Featured Headlines:

GAO Report on the Current State of Affairs for Drawback

CBP Plans to Suppress Counterfeit Imports Across E-commerce Market

Blank Sailings Following Chinese New Year 2020

Ocean Alliance Releases ‘Day 4’ Schedule

USTR to Investigate the Possibility of Additional Duties on Mexican Fruit and Vegetable Imports

Panama Canal Adds New Fees to Mitigate Low Water Level Impacts

Federal Dredging Funds Awarded to Port of Charleston

MTB Comment Period is Open!

Why is this important?

The Miscellaneous Tariff Bill (MTB) is a tariff reduction or elimination bill that was proposed by the International Trade Commission (ITC) in an effort to maintain and enhance the competitiveness of U.S. manufacturers in accordance with the American Manufacturing and Competitiveness Act of 2016. It became effective on October 13, 2018 and covers roughly 1,700 products originating from any country. It is set to expire on Dec 31, 2020.

The next round of MTB has already commenced, allowing members of the trade to submit petitions requesting reduced or eliminated tariff rates on specific products. The next round is set to open Jan 1, 2021 and last until Dec 31, 2023.

What can I do now?

While the time to request an eliminated or reduced duty rate closed on Dec 10, 2019, it is not too late to get involved! The Commission received over 4,000 petition requests and is now asking for the public’s help through comments on the submissions.

This is the perfect opportunity to voice your opinion on what products will be subject to reduced or eliminated duties!

Remember: MTB offers product-specific exclusions, which means while your item may be classified the same way as the petition, it does not automatically mean you can utilize the reduced or eliminated MTB rate. Your item must also meet the definition provided in the petition request.

Who can participate?

Any member of the public may file a comment, including individuals, companies and other parties with interest in the submission. The filer can use their comment to support the claim, object the petition or supply additional information.

Comments can also be used by the petition filer to clarify their submission or provide additional supporting details.

When can you file?

The period to request the lessened duty rates on specific products for the 2020 MTB has already passed. However, as previously mentioned, comments are encouraged and welcomed.

The Miscellaneous Tariff Bill Petition System (MTBPS) opened for public comments on January 10, 2020 and will close at 5:15pm EST on Monday, Feb 24, 2020. No comments, edits or corrections will be accepted after the comment period has closed.

What do I do if I have questions about MTB and the comment period? Email us at [email protected].

GAO Report on the Current State of Affairs for Drawback

On December 17th, the U.S. Government Accountability Office (GAO) published GAO-20-182 titled Risk Management for Tariff Refunds Should Be Improved.

According to Customs and Border Protection (CBP), the United States enacted the drawback program in 1789 to create jobs and encourage manufacturing and exports. CBP has primary responsibility for overseeing the drawback program. It disburses about $1 billion in drawback refunds per year.

The Trade Facilitation and Trade Enforcement Act of 2015 (TFTEA) generally expanded eligibility for the drawback program, which provides refunds to claimants of up to 99 percent of certain Customs duties, taxes, and fees. Electronic filing under the TFTEA began on February 24, 2018, and as of February 24, 2019, claimants could only file claims under the drawback statute as amended by TFTEA or otherwise known as “modernized drawback”. TFTEA also included a provision for GAO to assess drawback modernization.

Along with the changes to drawback under TFTEA and the increased participation in drawback since the additional 301 tariffs, there seems to be a backlog at CBP Drawback Centers.

Drawback specialists located in one of the four Drawback Centers in Chicago, Houston, Newark, or San Francisco are responsible for reviewing and processing drawback claims. They review claims, in whole or in part, to determine eligibility for drawback

Some of the points that jumped out in this report for companies that file drawback are:

- CBP is facing a growing workload, has not adequately managed the increased workload, and has not developed a plan for doing so.

- CBP faces delays in processing drawback claims that could result in uncertainty for industry, potentially impeding trade.

- The largest Drawback Centers expect their backlog of old claims will take about 5 years to work through.

- Drawback specialists face a learning curve as they become familiar with ACE and the new rules for drawback refunds. They explained that drawback specialists are still working through pre-TFTEA claims that were migrated into ACE.

- 18,319 claims filed during a 10-month period were put on hold by CBP pending the final rule, which CBP issued on December 17, 2018.

- CBP received 800 applications for limited modifications of manufacturing rulings, along with 50 new applications, which can take some time to process (some can take years).

- CBP limited the number of lines in a drawback claim in ACE, which increased the number of drawback claims filed. ACE line limitation is restricted to 10,000 lines per claim.

- CBP received 600 new privilege applications that are supposed to be responded to in 90 days, but specialists have not been able to meet that deadline 60 % of the time because of their workload. Claimants can also apply for privileges including accelerated payment privileges, a waiver of prior notice of intent to export or destroy, or a one-time waiver of prior notice of intent to export or destroy.

- Drawback Centers continue to face staffing shortages. CBP has 37 drawback specialists utilizing overtime that are not able to keep up with the influx of work as reported. The recommended number is 40. CBP thought that ACE would reduce the drawback specialists’ workload, but experience, to date, indicates that workload increased.

- Drawback specialists reported that one way they were managing their increased workload was by extending automatic liquidation, which can be done up to three times. CBP’s guidance states that liquidation extensions are intended to provide additional time to obtain information or documentation necessary to complete the review of a drawback claim prior to mandatory liquidation and may not be used to manage the workload.

The report made six recommendations starting on page number 58:

- Ensure the Office of Field Operations develops a plan for managing its increased workload.

- Ensure the Office of Trade assesses the feasibility of flagging excessive export submissions across multiple claims and takes cost-effective steps, based on assessment, to prevent over claiming.

- Ensure the Office of Trade develops a plan, with time frames, to establish a reliable system of record for proof of export.

- Ensure the Office of Trade turns the claim selection feature in ACE back on and captures the claims during the period when the feature was disabled.

- Ensure the Office of Trade analyzes the results of its targeting of claims for review and designs responses to mitigate identified risks.

- Ensure the Office of Trade prioritizes developing a plan to conduct an ex-post analysis of the impact on industry and government of key changes to the drawback program, including time frames and methodology.

GAO advises in the report that “until CBP develops a plan for managing its increased workload, it risks further delays in drawback claim processing that result in uncertainty for industry, potentially impeding trade—which runs counter to its strategic goal of enhancing U.S. competitiveness by enabling lawful trade and travel, such as by reducing barriers to the efficient flow of trade and streamlining and unifying processes and procedures”.

Drawback customers are anxiously awaiting their refunds, responses to applications and rulings and want to see additional personnel to help drawback specialists “dig out” of this backlog of claims. Be sure you are keeping track of your drawback claims and know that the backlog your drawback filer is experiencing is very real.

A Duty Drawback Offer

Many of you may not be aware that some reporting requirements pre-Automated Commercial Environment (ACE) are no longer required within ACE. Some of those reporting requirements involve drawback. More specifically, the price per unit, the unit of measure (UOM) and the number of units are no longer required to be reported in ACE. The catch is that these data elements are required to be reported when filing drawback.

To bridge this gap, a number of options are available to you:

- Shapiro can agree to begin to capture these data elements for you. (This assumes you can provide us with the information!)

- Shapiro can work with you on automating your entries and also ensure all drawback data elements are included.

- Shapiro can work with you on providing a feed of these required elements to the drawback provider, upon drawback filing.

If you are a current drawback filer or a company interested in pursuing this program, please reach out to us. Let’s discuss the best option for your situation!

CBP Plans to Suppress Counterfeit Imports Across E-commerce Market

On January 24th, members of the Department of Homeland Security’s (DHS) executive branch convened to review a robust report that addressed the deluge of counterfeit shipments coming into E-commerce marketplaces. The report was produced at the behest of President Trump, who heavily critiqued the process through which counterfeit goods enter the country late last year. The meeting follows on the heels of the Phase One trade deal between the U.S. and China, which called for Beijing to address counterfeits in a significant way. Upon adjournment, the committee heeded the analysis of the report and has begun to implement more nuanced plans to curb the importation of counterfeits.

According to White House Trade Advisor Peter Navarro, “…currently, the burden is on the intellectual property rights holders to police the internet, and the government to catch counterfeits in shipments.” Under the stipulations outlined in the report, Customs and Border Protection (CBP) will amend entry processes and requirements to be more exacting and applicable to parties throughout the supply chain.

Within their new design, CBP will increase its expectations of reasonable care for all parties involved in the importation process. In accordance with this process, the report emphasizes that CBP will, “treat domestic warehouses and fulfillment centers as the ultimate consignee for any good that has not been sold to a specific consumer at the time of its importation.” CBP will also expect a formal entry to be filed for any shipments perceived to be high-risk, meaning the presence of counterfeits is highly likely.

The new framework emphasizes the ability of individual consumers to report the presence of counterfeit goods across E-commerce platforms to CBP as well and seeks to allow the agency to file injunctions against marketplaces and third parties as necessary. It also calls for a reexamination of non-resident importers’ ability to claim de minimis benefits on their shipments.

While members of the trade are encouraged to start taking appropriate actions that are in line with the report, it may be up to 180 days before aspects of the report are signed into law.

Blank Sailings Following Chinese New Year 2020

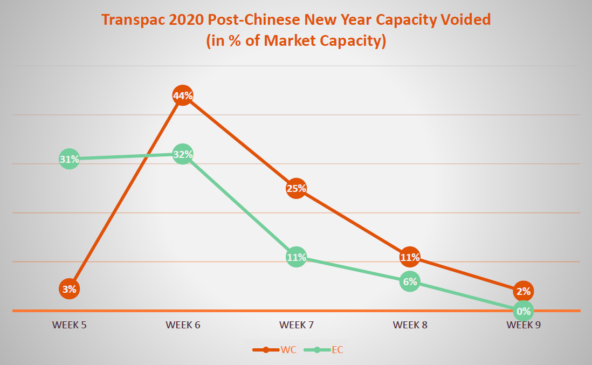

Per our ShapFlash sent on January 7th, Chinese New Year (CNY) 2020 commenced on Saturday, January 25th. As usual, it was and will be accompanied by the typical pre-holiday surge and post-holiday deluge of blank sailings implemented by the carriers.

Manufacturing in China began to cease as early as Thursday, January 16th, with most factories opening their doors again during the first week of February.

In conjunction with factory closures, and in an asserted effort to strike some semblance of parity between capacity and demand, carriers have announced a rather hefty blank sailing schedule, with nearly 40% of all Transpacific capacity voided in Week 6 (February 3rd through February 9th).

Needless to say, this will cause delays and marked disruptions for importers.

Please reference the following chart for a breakdown of blank sailings as a percent of market capacity following CNY:

TransPac 2020 Post-Chinese New Year Capacity Voided Chart

Please click HERE for a comprehensive list of voided sailings set to be imposed by the carriers in January and February.

Space is already fairly tight due to sporadic delays caused by rollovers and delays in space-confirmation. As CNY approaches, importers should expect further disruption with space availability and container rollovers.

Delays and disruptions are expected to be even further compounded due to the shipping restrictions put in place to halt the spread of the Coronavirus.

Should you require any assistance in successfully booking your cargo during this turbulent time, please reach out to our Transportation team today.

Ocean Alliance Releases ‘Day 4’ Schedule

The Ocean Alliance, comprised of COSCO Shipping/Orient Overseas Container Line (OOCL), CMA/CGM/APL and Evergreen Line, released its ‘Day 4’ schedule, which consists of a few adjustments to the 38 services, 330 container ships and 3.8 million TEU carrying capacity its members offered in 2019.

Effective April 2020, the Ocean Alliance’s schedule will maintain the same number of services that it offered in last year’s ‘Day 3’. However, members pledge that this year’s services will improve transit times, while adding direct links and port calls.

The most notable change is in the number of vessels that will be in service, which will decrease to 325 ships. CMA/CGM/APL will also increase its vessel allocation by 1, thereby supplying 112 out of the 325 total vessels.

Ocean Alliance’s ‘Day 4’ Services:

| # of Services | Service Route |

| 19 | Asia – North America |

| 7 | Asia – North Europe |

| 4 | Asia – Mediterranean |

| 4 | Asia – Middle East |

| 2 | Asia – Red Sea |

The minor tweaks to the Ocean Alliance’s services are a testament to the group’s continued stability, as both of its rival alliances faced unexpected capacity challenges following Hyundai Merchant Marine’s (HMM) announcement that it would be severing ties with the 2M Alliance in order to join THE Alliance in 2020. Although neither consortium has yet to announce their revised 2020 services, HMM’s move will add more than a dozen new ships to its service capabilities, leading analysts to project significant changes to the two other alliance schedules.

Interested in learning more about carrier alliances? Subscribe to our Freight Report for monthly updates and insights on the ever-changing landscape that surrounds the Trans-Pacific market!

USTR to Investigate the Possibility of Additional Duties on Mexican Fruit and Vegetable Imports

According to the U.S. Trade Representative (USTR), Robert Lighthizer, the department will begin analyzing historic trade laws, including the Trade Acts of 1930 and 1974, in an effort to identify and remedy “any distorting policies that may be contributing to unfair pricing in the U.S. market” as it pertains to perishable and seasonal products.

The Trade Act of 1974, which was previously used to justify the imposition of Section 201 and Section 301 tariffs on certain foreign goods, allows the U.S. President to:

- Deny preferential treatment to any specific country or product;

- Add up to 50% duties on imported products that are harmful to domestic producers;

- Evaluate and apply up to 50% duties on products that come from countries associated with drug transit or production.

Traditionally, U.S. anti-dumping laws have excluded vegetable and fruit products such as blueberries, avocados and strawberries as a result of the relatively low number of domestic producers in Florida and Georgia that are affected by the prices of Mexican imports. However, the USTR’s announcement reveals yet another marked shift in U.S. trade policy.

The impending agricultural evaluation will be divided into four stages:

- Stage 1: USTR will immediately begin compiling relevant documentation on any policies that may result in lopsided or unfair terms of trade for the U.S.

- Stage 2: Upon completion of its investigatory probe, field hearings will be held in Florida and Georgia within 90 days of the ratification of the U.S.-Mexico-Canada Agreement (USMCA) “to solicit feedback on how the Administration can better support these producers and redress unfair harm.”

- Stage 3: U.S. officials will enlist the assistance of the International Trade Commission (ITC) in enforcing any import measures the USTR should deem necessary in response to stages one and two.

- Stage 4: U.S. Department of Commerce and International Trade Administration to continuously monitor and initiate any trade cases that may violate Sections 702 and 732 of the Tariff Act of 1930.

Though critics have argued that federal monitoring of perishable and seasonal products has historically been relatively unenforced and ineffective, the USTR reserves the right to request the International Trade Commission (ITC) or Commerce Department’s involvement in certain anti-dumping and countervailing duty (AD/CVD) cases.

Should the investigation deem further action to be required, the USTR will release additional information regarding its planned course of action.

Click here to view the USTR letter sent to lawmakers on January 9th.

Panama Canal Adds New Fees to Mitigate Low Water Level Impacts

In response to recurring low water levels inhibiting the passage of larger vessels, new fees and booking system alterations have been implemented by the Panama Canal Authority (ACP).The low water levels were an unfortunate result of one of the driest years in Panama’s history, which saw an overall annual rainfall decrease of 20%.

Effective February 15, 2020, vessels over 125 feet will be charged:

| Fee | Fixed/Variable | Amount |

| Freshwater | Fixed | $10,000 |

| Water Level | Variable | Ranging from 1% to 10% of vessel’s toll dependent upon the water levels of nearby Gatun Lake – which is responsible for feeding canal locks with additional water during vessel transit |

| Handling Service | Variable |

|

Daily reservations at the Panama Canal are expected to be limited to 27 slots, with a requirement to pay the booking fee 48 hours prior to moving through the canal. Though capacity will continue to be maintained on a first-come, first-serve basis, there will also be some slots made available through an auction 3 days prior to transit for certain vessel appointments.

In addition to the new fixed and variable fees listed above, the ACP has taken other steps to conserve water. Thus far, it’s pledged to continually invest in water conservation initiatives, which will include dedicating a portion of their revenue towards discovering various solutions for drought-related issues.

Federal Dredging Funds Awarded to Port of Charleston

The Port of Charleston has been awarded $138 million by the Federal Government to aid in its pursuit of becoming the deepest port on the U.S. East Coast. The grant is part of a recently enacted U.S. Energy and Water Appropriations Act, which was signed into law in December.

Once construction concludes in 2022, the Port of Charleston will be able to accommodate three 14,000-TEU vessels at once. The anticipated cost of the project is $558 million; however, port officials are expected to apply for federal reimbursement in order to repay a $50 million loan that was utilized at the start of the project.

Charleston is not alone in its building efforts, as multiple harbor deepening projects in Savannah, Jacksonville, Wilmington and other East Coast ports are expected to begin in the coming years, pending approval.

While dredging is an important aspect of handling larger vessels, it’s not the only piece of the puzzle to take into consideration. Ports must also have the cranes, berths and landside capacities to properly accommodate the larger ships in a reasonable time frame.

The Wando Welch Terminal, located in Charleston, is expected to increase their crane inventory to 15 by 2021, which will provide the additional cranes required to handle increased cargo loads. This implement will allow the Port of Charleston to service three large vessels at once, each with five cranes for unloading cargo. Similarly, five additional cranes, with an even greater height capacity, are expected to be added to the Leatherman Terminal, also located in Charleston, by the end of 2022.

Larger crane versatility allows the carrier to stack the vessel how they want to, rather than the port requiring the vessel to be stacked a certain way. This will allow the Port of Charleston to service ultra large vessels that cannot be serviced by other East Coast ports.

With the increase in cargo, other changes are coming to the port. The South Carolina Port Authority (SCPA) is increasing overall terminal capacity in the container yard by relocating the chassis depot outside the ingate, in addition to switching to a system that allows containers to be stacked tighter together.

Despite the possible challenges that may result from the infrastructural enhancements, the Port of Charleston hopes to maintain their average turn time of 40 minutes.

Fate of AB5 in CA and NJ

Assembly Bill 5 (AB5) has been under significant scrutiny by the trucking industry since it was first introduced in late 2019. However, on January 9th, a California judge preliminarily ruled that truck drivers cannot be classified as independent contractors because state legislation is preempted by federal law.

The proposed three-pronged classification would have prevented owner-operators from being hired as independent contractors since they do not perform work outside of the scope of the freight brokers hiring them. The ruling was made in a case for The People of the State of California v. Cal Cartage Transportation. A formal hearing for the California Trucking Association (CTA) was held on January 13th, wherein U.S. District Court Judge Roger Benitez issued a preliminary injunction that removes trucking from AB5 applicability, marking a big win for owner-operators based in CA.

Unfortunately, NJ truckers did not fare as well as their CA counterparts, with a vote on January 14th upholding the stipulation that AB5 is applicable to owner-operators. The passage of AB5 in NJ essentially established a precedent that requires companies using independent contractors, such as owner-operators, to reclassify them as employees, which mitigates their ability to perform work for multiple parties.

“Gig-economy laws”, such as AB5, are expected to grow as more states seek to offer benefits to contracted workers. While these types of laws were first proposed as a means of targeting rideshare drivers, they have inadvertently brought the trucking industry into the fold.

As the threat of change grows, carriers and truckers are amending their practices. Many owner-operators have become licensed motor carriers and trucking companies have shifted more deliveries into their brokerage divisions, and not just in CA or NJ.

Quick Airfreight Update

Jet fuel prices, which are significantly impacted by oil prices, briefly surged following a U.S. airstrike on an Iranian general visiting Iraq and the subsequent retaliatory strikes at American bases in Iraq. While the situation appears to have subsided at this time, if conflict reemerges and Iran attacks the supply lines we could see higher fuel prices as result.

Prior to the current problems with Iran, analysts predicted a steady market for 2020. The brief surge is tempered because U.S. production is up and sanctions in Iran limit its impact on the world’s fuel. However, Cargolux has announced an increase in their fuel surcharge effective January 13th.

Shapiro News

As previously featured in Shap Talk, Shapiro has been sharing with you the names of employees who have been recognized for their exceptional efforts and contributions to our Company. At Shapiro, we continually work to develop, challenge, and inspire all of our employees to grow individually and with the Company.

This month, we would like to recognize Maura Perry, Marketing Strategy Specialist.

Maura has the unique gift of bringing order and structure to any situation, even if complete chaos is unfolding around her. She always brings her A-game and is willing to tackle any new projects head on and without wavering in her idea of grand design. She always brings inspiration and fresh ideas to her work and we are all lucky to continue to call her a team member. Congratulations, Maura!

We encourage you to provide us with employee feedback! Please email us at [email protected].

Shapiro Freight Report

This high-level, monthly review of the U.S. import freight market provides key insights into the tumultuous world of international shipping. From carrier alliances to labor strikes, Shapiro covers the pertinent information logistics managers need to know. Check back monthly to ensure you don’t miss key industry insights!

State of Trade

As the Chinese New Year (CNY) holiday approaches, the Transpacific market has seen a much stronger-than-expected cargo surge. This has caused many rollovers and delays with some carriers claiming to be over-booked by as much as 70% for key services.