Featured Headlines:

Reminder: Wood Packing Material Violations Still Exist for Importers!

Importers Should Prepare for the Worst When it Comes to WROs on Forced Labor

CBP Requests Public Comments on USMCA Interim Final Rule

US Court of Appeals Rules in Favor of Presidential Authority to Modify Section 232 Tariffs

Legislative Differences Emerge During GSP Program and MTB Renewal Process

US and EU Reach Deal on Boeing—Airbus Dispute

CIT Grants Preliminary Injunction in Lawsuit Challenging Legality of List 3 and 4 Tariffs

US and Vietnamese Officials Reach Agreement Regarding Vietnam’s Currency Practices

Operations Return to Normal in Yantian, But Regional Bottlenecks Remain

Midwest-Bound Cargo from the US West Coast Goes Off the Rail (Temporarily)

Airlines Struggle as Demand Spikes

COVID-19 Continues to Spread Across Southeast Asia Causing Further Supply Chain Disruption

Our Expert Shapinion – This Market is a Joke, So Don’t Knock (Knock) Our Magnificent Seven!

Reminder: Wood Packing Material Violations Still Exist for Importers!

Did you know that dangerous insects and their larvae can be burrowed into imported wood materials, allowing them to ‘jump ship’ while unloading at port and subsequently invade nearby environments, such as national forests? Considering the significant threat these pests pose domestically, U.S. Customs and Border Protection (CBP) enacted the final rule for Wood Packaging Materials (WPM) back on September 16, 2005.

This ruling requires all persons importing goods in connection with wood packaging materials into the U.S. to comply with the WPM standard approved by the International Plant Protection Convention (IPPC); this calls for WPM to be heat treated or fumigated with methyl bromide in accordance with the guidelines and marked with an approved international treatment certification.

While this standard has been in effect for many years, CBP officials continue to uncover non-compliant cargo shipments. In May, CBP discovered two separate shipments from South America at the Port of New Orleans. While the shipments hailed from different origins, one from Brazil and the other from Suriname, they did share one flagrant commonality: they were both missing IPPC 15 stamps on wood packaging materials.

When packing materials are incorrectly labeled, CBP requires remedial action up to and including the re-exportation of the entire shipment (including the imported commodity). In the case of the two shipments from South America, both were placed in containers and required to be re-exported to Brazil and Suriname at the importer’s expense.

Bottom line? If you are shipping WPM internationally, we encourage you to do the proper research first.

For any questions related to WPM, please contact a member of Shapiro’s Compliance Team.

Helpful Resources:

Importers Should Prepare for the Worst When it Comes to WROs on Forced Labor

The importation of merchandise mined, produced, or manufactured, wholly or in part, in any foreign country by forced or indentured labor – including forced child labor – is explicitly prohibited under Section 307 of the Tariff Act of 1930 (19 U.S.C. § 1307). As such, any applicable merchandise is subject to exclusion and/or seizure and may lead to criminal investigation of the importer(s).

When information reasonably indicates that the merchandise being imported may have been produced using forced labor, U.S. Customs and Border Protection (CBP) may issue a Withhold Release Order (WRO).

Because this process can be very costly and time consuming, importers should take time to proactively address any forced labor risks within the supply chain and be prepared to take immediate action should any of their shipment(s) be stopped.

Here are a few important things to keep in mind:

- The forced labor ban has no exceptions, and no de minimis provisions. Forced labor is a blanket prohibition on goods produced, even in part, with forced labor.

- CBP may act on information of any person that knows or has a reason to know goods were produced using forced labor.

- All importers are responsible for reasonable care; please review the forced labor section within CBP’s Informed Compliance Publication and be prepared to respond to the questions on a CBP Form 28 (Request for Information).

- There are currently WROs from China, Democratic Republic of Congo, India, Japan, Malawi, Malaysia, Mexico, Mongolia, Nepal, Turkmenistan, Zimbabwe, and even Fishing Vessels.

- Forced Labor can happen with any type of good; products implicated thus far have included apparel, bidi cigarettes, carpet, computer parts, diamonds, furniture, gold, hair products, palm oil, rubber gloves, seafood, stevia, toys, and video games.

Although forced labor is a global concern, US officials have become more vigilant of potential allegations recently. Last year, CBP issued a WRO on any shipments that contain cotton and/or cotton products originating from the Xinjiang Production and Construction Corps (XPCC).

Even more recently, the US announced it would be detaining silica-based products made by Hoshine Silicon Industry Co., Ltd. and its subsidiaries under a new WRO. In last month’s press release, White House officials said there is information that indicates Hoshine used forced labor in manufacturing these products.

Companies that are unprepared to comply may face serious financial consequences, along with serious delays of their products. Be sure there is a robust internal control process in place to identify and combat forced labor.

How to protect yourself:

- When it comes to forced labor, utilize CBP Resources.

- Implement Responsible Business Practices on Forced Labor Risk in the Global Supply Chain in your own supply chain; document and audit this thoroughly.

- See additional CBP FAQs and resources on Withhold Release Orders and learn how to report forced labor allegations.

If you have a question or concern regarding forced labor, reach out to Shapiro’s Compliance Team.

CBP Requests Public Comments on USMCA Interim Final Rule

On July 6th, U.S. Customs and Border Protection (CBP) issued an interim final rule in the Federal Register for the US-Mexico-Canada Agreement (USMCA) Implementing Regulations Related to the Marking Rules, Tariff-Rate Quotas, and Other USMCA Provisions.

This interim final rule amends CBP’s regulations to include implementing policies for the preferential tariff treatment and USMCA-related customs provisions. The USMCA applies to goods from Canada and Mexico entered for consumption, or withdrawn from warehouse for consumption, on or after July 1, 2020.

Here are some of the provisions addressed in the ruling. The document:

- Amends the Code of Federal Regulations (CFR) to implement the provisions in Chapters 1, 2, 5, and 7 of the USMCA related to general definitions, confidentiality, import requirements, export requirements, post-importation duty refund claims, drawback and duty deferral programs, general verifications and determinations of origin, commercial samples, goods re-entered after repair or alteration in Canada or Mexico, and penalties.

- Makes amendments to apply the marking rules in determining the country of origin for marking purposes for goods imported from Canada or Mexico and for other purposes specified by the USMCA.

- Adds the sugar containing products subject to a tariff rate quota under Appendix 2 to Annex 2–B of Chapter 2 of the USMCA to the CBP regulations governing the requirement for an export certificate.

- Includes conforming amendments for the declaration required for goods re-entered after repair or alteration in Canada or Mexico that are eligible for duty-free treatment even if subject to NAFTA or USMCA drawback.

- Clarifies recordkeeping provisions.

- Contains the modernized drawback provisions.

- Concurrently with this interim final rule, CBP published a notice of proposed rulemaking on July 6 that proposes to apply the rules for all non-preferential origin determinations made by CBP for goods imported from Canada or Mexico for Implementation of the USMCA.

Interested persons are invited to participate in this rulemaking by submitting written data, views, or arguments on all aspects of this interim final rule. CBP also invites comments related to the economic, environmental, or federalism effects that might result from this interim final rule. Comments that will provide the most assistance to CBP will reference a specific portion of the interim final rule; explain the reason for any recommended change; and include data, information or authority that support such recommended change.

Comments are due no later than September 7, 2021. All public submission requests must be sent electronically via the Federal eRulemaking Portal; the docket number is USCBP–2021–0026.

FOR FURTHER INFORMATION CONTACT:

- Operational Aspects and Audit Aspects: Queena Fan, Director, USMCA Center, Office of Trade, U.S. Customs and Border Protection, (202) 738–8946 or [email protected].

- Legal Aspects: Craig T. Clark, Director, Commercial and Trade Facilitation Division, Regulations and Rulings, Office of Trade, U.S. Customs and Border Protection, (202) 325–0276 or [email protected].

You can also learn more about by visiting our Shap Blog article – How to Dance Your Way Through the New US – M – C – A.

US Court of Appeals Rules in Favor of Presidential Authority to Modify Section 232 Tariffs

On July 13, 2021, the US Court of Appeals for the Federal Circuit issued a ruling to reverse a US Court of International Trade (CIT) decision that placed strict time limits on the President’s tariff authority.

The decision (2-1) found that Trump was reasonably acting within his presidential power when he raised tariffs on Turkish steel, thereby resulting in a prolonged tariff increase – from 25% to 50% – several months after the initial duty took effect.

The ruling supports the President’s authority to act based on national security concerns, such as increasing import restrictions, given the amount of Turkish steel imported at the time, as well as an earlier Commerce report flagging Turkey to be considered for increased duties.

Do you have questions related to Section 232? We encourage you to reach out to [email protected] for additional assistance.

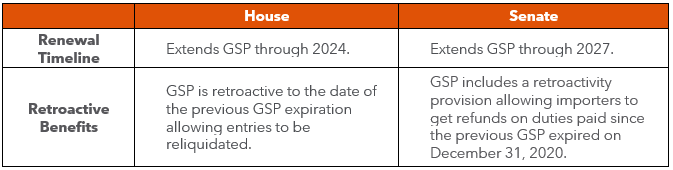

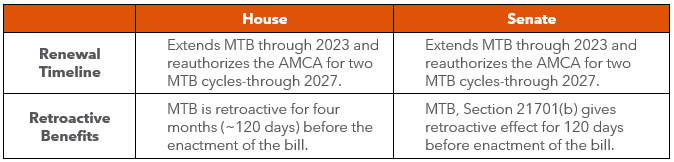

Legislative Differences Emerge During GSP Program and MTB Renewal Process

Earlier this year, officials announced the Trade Act of 2021, a legislative package aimed at promoting tariff relief and competitive advantage for the U.S. in world trade, would include an amendment to renew the Miscellaneous Tariff Bill (MTB) and the Generalized System of Preferences (GSP) benefits program. Since its introduction in the Senate on June 8, the bill has undergone several revisions due to intense bipartisanship.

Although the MTB and GSP renewals receive support from both sides of the aisle, procedural hurdles have developed because of inconsistencies between the two versions of the bills (one for the Senate and one for the House) which remain unresolved at this time.

The following are a few of the key differences and notable provisions that Congressional legislators are actively working through:

Generalized System of Preferences

Miscellaneous Tariff Bill

Helpful Resources:

- A fact sheet on the bill can be found here.

- Full text of the legislation is available here.

- Click here to access the full text of the Trade Act of 2021.

For more information on MTB or GSP, please reach out to the Shapiro Compliance Team.

US and EU Reach Deal on Boeing—Airbus Dispute

As you may already be aware, last month the US and EU announced that they have reached a deal related to the Boeing – Airbus dispute. This marks the end of the longest running quarrel in the history of the World Trade Organization (WTO).

According to the official White House Press release, the US and EU will suspend tariffs for five years and work together to challenge and counter China’s non-market practices.

To help support their efforts, US and EU officials have agreed to the following measures:

- Suspend the tariffs related to this dispute for 5 years; however, the US retains the right to reapply tariffs if the playing field shifts in the EU’s favor.

- Establish a Working Group to analyze and overcome any disagreements that may arise between the sides; this group will meet at least every 6 months or upon request.

- Ensure that both US and EU workers and industries can compete on a level playing field.

- Work together to confront the threat faced from China’s efforts to disrupt global markets.

Click here to read the press release from the European Commission.

For any questions related to this program, please contact [email protected].

CIT Grants Preliminary Injunction in Lawsuit Challenging Legality of List 3 and 4 Tariffs

Earlier this month, the U.S. Court of International Trade (CIT) announced that it will halt the liquidation of unliquidated entries subject to Section 301 tariffs in wake of the thousands of plaintiffs who filed lawsuits targeting the legality of List 3 and List 4 tariffs on Chinese goods.

In its preliminary injunction, most of the judges on the CIT panel said that in order “to give the parties time to implement appropriate procedures, gather pertinent information, and otherwise take necessary action to comply with this order, the court will temporarily restrain liquidation of any unliquidated entries of merchandise imported from China by any plaintiffs in the Section 301 Cases which are subject to List 3 or List 4A duties.”

Importantly, the court provided that, to reduce the administrative burden of this injunction, the Government may stipulate that Customs duties are refundable for those entries which are not suspended. At this point, we do not have an indication whether the Government will take this option. However, if it does, the duties of currently unliquidated entries would be protected under the court order. Liquidations may still occur, but the potential duty refunds could be protected if the Government agrees to a stipulation whereby refunds are granted on entries where List 3 and 4 tariffs were paid.

Each plaintiff has until Tuesday, August 3, 2021, to submit this information to a “repository” that CBP will establish and maintain. Unfortunately, details of the repository are not currently available. The Section 301 Steering Committee met with the Government last week regarding the specifics to include: who will have access; how plaintiffs should submit the information; and how to submit information about future entries. It is also possible that CBP will stipulate that recovery is available for liquidated entries. If this happens, there will be no need for the repository.

How can we help? Please reach out to [email protected] for assistance.

US and Vietnamese Officials Reach Agreement Regarding Vietnam’s Currency Practices

Per our previous Flash, U.S. Department of Treasury and State Bank of Vietnam (SBV) officials announced earlier this week that they have “reached agreement to address Treasury’s concerns about Vietnam’s currency practices as described in Treasury’s Report to Congress on the Macroeconomic and Foreign Exchange Policies of Major Trading Partners of the United States.”

Although the announcement falls short of explicitly resolving the ongoing Section 301 investigation into Vietnam’s acts, policies, and practices at this time, officials did say that “Treasury will inform other U.S. government agencies that it has reached agreement with the SBV to address Treasury’s concerns about Vietnam’s currency practices.”

Click here to view the Joint Statement from the U.S. Department of the Treasury and the State Bank of Vietnam.

Want more up-to-date information sent directly to your inbox? Then sign-up today to receive our Shap Flash alerts for FREE via our Subscription Center!

Operations Return to Normal in Yantian, But Regional Bottlenecks Remain

At the end of May, Yantian International Container Terminals (YICT) faced partial shutdowns after a spike in local COVID-19 outbreaks forced officials to impose quarantine restrictions in the area. In the weeks that ensued, the port continued at 30% of its normal productivity. During this time, Yantian restricted the delivery of full containers for export and closed certain areas handling feeder operations.

Carriers managed the change by reducing allocations to Yantian. Some strings responded to the situation by skipping port calls to Yantian and in certain cases, all of South China. As a result of the service disruptions, vessels could be expected to wait up to two weeks to berth at times.

Normal operations at YICT resumed on June 24th. Since then, ship dwell time has been reduced to zero. Nearby ports, including Shekou and Nansha, have also experienced a decrease in congestion levels. As a result of these recent improvements, carriers have resumed their normal port calls.

Despite the return to normal operations, it will take time for the congestion to fully clear. To help manage the backlog of containers at the end of June, Yantian only allowed cargo to enter seven days before a booked vessel arrived. In addition to the bottlenecks within the port borders, factories throughout the region also saw a build-up of sitting cargo. The region faced additional obstacles in July as the threat of Typhoon Cempaka and Typhoon In-Fa caused terminal closings.

Importers and exporters alike can expect lead times to remain high until the supply chain is able to normalize from these origins.

How can Shapiro help? Should you require any assistance in successfully booking your cargo during this turbulent time, or additional information about current rates, please reach out to our Transportation team today.

Midwest-Bound Cargo from the US West Coast Goes Off the Rail (Temporarily)

Per our previous Flash, Union Pacific railroad announced that it will halt the movement of international cargo from the West Coast to its Global IV terminal in Chicago for a week, beginning Sunday, July 18th. Officials attributed the decision to the labor shortages, pandemic limitations, and chassis shortages that have constricted operations at the terminal.

Additionally, BNSF Railway announced a two-week halt of their railway services beginning Sunday, July 18th. BNSF services from the West Coast ports to Chicago, Indianapolis and Cleveland have been disrupted due to lack of container availability and the extreme congestion at these locations.

Also with consideration to congestion and backlogs, BNSF also revealed that they are currently monitoring the rail services from New York to Chicago and Cleveland and Indianapolis, as well as to/from Savannah, to determine if additional restrictions should go into effect in these areas.

Despite the limited pause in operations, UP and BNSF hope their respective restrictions will alleviate congestion and minimize delays over time.

In the short term, importers can expect West Coast dwell times to worsen and transit times to lengthen for cargo that has not yet loaded to the rail. The obvious fear is that this will ultimately lead to even further congestion at the ports and terminals.

Airlines Struggle as Demand Spikes

Recently, due to staffing issues and severe weather, American Airlines has struggled to meet renewed demand.

As travel restrictions ease, demand is spiking; however, earlier furloughs and retraining requirements for Pilots, along with a slow re-hiring process, forced the airline to cancel 950 flights from their early July schedule. American has inched closer than other US carriers to pre-pandemic levels of passenger counts, driving their capacity.

Southwest and Delta have also had to cancel large chunks from their schedules due to weather-related issues and unprepared passenger demand. A spike in demand over the Easter weekend prompted Delta to open their middle seat option earlier than planned and to cancel hundreds of flights over Thanksgiving due to high number COVID-19 cases of their staff.

Cargo already tendered will normally get re-booked on next available flight, but congestion and backups can cause further delays as airport warehousing staff and hours have also not returned to pre-pandemic levels.

Interested learning more about current airfreight rates? Check out our June-July issue of Supply Chain Reactions to learn more!

COVID-19 Continues to Spread Across Southeast Asia Causing Further Supply Chain Disruption

Indonesia

Earlier this month, Indonesia imposed an emergency public activity restriction (PPKM) due to ongoing spikes of COVID-19 cases; it was originally scheduled to last until July 20th. The PPKM restrictions are focused on Java, Bali, and Jakarta.

The Indonesian government has officially extended the emergency PPKM until July 25th due to continued spikes in cases; however, the restrictions on economic activity, will be relaxed on July 26th if the daily average of positive COVID-19 cases improves.

Malaysia

COVID-19 also continues to surge in Malaysia with 13,215 new cases as of July 15, 2021. A full lockdown remains in effect under the Movement Control Order (MCO) issued by the government. Extensions of MCO will be in place for most states until further notice, due to the number of extremely high cases.

Vietnam

Further COVID-19 alerts in Vietnam (4049 cases as of July 15, 2021) have also led to further operational disruptions and health procedures at the ports and surrounding areas since the country went into lockdown on July 9.

Shippers should expect operational delays throughout the logistics chain due to staffing challenges, increased quarantine protocols, and backlogs.

Want more intel like this delivered straight to your inbox? Visit our Subscription Center to sign-up to receive our Shap Flash alerts.

Our Expert Shapinion – This Market is a Joke, So Don’t Knock (Knock) Our Magnificent Seven!

#1: Knock, Knock. Who’s There? Water. Water Who?

Water You Dewing Telling Knock Knock Jokes?

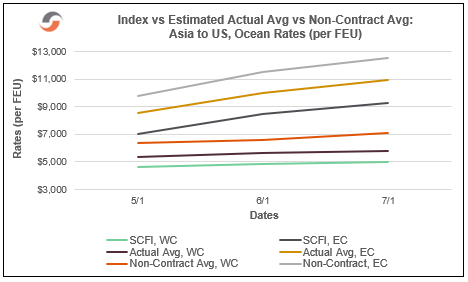

Look, not only is the current market a joke, but it is a joke within a joke within a vicious circle. Suez + Yantian + Blank Sailings + Port Congestion + Detention and Demurrage + Dislocated Containers and Vessels + Skyrocketing Rates … and they all feed the same cycle, again and again. We might as well laugh!

#2: Knock, Knock. Who’s There? Figs. Figs Who?

Figs this US Infrastructure, Please!

Our ports can’t handle mega vessels efficiently, and the overall import volume overwhelms our truckers, our railroads, and our ports while leaving our exporters high and dry. The time has come to improve our roads, bridges, rails, ports, and the underlying transportation technologies. China is outpacing the world when it comes to infrastructure investments; we better wake up!

#3: Knock, Knock. Who’s There? Police. Police Who?

Police Help us with Better Detention and Demurrage Rules, FMC!

In a recent survey, American importers estimated that 15% of their freight budgets were now devoted to demurrage and per diem. This comes at a time when freight rates are 350-450% higher than their five-year averages! That is an “E” on the calculator, y’all!

#4 Knock, Knock. Who’s There? Stopwatch. Stopwatch Who?

Stopwatch You are Doing, Steamship Lines!

We are all so very deeply sorry that your industry struggled with profitability in the decade before COVID, and we too were terrified early in 2020. However, the time has come to focus on fairness, scalability, and a return to collaboration, communication, and partnerships.

When freight rates eclipse $20,000, is it really the best time to be layering in new congestion and inland surcharges? Is it the best time to take a hard line on demurrage? Do you really want to invite regulators and government oversight to our already highly inefficient party?!

Chart of the Issue:

#5 Knock, Knock. Who’s There? Dozen. Dozen Who?

Dozen Anybody Else See that Smaller Importers are Being Squeezed Out?

Especially for lower value and heavier cargo, the current high costs and long transit times make international sourcing all but impossible. At the same time, the monolithic wealthy big importers can out-bid the smaller guys when supply is so very scarce. While they may not be actually paying $20,000, Walmart certainly CAN and WILL pay whatever it takes to secure inventory.

#6 Knock, Knock. Who’s There? Razor. Razor Who?

Razor Hands if You Think Today’s Consumer Demand is Loco!

Talk about a vicious circle. With inventory to sales ratios at 20-year lows, importers are desperate to replenish inventories in part because their supply chains are literally broken with huge delays at each link. At the same time, America seems to be in a goods AND services demand frenzy. While it seems like services will become dominant again, the question is when!

#7 Knock, Knock. Who’s There? Ice Cream. Ice Cream Who?

Ice Cream every single day in today’s market!

Consider Joining Our Crew!

Tired of feeling like you’re floating around aimlessly in an open sea at your current job?

Are you looking to explore new waters?

Well, it may be time to set sail for a new career — consider joining the Shapiro crew today!

Employee of the Month

As previously featured in Shap Talk, Shapiro has been sharing with you the names of employees who have been recognized for their exceptional efforts and contributions to our Company. At Shapiro, we continually work to develop, challenge, and inspire all of our employees to grow individually and with the Company.

This month, we would like to recognize MELINDA KING, IMPORT MANAGER.

What can we say about Melinda King…Well, for starters, she has been a complete pillar during the pandemic and beyond. As soon as it was announced that employees were to begin working from home last year, it only took Melinda mere seconds to kick into gear and recognize the need for a continued office presence to help keep things flowing. Over the past 18 months, Melinda has been the “go to” for many and she has never wavered in her willingness to assist any and all – even going so far as to taking on extra tasks and responsibilities in addition to her day-to-day. Congratulations, and thank you, Melinda!

We encourage you to provide us with employee feedback! Please email us at [email protected].