Maritime Commission (FMC) against logistics giant Flexport, arguing that “millions of dollars” in detention and demurrage charges were improperly charged to the company from 2020 to 2023.

- Peloton had entered a carrier haulage agreement with Flexport to handle both ocean and inland transport of its products.

- However, Peloton claims Flexport chronically failed to meet its obligations—specifically; not removing containers from U.S. terminals timely, not delivering goods on time, and not returning empty containers within free time limits.

- Central to the complaint is Flexport’s supposed violation of the Ocean Shipping Reform Act of 2022 (OSRA-22). This “newish” regulation demands detailed billing for detention and demurrage—specifying 13 required items—including the start and end of free time and daily rate calculations.

- The complaint also highlights broader supply chain disruptions during the pandemic, which hit Peloton with “over 10 times [their] usual cost per bike and tread” due to forced adaptations like air shipping in response to port congestion.

- For a company famous for making people sweat, Peloton is covering familiar ground here though they certainly hope that unlike their bikes, this case will actually go somewhere!

Like Deadly Sins, APHIS Faces Impending Seventh Lacey Phase

- The US Department of Agriculture’s (USDA) Animal and Plant Health Inspection Services (APHIS) Core has shared the draft list of Harmonized Tariff Schedule (HTS) codes that may be included in Phase VII Implementation of the Lacey Act Declaration.

- The classifications contain the remaining plant products that are not 100% composite materials.

- APHIS will likely finalize and publish the list of affected HTS codes in the Federal Register sometime this summer.

- The Lacey Act declaration requirements will then go into effect for the HTS codes six months after publication.

- Importers of these items will need to know each link in their supply chain for every piece of plant material in a given product and be prepared to provide the Lacey Act declaration information as needed.

- For additional information, kindly visit the USDA’s webpage on Phase VII Implementation.

Guess Who’s Back for Glee and Fun…That’s Right, It’s Section 301!

- Following an exhaustive evaluation, the Biden administration has decided to implement additional Section 301 tariffs. In the official press release, Ambassador Katherine Tai explained, “After a thorough review of the statutory report on Section 301 tariffs, and in light of my recommendations, President Biden has directed me to take further steps to counteract the People’s Republic of China’s unfair technology transfer-related policies and practices. These measures continue to impede U.S. commerce and adversely affect American workers and businesses.”

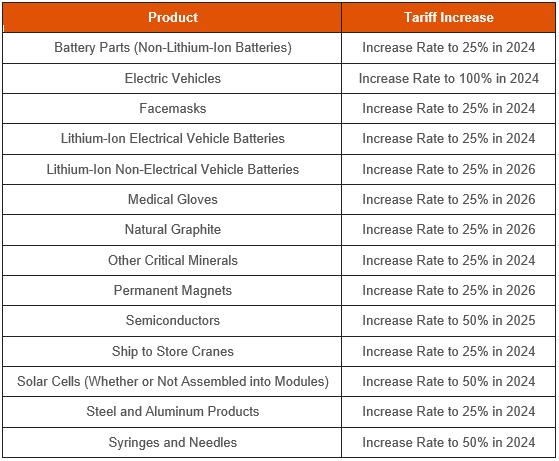

- The recommendation is that the products from the People’s Republic of China (PRC) currently under Section 301 tariffs will continue to remain subject to these tariffs, with an increase on the following items:

- The Biden Administration has also proposed the following recommendations:

- A new process for petitioning for exclusion from these tariffs, though it appears exclusions will be restricted to certain items in Chapter 84 and 85 used in domestic manufacturing.

- Allocating additional funds to US Customs and Border Protection (CBP) to enhance enforcement of Section 301 actions.

- Fostering greater collaboration between private companies and government authorities to tackle state-sponsored technology theft.

- Next week, the USTR will issue a Federal Register notice announcing procedures for interested persons to comment on the proposed modifications and information concerning an exclusion process for machinery used in domestic manufacturing. Click here to read the official USTR press release.

- Be on the lookout for more information—and don’t be shy…Shapiro’s Compliance Team is standing by to answer all your burning Section 301 questions!

The Not-So-Sweet 26 Textile Companies Added to the UFLPA Entity List

- Effective May 17, 2024, goods produced by the named 26 entities will be restricted from entering the United States.

- By focusing on cotton manufacturers based outside of the Xinjiang Uyghur Autonomous Region (XUAR) that source cotton from the XUAR; their designation will increase transparency and ensure responsible companies can conduct due diligence on their supply chains to ensure they do not include goods made with forced labor.

- The United States’ commitment to eliminating the use of forced labor in the U.S. supply chain and promoting accountability for the ongoing genocide and crimes against humanity against Uyghurs and other religious and ethnic minority groups in the XUAR.

- Adding these entities to the UFLPA Entity List advances DHS’ Textile Enforcement Plan, which prioritizes examination and review of entities in the textile sector for possible inclusion on the UFLPA Entity List.

- The full list of entities can be found here, including the 26 that go into effect on May 17, 2024.

- Never miss another not-so-sweet update like this! Spice up your life by visiting our dedicated Forced Labor Webpage.

ILA Fearmongering Takes a Dip

- Many of us on the commercial side of the international freight business have been shamelessly scaring shipper prospects with stories of huge tariffs coming in November, the 101% certainty of an East Coast strike, and the presence of evil goblins lurking in the darkness. For now, we will have to focus more on tariffs and hideous bloodthirsty goblins!

- The International Longshoremen’s Association (ILA), representing about 45,000 longshore workers across the US East and Gulf Coasts, is nearing the completion of local contract negotiations with maritime employers, setting the stage for broader, coastwide talks.

- Local contract bargaining is expected to conclude by May 17, the original deadline set by union leadership back in February.

- ILA President Harold Daggett and USMX Chief Executive David Adam expressed confidence in wrapping up local talks soon. Their goal is to forge a new master contract well before the current one expires on September 30, 2024, thereby avoiding disruptions.

- Key ports like New York, New Jersey, and Baltimore have already settled their local contracts. However, 13 other container facilities still need to resolve specific issues such as shift timings, longshore gang sizes, pensions, and health benefits.

- Despite past tensions, the recent statements from both the ILA and USMX are hopeful, pledging commitment to reach an agreement and continue the success of previous negotiations—like those in 2012 and 2018, which concluded without any shipment disruptions.

- Coastwide negotiations are anticipated to resume in early June.

Canada’s Martial Law!?

- Canada pulled the red tape to stop a rail strike right in its tracks! The Canadian government has enacted a special “red tape” regulation to dodge a potentially crippling rail strike.

- Invoking the rarely used Emergency Directive under the Canada Transportation Act, the government is making sure the trains keep chugging along.

- The directive effectively pauses any strike action for the next six months, securing uninterrupted rail services crucial for transporting goods across the country.

- This move comes amid tense negotiations with the Teamsters Canada Rail Conference, representing the engineers who were on the brink of walking out.

- The government is eyeing further discussions and solutions to address the underlying issues without derailing the economy.

- With American imports surging, Los Angeles choking on intermodal volumes, and the possibility of disruptions at Gulf and East Coast ports looming, rail linkage through Canada has perhaps never been more important for US shippers. So, let’s hope the red tape becomes the red carpet for Canada’s rail workers during these critical negotiations!

Trucking Isn’t Smelling the Roses

- The U.S. Bank Freight Payment Index reported a significant contraction in truckload volumes and shipper spending across most US regions in the first quarter of 2024.

- Domestic shipments plummeted by 21.6% year-over-year (YoY) and 7.8% from the previous quarter, marking the largest recorded decline to date.

- Alongside the drop in volumes, shipper spending fell even more drastically, by 27.9% YoY and 16.8% from the fourth quarter, respectively.

- The report highlighted that many sectors crucial for generating truck freight—such as retail sales, home construction, and factory output—remained flatter than a flatbed. International trade also faced disruptions, particularly from incidents in the Red Sea affecting shipping.

- The Journal of Commerce reported a minor decrease in the all-inclusive shipper-paid spot truckload rate from $2.20 per mile in February to $2.36 per mile a year ago, reflecting ongoing rate pressure.

- While the U.S. Bank Freight Payment Index doesn’t forecast future trends, initial observations suggest a muddier domestic freight market future than anticipated.

Dela-Where’s the Expansion Project?

- The state of Delaware has partnered with terminal operator Enstructure to push forward the $635 million development of the Edgemoor container terminal at the Port of Wilmington.

- Enstructure is set to contribute $335 million towards the project, supported by a credit agreement with the Blackstone Group.

- Additionally, the Diamond State Port Corporation will add $250 million through bonds and funds from the Biden Administration’s America Rescue Plan Act, aimed at aiding recovery from the COVID-19 pandemic.

- The project is also slated to receive $50 million in direct federal funding through the US Maritime Administration’s port grant program.

- The new terminal, named Port Delaware North, will be developed in stages over five years. It aims to ramp up from an initial capacity of 250,000 TEUs to 1.2 million TEUs by 2027.

- Meanwhile, Wilmington’s existing container terminal—soon to be dubbed Port Delaware South—currently handles 400,000 TEUs annually.

- The project is expected to create over 3,000 new longshore jobs at the new terminal, adding to the nearly 3,000 jobs at the existing facility.