Featured Headlines:

The Chinese Tariffs Are Among Us!

Space Policy Directive 3 Brings Space Traffic Coordination to Commerce

New Supreme Court Decision Impacts Ecomm Sales Tax

CMA CGM Turns to Startup to Improve Technology

CMA CGM Turns to Startup to Improve Technology

Nippon Express Expands Rail, Air Services to Europe

OOIDA Petition Denied by FMCSA

Trucking Facing Unexplained Rise in Freight Demand

Save the Date: Shapiro’s Supply Chain Summer Seminar!

The Chinese Tariffs Are Among Us!

As many of you are aware, on July 6, 2018, with the trade war between the US and China looming, the United States Trade Representative (USTR) implemented the imposition of an additional 25% duties on $34 billion on certain Chinese imports that contain “industrially significant technologies,” The finalized list of the 818 products subjected to the new tariffs can be found on the USTR website using this link here.

In late June, the USTR subsequently announced a proposed second list of 284 additional subheadings, worth $16 billion, that may also be subjected to 25% additional tariffs. The comment period for this list is open until July 23, 2018. The roster of affected tariffs can be found here. It is likely that duties on this list will not go into effect until mid to late August.

And on July 10th, a third list encompassing 6,031 items, that may be subjected to 10% additional duties and valued at $200 billion, was released. A complete list of the products subjected to the tariffs can be found here on the USTR website. This list is now scheduled for hearings. It is likely that duties on this list will not go into effect until mid to late September, or later.

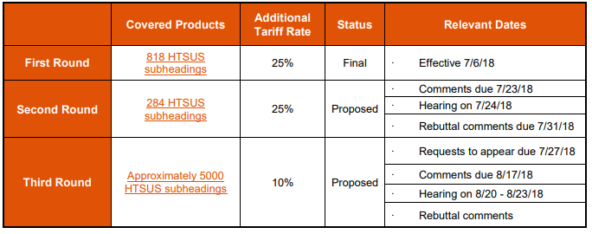

Here’s a quick Chinese Tariff (Section 301) Reference Chart

First Round: 818 HTSUS subheadings

Second Round: 284 HTSUS subheadings

Third Round: Approximately 5000 HTSUS subheadings

Certainly, this is having an effect on many supply chains.

But fear not! There are options available to importers. Please reach out to [email protected] to learn more.

SIMP Updates

Last year, the National Marine Fisheries Services (NMFS) implemented the Seafood Import Monitoring Program (SIMP) to regulate Atlantic Cod, Blue Crab, Dolphinfish (Mahi Mahi), Grouper, King Crab, Pacific Cod, Red Snapper, Sea Cucumber, Sharks, Swordfish, and Tunas (albacore, bigeye, skipjack, yellowfin, and bluefin). The two items that were left off the list, Abalone and Shrimp, will now become mandatory items under SIMP beginning on December 31, 2018.

In order to import these items, the importer will need to be a U.S. resident with an International Fisheries Trade Permit (IFTP). The IFTP is an easy set up that costs $30 and must be renewed annually. Along with that, importers need to have their harvest information as well as the chain of custody documentation. NMFS must be able to trace the fish items all the way back to harvest. If multiple small-scale vessels are used to catch the same fish on the same day, then an aggregated harvest report can be used rather than making multiple small vessel entries.

Before the end of the year, make sure you are testing your supply chain and preparing your chain of custody and harvest documentation. NMFS will be auditing data, so make sure you are keeping the records. Also, make sure your permit is renewed and ready to be used for importation. If you have any questions about the upcoming implementation date of SIMP for Abalone and Shrimp, please reach out to us at [email protected].

Space Policy Directive 3 Brings Space Traffic Coordination to Commerce

On June 18, 2018 the U.S. Secretary of Commerce Wilbur Ross praised President Trump’s signing of Space Policy Directive 3(SPD-3), America’s first national space traffic management policy. The policy acknowledges the rapidly increasing volume and diversity of commercial space activity and announces that the Department of Commerce should be the new civil agency interface for space traffic management (STM) and space situational awareness (SSA).

“I commend President Trump and the National Space Council for reaching yet another important milestone as we work to ensure U.S. commercial leadership in space,” said Secretary Ross. “I look forward to working closely with DoD and other departments and agencies as we meet the challenge of increased commercial and civil space traffic.”

SPD-3 establishes foundational principles, lays out achievable goals, and provides specific guidance to achieve each goal. It emphasizes safety, stability, and sustainability, foundational elements to successful space activities. The Department of Commerce will work closely with the Department of Defense (DoD) to develop a plan to transfer the responsibilities for commercial dissemination of SSA data and STM.

Currently, the DoD’s USSTRATCOM officers at the Joint Space Operations Center (JSpOC) collect SSA data and create the authoritative catalog of space objects. JSpOC will continue to maintain this catalog, but Commerce will transition to provide basic SSA data and collision avoidance support services to the public.

“Given that there are over 800 operational American satellites amidst a sea of space debris numbering over 600,000, efforts must be taken to protect those significant investments,” continued Ross. “The transition will allow DoD to concentrate on its main objective, defending and securing the United States in both earth and space. Communicating with various space companies and providing basic SSA data for innovative commercial applications will become the province of Commerce.”

Commerce’s STM and SSA efforts will be coordinated by its new Space Policy Advancing Commercial Enterprise (SPACE) Administration. The SPACE Administration will soon oversee all Department space activities, including the existing Office of Space Commerce and the Commercial Remote Sensing Regulatory Affairs office, presently housed in the National Oceanic and Atmospheric Administration. The addition of space traffic management responsibilities will further establish the SPACE Administration as a voice for the space industry in the federal government.

Today’s announcements demonstrate the Department and Administration’s continued emphasis of the importance of developing and supporting the U.S. commercial space industry.

Secretary Ross and the Department of Commerce will work with President Trump, Vice President Pence, the National Space Council, Congress, and private industry as America continues its leadership in space.

New Supreme Court Decision Impacts Ecomm Sales Tax

This month marked a huge milestone in the development of eCommerce. Online sales have steadily grown to become 10% of the total sales in the US. By overruling the Quill case, the US Supreme Court ruling throws the traditional definition of physical nexus completely out the window.

According to CNBC, some states including Washington, Pennsylvania, and Minnesota now require Amazon and other online marketplaces to collect sales tax on behalf of their third-party sellers. Other states make it the seller’s responsibility. Under the new Supreme Court decision, states may decide to tax ecommerce sellers directly, freeing Amazon from the complicated tax collection process in different states.

The ruling has angered many small online retailers and advocates for small companies because it will increase their expenses, mostly from the cost of software and services to help sellers collect the taxes and send the money to state authorities. There are still many unknowns. The ruling upheld a South Dakota law that exempts sellers with $100,000 or less in sales in the state. Other states are free to set their own threshold, and it’s not yet known what they might be.

What does this mean for the e-Commerce sellers? Sellers should consult a tax or accounting professional to review what these changes will mean for them. If there are sales in that state, the state can create its own rules about who is subject to collecting and filing. Several states have begun to consider the concept of “economic nexus” by forcing companies to file based on dollars sold and/or number of sales in that state. There are currently 24 states that already have a threshold for transaction limits. It will be up to the US Congress to pass laws to protect small businesses by setting a uniform ceiling that all states would have to adhere to. For now, it seems that the decision on how sales tax will be collected is up to each state individually.

CMA CGM Turns to Startup to Improve Technology

With constant changes to technology, stakeholders within the shipping industry are reaching out to startup companies for assistance.

French shipping company CMA CGM recently collaborated with San Francisco-based startup company Shone to bring artificial intelligence (AI) onboard their vessels. The startup will have access to CMA CGM’s vessels to continue the development of AI usage throughout the fleet.

Shone is an expert in maritime transportation technology, and the data they retrieve from the vessels is sent to their headquarters in San Francisco to be analyzed. Their venture with CMA CGM will facilitate the work of vessel crews to aid in decision support, maritime safety and piloting assistance.

Shone is also working on improving security and anti-collision alert systems. By fusing data from multiple sensors, detection accuracy is enhanced to prevent potential collisions. Shone has ensured COLREGS (International Regulations for Preventing Collisions at Sea 1972) are considered, which are essentially the ocean navigation rules created to avoid vessel collisions.

Peak Season Outlook

Trans Pacific spot rates made their first year-over-year gain of 2018, a sign that eastbound Pacific may be returning to normal seasonal trends after two years of disruptions, including the Panama Canal expansion, the Hanjin bankruptcy, and the formation and re-formations of alliances and carrier reorganization.

With US imports surging 7.6% in the first quarter of 2018 according to PIERS, and little sign of a slowdown in demand, the trans-Pacific is in healthy shape for a seasonal trend. The same, however, cannot be said about matching demand to capacity. The carriers are implementing an 8 to 9 % increase in capacity, while imports are projected to increase 5 to 6% according to industry analyst Alphaliner. The result is downward pressure on service contract rates and a challenging environment for the carriers. With persistent overcapacity, carriers are working to differentiate themselves by selling more service such as guaranteed reliability and faster transit times and will be looking to recoup surging bunker fuel prices through a series of surcharges during peak season.

With the Trump administration engaged in sanctions battles with trading countries and partners in the world, the outlook for critical peak shipping season and beyond will certainly be impacted by economic and policy trends.

CMA CGM Turns to Startup to Improve Technology

With constant changes to technology, stakeholders within the shipping industry are reaching out to startup companies for assistance.

French shipping company CMA CGM recently collaborated with San Francisco-based startup company Shone to bring artificial intelligence (AI) onboard their vessels. The startup will have access to CMA CGM’s vessels to continue the development of AI usage throughout the fleet.

Shone is an expert in maritime transportation technology, and the data they retrieve from the vessels is sent to their headquarters in San Francisco to be analyzed. Their venture with CMA CGM will facilitate the work of vessel crews to aid in decision support, maritime safety and piloting assistance.

Shone is also working on improving security and anti-collision alert systems. By fusing data from multiple sensors, detection accuracy is enhanced to prevent potential collisions. Shone has ensured COLREGS (International Regulations for Preventing Collisions at Sea 1972) are considered, which are essentially the ocean navigation rules created to avoid vessel collisions.

Peak Season Outlook

Trans Pacific spot rates made their first year-over-year gain of 2018, a sign that eastbound Pacific may be returning to normal seasonal trends after two years of disruptions, including the Panama Canal expansion, the Hanjin bankruptcy, and the formation and re-formations of alliances and carrier reorganization.

With US imports surging 7.6% in the first quarter of 2018 according to PIERS, and little sign of a slowdown in demand, the trans-Pacific is in healthy shape for a seasonal trend. The same, however, cannot be said about matching demand to capacity. The carriers are implementing an 8 to 9 % increase in capacity, while imports are projected to increase 5 to 6% according to industry analyst Alphaliner. The result is downward pressure on service contract rates and a challenging environment for the carriers. With persistent overcapacity, carriers are working to differentiate themselves by selling more service such as guaranteed reliability and faster transit times and will be looking to recoup surging bunker fuel prices through a series of surcharges during peak season.

With the Trump administration engaged in sanctions battles with trading countries and partners in the world, the outlook for critical peak shipping season and beyond will certainly be impacted by economic and policy trends.

Nippon Express Expands Rail, Air Services to Europe

Nippon Express has launched new intermodal services connecting Japanese ports and airports with Europe via the Eurasian rail network.

The Tokyo-listed company is aggressively expanding its portfolio of different regional services with a focus on cross border, land and links in China and Southeast Asia.

In May, Nippon announced the addition of sea-rail and air-rail intermodal services to Europe via China, and this month Nippon was granted a permit to transport goods overland between China and four Southeast Asia countries.

This service leverages the China-Europe rail landbridge using both Dalian and Chongqing as transit points, and was launched in response to demands from shippers, Nippon said in a statement.

The sea-rail option now links the Japanese ports of Tokyo, Yokohama, Nagoya, Osaka and Kobe with Duisburg in Germany via Dalian. The delivery time is estimated at 28 days, which is 12 days shorter than all-water services.

The air route links the Japanese airports of Narita, Haneda, Chubu and Kansai with Chongqing in central China before the cargo is shipped by rail. The lead time from Narita to the rail terminal is an estimated 22 days for full container shipments and 24 days for less than container shipments.

The air-rail combination service is meant to target shipments during peak periods as well as emergency shipments.

OOIDA Petition Denied by FMCSA

On July 3, the Owner-Operator Independent Drivers Association (OOIDA) said they were denied by the Federal Motor Carrier Safety Administration (FMCSA) on their petition for a five-year, small business exemption to the ELD mandate which has been in effect since December of last year.

If the petition had been successful, it would have exempted a sizeable portion of the U.S. trucking sector from the ELD mandate (which compelled drivers to switch from a paper logbook environment to logging their hours electronically). According to the JOC, “OOIDA executive vice president Todd Spencer said he was ‘puzzled and disappointed’ at the response from the agency.”

There have been several unsuccessful attempts by the trucking, intermodal, shipping and importing community to reverse the mandate that went into full effect on April 1st. The latest decision by the FMCSA is yet another setback for those opposing the resulting changes that ELD has brought to their respective operating models.

Trucking Facing Unexplained Rise in Freight Demand

An unheard-of uptick in freight demand is facing US freight carriers across the country, with no signs of slowing down. Carriers are already dealing with scarce capacity and rising fuel prices, and this unexplained spike in freight demand is causing rates to soar.

It is difficult to pinpoint an exact cause for the increase, but a combination of factors could be contributing: The international road check that took place in early June, a wet spring throughout the country which backed up the produce season, and a record amount of oil being pumped at the Permian Basin.

This year’s Commercial Vehicle Safety Alliances’ annual road check focused on ensuring truck drivers were complying with the electronic logging device (ELD) mandate and hours-of-service. Law enforcement and regulatory officials across the United States, Canada and Mexico all participated and performed detailed safety inspections, causing many drivers to take off work to avoid any potential fines. With a wet spring and a late start to the produce season across much of the country, truck rates spiked according to the US Department of Agriculture. Finally, the Permian Basin is pumping a record amount of oil this year, forcing more trucks than expected to help haul the oil.

According to the Trans-Logistics Group, this year’s contract rates are up 11% and will continue to rise, making it one of the strongest markets so far. Already this year, shippers are shipping more freight than last year, adding to the scarce truck capacity and causing US drayage drivers to be greatly impacted by the spike in demand. According to the Intermodal Association of North America, on a year-to-year basis, volume is up 7.1% this year through April.

Since the exact cause of the unprecedented rise in freight demand is unclear, it’s hard to tell if this is a phase or something to expect to continue. The scarce capacity yet expanding economy might mean that shippers and freight carriers should expect this for some time.

Save the Date: Shapiro’s Supply Chain Summer Seminar!

Shapiro is excited to host its annual summer seminar in Baltimore, MD on Thursday, August 9th, 2018.

Come join us and our panel of leading industry experts that will cover the hottest topics affecting the logistics and compliance industries today.

Topics for discussion include:

- Domestic Freight

- International Freight

- Compliance

- Technology

Location

Royal Sonesta Harbor Court

550 Light Street | Baltimore, MD | 21202, USA

Date & Time

Thursday, August 9th, 2018

8:30 AM – 12:00 PM

Just prior to the Propeller Club Crab Feast

Employee of the Month

As previously featured in Shap Talk, Shapiro has been sharing with you the names of employees who have been recognized for their exceptional efforts and contributions to our Company. At Shapiro, we continually work to develop, challenge, and inspire all of our employees to grow individually and with the Company.

This month, we would like to recognize Devin Turner, Implementation Manager in GLG for his outstanding performance and contributions.

We encourage you to provide us with employee feedback! Please email us at [email protected].

Freight Report

With all the capacity reductions for the Trans-Pacific freight market, we are putting extra effort into our forward forecasts, please visit https://www.shapiro.com/white-papers/ on Monday, July 16th to find our monthly Transpacific freight report.