Featured Headlines:

Upcoming Steel Import Monitoring and Analysis System Enhancements

Courses of Action for Importers Challenging the Legality of List 3 and 4 Tariffs

Proposed Amendments for the Importation of Organic Products

Section 301 Exclusion Monitoring – What You May Have Missed!

Eastbound Transpacific Catches Government Attention

High Import Volumes from China Continue to Cause Chaos at US Terminals

Australian Stink Bug Exemptions End

Upcoming Steel Import Monitoring and Analysis System Enhancements

On September 11, 2020, in addition to announcing a new online platform for the SIMA system, the US Department of Commerce (DOC) published a final rule in the Federal Register (FR) that modified its Steel Import Monitoring and Analysis (SIMA) regulations,

According to the FR notice, these regulatory changes will:

- Require steel import license applicants to identify not only the country of origin, but also the country from where the steel used in the manufacture of the imported product was melted and poured (as defined in the final rule).

- Expand the scope of steel products subject to the import licensing requirement to include all products subject to Section 232 tariffs.

- Extend the SIMA system indefinitely.

- Codify the existing low-value license requirement for certain steel entries up to $5,000.

Note: SIMA is administered by the Commerce Department’s Enforcement and Compliance Unit within the International Trade Administration (ITA); this is a group responsible for vigorously enforcing US trade laws.

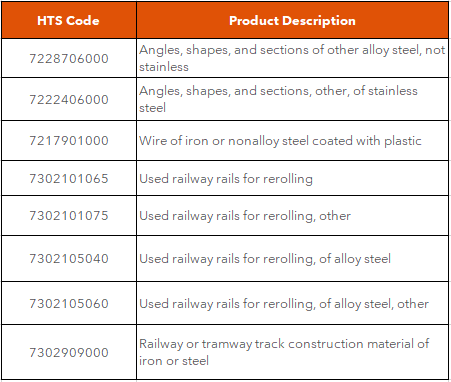

The following eight (8) HTS codes will require a Steel Import License under the final rule:

Please refer to the new table of HTS codes requiring licenses to view the full list of applicable products.

The New SIMA System

Once the new online platform for SIMA is released, steel importers will be required to complete a new field in which users must provide information about the country of melt and pour on all standard licenses (from all countries).

The modernized SIMA will also offer free data analytic tools to the public for performing detailed, customized data analysis. These tools will aid in the identification of changing trade patterns, including surges in US steel imports, as well as potential circumvention and evasion efforts.

At this time, the new online platform for SIMA is scheduled for release on Tuesday, October 13, 2020. In order to move the legacy licenses to the new platform, the platform will be unavailable from October 10-12. These licenses will remain valid for entry until the date of expiration. DOC will also accept manual license applications on an emergency basis from October 10-12.

As a result of the upcoming changes, such as the new license registration/application process, DOC has created a website to help introduce the new look and features of the system. The site will assist users with transitioning; it will also explore the various features designed to improve users’ ability to manage their accounts (including resetting passwords and correcting licenses older than three months).

The SIMA information web page has details to help transition to the new system, such as:

- Modifications to the SIMA System

- Instructional Videos on How to Apply for Licenses on The New Platform

- Information About Registering for A Demo

- Samples of the New Licenses

- New Product Concordance

- Updated FAQs (including a Glossary of Terms)

- Contact Information for SIMA team

Note: An email was sent out to all users of the SIMA system. If you did not receive notification, or you do not receive confirmation emails when applying for licenses, or your username is no longer a valid email address, please contact SIMA immediately! Doing this now will help avoid issues when the new system goes in on October 13, 2020. Please send any related questions to the SIMA team directly via [email protected].

The DOC will also hold a series of webinars for users to become familiar with the updated SIMA system. The webinars will be offered on a first-come, first-served basis. For specific dates and times of the demonstrations, and for information about participating, please click here.

Courses of Action for Importers Challenging the Legality of List 3 and 4 Tariffs

Per our previous Shap Flash, last month a lawsuit was filed in the U.S. Court of International Trade (CIT) targeting the legality of List 3 and List 4 tariffs on Chinese goods pursuant to Section 301 of the Trade Act of 1974.

If successful, this lawsuit could result in the refund of all Section 301 tariffs levied on List 3 and 4A goods over the past two years and up until the case is resolved, regardless of whether an exclusion was previously available or filed by an importer.

It was recommended that importers file their own independent lawsuits to ensure eligibility for any refunds that may arise due to the CIT lawsuit.

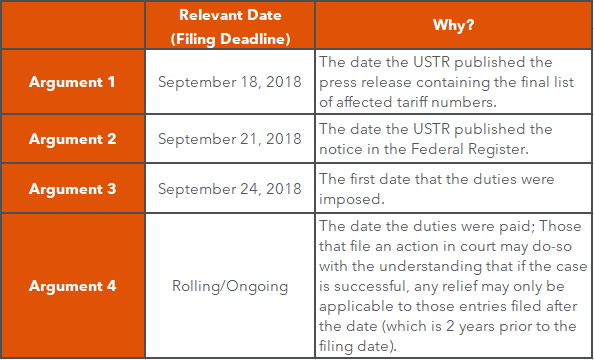

What has become less clear is the deadline to file. Yes, the statute of limitations is two (2) years from the date of the cause of action. However, the question is: when did the cause of action arise and what is the deadline to file?

Here are the arguments regarding the specific filing deadline currently being circulated and debated by the trade and legal community:

Some have also raised a separate practical issue. As a general matter, CBP may only refund duties through the liquidation process. Therefore, it is arguable that even if the case is successful, CBP would have no authority to issue refunds of duties on liquidated entries unless Congress authorizes such relief. In that case, importers may either protest the entries, or request that the liquidation of the entries be suspended until the litigation is finally resolved.

If you missed the originally imposed deadline of September 18th — or even if you did not — it is wise to act now, to protect your interests.

Here are some options available to you as an importer:

- Ensure protests are filed on any unliquidated entries for which Section 301 duties were paid. The protest provides CBP with a legal mechanism by which CBP is authorized to issue any refunds, should the lawsuit be successful. The only other means to do this is congressional action, which seems like a longshot to us.

- Important Note: This suggestion also applies to importers who have filed the independent lawsuits.

- Request suspension of all entries on which Section 301 duties were paid until the case is finalized.

Please reach out to [email protected] if we can provide additional assistance.

Shapiro will continue to monitor the situation and provide updates as they become available.

Proposed Amendments for the Importation of Organic Products

The Agricultural Marketing Service (AMS) division of the US Department of Agriculture (USDA) issued a proposal to amend the regulations for importations of organic products, including the certification of most parties involved in the supply chain.

Some of the proposed rules include:

- Reducing the types of uncertified entities in the organic supply chain, including importers, brokers, and traders of organic products. This will safeguard organic product integrity and improve traceability.

- Requiring the use of Import Certificates, or equivalent data, for all organic products entering the United States.

- Clarifying the labeling of nonretail containers used to ship or store organic products.

Click here to view the entire list of proposed changes/improvements contained in the Federal Register notices.

Additional Resources:

If you have any questions, please reach out to [email protected].

Census Bureau Seeking Public Comments on Proposed Removal of EEI Filing Requirements for Certain Shipments

On September 17, the Bureau of the Census issued an advanced notice of proposed rulemaking in the Federal Register (15 CFR Part 30) seeking public comments on its consideration to remove the Electronic Export Information (EEI) filing requirement for shipments between the United States and Puerto Rico and the US Virgin Islands.

Why does EEI filing to Puerto Rico matter?

Since Puerto Rico is considered part of the US Customs area for import and a US territory, this poses a question for the Census Bureau since the EEI filing statistics are used as part of its monthly processing. You can access these statistics in the FT–895 report, an annual report that presents total quantity and value of commodities shipped between the US, Puerto Rico, and US possessions – which includes the US Virgin Islands.

The Census Bureau is now seeking public comment on what measure of statistics could replace the EEI filings and satisfy all parties mentioned in the FR notice. Specifically, it is looking to assess the possible impact on statistics, data users, and businesses of removal of the filing requirement, and to identify any other possible impacts.

The Bureau will accept any pertinent feedback; however, below are some questions to consider:

- What Census Bureau statistical data on shipments between the 50 states and Puerto Rico (e.g., the FT–895 US Trade with Puerto Rico and US Possessions publications and digital datasets) are useful and how are they useful?

- What information in the Census Bureau’s statistical data on shipments between the 50 states and Puerto Rico is most relevant? What characteristics of data on trade for Puerto Rico are most relevant (e.g., consistency and comparability, timeliness, monthly publication)?

- The Congressional Task Force on Economic Growth in Puerto Rico requested an assessment of whether alternative datasets could be used, with or without modification, to achieve the same statistical objective of the current reporting requirement for Puerto Rico, while imposing a lesser burden on businesses. Are there additional or alternative datasets that you believe could be used for this assessment?

- If the EEI reporting requirement were eliminated and replaced by an alternative data collection intended to reduce burden, which information should be considered essential for inclusion in that alternative collection?

- Shipments from the 50 states to the U.S. Virgin Islands have a similar filing requirement that enables the Census Bureau to produce trade statistics for shipments from the 50 states to the U.S. Virgin Islands (also included in the FT– 895). Do you have any feedback on these statistical products, the information provided in them, and possible alternative datasets that would achieve the same statistical objective as the current reporting requirement, if the reporting requirement for the U.S. Virgin Islands also was eliminated?

Written comments must be received on or before November 16, 2020.

How to Submit Your Comment Directly:

- Online via the Federal eRulemaking Portal; the rulemaking RIN number is 0607–AA58.

- By email via [email protected]; include RIN number 0607–AA58 in the subject line.

Section 301 Exclusion Monitoring – What You May Have Missed!

The Office of the U.S. Trade Representative (USTR) has announced additional rounds of product exclusion extensions for Section 301 tariffs in the past month. Please refer to the following timeline for more information regarding each exclusion extension:

- September 17, 2020: USTR announces that 62 product exclusions from List 1 goods and 17 product exclusions from List 2 goods will retain their exclusionary status until December 31, 2020.

- September 30, 2020: USTR announces that 9 product exclusions from List 1 goods and 28 product exclusions from List 2 goods will retain their exclusionary status until December 31, 2020.

For issues with online submissions related to Section 301, please contact: Assistant General Counsels Philip Butler or Benjamin Allen, (202) 395–5725.

How can we help? Please reach out to [email protected] for assistance.

You can also learn more about by visiting our Shap Blog article – Food for Thought: Are Your Section 301 Exclusions Approaching Their Expiration Date?

Shapiro will continue to monitor and provide status updates on our Section 301 Tariff News page as they become available.

Eastbound Transpacific Catches Government Attention

The US Federal Maritime Commission (FMC) and the Chinese government are both currently reviewing market mechanisms that manage freight capacity and costs after the industry’s unprecedented conditions led to record high rates in September.

Back in February, the COVID-19 outbreak prompted widespread shutdowns for Chinese factories during a time that is traditionally a ramp-up period as the country emerges from its Chinese New Year (CNY) celebrations. Then, just as China was beginning to recover, the US began to shut down commercially as orders were halted or canceled altogether. As a result, carriers reacted by vigorously blanking routine sailings and greatly reducing capacity.

In May, US importers began to replenish sinking inventories by once again booking out of China and Greater Asia. Carriers were slow to react to the surge, which helped contribute to the historic capacity crunch. Once the blank sailings were fully reinstated, the demand had been chugging at full speed, without signs of stopping. May’s rush to restock inventories was soon replaced by spikes in personal protective equipment (PPE) imports and a higher than anticipated forecast for the US holiday season. Since the May rejuvenation, compounding general rate increases (GRI) at 15-day increments have driven rates to new highs.

However, cost is not the only symptom. Importers have also experienced higher-than-average rolls and severe equipment shortages at origin. Due to these circumstances, a last-minute meeting was called in Shanghai to press carriers to pause GRI’s and reinstate Golden Week sailings.

China’s Ministry of Transportation and Communication (MOT) met with carriers out of concern for its exporters ability to compete in the global market. Traditionally, carriers will remove sailings to make up for the reduced exporting during this period. Because the demand has yet to fall, the Chinese government is asking that carriers retain capacity and hold prices steady. Since COSCO and their subsidiary OOCL are largely owned by China, they had to follow the MOT’s guidance.

Following that meeting, the FMC alerted carriers that it was monitoring blank sailings, revenue trends and the utilization of equipment. Through strategic alliances, carriers have created an environment in which they are able to make swift, highly impactful choices that are under scrutiny for anti-competitive behavior. If future actions are found to have violated the Shipping Act, the FMC has already confirmed that they will take legal action.

Interested in staying up to date on Transpacific capacity? Visit our Subscription Center to sign-up to get the latest industry alerts delivered right to your inbox!

High Import Volumes from China Continue to Cause Chaos at US Terminals

Per our earlier Flash, US imports from Asia in August increased 34 percent from June, driven by a high demand for e-commerce fulfillment and personal protective equipment (PPE). In August alone, imports from China were up 32 percent.

According to the JOC:

- US imports from all of Asia accelerated from 1.23 million TEU in June to 1.5 million TEU in July to 1.65 million TEU in August.

- The 450,000 TEU gain from June to August meant a 34 percent jump in imports over the summer and a 16.5 percent increase from last year.

- August was the first month in 2020 that total US imports globally increased year over year.

- August imports were up 11.7 percent from August 2019, after declining 2.5 percent in July from July 2019.

- Year-to-date, total US imports are down 5.2 percent.

This import fluctuation has had an uneven impact on supply chains at US ports and within inland transportation chains causing marine terminal congestion, chassis shortages and slower processing of shipments at inland distribution centers.

The blank sailings previously initiated by ocean carriers have further complicated the situation, as not only have import volumes increased, but containers are now arriving into ports on larger, more condensed vessels at the same time.

In Los Angeles-Long Beach (LA/LB), truckers and marine terminals said a shortage of chassis has recurred. According to the Harbor Trucking Association, drayage operators are struggling each day to secure enough equipment to move containers to and from all terminals in the LA/LB region. DCLI reports that the real problem is a chassis dislocation rather than an actual shortage of equipment in the region. Warehouses and manufacturing plants are keeping the equipment longer, keeping chassis out of circulation.

LA/LB is not the only terminal experiencing port congestions and chassis shortages. NY/NJ terminals are also experiencing similar situations causing disruptions throughout the US Supply chain.

Importers have been warned of delays and increased costs, such as congestion, detention, per diem and demurrage charges.

Australian Stink Bug Exemptions End

According to Australian authorities, the threat of the brown marmorated stink bug is too high to continue exempting air-sea shipments from treatment requirements.

Earlier this year, the pandemic severely limited air cargo capacity into Australia, thereby forcing air cargo to move by any means possible. This included scenarios such as a shipment flying into Singapore, that is then transshipped onto a vessel for the final leg by ocean. Due to these unusual circumstances, normal ocean freight biosecurity requirements were not enforced, mostly because authorities recognized the impact to the supply chain and the lower threat in the off season.

As the season for these bugs begins to flourish in September, officials have recently reversed this move, and have returned to typically observed regulatory requirements. However, because capacity is still an ongoing issue, the requirement will again be up for review in December.

Stink bug season has grown in recent years and spans from September 1 to May 31 annually. The smelly bug is notorious for damaging produce and crops by feeding and scarring. It affects products imported from more than 30 countries.

Questions? Don’t hesitate to contact our airfreight specialists with any and all questions related to capacity and rates.

A Brief Trucking Update

In April, the trucking industry lost jobs to the COVID-19 pandemic. To date, some drivers have not yet returned to the industry.

The Truckload Carriers Association (TCA) reported that June turnover saw only three out of every four departed drivers replaced.

There is concern inside the industry that many drivers have left permanently for other sectors such as construction. If this reduced turnover holds, it could have poor implications for the future of driver capacity.

Employee of the Month

As previously featured in Shap Talk, Shapiro has been sharing with you the names of employees who have been recognized for their exceptional efforts and contributions to our Company. At Shapiro, we continually work to develop, challenge, and inspire all of our employees to grow individually and with the Company.

This month, we would like to recognize CRISTY KIRSSIN, IMPORT ANALYST.

If you are lucky enough to interact with Cristy, you will find that she leaves no stone unturned; nothing is incomplete or undone on her watch. Though many of our teammates find themselves a bit overwhelmed during this peak season, she always maintains a positive attitude and helps to motivate others in the process. Cristy never has a “lazy” attitude and she ALWAYS gives her all.

When covering someone’s desk, she will go the extra mile to ensure her team member’s work is complete. When it comes to having a reject on file, Cristy is one of the few who goes the extra mile to fix it on her own. And if she cannot figure it out for herself, then she will ask someone who knows so that she learns how to do so in the future. She truly is a star. Congratulations, and thank you, Cristy!

We encourage you to provide us with employee feedback! Please email us at [email protected].