Featured Headlines:

CBP User Fees Going Up in 2018

CBP Initiates Inquiries on Nationality of Workers in Supply Chain

Advanced Notice of Proposed Rulemaking (ANPRM): Standard and Routed Export Transactions

Lawmakers Call for Extension of GSP Prior to December 31

Port of Qingdao Bans Dangerous Goods

September 2017 U.S. Trade Deficit Update

Quality Control vs. Speed to Market: The Risk of the Retail Rush

CSX Brings Baltimore’s Double-Stack Project to a Screeching Halt

DCLI to Acquire TRAC’s Domestic Chassis Fleet

CBP User Fees Going Up in 2018

CBP has announced that effective January 1, 2018, several CBP user fees will be adjusted for inflation at a rate of 2.677%. Among the fees being adjusted are Customs broker permit user fees and merchandise processing fees.

Currently the Customs broker permit user fee is $138 and will be increased to $141.70. The merchandise processing fee currently has a $25.00 minimum and $485.00 maximum. This fee will be increased to a $25.67 minimum and $497.99 maximum.

CBP Initiates Inquiries on Nationality of Workers in Supply Chain

Importers need to act immediately to ensure no vendors in their international supply chains are employing North Korean nationals as forced laborers to produce goods imported into the United States.

U.S. Customs and Border Protection has initiated inquiries to importers enforcing new legislation on this issue and has the authority to detain shipments for admissibility. Any goods made with forced North Korean labor, regardless of their origin, are banned effective Sept. 21, 2017, with the burden of proof on importers to demonstrate that either no North Korean nationals were used in the production of the detained goods, or if they were used, that it was not under forced conditions.

The U.S. Government is monitoring media reports of North Koreans working in a forced capacity in various countries, such as Poland, Mexico, Angola, Equatorial Guinea, China and Russia.

Advanced Notice of Proposed Rulemaking (ANPRM): Standard and Routed Export Transactions

The U.S. Census Bureau is requesting comments regarding the Advanced Notice of Proposed Rulemaking that was published on October 6, 2017 pertaining to standard and routed export transactions. Routed export transactions are transactions in which the Foreign Principal Party in Interest (FPPI) controls the movement of the goods out of the country.

While all feedback is welcome, the Bureau of the Census is specifically interested in feedback related to the following questions:

- If you do not think the definition of a routed export transaction in 15 CFR 30.1 is clearly stated, then what definition of routed export transaction would you suggest?

- Should the Census Bureau modify the list of data elements in 15 CFR 30.3(e)(2) that the U.S. authorized agent is required to provide when filing the electronic export information? If so, what changes would you suggest?

- Should the Census Bureau modify the list of data elements in 15 CFR 30.3(e)(1) that the U.S. Principal Party in Interest (USPPI) is required to provide to the U.S. authorized agent? If so, what changes would you suggest?

- The carrier’s responsibilities under the Foreign Trade Regulations, or FTR, are the same in both standard and routed transactions. Does the FTR clearly communicate these responsibilities? If not, what clarification would you suggest?

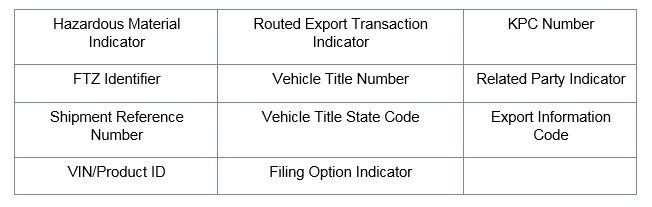

- The data elements that the USPPI and U.S authorized agent are required to provide are currently located in Section 30.3(e) of the FTR. However, additional data elements are needed to complete the Automated Export System filing. Below is a list of data elements that are required to be reported, but for which a responsible party is not listed. Please provide comments on which party, the USPPI or the U.S. authorized agent, should report these data elements.

- Are the responsibilities of parties in a routed export transaction clearly stated? If not, what improvements would you suggest?

- How could we improve the process to authorize filing in a routed export transaction?

- How could the FTR be revised to align with the Bureau of Industry and Security’s Export Administration Regulations on routed export transactions?

- What changes would you suggest in Section 30.3 of the FTR that might improve the parties’ understanding of the requirements of a routed export transaction?

- What changes would you suggest in Section 30.3 of the FTR that might improve the parties’ understanding of their roles in a routed or standard export transaction?

Comments should be directed to the Chief, International Trade Management Division, U.S. Census Bureau, Room 5K158, Washington DC 20233-6010. All comments should be received on or before December 5, 2017.

Lawmakers Call for Extension of GSP Prior to December 31

Members of the House of Representatives called for Congress to approve a long-term extension of the Generalized System of Preferences (GSP) before it expires on December 31st. When GSP last expired, it lapsed for two years and cost importers millions. There is some concern a similar situation could occur during this potential period of cessation.

There are many benefits to this program aside from the duty-free treatment of goods. Some of these benefits include improvement of labor practices in eligible countries and decreased costs of consumer goods domestically.

If GSP is not renewed in a timely fashion, then all of these benefits will become void. An untimely renewal of GSP could cause companies to lay off workers, lower wages and benefits, and reduce investment. In an effort to avoid any negative fallout, lawmakers are urging Congress to act quickly and also to reauthorize GSP on a 5-year term.

Port of Qingdao Bans Dangerous Goods

With the port of Tianjin set to ease restrictions after a two-year ban on dangerous goods, Qingdao has now enforced a similar prohibition in an effort to revamp their dangerous goods policy. The new policy takes the form of a “Ban, Limit, Turn” program, forcing hazardous goods to ship from Shanghai. Qingdao’s Office of Safety Committee announced the ban, effective August 4th 2017, on Class 1-7 dangerous goods. These goods are prohibited from loading, discharging and/or transshipping though Qingdao.

The “Ban, Limit, Turn” policy began with a full prohibition of Class 1-7 goods. During the first phase, local government, port authorities, Customs, and inspection departments will focus on improving coordination and inspection policies to ensure enforcement and expand interdepartmental processes for the future. The “Limit” phase focuses on reducing stockpiling and storage of dangerous goods, improving loading procedures, and assessing commodities into high and low risk categories for more specific regulations. “Turn” also refers to “transfer” or “shift” and represents the long-term strategic change in development policies to promote safety while still encouraging economic growth.

Tianjin Port closed to all dangerous goods in 2015 after a devastating explosion in a warehouse near the port was caused by hazardous materials. Shippers were forced to route dangerous goods through Qingdao during Tianjin’s prohibition. At that same time Qingdao put a hold on dangerous goods storage, requiring direct loading and discharge within a 72-hour window.

Until Tianjin and Qingdao reopen to all DG classes (currently they allow only classes 8 & 9), Shanghai offers the best option for moving class 1-7 cargo from North Central China. We can expect to see an increase in rates for shipping hazardous goods through Shanghai as carriers are asked to carry the additional load. Adding to costs, shippers face steeper trucking rates to Shanghai from these areas. Manufacturers must consider alternative sailing schedules as storage options decrease, especially if we see Shanghai implement a “no storage” policy as Qingdao did in 2015.

Hopefully Qingdao can employ lessons learned from Tianjin’s process and telescope their “Ban, Limit, Turn” policy. However, despite some rumors, the ban does not have an expiration date. Neither the Safety Committee, nor Qingdao Qianwan United Container Terminal Co. have published an implementation schedule or expiration to the new prohibition. In the meantime, shippers must focus on minimalizing impact to their supply chains by adjusting to the new requirements and offering alternative shipping options.

September 2017 U.S. Trade Deficit Update

The U.S. trade deficit increased in September of 2017 to $43.5 billion as imported goods and services continued their trend of outgrowing exports. The September gap spiked from $42.8 billion in August.

The Washington Post reported that “exports rose 1.1 percent to $196.8 billion, the highest level since December 2014. But imports rose more: up 1.2 percent to $240.3 billion.”

The deficit in trade reflects that the U.S. is purchasing more goods and services than it is selling and indicates an overall reduction in economic growth.

So far in 2017, the U.S. has accumulated a trade gap of $405.2 billion, which represents an increase of 9 percent vs. the same period in 2016. This is despite the fact that a weakening U.S. dollar has made American-made products less expensive in overseas markets, a statistic that typically boosts U.S. exports and results in foreign produced goods being less cost competitive for American consumers.

Quality Control vs. Speed to Market: The Risk of the Retail Rush

As the retail marketspace continues to be dominated by trending products, suppliers face increased pressure to manufacture goods at rapid speeds. But at what cost does this rapidity come to buyers and end consumers? Varying product markets are subject to these demands, from fidget spinners to Apple’s iPhone X, and the pressure to meet production deadlines can often result in manufacturers compromising on quality.

Asia Inspection, one of the leading quality control inspection service providers in China, reported in their Q4 2017 market analysis that many popular products are shipped to stores without thorough testing and inspections. AI’s analysis found that overall, Chinese manufacturing quality improved 4% from 2016 to 2017 in Q3. However, while quality improved, product compliance took a significant hit – Asia Inspection found that “up to 8% of toys did not meet the requirements on flame retardancy, 9% failed due to mechanical hazards, and up to 10% contained unacceptable amounts of heavy metals.”

Products with lithium ion batteries are those most likely to suffer from poor quality control at origin and can be costly to importers. The Samsung Galaxy Note 7 recall was largely due to subpar manufacturing – after the initial recall of the phones because of issues with the lithium ion batteries, the second round of batteries were hastily expedited only to result in total recall of the product. Light up fidget spinners, touted to assist in concentration, were banned and recalled as there have been numerous instances of their lithium ion batteries overheating or melting during use. Earlier this year, HP recalled over 100,000 laptop batteries as its lithium ion batteries overheated, causing fire and burn hazards.

As retailers push the cutting edges of technology, this places unprecedented demand on suppliers. Apple’s iPhone X launch has been delayed significantly, in large part due to component sourcing issues, labor shortages at factories, and the rush to market placing difficult demands on their suppliers. Its 3D face recognition technology implementation has been its biggest source of concern as manufacturers struggle to mass produce exceptionally fragile components to meet Apple’s looming deadline. Bloomberg Technology reported Apple quietly instructed suppliers to reduce the accuracy of the face recognition to meet their projected launch date, though Apple denies this claim.

Quality control is key to any successful product launch. For retailers, both large and small, whenever considering a new product or supplier, it is crucial to do the research and ensure a quality product is being manufactured. Lithium ion batteries pose the greatest risk to importers; when sourcing these goods, suppliers should be able to readily supply the Material Safety Data Sheet (MSDS) to ensure the batteries meet shipping standards. Shapiro suggests beginning the dialogue early with your supplier whenever sourcing a new product – have them send a sample directly to you, request inspection reports, consider other buyers’ experiences via online reviews. Research done early in the process can save you costly delays later, and can help to ensure the success of your eCommerce venture.

CSX Brings Baltimore’s Double-Stack Project to a Screeching Halt

A major blow was dealt to the Port of Baltimore as CSX Transportation decided to halt its funding for the renovation of the 121-year-old Howard Street Tunnel. The 425 million dollar project would have raised the tunnel, giving double-stacked trains the ability to come into Baltimore’s port, thus greatly improving rail service up and down the East Coast.

CSX had agreed to pay for $125 million of the project, but withdrew its offer in an effort to focus more on its companywide “precision railroading” strategy, which seeks to enhance performance and create greater cargo density. With CSX dropping out of the deal, the additional costs would have been split between the U.S. Department of Transportation and the Maryland Department of Transportation. Despite the support of the Hogan Administration and INFRA grant program, the Maryland Department of Transportation could not spare additional funding for the project.

Completion of this project would have catapulted the port of Baltimore into a high growth future via new trade lanes, and increased shipping productivity. Double-stacked trains could have more than tripled the number of containers serviced by Baltimore rail each year, from 30,000 containers to 110,000 containers. States such as New York, New Jersey and Virginia already have double-stacked capability, so this is a significant loss for the future of Baltimore’s rail industry.

The Maryland Department of Transportation is working with CSX to explore other options that could help secure the rail’s future and improve overall freight services.

Auf Wiedersehen, Air Berlin

Air Berlin (AB), a member of the One World Alliance, flew its last flight operating under the AB name on Oct 27th, 2017 from Munich to Berlin. The last long haul flight was October 15th from Miami to Dusseldorf. Amidst a history of disruptive labor negotiations, a revolving door in the executive offices, and frequent strategy changes, the airline is now going through insolvency proceedings. The roots of the airline date back to the 1970’s as a U.S. carrier, with their group of co-founders having ties to both Pan-Am and National airlines.

In 2011, Etihad had invested in Air Berlin, but pulled the rip cord in August 2017 after deteriorating performance. The German government stepped in to buoy the end processes in an effort to allow thousands of employees to keep their jobs. The number retaining jobs during parceling is uncertain. Lufthansa and Easyjet are among carriers interested in acquiring parts of AB.

DCLI to Acquire TRAC’s Domestic Chassis Fleet

On October 25th Direct ChassisLink, Inc. signed an agreement to purchase the entire domestic chassis fleet from major competitor TRAC Intermodal. The acquisition, which encompasses approximately 77,000 53-foot domestic chassis, also includes TRAC’s contracts with major Class I railroads, drayage providers, intermodal marketing companies and shippers across the United States. The financial terms of the transaction, due to close in January 2018, have not been released.

As a result of this acquisition, DCLI will own, lease, or manage approximately 136,000 marine chassis, as well as approximately 80,000 domestic chassis, for a total chassis fleet of over 216,000. In addition, through its REZ-1 asset management platform, the company manages over 86,000 domestic intermodal containers for third parties. In order to guarantee a seamless transition for its customers, DCLI is entering into a Transition Services Agreement with TRAC until the complete system migration is accomplished.

TRAC will continue to focus on its marine intermodal business, providing chassis used for international cargo to and from ports. Currently TRAC’s chassis fleet includes more than 177,000 chassis servicing nine pools and 60 depots.

The U.S. chassis market changed when Maersk Lines created DCLI and transferred its chassis fleet to the company in 2008. Other container lines quickly followed suit and stepped away from the chassis business. During the last decade, TRAC, DCLI and Flexi-Van have come to dominate the market for leasing of U.S. marine chassis.

November Rate Environment

October witnessed an unexpectedly sharp plunge in spot rates, especially to the U.S. East Coast, further highlighting the carriers’ excess capacity woes. Despite an overall increase of 6% for global volume (demand), even small reductions in that demand create tremendous and prompt downward pressure on rates. Remember that the overall global capacity increase is estimated at 8-9% for 2017.

In a pleasant surprise for carriers, demand rose somewhat powerfully to close October, and this allowed carriers to boost spot rates by roughly $450 to the U.S. East Coast and roughly $350 to the U.S. West Coast. The presumption is that U.S. retailers created this spike as they eyed arrivals just before Black Friday. It remains to be seen if the typical Q4 demand slippage will be as dramatic as it has been in recent years.

Interestingly, ocean carriers have all but ignored the use of blank sailings to quickly adjust market supply. It feels quite likely that ocean carriers are holding this weapon in reserve should demand weaken again in the coming weeks. Also, the industry continues to watch winter deployment configurations to best understand potential shipping windows and supply chain disruptions.

Employee of the Month

As previously featured in Shap Talk, Shapiro has been sharing with you the names of employees who have been recognized for their exceptional efforts and contributions to our Company. At Shapiro, we continually work to develop, challenge, and inspire all of our employees to grow individually and with the Company. This month, we would like to recognize Chris McCray, Senior Accountant in Baltimore for his outstanding performance and contributions.

We encourage you to provide us with employee feedback! Please email us at [email protected].

Shapiro Freight Report

This high-level, monthly review of the U.S. import freight market to provides key insights into the tumultuous world of international shipping. From carrier alliances to labor strikes, Shapiro covers the pertinent information logistics managers need to know. Check back monthly to ensure you don’t miss key industry insights!

October witnessed an unexpectedly sharp plunge in spot rates, especially to the US East Coast. This highlighted the carriers’ excess capacity woes. Despite an overall increase of 6% for global volume (demand), even small reductions in that demand create tremendous and prompt downward pressure on rates. Remember that the overall capacity increase globally is estimated at 8-9% for 2017.

In a pleasant surprise for carriers, demand rose significantly to close October, and this allowed carriers to boost spot rates by roughly $450 to the US East Coast and roughly $350 for the US West Coast. The presumption is that US retailers created this spike as they eyed arrivals just before Black Friday. It remainsto be seen if the typical Q4 demand slippage will be as dramatic as it has been in recent years…..