Featured Headlines:

House Passes Miscellaneous Tariff Bill

CBP Reaches Historic Milestone with Final Core Trade Processing Deployment in ACE

The Winds of Change: Reshaping the Container Shipping Industry

NY-NJ Terminal Upgrade’s Goal is 25 percent Turn Time Reduction

“ONE” More Thing to Consider with the Japanese Big 3 Merger

Major Rail Delays in the Chicago Area

Shippers Continue to Experience Heavy Rail Delays in Vancouver

Homeland Security Committee Approves Bill to Review TSA Known Shipper Program

Amazon’s New Delivery Service a Challenge to UPS and FedEx?

President Trump Issues Presidential Proclamations with Additional Import Steel and Aluminum Tariffs Effective March 23, 2018

Under Presidential Proclamations issued on March 8, 2018:

“Steel article” imports specified in the Annex shall be subject to an additional 25 percent ad valorem rate of duty with respect to goods entered, or withdrawn from warehouse for consumption, on or after 12:01 a.m. eastern daylight time on March 23, 2018. This rate of duty, which is in addition to any other duties, fees, exactions, and charges applicable to such imported steel articles, shall apply to imports of steel articles from all countries except Canada and Mexico.

“Steel articles” are defined at the Harmonized Tariff Schedule (HTS) 6‑digit level as: 7206.10 through 7216.50 (including ingots, bars, rods and angles), 7216.99 through 7301.10 (including bars, rods, wire, ingots, and sheet piling), 7302.10 (rails), 7302.40 through 7302.90 (including plates and sleepers), and 7304.10 through 7306.90 (including tubes, pipes and hollow profiles), including any subsequent revisions to these HTS classifications.

“Aluminum articles” specified in the Annex shall be subject to an additional 10 percent ad valorem rate of duty with respect to goods entered, or withdrawn from warehouse for consumption, on or after 12:01 a.m. eastern daylight time on March 23, 2018. This rate of duty, which is in addition to any other duties, fees, exactions, and charges applicable to such imported aluminum articles, shall apply to imports of aluminum articles from all countries except Canada and Mexico.

“Aluminum articles” are defined as (a) unwrought aluminum (HTS 7601); (b) aluminum bars, rods, and profiles (HTS 7604); (c) aluminum wire (HTS 7605); (d) aluminum plate, sheet, strip and foil (flat rolled products) (HTS 7606 and 7607); (e) aluminum tubes and pipes and tube and pipe fittings (HTS 7608 and 7609); and (f) aluminum castings and forgings (HTS 7616.99.5160 and 7616.99.51.70).

Countries Exempt from these tariffs (for now): Canada and Mexico

Canada and Mexico are exempt for now while the U.S. is in NAFTA renegotiations. If negotiations are successful, Canada and Mexico will remain exempt from the tariffs.

As far as U.S. allies are concerned, it is wait and see based on President’s Trump’s comments at the signing of the proclamations.

President Trump announced at the press conference, “Some of the countries that we are dealing with are great partners, great military allies and we’re going to be looking at that very strongly. The tariffs don’t go effective for at least another 15 days and we’re going to see who’s treating us fairly, who’s not treating us fairly. Part of that’s going to be military. Who’s paying the bills, who’s not paying the bills. We subsidize many rich countries with our military. They pay not one hundred cents on the dollar and in some cases not fifty cents on the dollar and they’re massively wealthy countries. So, we have to stop that and that will enter into the equation also.”

Note: There is a provision for exclusions to the additional tariffs. Relief shall be provided for a steel or aluminum article only after a request for exclusion is made by a directly affected party located in the United States. If the Secretary determines that a particular article should be excluded, the Secretary shall, upon publishing a notice of such determination in the Federal Register, notify Customs and Border Protection (CBP) of the Department of Homeland Security concerning such article so that it will be excluded from the additional tariffs described in the proclamations. The Secretary shall issue procedures for requests for exclusion by March 18, 2018.

The next 15 days will bring forth additional details on countries affected and exclusion requests. Stay tuned!

Background: On February 16, 2018 , Department of Commerce Secretary Wilbur Ross released reports on the U.S. Department of Commerce’s investigations into the impact on our national security from imports of steel mill products and from imports of wrought and unwrought aluminum.

These investigations were carried out under Section 232 of the Trade Expansion Act of 1962, as amended. The purpose of a Section 232 investigation is to determine the effect of imports on the national security. Investigations can be initiated based on an application from an interested party, a request from the head of any department or agency, or may be self-initiated by the Secretary of Commerce. Commerce has 270 days to present the finding and recommendations to the President. If the Secretary finds that imports threaten to impair the national security, the President has 90 days to determine whether he agrees with the Secretary’s findings, and to determine whether to use his statutory authority to “adjust imports.”

Initial recommendations from the Steel Report:

Secretary Ross has recommended to the President that he consider the following alternative remedies to address the problem of steel imports:

- A global tariff of at least 24% on all steel imports from all countries, or

- A tariff of at least 53% on all steel imports from 12 countries (Brazil, China, Costa Rica, Egypt, India, Malaysia, Republic of Korea, Russia, South Africa, Thailand, Turkey and Vietnam) with a quota by product on steel imports from all other countries equal to 100% of their 2017 exports to the United States, or

- A quota on all steel products from all countries equal to 63% of each country’s 2017 exports to the United States.

Initial recommendations from the Aluminum Report:

Secretary Ross has recommended to President Trump three alternative remedies for dealing with the excessive imports of aluminum. These would cover both aluminum ingots and a wide variety of aluminum products.

- A tariff of at least 7.7% on all aluminum exports from all countries, or

- A tariff of 23.6% on all products from China, Hong Kong, Russia, Venezuela and Vietnam. All the other countries would be subject to quotas equal to 100% of their 2017 exports to the United States, or

- A quota on all imports from all countries equal to a maximum of 86.7% of their 2017 exports to the United States.

House Passes Miscellaneous Tariff Bill

The House passed the Miscellaneous Tariff Bill Act on Jan. 16, moving the legislation closer to becoming law. The bill would lower tariffs on goods largely unavailable in the U.S. through Dec. 31, 2020.

“Over seven years have gone by since the last time Congress passed MTB legislation,” House Ways and Means Committee Chairman Kevin Brady, R-Texas, said in a news release. “Today’s decisive and overwhelmingly bipartisan vote brings us one crucial step closer to providing much-needed tariff relief for American job creators. I strongly encourage the Senate to pass this legislation as soon as possible and join the House in taking action to help our manufacturers and workers compete and win.”

According to the ITC, an August International Trade Commission report on MTB petitions to Congress classified 1,825 petitions as meeting MTB statutory requirements, with the largest product categories being chemicals, accounting for 1,464 petitions; machinery and equipment, accounting for 457 petitions; and textiles, apparel and footwear, accounting for 456 petitions. The bill would take effect 30 days after enactment. The lost revenue caused by the reduced tariffs would be offset by extending the expiration date for Customs user fees.

CBP Reaches Historic Milestone with Final Core Trade Processing Deployment in ACE

U.S. Customs and Border Protection (CBP) reached a historic milestone on Feb. 24, deploying the last of the major scheduled core, trade processing capabilities in the Automated Commercial Environment (ACE). ACE streamlines the import/export process into a “single window” that allows businesses to electronically transmit the data required by the U.S. Government to import or export cargo. The final deployment included post release capabilities for liquidation, reconciliation and drawback processes.

ACE provides for a transition away from paper-based procedures to faster, more streamlined processes for both government and industry. Built on a modernized platform, ACE expedites transaction processing by automating 269 forms across CBP and more than 47 PGAs. It has resulted in a 44 percent reduction in wait times for truck processing at land ports of entry and 68 times faster processing of bonds.

ACE facilitates legitimate trade and strengthens border security by providing government officials and the trade community with improved automated tools and information. This is significant in light of CBP’s recently released trade statistics. In FY2017, CBP processed more than $2.4 trillion in imports, almost $1.7 trillion in exports, and collected approximately $40.7 billion in duties, taxes, and fees.

A key component of this last deployment is the updated approach to drawback authorized by the Trade Facilitation and Enforcement Act of 2015 (TFTEA) (Pub. L. 114-125). By liberalizing and automating drawback operations, the number of drawback claims filed with CBP and the amount of duty, taxes and fees correspondingly refunded is expected to increase in the coming years.

Looking ahead, CBP will focus on sustaining all deployed ACE capabilities and ensuring ACE operates as a highly available, reliable system. There is an ongoing demand for additional and enhanced ACE capabilities, and CBP will continue to collaborate with the trade community, PGAs and stakeholders to implement automated solutions that advance secure shipments, streamline trade processes and support strong enforcement of trade laws.

CBP's Ecommerce Strategy

Customs and Border Protection (CBP) has formalized their targeted strategy for E-Commerce, emphasizing enforcement initiatives within CBP and leveraging enforcement partnerships with partner government agencies and foreign governments, all while improving data collection for CBP targeting systems and information from CBP field personnel. CBP remains committed to facilitating legitimate trade while ensuring consumer safety and economic vitality as the volume of E-Commerce shipments continues to increase at a rapid rate. Acting Commissioner Kevin McAleenan’s message and executive summary can be found here on CBP’s website. The trade expects specific steps to be taken by CBP in the future to address some of the emerging threats with E-Commerce.

2018 TPM Tech Buzz

In an industry that has generally adhered to manual, often belt-and-suspender, practices, it’s hard to imagine the shift to a more technology-focused modus operandi. The day has come and the tech revolution in shipping has taken hold. Buzz words like “digital forwarding”, “visibility” and “blockchain” are all the rage. But what does this (or should this) mean for the overall supply chain and its participants?

Digital forwarders are getting a lot of press for modernizing processes, but even the most traditional forwarders (like Shapiro) have employed automated functions, online portals, and APIs for years. The shift comes in the form of core tech focus (sprinkled with a bit of great publicity). Jochan Thewes of DB Shenker suggested that the real race is between traditional forwarders building up their tech prowess and “digital forwarders” building up their freight competency and infrastructure. Those who aren’t building one or the other will likely be left in the dust.

While the quest for visibility is nothing new, the availability of data is quickly evolving, as evidenced by GPS tracking of vessels with a feed to clients, online freight marketplaces, and carrier contract integration with various service providers. All this is in the name of increased visibility and automation. As supply chain participants become adopters of these various tech solutions, the rubber meets the road when determining where to focus efforts and which will provide the greatest return.

Integrations of all kinds are taking hold- TMS to ERP to WMS and beyond. Removing manual tasks (and data entry) is a common theme. Thanks to companies like Ocean Insights, we can receive regular GPS coordinates from vessels across the globe, eliminating manual tracking tasks. Logic-based analysis and automated decision making can easily be achieved by the masses utilizing companies like Log-Net.

Freight marketplaces are still a developing segment of disruptors who are touting visibility as the solution, nearly leaving customer service consideration behind in favor of cheap rates. Unfortunately, international logistics has always been about more than just cheap freight rates, so the marriage of rate visibility and customer service is still developing.

But the latest belle of the tech talk ball is blockchain. The industry is still trying to figure out what role the technology will play and with whom, but multiple participants are coming out to talk about various uses. Wave, a blockchain solution for bills of lading, is currently integrated with Zim as a pilot program to offer a decentralized platform for its customers. As more users adopt blockchain applications, further benefits are sure to be seen.

Tying all of this together, our industry leaders of tomorrow must also have a different skillset. Certainly, subject matter expertise is a key component, but with this technology eruption comes a need for decision makers who embrace the evolution of our people and paper-based business to one that capitalizes on these new processes and tools.

The Winds of Change: Reshaping the Container Shipping Industry

The competitive pressure of ocean carriers has always been largely driven by demands of “who has the best rate?” Now that rates have been in the doldrums for the carriers because of a supply-demand imbalance, the carriers are currently facing the reality that in the massive Asia to USA market the capacity expansion is predicted to be 8 to 9 percent versus demand at 5 to 6 percent. This leaves carriers with the question, “If rates go down, how can I afford to hire customer service employees that are being demanded by the customers?” Importers may have enjoyed the competitive rate levels, but rates alone have not been enough to give a completely satisfying experience as shipper customers feel the pressure to provide more visibility and data analysis of their supply chains.

The current protectionist attitude of the White House Administration may be a defining moment in the industry as trade growth is threatened. Just at a time when importers and exporters are demanding more visibility and customer service from the carriers, the carriers may be forced to look for ways to be compensated for such services. If supply continues to exceed demand, particularly if trade growth diminishes to some extent, there will be more pressure on already depressed rate levels.

As we move into the coming year, we will see NYK, K-Line, and MOL literally become ONE. (Ocean Network Express). This is just one example where technology companies, carriers, forwarders, and brokers may unite and collaborate in ways we have not experienced before. The trucking industry is a great example of an industry that is reacting to new demands where many companies grapple with the “survival of the fittest” reality they currently face.

Technology is a key component to our industry and quickly becomes an expensive endeavor for any company that needs to deliver service and visibility. Look for fees and surcharges to continue to drive revenue for the carriers and the providers that surround the carriers in the transportation industry as a means of paying for value added services, especially in a time when ocean freight rates are depressed due to overcapacity.

On the trucking end, look for freight rates to continue to increase in 2018 and beyond as the industry grapples with hiring enough drivers to support their business and new ELD/HOS requirements. Trucking shortages have become chronic in the Unites States and in many cases the supply chain comes to a screeching halt as soon as the containers hit the rail CY destinations. This is a reality that all of us in the industry will be facing and there is no clear end in sight. This will be perhaps the biggest challenge faced by the supply chain industry in 2018.

NY-NJ Terminal Upgrade’s Goal is 25 percent Turn Time Reduction

The new gate system at Port Newark Container Terminal (PNCT) at the Port of New York and New Jersey is scheduled to be available in late May or early April. This $500 million upgraded system promises to take off nearly a quarter of the average trucker’s turn time. Once the system goes online, trucks will only be required to make one stop instead of three. Due to this change, the movement of vehicles throughout the terminal is expected to significantly increase.

The new gate system is just one of the port’s current projects. Others include expanding the terminal’s footprint, improving its electrical and wi-fi equipment, and adding four super-post-Panamax cranes, which are expected to arrive this year. According to PNCT officials, the project is projected to increase PNCT’s capacity to 2.3 million TEU’s by the end of 2019.

The terminal hopes to establish an appointment system once gate renovations are fully completed. This is an expected move considering the expansion of the terminal footprint; however, due to current truck flow improvement, the pressure to implement these changes is less urgent.

The elevation of the Bayonne Bridge in June enabled ships of greater than 9,500 TEU to reach PNCT, amongst three other ports, for the first time. This was expected to bring greater activity, demanding large volumes of cargo to be loaded and unloaded in a limited amount of time. However, currently, terminals have not seen dramatic increases in larger ships or cargo arriving at the ports.

GCT Bayonne developed a new pilot appointment system fifteen months ago. It became so successful that it expanded from covering the first two hours to the first seven hours of the day. According to the terminal operator, turn times are now 45 percent lower during appointment periods.

PNCT has already invested $250 million in the terminal, expanding its footprint and efficiency. Over the past six years, leasing rates increased nearly 40 percent due to the shortage of space close to the port. However, PNCT recently acquired 46 acres of land, allowing it to enlarge its container stacking capacity by 50 percent. This additional land has improved the efficiency of the terminal.

PNCT welcomes competition with other terminals in the port and on the East Coast, since there is opportunity to attract discretionary cargo headed to or from the Midwest. This is thought to be a crucial factor in the port’s future growth.

“ONE” More Thing to Consider with the Japanese Big 3 Merger

K-Line, MOL, and NYK: Japan’s big three carriers that merged to form the Ocean Network Express (“ONE”) will be finalizing their transition by April 1.

The three legacy carriers have historically been known among the industry for customer service and value. Once the transition is complete, ONE has promised the same value and service while taking advantage of the legacy carriers’ existing strengths. However, there have been warning signs that the transition may result in a temporary dip in customer service due to the possible confusion resulting from key contacts being shuffled to different positions or replaced.

Although it’s been noted that existing MOL, NYK, and K-Line contracts will be unchanged for now, some NVOCC agents in Asia are advising shippers to avoid the 3 carriers on the Asia to US trade lanes in March. There are still comparable options with other carriers if shippers need a temporary alternative.

Major Rail Delays in the Chicago Area

Since the beginning of the year, congestion at Chicago ramps is worsening and some drayage providers are refusing to take on new customers. A perfect storm of winter weather, intermodal rail yard delays, chassis shortages and dray capacity issues triggered by the ELD mandate is causing problems for shippers and logistics providers alike.

Trucking and logistics executives have expressed their concerns to intermodal yard operators since the beginning of the year, worried that the long wait times at the terminals could make the situation worse. The Canadian National Railway believes some of these issues are caused by winter storms, driver shortages and ELDs and they are working with other supply chain partners on finding solutions to these delays.

According to the vice president of On Track Transportation, owner-operators and other dray providers are considering changing to over-the road moves to avoid the Chicago ramps.

The chassis situation in the area is not much better. According to Tracy Davis, president of Acme Transportation Company, truckers often arrive at the ramps to discover no available chassis or small, defective units.

Shippers Continue to Experience Heavy Rail Delays in Vancouver

With spring right around the corner, cargo owners and freight forwarders are hopeful that warmer temperatures will improve the current 6 to 8-day delays that have been typical since the beginning of December.

Without question, winter weather has contributed significantly to the congestion Vancouver is experiencing. According to the JOC, “Heavy snow storms in British Columbia and frigid temperatures throughout western Canada and the United States, have forced the railroads to run shorter trains – in effect almost doubling the number of trains to move the same amount of freight.”

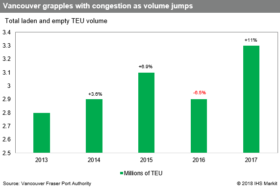

Substantial year over year increases in the Port of Vancouver’s volume levels in four of the past five years have also led to a broader congestion condition, further exacerbating an already challenging situation. Vancouver announced last week that their container volume increased by 11% to 3.3 million TEU’s (2016 to 2017), and total imports have surged during this same span by 10% to 1.7 million TEU’s.

Homeland Security Committee Approves Bill to Review TSA Known Shipper Program

If you have shipped air cargo in the last decade you likely have heard the term “Known Shipper.” Information about the Known Shipper program can be found on TSA.gov, but can be summed up as a program wherein the government vets air cargo shippers as safe or not for tendering cargo on passenger or cargo aircraft-only flights. However, the program could be changed or scrapped altogether as H.R.4176, which recommends a review of the Known Shipper program now that 100% screening is well established, was passed on March 7th. New technology has advanced for cargo screening machines, and the newly proposed bill calls for a feasibility study of the tomography machines and review for a “modified or eliminated” change of the Known Shipper program.

Amazon’s New Delivery Service a Challenge to UPS and FedEx?

It should come as no surprise that Amazon is continuing to expand business through new ventures; however, their recent announcement surprised some in the e-commerce world. In early February, Amazon announced plans to launch its own delivery service called “Shipping with Amazon,” or “SWA” for short, to compete with small parcel carriers FedEx and UPS. Though some market analysts were quick to criticize the announcement, Amazon sees this as an essential step to continue their rampant online retail growth and business diversification.

Once fully launched, “SWA” will allow Amazon to pick up packages from businesses and deliver them directly to consumers, rather than FedEx or UPS. By taking over a portion of this delivery process from current service providers, Amazon will be able to enhance their own delivery operations, which will make delivery times quicker and more reliable, especially during peak season holiday shipping. Amazon hopes this will allow them to offer a wider variety of products for free two-day delivery and help lessen congestion issues that many of their warehouses are currently facing.

So where does this leave parcel carriers such as UPS and FedEx? Only a small percentage of these companies’ revenues comes from Amazon. FedEx has said that only 3% of revenue comes from Amazon deliveries, while UPS points towards a larger number of 5-10%. Further alleviating concerns of a sweeping SWA takeover is the time that this delivery program will take to implement. Amazon is currently testing the delivery program in Los Angeles, before broadening this delivery service to other cities later in 2018. Furthermore, Amazon will also need to build a sufficient infrastructure and acquire the necessary resources to accommodate this project. Before Amazon can launch this in other cities, they will first need to fine tune their delivery model. Once this has been accomplished, then they will be able to replicate this process in other cities.

In the end, the real winners here are the customers. “SWA” will allow Amazon to not only deliver shipments faster, but will also be more efficient for customers, saving them time and money. Because of this, Amazon will be able to sell and ship more products, and satisfy more customers. Only time will tell if Amazon will be able to deliver on this ambitious goal, or if this delivery experiment will falter.

Employee of the Month

As previously featured in Shap Talk, Shapiro has been sharing with you the names of employees who have been recognized for their exceptional efforts and contributions to our Company. At Shapiro, we continually work to develop, challenge, and inspire all of our employees to grow individually and with the Company. This month, we would like to recognize Josh Hoagland, Sr. Import Analyst in New York for his outstanding performance and contributions.

We encourage you to provide us with employee feedback! Please email us at [email protected].

Shapiro Freight Report

This high-level, monthly review of the U.S. import freight market to provides key insights into the tumultuous world of international shipping. From carrier alliances to labor strikes, Shapiro covers the pertinent information logistics managers need to know. Check back monthly to ensure you don’t miss key industry insights!

Having cleared her final regulatory hurdles in January, the Ocean Network Express (ONE) is on schedule to begin combined operations in April 2018. As all of you will remember, ONE is the merged entity comprised of the three major Japanese lines, NYK, K-Line, and MOL. To celebrate ONE’s launch, but with a cautionary eye on the competitive playing field, please note the members of each major alliance with an approximation of US market share below…