Featured Headlines:

FEMA Modifies and Extends Restrictions on PPE Exports Until 2021

Priority Trade Issue: Textiles

North Korea Ballistic Missile Procurement Advisory

CBP Fees Effective October 1, 2020

APHIS Accepting Electronic Phytosanitary Certificates and Forms through September 30

Section 301 Exclusion Monitoring – What You May Have Missed!

Commerce Proposes Broad Changes to Antidumping/Countervailing (AD/CVD) Regulations: Comments Due September 14

The Department of Commerce (DOC) has proposed substantial changes to the administration of AD/CVD regulations. According to Commerce, the aim is to strengthen and improve efficiency of the administration and enforcement of AD/CVD laws and to “create new enforcement tools for Commerce to address circumvention and evasion of trade remedies.” The new proposal includes major changes to the implementation of scope rulings. Public comments are due September 14.

Below are a few of the areas that the proposal affects:

SCOPE RULINGS

Retroactive suspension of liquidation and collection of cash deposits based on scope rulings

Under current regulations, formal scope rulings apply to goods entered on or after the initiation date of the scope inquiry. Under the proposed regulation, Commerce said “a scope ruling that a product is within the scope of the order is a determination that the product has always been within the scope.”

“Put another way, if a party has imported merchandise and declared that merchandise as not covered by the scope of an order, and then Commerce issues a scope ruling finding that such merchandise is subject to an order, under these proposed regulations, Commerce’s scope ruling would apply to all unliquidated entries of the merchandise,” said Commerce.

An affirmative scope or anti-circumvention inquiry decision would apply retroactively to all unliquidated entries. The implementation would revert to the original date for suspension of liquidation under the AD/CVD order, usually the preliminary affirmative decision. This earlier date could include a time when the importer was unaware the merchandise was subject to AD/CVD.

Commerce claims that the current system incentivizes importers to enter potentially subjected goods without declaring them subject to AD/CV duties. By filing a scope inquiry only after importing as much as possible, parties could avoid liability for AD/CV duty for those goods. “Under the proposed approach, importers have an incentive to seek a determination as soon as possible whether a particular product is subject to the scope of an existing AD/CVD order,” Commerce said.

The impact of the new policy would be limited by the timeframes for CBP liquidation. It is unlikely that there would be unliquidated entries more than a year old that would be covered by a scope ruling. Also, the new policy would not apply to scope rulings initiated before the effective date of the new regulations.

Additional proposed changes to scope rulings:

- Negative scope rulings: After a preliminary negative scope ruling, the suspension of liquidation would continue. If the final scope ruling is negative, only then would CBP be directed to end suspension of liquidation.

- Uniform applications: A standardized application form for scope rulings will be published on the DOC website. The form will list required information, reducing multiple requests from DOC for additional clarification and evidence.

- Existing scope rulings: DOC will be able to apply an existing scope ruling to a new request based on a product with identical physical description and same country of origin.

- Scope issues in other proceedings: DOC will be able to address scope issues within administrative reviews and other proceedings without having to initiate a separate scope inquiry.

- Basis for scope rulings: The “revisions also clarify and codify the substantive basis for Commerce’s scope rulings pertaining to country of origin, scope language interpretation, and ‘mixed media’ products.”

ANTI-CIRCUMVENTION INQUIRIES

Commerce has proposed a separate section to address anti-circumvention inquiries, with changes in procedure like those proposed for scope rulings.

- Suspension of liquidation would apply to all unliquidated entries, rather than just those after initiation of the inquiry.

- Commerce would not be required to notify CBP of negative preliminary determinations in anti-circumvention inquiries. As a result, “suspension of liquidation for already suspended entries (if any) will remain in effect pending Commerce’s final circumvention determination.”

IMPORTER CERTIFICATIONS

A new section regarding importer certifications would be created under Commerce’s proposed regulations. The changes would “codify and enhance Commerce’s existing authority and practice to require certifications by importers and other interested parties as to whether merchandise is subject to an AD/CVD order.” Commerce would be able to direct CBP to require AD/CVD cash deposits from importers who do not provide certifications or who make false statements.

Commerce also proposes to modify the regulations for reimbursement certification, which is required for all entries subject to AD duties.

- Electronic Filing: Importer reimbursement certificates could be provided electronically as well as in paper form.

- Language: Specific certification language would no longer be required. Instead, importers would “certify to the substance of the certification.”

- Certification Clarification: Commerce “proposes to clarify that a certification is required for each entry of merchandise subject to AD duties imported on or after the date of the first suspension of liquidation.”

- Additional clarification: The certifications are required before liquidation; however, “CBP may also accept the reimbursement certification in accordance with its protest procedures.”

ADDITIONAL PROPOSED CHANGES

- New shipper reviews: To preserve resources as well as discourage meritless claims, Commerce would revise procedures for new shipper reviews. These steps would support Commerce in determining if “the sales to be reviewed are, in fact, bona fide sales.”

- Covered merchandise referrals: New regulations are proposed for referrals coming from CBP to Commerce in the process of an Enforce and Protect Act (EAPA) investigation. These scope rulings determine if merchandise subject to an EAPA investigation is “covered merchandise.”

- Revised procedures: Proposals include changes to time for submission of industry support comments in AD/CVD proceedings, expedited deadlines, and streamlined notifications by DOC.

PUBLIC COMMENTS

- Written comments must be received no later than September 14.

- Submit comments through the Federal eRulemaking Portal, docket no. ITA-2020-0001.

- Comments may also be submitted by mail or hand delivery/courier, addressed to:

Jeffrey I. Kessler, Assistant Secretary for Enforcement and Compliance, Room 1870, Department of Commerce, 1401 Constitution Ave. NW, Washington, DC 20230. - Commerce will “carefully consider all public comments before issuing a final rule that revises the existing regulation.”

- This proposal was published on August 13 in the Federal Register: https://www.federalregister.gov/documents/2020/08/13/2020-15283/regulations-to-improve-administration-and-enforcement-of-antidumping-and-countervailing-duty-laws

FEMA Modifies and Extends Restrictions on PPE Exports Until 2021

On August 10, 2020, the Federal Emergency Management Agency (FEMA) published an official notice in the Federal Register modifying and extending an export ban on certain Personal Protective Equipment (PPE) from the United States until December 31, 2020.

This temporary final rule in the Federal Register allocates certain health and medical resources for domestic use so that these resources may not be exported from the United States without explicit approval by FEMA. The rule aids in the attempt to halt the spread of COVID-19 by ensuring that there are enough medical supplies readily available domestically should the need arise.

The below items are said to not be meeting domestic demand; as a result, the US will require these items to continue to be subject to the export ban. These items may not be exported from the United States without explicit approval by FEMA. See 44 CFR 328.102(a):

- Surgical N95 Filtering Facepiece Respirators, including devices that are disposable half-face-piece non-powered air-purifying particulate respirators intended for use to cover the nose and mouth of the wearer to help reduce wearer exposure to pathogenic biological airborne particulates.

Note: N95 respirators for medical use are still in great need within the United States, and supply is not expected to catch up with demand until January 2021. As of August 4, 2020, FEMA had open requests for over 6 million N95 respirators from State, local, Tribal, and territorial (SLTT) jurisdictions.

- PPE Surgical Masks or Other Filtering Facepiece Respirators (e.g., those designated as N99, N100, R95, R99, R100, or P95, P99, P100), including single-use, disposable half-mask respiratory protective devices that cover the user’s airway (nose and mouth) and offer protection from particulate materials at an N95 filtration efficiency level per 42 CFR 84.181.

Note: As of August 4, 2020, FEMA had open requests for over 28 million surgical masks from SLTT jurisdictions.

- PPE Nitrile Gloves or Surgical Gloves as Covered Materials, with Modification. FEMA is narrowing the scope of the materials covered to PPE nitrile gloves, specifically those defined at 21 CFR 880.6250 (exam gloves) and 878.4460 (surgical gloves) and other such nitrile gloves intended for the same purposes.

Note: Domestic supply for latex and vinyl examination and surgical gloves has largely caught up with demand, but there is still a significant shortage of nitrile gloves. As of August 4, 2020, FEMA had open requests for over 139 million nitrile gloves from SLTT jurisdictions.

- Level 3 and 4 Surgical Gowns and Surgical Isolation Gowns that meet all the requirements in ANSI/AAMI PB7014 and ASTM F2407 – 0615 and are classified by Surgical Gown Barrier Performance based on AAMI PB70.

Note: As of August 4, 2020, FEMA had open requests for over 11 million of these gowns from SLTT jurisdictions.

FEMA is also eliminating two items from the initial covered materials list on April 10, 2020:

- FEMA is removing other filtering facepiece respirators since this category has seen a significant drop in the number of orders received from SLTT jurisdictions, and the current supply is sufficient to fill demand from these jurisdictions.

- FEMA is also removing elastomeric, air-purifying respirators and appropriate particulate filters/cartridges from the list of covered materials since these items have seen low demand from SLTT jurisdictions and FEMA has been able to fill all orders that have been placed for these items in the past 45 days, as of July 16, 2020.

Note: This rule covers only those PPE items described above; it does not cover other forms of PPE not described in the rule, such as cloth-based masks.

Exporters are required to send a Letter of Attestation to FEMA for approval of any exports of the above materials. There are certain exceptions, but they must be approved by FEMA. This may include U.S. manufacturers with continuous export agreements with customers in other countries since at least January 1, 2020, so long as at least 80 percent of such manufacturer’s domestic production of covered materials, on a per item basis, was distributed in the United States in the preceding 12 months. All exceptions are listed in the original temporary final rule found at 85 FR 20195 (Apr. 10, 2020).

Click here to access the full Federal Register Notice issued on August 10, 2020 (2020-17467).

Click here to view CSMS #43631316.

If you have any questions about this development, please reach out to [email protected].

Priority Trade Issue: Textiles

U.S. Customs and Border Protection (CBP) remains focused on the enforcement of trade laws and regulations that govern the vital sectors that make up the backbone of the US economy – including textiles.

Did you know that the US is the second largest exporter of textiles and apparel goods in the world and is responsible for employing nearly 600,000 workers domestically?

Because textiles have some of the highest duty rates of all commodities imported into the US, they are extremely susceptible to trade fraud and have therefore become a top priority for CBP’s enforcement efforts. In 2019 alone, 23% of all duties collected by CBP were on textile products, which amounted to a staggering $15.9 billion in revenue.

According to CBP officials, some of the methods importers use to attempt to circumvent textile tariffs and trade laws include:

- Illegal transshipment and/or origin fraud

- Invalid Importers of Record (IORs)

- Inaccurate description

- Undervaluation

- Smuggling and/or overstuffing

- De minimis misuse of trade preference programs and free trade agreements (FTAs)

CBP recently released the statistics of its enforcement efforts for FY 2019 which include the following:

- 645 seizures (non-IPR, including smuggling) worth $11.78M; 4,396 seizures (IPR) totaling worth $19.52M

- 5 commercial fraud penalties worth $138K

- 76 factories in six countries visited to verify production and compliance with U.S. trade preference programs, resulting in a discovery of 36% non-compliance

- 12,794 cargo examinations finding 844 (6.60%) discrepancies

- 51 CBP audits resulting in $7.691M recommended or accepted recoveries

A full list of statistics can be found here.

Although it seems very overwhelming, there are many ways textile importers can ensure compliance and avoid costly fines and penalties. Below is a list of a few ways to help you navigate.

- Know your supply chain and every member of it. Be knowledgeable of your suppliers and their suppliers.

- Rules of origin: CBP has lots of tools and publications to assist you with the rules of origin.

- Check your marking and labeling to ensure compliance with CBP regulations.

- Inspect your documentation and ensure your item is accurately and completely described and provides complete information (including the actual manufacturer).

- Ensure proper classification; textile classification can be complex at times but a lot easier the more informed you are about your product.

- Good record keeping: This is an easy thing that importers often overlook but will carry heavy fines if documents cannot be produced by the importer if or when requested by Customs.

- Review your entry summary when supplied by your broker; it is the responsibility of the importer to ensure the accuracy of the customs entry. Reviewing your Entry Summary (7501) timely will allow for any necessary corrections to be made prior to duty payment. Do not wait for Customs to find the errors.

If you have any questions or concerns, we would love to help!

Our knowledgeable compliance team can be reached at [email protected].

North Korea Ballistic Missile Procurement Advisory

The United States is issuing an advisory to alert industry worldwide to North Korea’s ballistic missile procurement activities. This joint advisory from the Department of State, the Department of the Treasury, and the Department of Commerce identifies key North Korean procurement entities and deceptive techniques employed by North Korean proliferators and procurement networks, provides an overview of U.S. sanctions authorities related to Democratic People’s Republic of Korea (DPRK) proliferation, and lists North Korea-related sanctions enforcement resources.

For more information on this specific action, please visit the Treasury’s Recent Actions page.

CBP Fees Effective October 1, 2020

In the Federal Register Notice dated July 29, 2020, U.S. Customs and Border Protection (CBP) has announced fee increases adjusted to reflect inflation effective October 1, 2020. These fees will directly affect your Customs entry.

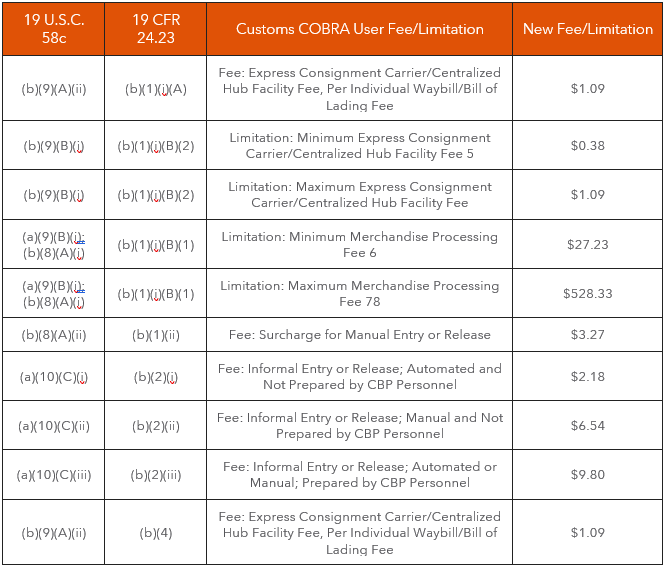

For instance, the Merchandise Processing Fee (MPF) limitation for formal entries (class code 499) will increase from $26.79 to $27.23 and the maximum limitation will increase from $519.76 to $528.33. The ad valorem rate of 0.3464% will NOT change.

Please reference the table below and the link to the Federal Register Notice (pgs. 45647 and 45648) above to gain an understanding of all increases that will commence on October 1, 2020.

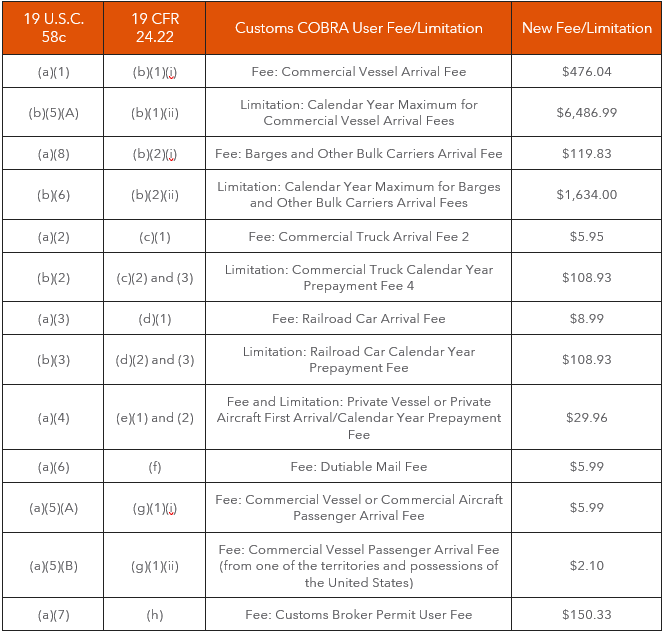

TABLE 1 — Customs Cobra User Fees and Limitations Found in 19 CFR 24.22 for Fiscal Year 2021 (adjusted in accordance with the FAST Act)

TABLE 2 —Customs Cobra User Fees and Limitations Found in 19 CFR 24.23 for Fiscal Year 2021 (adjusted in accordance with the FAST Act)

For more information on CBP fees, reach out to [email protected].

APHIS Accepting Electronic Phytosanitary Certificates and Forms through September 30

Importing plants and plant products in the age of COVID-19 is a challenge. APHIS Plant Protection and Quarantine (PPQ) is easing the stress as they continue to embrace electronic solutions.

Electronic Phytosanitary Certificates and Forms

APHIS PPQ and Customs and Border Protection (CBP) will continue to accept Electronic Phytosanitary Certificates and Forms through September 30, 2020.

APHIS PPQ is taking advantage of their recent progress utilizing ACE (Automated Commercial Environment). PPQ currently allows importers and brokers to submit APHIS-required import data for APHIS-regulated products via ACE. Documents may be uploaded into ACE using the Document Imaging System (DIS). Documents may also be provided by other means, including as email attachments.

Acceptable Phytosanitary Certificates include:

- Scanned copies of original certificates

- Electronic certificates created through a participating country’s ePhyto system

- Signed paper forms

Certificates should be legible and include APHIS-required statements.

Precleared Consignments

PPQ will also continue to accept precleared consignments that are accompanied by an email from PPQ with an electronic copy of PPQ Form 203 attached, if the original form is not available.

If you have any questions about which forms may be submitted electronically, please reach out to [email protected].

Section 301 Exclusion Monitoring – What You May Have Missed!

The Office of the U.S. Trade Representative (USTR) has issued several rounds of products excluded from Section 301 tariffs in recent weeks. Please refer to the following timeline for more information regarding each exclusion:

- July 28, 2020: USTR announces that 14 products from the first round of exclusions on List 2 goods will retain their exclusionary status from additional tariffs until December 31, 2020.

- August 5, 2020: USTR releases its 37th round of product exclusions. The notice contains (1) HTS subheading completely excluded from List 4A tariffs and (9) partially excluded subheadings, which cover 25 separate exclusion requests.

- August 6, 2020: USTR announces that 266 products from all fifteen rounds of List 3 goods will retain their exclusionary status from additional tariffs until December 31, 2020.

- August 31, 2020: USTR announced that 87 products from all eight rounds of List 4A goods will retain their exclusionary status from additional tariffs until December 31, 2020.

For issues with online submissions related to Section 301, please contact: Assistant General Counsels Philip Butler or Benjamin Allen, (202) 395–5725.

How can we help? Please reach out to [email protected] for assistance with your 301 exclusion filings!

Shapiro will continue to monitor and provide status updates on our Section 301 Tariff News page as they become available.

To Peak Season and Beyond

The extreme spike for imports that began in June is no longer thought of as a temporary volume increase. Instead, many have now shifted to calling it a “peak season.” Normally, peak season for US ports starts in August and lasts through October while retailers prepare for the holiday shopping season. As summer holds on so does the remarkable peak season of 2020.

Only six blank sailings remain through September; three to the West Coast and three to the East Coast. BCO contract holders are increasing their forecasts, and carriers are responding with rate hikes and peak season surcharges accordingly. Lastly, the continuing boom in online orders is calling for more and more ecommerce imports to replenish inventories.

In addition to more orders, there is an urgency to get product here now which has importers favoring the West Coast. This shift in the balance is partially attributed to importers attempting to beat the expiration of some Section 301 tariff exclusions. The rest is the result of frozen orders that must now rush to the shelves for back-to-school and other seasonal deadlines.

The results are many-fold. First, there is the clogging of the rails that is causing BNSF to cap their acceptance of domestic intermodal cargo. This cargo usually shares the rail with the international cargo coming through the ports. For cargo that is destined to west coast warehouses, other bottlenecks await. A trend of inconveniently placed chassis is stressing already scarce truck availability. Finally, worker shortages and physical distancing measures are slowing the rate at which cargo can be received and stored.

When will it end? Pundits assert that the booking surge could last through early September, while the import arrivals surge will be felt through October. In place of back-to-school goods, insiders suggest that we will see a mixture of stay-at-home and home improvement products. Overall, there is a lot to watch since normal consumer trends are nowhere to be seen in these unprecedented times.” Oh, and don’t look now, but here comes Golden Week (Oct 1-7); Chinese manufacturing will stop, and that always gives us a mini-peak when workers return. The question is whether we will even feel a mini-peak if the current tsunami continues.

Interested in staying up to date on Transpacific capacity? Visit our Subscription Center to sign-up to get the latest industry alerts delivered right to your inbox!

Air Freight Update

- Due to a Covid outbreak in their Melbourne terminal, Qantas freight halted cargo operations on August 3rd until further notice.

- Melbourne’s local government has also recently locked down the city due to increase of infection rates. Airline authorities are working with the Victorian Health Agency to re-open since import and export flows, including medical products, are essential.

- Virgin Atlantic filed for bankruptcy protection after running out of cash. In a letter to customers, they assured they are filing for chapter 15 and not chapter 11, which protects US assets of foreign companies that have restructuring proceedings in their home country. The airline will continue operations during their restructure.

- KLM is back to IAD (Dulles) flying three times a week non-stop to Amsterdam.

- American Airlines is not expecting volumes to rebound until 2022-23. Looking forward to 2021, American reportedly cut down next year’s summer schedule by 25%. Route changes planned include pulling Asia-bound flights out of Los Angeles in favor of Seattle and Dallas, and using Trans-Atlantic flights from Philadelphia and Miami to handle the Caribbean, Central and South American routes. The airline reached a deal with the pilot union giving more leave and early retirement options as they try to avoid involuntary furloughs.

- Every branch of LATAM Airline is now under bankruptcy reorganization except Argentina, where they ceased operations of their subsidiary, and Paraguay, which remains closed due to the Pandemic. The airline continues to operate flights and is quickly shrinking its routes.

- United air cargo is bolstering the airline amid passenger declines. Quick to emphasize cargo during the scramble at the start of the pandemic, United has leveraged space and route options to increase cargo revenue in Q2 by 36.3 %.

Questions? Don’t hesitate to contact our airfreight specialists with any and all questions related to capacity and rates.

The Airfreight Capacity Issue

In March 2020, 90% of passenger aircraft capacity was removed from the broader airfreight market. This had a tremendous impact on industry capacity since 50% of cargo travels via passenger aircraft. This extraordinary reduction in capacity, coupled with a large spike in PPP shipping, resulted in record high rates from China and India for more than two months. During that time, we saw several airlines temporarily convert their passenger aircraft into passenger-freighters, or “preighters”, to increase their cargo capacity.

As cargo demand spikes again, airfreight rates have begun to increase again. Where adding capacity to the market would generally be the strategy in a stable market, airlines have advised that they expect only 20—40% of their passenger craft to return to the market by Q4 2020. It is not cargo demand that will drive the return of passenger aircraft to the market, but the passengers themselves.

With this in mind, industry leaders are expecting disruption to the market to continue through the year, with the slow re-entry of passenger craft continuing to greatly choke cargo capacity.