Featured Headlines:

Deep Doo-Doo in EU for You-Know-Who

Congress is Gettin' "GSP-y" with It!

Weaving the NCSD Webinars for July 2024

Trade Deficit Swells Like a Balloon

The Baltimore Triumph Recipe

- Editor’s Note: The loss of life, ramifications for livelihoods and incomes, and the destruction of a city landmark make the Key Bridge collapse no joke. Yet, we hope you’ll allow us a light-hearted look at how they cleared the shipping channel in under three months!

- Ingredients: One Very Large Bridge (Badly Mangled); One Giant Vessel (Damaged and Immobilized), Nine Million Pounds of Steel Underwater (Five Million must be Removed); Three Million Pounds of Concrete (Uncertain Quantity must be Removed); Thousands of People Unemployed or Underemployed; Millions of Americans Affected by $80B of Goods Not Moving Efficiently; Potential Political Powder Keg; Approximately 17 Government Agencies and Departments with Overlapping Jurisdictions; The Following Added Ingredients to be Combined on the Patapsco River:

- 1,600 Brave Workers

- 45 Miscellaneous Navy Vessels

- 36 Barges

- 27 Tugboats

- 22 Floating Cranes

- 10 Excavators

- 1 (Lonely) Dredger

- 1 (Lively) Skimmer

- Instructions:

- Ignore Politics for Once and Heed Biden’s Call to “Move Heaven and Earth or My Campaign is Sunk!” Ooops, We Mean Just the “Move Heaven and Earth” Part!

- Assemble the White House Chief of Staff; the National Economic Council; the Council of Economic Advisors; the Department of Defense; the Department of Transportation; the Department of Agriculture; Auto Industry Experts.

- Calculate the Potential Economic Stakes, Best Outcomes, and a Leadership Plan.

- Create the US Coast Guard Unified Command to Call the Shots.

- Lean VERY Heavily on the US Coast Guard and the Army Corps of Engineers. Let the “Do People” Do!

- Refloat that Nasty Vessel and Get Her the Hell out of the Way Back to Port!

- Stay Steady and Productive (and Apolitical) to Keep that Debris Coming out of that Famous River.

- Stay Focused; We Can and Will Talk about Who Pays for the $2B New Bridge LATER!

- Kick Some Serious Pirate’s Booty on Deadlines, While Keeping Safety Front of Mind All Along.

- Result: A 700-foot Wide, 50-foot Deep Channel Ready for Business, Miraculously Delivered in Under Three Months.

- Yes, the unimaginable occurred at 4am on March 26th. Yes, we have a brutal fight coming between insurance companies, vessel owners, vessel charterers, cargo owners, the State of Maryland, and the Federal Government (to say nothing of the obnoxious 13-year-olds on both sides in Congress… why do we tolerate that, again?). Yet, we can all be very proud, even if a little surprised, that so many people came together to get the Port of Baltimore back on her feet again in record time!

- How could it be that so many different groups, agencies, departments, governments, and constituencies built a highly complex plan and stuck to it? By keeping the bigger picture in mind at all times. Maryland and the United States need the Port of Baltimore, and a fond welcome back to Fort McHenry Federal Channel; boy, are we glad to see you flowing into action right on-time!

Deep Doo-Doo in EU for You-Know-Who

- Not THAT “you-know-who;” we mean China! After the US recently announced 100% tariffs on Chinese electric vehicle (EV) imports, the European Union (EU) has followed suit with increases of up to 38% on some brands, creating total tariffs of up to 48% after July 4, 2024.

- Thanks for celebrating US independence from Britain by trade shaming China, EU! We hope your party comes with special, environmentally friendly hats!

- Did you know that the EU purchases 617 times more EVs from China than the US does per year? (No… you didn’t!)

- The biggest complaint, one the EU says is supported by World Trade Organization (WTO) rules, is the presence of highly valuable Chinese government subsidies creating an unfair playing field for EVs manufactured elsewhere (like maybe lovely EU locations in Germany, France, Italy, or Lichtenstein?).

- Shockingly, China said, “we never did it” and “our “assets,” the EU is following WTO protocols!” China then quickly pivoted to trade threats, targeting EU exports of agriculture, aviation, and automobiles to China.

- When you look under the hood (quite literally), you find that 36% of Mercedes Benz sales are made in China! While the percentages are smaller, China is the largest market for both BMW and VW as well. Guess who is decrying the tariff increases as “reckless, irresponsible, deranged, and downright kooky”? Yes, Mercedies, Beemer, and VW!

- Ironically, it is Germany, and her decision to remove tax incentives for EVs that has helped make lower cost Chinese alternatives more attractive in the EU.

- While we may all be impressed with the EU’s combustion engine ban by 2035, it is a backflip on a balance beam to require fair trade and green trade in the same policy.

- Given a domestic EV price war in China and the small size of the US market, it is safe to say that EV giants like BYD, Geely (Volvo), and SAIC (MG) have the most to lose, and their stocks certainly took a beating after the announcement.

- In 2020, the Chinese EV market share in the EU was under 2%; in 2024 it will climb to 25%. The market is currently worth at least $5B a year though the expectation is a $1B decline should these tariffs be implemented and persist.

- For those of you glad the US market for Chinese EVs is more than 150 times smaller than the EU, please do note that the US market grew 35% in 2023. It is “e v” to see that this will be a key commodity in the trade “cold war” in front of us!

Export Shipping Shenanigans

- Inland US exporters are facing a major container crunch due to global shipping disruptions, making containers harder to find than a needle in a haystack.

- To make matters even more exciting, the additional ships being re-routed around the Cape of Good Hope, combined with increased port congestion are stretching transit times and adding more fuel to the fire.

- Key hubs such as Asia Base Ports and the Strait of Gibraltar’s Tanger-Med and Algeciras are experiencing severe congestion, making things even more of a pain in the you-know-what for US exporters.

- To dodge the chaos, Shapiro recommends booking your containers 3-4 weeks ahead for coastal ports and at least 4 weeks for inland rail points. It’s all about the planning folks!

- Need to work on your contingency planning skills? Contact Shapiro’s Freight Experts for assistance!

Just Airly An Article

- Here are some quick air cargo updates for you today…

- Cargo demand in May is up 12% year-over-year (YoY), and this is the 5th straight month of double-digit growth. Many pundits expect 2024 in total to produce double-digit growth.

- Looking for a headwind? The US is cracking down on several unscrupulous e-commerce shipping patterns, and e-commerce is the belle of the ball for air cargo today.

- The average global rate for airfreight sits at $2.58—which is about 10% higher than a year ago, though 2023 was perhaps the most boring shipping year in history.

- Supply is up 4%, which likely showcases the very strategic use of airline cargo jets because of what we are about to tell you. Wait for it, please! Wait for your zone!

- The International Transport Association (through Bloomberg) expects the global airline industry to make $30.5 billion in net income this year, up over $3B from last year. They have also increased revenue per passenger by over 5.5%.

- Ahhh, now we know why it cost us $600 a person to fly 300 miles, last month!

- More passengers = more belly space for cargo; the 4% number is low, y’all! None of us ocean heads can relate to manipulating capacity, can we??!!

- Hey, the airlines took their lumps during Covid, and we are pleased to see a very high 60% global load-factor average. That kind of efficiency is good for profits and the planet!

Congress is Gettin' "GSP-y" with It!

- Another day, another catchy song to get stuck in your head! I won’t spoil this classic for you…bonus points if you can work it out in your head… Now that we’ve had our karaoke fun, let’s get down to business.

- Congress is expected to pass the Generalized System of Preferences (GSP) for another six years, which will allow importers to submit retroactive GSP claims and refunds.

- For any of you needing a refresher, GSP originally expired on December 31, 2020; and, if passed, would have a new expiration date of December 31, 2030.

- New criteria have been added that would cause GSP beneficiary countries to lose their eligibility if they commit gross human rights violations, or if they permit construction of military bases in their territories by US adversaries, including China, Russia, North Korea, and Iran.

- In addition, GSP beneficiaries cannot impose bans on US agricultural goods or digital services.

- The bill also sets origin material requirements of 35%, starting in 2024, but gradually increases the regional value content threshold to 50% by 2031.

- For more information, please refer to the GSP Reform Act—which was first introduced on April 15, 2024 and has already been approved by the House Ways and Means Committee.

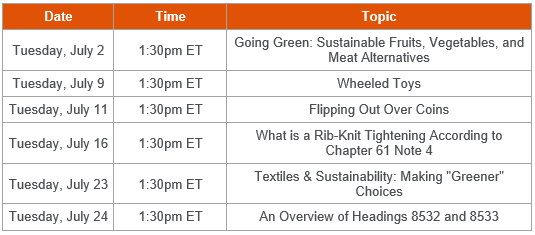

Weaving the NCSD Webinars for July 2024

- Hold the phone! Stop the presses! Did you hear that US Customs and Border Protection’s (CBP) National Commodity Specialist Division (NCSD) is presenting the next round of commodity-specific, educational webinars (more than 30 to be exact) to support internal and external stakeholders?!

- This year, NCSD officials have decided to focus the webinars on Greening the Tariff—meaning it intends to provide guidance on the classification of sustainable products and environmentally friendly practices in addition to our general tariff training. Talk about planting the seed of knowledge…badumpish!

- From March through September 2024, the NCSD will hold a series of one-hour webinars. Here is the July 2024 schedule:

- CBP officials are now registering attendees for the webinars scheduled for July and will proceed with monthly registrations for the remaining webinars. Registration links for upcoming meetings and recordings of previous webinars can be found here.

- For more information, please refer to CSMS # 60937863.

- And hey, if you read this far, then you are more than likely a HUGE fan of webinars. Contact [email protected] to learn more about our FREE webinar on the new Cosmetics Regulations this Tuesday (July 18)!

ILA Says No Way Jose

- The International Longshoremen’s Association (ILA) recently hit the pause button on the master contract talks with the United States Maritime Alliance (USMX) due to sneaky and loco automation (not to be confused with locomotion, as we cover that in a bit) moves at the Port of Mobile in Alabama.

- The catalyst of this controversy can be tracked back to allegations of automated truck gates, which the ILA argues violates their master contract and threatens jobs.

- With the current contract expiring on September 30, there’s mounting tension. The ILA has already warned of potential strikes on the horizon if no resolution is reached by October.

- With the holiday season approaching, the supply chain community is bracing for potential disruptions—which means it’s as good of a time as ever to work with your freight forwarder to ensure you have a contingency plan in place to keep the goods flowing.

- The outcome of this labor dispute could have significant impacts on shipping schedules, costs, and the broader logistics landscape…among other things.

- Worried your shipments might go off the rails?! (Yes, another locomotive reference felt needed) Keep up with the status of this ongoing situation by visiting our Labor Strikes Hot News page.

'Tis the Season for Strikes

- On the northside of our border, talks between the Teamsters Union and the Canadian National Railway (CN) have broken down, after neither side has been able to find common ground.

- Rail workers at CN and Canadian Pacific Kansas City (CPKC) were ready to strike on May 22nd, but the Canada Industrial Relations Board (CIRB) decided to intervene by reviewing if the strike might threaten public safety.

- On Friday, the union announced, “After just one day, it was clear CN wasn’t interested in our demands.” As a result, they canceled the remaining two days of talks.

- The union suggested two weeks of staggered negotiations with both CN and CPKC to minimize disruptions and address concerns more effectively, but the offer was apparently left hanging.

- We’ve all heard of French-Canadians and maybe argued with a few in Montreal, but the French are acting like Canadians… in France!

- June might be wild at France’s major ports, such as Le Havre and Marseille-Fos, as dockworkers are fired up over pension reforms affecting their retirement age.

- On June 7, dockers kicked off with a 24-hour strike, during which:

- Le Havre’s terminals were blocked;

- Four ship calls got canceled, and 18 more were delayed;

- Around 600 workers blocked truck entries at Marseille-Fos;

- One poor partridge was left in a pear tree.

- Ports like Dunkirk, Rouen, Bordeaux, and Nantes Saint-Nazaire are also becoming collateral damage. Rouen saw delays for three ships and two barges, and CGT union’s Serge Coutouris declared, “The government doubted our resolve. They’ll see our unity in action.”

Total Trucker Takeover

- Private chassis fleets are shaking up the game, forcing railroads and chassis providers to rethink their operations as truckers want more control over their wheels.

- The Federal Maritime Commission (FMC) supports truckers’ right to choose their chassis, but shippers still hit roadblocks, especially at inland rail ramps.

- Mike O’Malley from industry-leading chassis provider, DCLI, shared that trucker-owned chassis usage has doubled in the past seven years. In Memphis, DCLI’s pool now handles less than 60% of the volume, down from 95% just four years ago. In Chicago, over half of the containers are moved using trucker-controlled chassis.

- Union Pacific (UP) is adapting by moving towards stacked operations at their yards, investing “hundreds of millions” to accommodate the rise of trucker-controlled chassis.

- As rail yards evolve, expect more stacked operations to handle private chassis efficiently, with UP leading the charge in Kansas City, Dallas, and Memphis.

- The battle for chassis control continues…tune in next time for more exciting trucking updates!

- And, yes, we know it has been truckers owning chassis in Europe since Charlemagne’s reign! Yes yes, European pals, we do know that!

Trade Deficit Swells Like a Balloon

- April’s total trade deficit hit $74.6 billion, the highest since October 2022, fueled by a surge in imports like cars, computers, and industrial supplies.

- Imports jumped 2.4%—a level not seen since mid-2022—while exports crept up by just 0.8%.

- The swelling deficit hints at trade dragging down broader economic growth again, after a similar impact was seen in Q1.

- After accounting for inflation, the merchandise only trade deficit hit $93.5 billion in April, the largest in a year.

- With Americans spending like there’s no tomorrow and weaker overseas demand for US goods, the trade gap might just eclipse $100 billion.