Featured Headlines:

Hot Town, Summer in Houston City

Stocking Up for a Trade Typhoon

US Considers ADD-ed Protection Against Drum Rolls & Freezer Burn

US Adding More Export Restrictions to Counter Russian Aggression

Cautionary Tales from the Compliance Corner

US Logistics Provider Capsizes

Ocean Carrier Supply is Awry!

- Very quietly, the steamship industry has welcomed about 1.4 million bright-eyed and bushy-tailed TEUs of new capacity to the global market year-to-date (YTD). That means that over 3% of today’s total capacity is bright, shiny, and toting a new Taylor Swift lunchbox to the school of international supply chain logistics!

- And this is just the beginning of a three million plus wave of new “students” expected to add almost 10% enrollment to the crowded classrooms of the sea. That’s a lot of new faces aboard the world’s global containership fleet, gang!

- Yet, expectations are quite low that these new scholars will help cover much demand in their rookie campaigns. How can this be so?

- Well, it must be that the robber baron steamship executives are keeping more experienced kids out of school to lower capacity, right? At 0.7%, the idle fleet is at one of its lowest grade point averages in recent history. Nope, it isn’t vessels parked, in dry dock, or being kept after class in detention (when the vice principal punishes TEUs, is it called detention, demurrage, or per diem? Hmmm…)

- So, despite our skepticism, it must be all about the Red Sea crisis and those longer transits, after all? To a great extent, gentle scholars, the answer is “yes,” but we really should say, “yes and.”

- First, ocean carriers must add 15-30% more allocation just to “break even” on effective capacity for European service strings. Second, even the squeakiest cleanest new vessels are not on time to port, and they hang out with the older leather-clad vessels smoking out back waiting for a berth. Thus, delay leads to delinquency leads to congestion leads to more delay… leads to on-time shipping graduation rates plummeting. Alas and dear me!

- And once these juvenile delinquent vessels fail a course in Antwerp, do you really think they show up prepared and on-time in New York or Shanghai? Nope, their grades suffer in all subjects, and the problem multiplies even for vessels that do not know their multiplication tables or their Latin verbs.

- So, if we keep the guns out of our schools, and the Red Sea crisis abates, this whole lesson on supply and demand shifts immediately in favor of supply, right?

- On (college-ruled) paper, yes it will help immensely. However, who is to say the Houthis won’t be just as angry about school yard brawls between Israel and Hezbollah as they have been about Hamas? Once a bully, always a bully in the Red Sea?

- As ocean rates in many markets near a 300% increase YTD, we are looking for hope on the great horizon of potential supply, but even an expected 10% gain isn’t enough to correct the profound dysfunction schooling us all on the power on global interconnections.

Hot Town, Summer in Houston City

- Port Houston handled 364,866 TEUs in May, a whopping 21% increase over last year, adding more than 64,000 TEUs. From January through May, they’ve moved 1,758,960 TEUs, marking a 14% rise compared to the same period in 2023.

- Thanks to robust warehouse construction and consumer spending on furniture, hardware, and retail goods, loaded import volumes skyrocketed by 18% this month compared to last year.

- Strong manufacturing in Texas pushed loaded exports up by 21% this month to 131,690 TEUs and by 15% year-to-date, reaching 655,116 TEUs. The oil business that is, black gold, Texas tea! The first reader not working at Shapiro who identifies that oil reference and emails [email protected] wins an Amazon gift certificate!

- By the end of 2024, the Houston Ship Channel Expansion will allow 14,500 TEU neo-Panamax class vessels to berth at Bayport. Houston’s improved infrastructure is arriving right on time (like exactly 2% of ocean vessels globally since the Houthis got unhappy).

- Quick reminder on the major classes of containerships:

- Small Feeder (1-1,000 TEUs)

- Feeder/Barge (1,001-2,000 TEUs)

- Feedermax (2,001-3,000 TEUs)

- Panamax (3,001-5,000 TEUs)

- Post-Panamax (5001-10,000 TEUs)

- Neo-Panamax (10,001-14,500 TEUs)

- Ultra Large (14,501 TEUs and Up)

Stocking Up for a Trade Typhoon

- With several potential and on-going global and domestic crises looming, US importers are pulling orders forward, eager to move containerized freight into the country ASAP. This despite the absurd increases in shipping costs (with four digit per container increases seemingly every 15 days).

- Laden imports from Asia surged 6.7% in May, with forecasts for impressive growth continuing through September. While US retailers are optimistic on consumer demand, it’s also quite a bit like stocking up before a storm – everyone’s bracing for what’s next.

- From potential “labor pains” from the ILA to the potent nausea of “morning sickness” over protectionist potentials in November, importers have every reason to pray for demand while over-shipping (wait, didn’t we do this in 2022?!).

- While the container drayage sector is already feeling the spiking import volumes, other surface transportation modes, especially FTL are still waiting for a demand boost.

- Experts predict steady growth in US surface transportation though nothing like the tsunami that is the ocean freight rate market.

US Considers ADD-ed Protection Against Drum Rolls & Freezer Burn

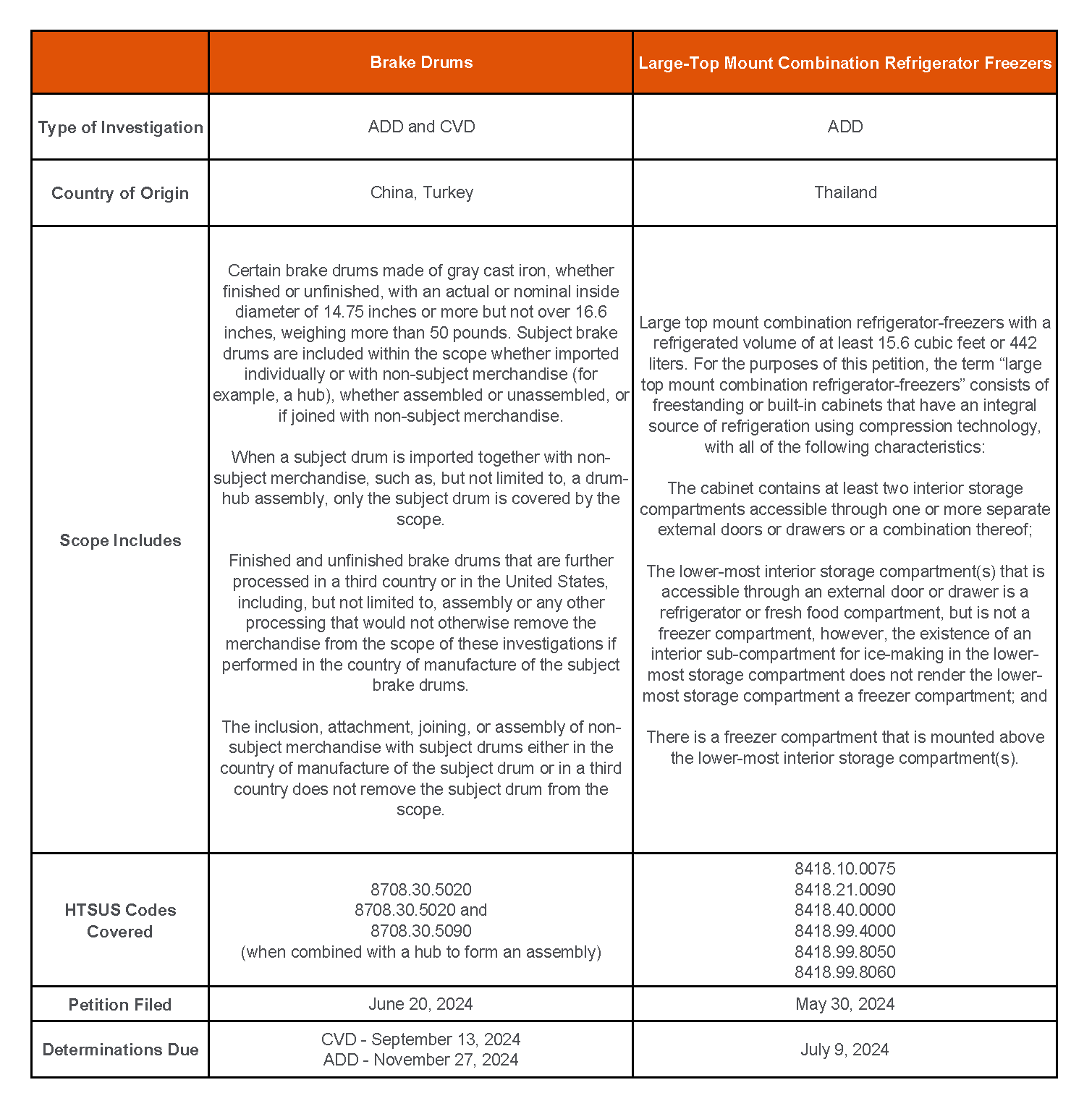

- Is it just us, or does it feel like US trade officials have been knee deep in Antidumping and Countervailing Duty (ADD/CVD) Investigations of late…? (Spoiler Alert: This is a rhetorical question!)

- Here is a summary of two ongoing investigations currently under the microscope:

- Link to Notice: Brake Drums from China and Turkey

- Link to Notice: Large Top Mount Combination Refrigerator-Freezers from Thailand

- It’s important to keep in mind that duties such as AD/CVD are important trade measures used to protect domestic companies from unfair actions taken by foreign competitors. Due to the additional costs and liabilities incurred, it pays to tap the brakes and know this stuff cold (get it?).

- Stay ahead of the curve and visit our Regulatory Compliance Hot News page to boost your ADD/CVD knowledge…and potentially save yourself a boatload of time and cash later!

US Adding More Export Restrictions to Counter Russian Aggression

- In advance of the G7 Summit, today, and in concert with the Department of the Treasury and the Department of State, the Commerce Department’s Bureau of Industry and Security (BIS) is announcing several significant additional export control restrictions and related actions against Russia to further degrade its ability to continue waging war against Ukraine.

- These actions underscore the Biden-Harris Administration’s unwavering commitment to countering Russian aggression and its illegal, unjustified, and unprovoked war in Ukraine.

- Key actions include:

- Cracking down on diversion through shell companies;

- Further cutting off exports of business software that enable Russian and Belarusian defense industries;

- Restricting trade in more items destined to Russia and Belarus;

- Tightening the availability of license exceptions for Russia and Belarus;

- Cutting off trade to foreign companies through the Entity List;

- Issuing Temporary Denial Orders (TDO), which cuts off not only the right to export items subject to the Export Administration Regulations (EAR) from the U.S., but also to receive or participate in exports from the U.S. or reexports of items subject to the EAR; and

- Restricting distributors and transhippers.

- “BIS will continue working with our international and interagency partners to tighten and enforce our restrictions. This work is imperative to limiting Putin’s military options by imposing substantial costs on his ability to repair, replenish, and rearm with high-tech, high-quality equipment,” said Under Secretary of Commerce for Industry and Security Alan Estevez.

- “BIS will continue to stand with Ukraine and do its part by restricting Russia’s access to items that can sustain its war effort, as well as by identifying entities—wherever located—that seek to provide support to Russia’s war effort and further Putin’s horrors,” said Assistant Secretary of Commerce for Export Administration Thea D. Rozman Kendler. “We remain determined, along with our allies and partners, to degrade Russia’s ability to wage this tragic war of aggression.”

Cautionary Tales from the Compliance Corner

- It’s no secret that the US Department of Commerce’s (DOC) Bureau of Industry and Security (BIS) has allocated a good amount of both time and resources towards preventing certain technologies from falling into the hands of foreign rivals—especially those associated with Russia and/or China.

- Let’s take a gander at the results of two recent investigations performed by BIS officials:

- An Oregon-based freight-forwarder (USGoBuy) was hit with a three-year export ban by the DOC for failing to comply with export-control laws and this denial order could shut down their operations completely.

- The ban serves as a stern warning to other companies about the importance of adhering to US export restrictions, especially regarding sensitive technologies.

- The last time such a ban was imposed was in 2018 against ZTE Corp. That ban was lifted after three months, but not without placing ZTE under additional compliance-monitoring.

- USGoBuy’s troubles began with a 2021 settlement for shipping riflescopes to China and the UAE. BIS agents tested USGoBuy’s procedures by sending a dummy package labeled with conspicuous warnings. The company reshipped it to China the same day, showing they missed the compliance boat entirely.

- A Russian-based anti-virus software and cybersecurity company (Kaspersky Lab, Inc.) was banned from directly or indirectly providing anti-virus software and cybersecurity products or services in the US and/or to US persons.

- An Oregon-based freight-forwarder (USGoBuy) was hit with a three-year export ban by the DOC for failing to comply with export-control laws and this denial order could shut down their operations completely.

Savannah's Rail Surge

- The Port of Savannah has seen a boost in containerized cargo moving by rail, increasing from 16% to over 19% last year. More freight is now heading to inland hubs like Atlanta and Memphis via train, easing the load on highways.

- The Mason Mega Rail Terminal, opened in late 2021, aims to push intermodal cargo share to 25%. This target is set to get a significant boost with the opening of an inland port in Gainesville, GA, in 2026.

- What makes these numbers even more impressive is that overall cargo volume into and out of Savannah continues to grow impressively (and this certainly upsets the proud denizens of Charleston, SC!). You see a higher percentage of a growing number creates a bigger number, and that is how math works, people!

- During the pandemic, there was a shift away from rail, but now ocean carriers are back on track, embracing rail to reach final destinations.

- Intermodal volume between Savannah and Atlanta has skyrocketed by 38% year-over-year. This means over 60,000 additional containers on rail, clearing the roads and speeding up deliveries. This is also a stat to make your Mother (Nature) proud!

- The Georgia Port Authority (GPA) is on track for a record year, expecting close to 1.1 million TEUs of rail lifts. The Mason Mega Rail terminal can handle up to 2 million TEUs annually, doubling the capacity of the old terminal. Savannah has the capacity to continue to grow!

US Logistics Provider Capsizes

- US Logistics Solutions, formerly doing business as Forward Air Solutions, has filed for Chapter 7 bankruptcy, resulting in 2,000 jobs lost and the end of its operations.

- With 1,000-5,000 creditors, US Logistics Solutions faces liabilities between $100 million and $500 million, against assets estimated between $50 million and $100 million.

- Pundits speculate that the loss of key contracts, including a $30 million deal with Bath & Body Works, lead to a lawsuit against the former CEO for alleged breaches of non-compete agreements.

- Employees were abruptly informed via text and calls that operations would cease, leaving many without their final paychecks. Under the WARN Act, employees might take legal action for the lack of the required 60-day notice before mass layoffs.