Featured Headlines:

Airfreight's High-Flying Rates Losing Altitude?

US Flexes Its Export Control Abilities on Chinese Semiconductor Production

Antidumping/Countervailing Duty Investigations on Aluminum Extrusions Terminated

US No Longer "Wafering" on Proposed Section 301 Tariff Increases

Premier Alliance Pushes Berth Date

The ILA Automation Showdown

- Things have been “all quiet on the eastern front” in the ongoing negotiations between the International Longshoremen’s Association (ILA) and the US Maritime Alliance (USMX) since October’s dramatic contract expiration, but that doesn’t mean the potential economic disaster has simply gone away!

- While rail-mounted gantry cranes (RMGs) allow terminals to handle higher TEU volumes on smaller land footprints, critics argue there’s minimal difference in man-hours per lift compared to traditional methods.

- The ILA opposes RMGs because they claim it will inevitably lead to job losses, cybersecurity physical risks, and questionable efficiency. The union also speculates that RMG technology has failed to outperform traditional equipment operated by human workers. No offense intended… but are they inefficient or do they kill jobs?!

- The billionaires at the USMX, however, argue that RMGs are essential for land-constrained ports to densify and remain competitive. The alliance defends RMGs as tools for modernization, not job elimination. They emphasize that these cranes are already in use under current agreements and are critical for future competitiveness.

- Previous contracts allowed RMG rollouts at Norfolk and Bayonne ports, but the ILA now sees their further implementation as a direct threat to jobs.

- From the fully automated Long Beach Container Terminal to Vancouver’s Centerm facility, RMG implementation continues to spark labor disputes and even lockouts, as seen in Canada.

- Without scheduled negotiations, both sides face the possibility of a port strike in January. The outcome could and should set a precedent for automation in the US port industry for years to come.

- If you get bored, read what Elon Musk has to say and what he likes on the subject of labor unions! Interestingly, it could come down to Musk’s influence and very outspoken dislike, distrust, and general “dissitude” of labor unions. Pass that popcorn!

Airfreight's High-Flying Rates Losing Altitude?

- There’s no disputing the fact that airfreight had one banner of a year in 2024 after soaring to double-digit volume and profit gains. However, pundits are speculating that air rates could soon lose nearly half their altitude in 2025—or at the very best, remain flat.

- The most significant factors for this market turbulence? Businesses adapting to less reliable ocean supply chains and slowing B2B demand.

- Online giants like Temu and Shein are pivoting to ocean shipping and U.S. distribution strategies as stricter de minimus Customs regulations loom. While emerging markets like Southeast Asia offer new growth, saturated markets may dampen total air cargo volumes.

- Other major supply-side contributors include aging fleets, regulatory delays for new freighters, major production slowdowns at both Airbus and Boeing, and geopolitical factors like Russian airspace restrictions, which are limiting air cargo capacity.

- Interestingly, supply woes could serve to prop up (get it?) airfreight rates even as demand may slide.

- Currently, airlines are scrambling to meet demand with just a 4.4% capacity increase projected for 2025. A potential dockworker strike on the East and Gulf coasts in January could well redirect critical shipments to air carriers, providing short-term hope in the form of a demand bump.

- While B2B shipments decline, e-commerce continues to drive air cargo growth, representing over half of China’s exports. Emerging markets and global online sales are projected to hit $8 trillion by 2027—offering long-term promise.

US Flexes Its Export Control Abilities on Chinese Semiconductor Production

- The U.S. Department of Commerce’s (DOC) Bureau of Industry and Security (BIS) announced new export controls to limit China’s ability to produce advanced semiconductors for military, AI, and advanced computing applications.

- The decision includes the following key measures:

- Implements new controls on 24 types of semiconductor manufacturing equipment and three types of software tools.

- Places controls on high-bandwidth memory (HBM), critical for AI and advanced computing.

- Adds 140 entities to the US Entity List, including semiconductor fabs and companies linked to China’s military modernization.

- Introduces new Foreign Direct Product (FDP) rules, extending U.S. jurisdiction over foreign-produced semiconductor equipment that supports Chinese military goals.

- Restricts design software (ECAD and TCAD) for advanced-node semiconductors.

- These actions aim to safeguard US national and allied national security by slowing China’s development of advanced AI and semiconductors that could be used in military applications and prevent them from achieving semiconductor self-sufficiency.

- Most of the rules announced are effective December 2, 2024. However, there is a delayed compliance date of December 31, 2024 for certain controls.

- For additional details regarding these rulings, including a list of their implementation dates, please refer to the following links:

Antidumping/Countervailing Duty Investigations on Aluminum Extrusions Terminated

- In October, the US International Trade Commission (USITC) published its final ruling in the Antidumping and Countervailing Duty (AD/CVD) Investigation on Aluminum Extrusions.

- According to the ruling, USITC officials determined that US industries are NOT materially injured and/or threatened with material injury by aluminum extrusion imports from the following countries:

- China, Colombia, Ecuador, India, Indonesia, Italy, Malaysia, Mexico, South Korea, Taiwan, Thailand, Turkey, United Arab Emirates, and Vietnam.

- Therefore, all AD/CVD investigations on Aluminum Extrusions from the above countries are terminated.

- The suspension of liquidation will be discontinued, and all cash deposits previously applied due to these investigations will be refunded.

US No Longer "Wafering" on Proposed Section 301 Tariff Increases

- In case you missed the memo, the Office of the US Trade Representative (USTR) opened a comment period in September 2024 to allow the public to submit comments related to the proposed increase of Section 301 tariffs on certain tungsten, wafer and polysilicon products.

- On December 11, 2024, USTR officials revealed the conclusion of its investigation; and that it plans to move forward with the rate increases—25% on certain tungsten products and up to 50% on wafers and polysilicon products, respectively.

- Beginning January 1, 2025, the following duty rate increases will go into effect:

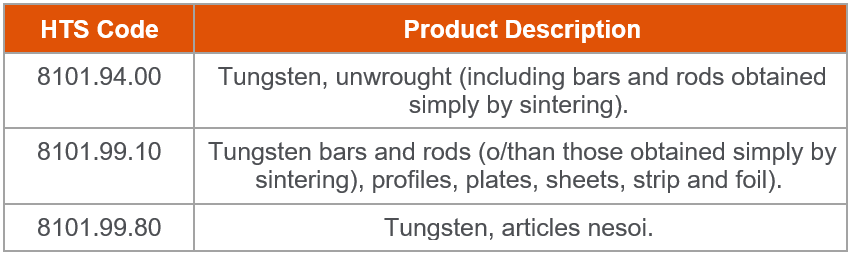

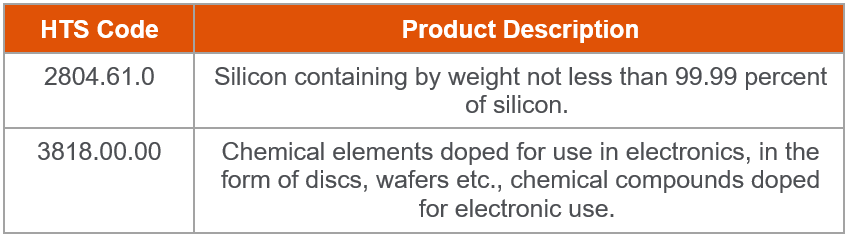

- Increases tariffs to 25% on the following TUNGSTEN products:

- Increases tariffs to 50% on the following WAFER/POLISILICON products:

- The decision marks the final act in the Biden administration’s four-year review of the effectiveness and impacts related to the additional 301 tariffs on certain Chinese products.

- For more details, please refer to the below Federal Register Notices:

Premier Alliance Pushes Berth Date

- The Premier Alliance, a new Asian liner grouping featuring Yang Ming, Ocean Network Express (ONE), and HMM, just hit some unexpected headwinds from the Federal Maritime Commission (FMC). And unfortunately, it’s beginning to look a lot like (not Christmas!) but like the Alliance’s launch party launch party on February 1st will be rescheduled!

- With Hapag-Lloyd exiting stage left and leaving THE Alliance to partner with Maersk in the upcoming (spy thriller) Gemini Cooperation, the Premier Alliance was all set to begin making bookings this week.

- The FMC has flagged the alliance’s submission as lacking the info needed to analyze competitive impacts and compliance with statutory requirements. (Translation: The FMC isn’t convinced yet, and it’s not letting this ship set sail without a proper inspection.)

- If the alliance gets its mother ducks (or storks) in a row and wins the FMC’s approval, then it might still have a chance for a 2025 berth date.

China's Trade Slowdown

- First, an ILA Automation Showdown and now a Chinese Trade Slowdown…?

- In November, China’s exports grew by just 6.7%, well below October’s 12.7% and missing the projected forecast of 8.5%.

- Imports? They shrank by 3.9%, the worst performance in nine months, another kind of birth date—signaling deeper economic woes.

- With Trump poised to re-enter the White House, his promised new tariffs (remember, we are “Switzerland”!) of up to 60% duties on Chinese goods—have exporters scrambling.

- Frontloading shipments to the U.S. provided a temporary October boost, but the November slump shows stormy seas ahead.

- Despite slowing trade, China’s trade surplus edged up to $97.44 billion, but the numbers reflect a worrisome over-reliance on exports.

- China faces a second trade front with the EU, as tensions over tariffs on electric vehicles (up to 45.3%) threaten another blow to its export-dependent economy.

- Policymakers have pledged more aggressive stimulus in 2025, aiming to boost domestic demand and consumer confidence.

- Economists are urging China to move away from export reliance. A 5% growth target for next year and expanded fiscal policies could stabilize the ship—if Beijing can rally its vast domestic market.

FMSCA Trucking Transparency

- The Federal Motor Carrier Safety Association (FMCSA) has proposed a rule to give US trucking companies access to broker rate data within 48 hours of a request, aiming to enhance transparency in freight transactions.

- The proposal seeks to update recordkeeping requirements established in the 1940s and last amended in 1980, reflecting the modernized needs of the trucking industry.

- The Transportation Intermediaries Association (TIA) is seeing red while calling the proposal “un-American” and warning it could stifle innovation.

- Meanwhile, trucking groups like OOIDA see it as a win for small carriers.

- Rooted in 2020 protests over “price gouging” during the pandemic, the rulemaking addresses long-standing grievances from owner-operators and small trucking firms about broker margins.

- With shippers paying an average spot rate of $2.19 per mile (compared to the $2.02 per mile paid to carriers), the 17-cent broker margin is under scrutiny. The new rule could spark tougher rate negotiations between brokers and carriers.

- Non-disclosure agreements and waivers might lose their grip, as the proposal redefines carrier access to data as a broker’s regulatory obligation—not a contractual courtesy.

- The FMCSA is inviting feedback on the changes until January 21, 2025.