Featured Headlines:

Additional Duty on Certain Steel & Aluminum Products in a Nutshell

With Additional Tariffs, Will Your Import Bond be Sufficient?

Supply Chain Cybersecurity Threats Set to Increase in 2018

ILA, USMX Report ‘Significant Progress’ on 6-year Extension

Ocean Carriers Not Immune to Rising Drayage Costs

2018 Changes to Amazon FBA Inventory Storage Fees and Policies

DRIVE – Safe Act To Lift Restrictions on Inter-State Driving for 18-21-Year-Old Truckers

Getting Ready for the Mega-Vessels at the Port of NY/NJ

Automated Commercial Environment (ACE) Import Workshop

Additional Duty on Certain Steel & Aluminum Products in a Nutshell

The additional duty that came into effect on March 23rd is applicable to select HTS numbers and offers exemptions, though these may prove to be temporary, to a select few countries. Exemptions are set to expire on April 30, 2018 unless President Trump offers an extension. The following is a list of affected HTS numbers as well as countries exempt from the additional tariff:

Steel, add’l 25%

7206.10 – 7216.50: includes ingots, bars, rods and angles

7216.99 – 7301.10: includes bars, rods, wire, ingots, and sheet piling

7302.10: rails

7302.40 – 7302.90: includes plates and sleepers

7304.10 – 7306.90: includes tubes, pipes and hollow profiles

Aluminum, add’l 10%

7601: unwrought aluminum

7604: bars, rods, and profiles

7605: wire

7606 & 7607: plate, sheet, strip and foil (flat rolled products)

7608 & 7609: tubes and pipes and tube and pipe fittings

7616.99.5160 & 7616.99.5170: castings and forgings

Temporary exemptions until April 30, 2018: Canada, Mexico, Australia, Argentina, South Korea, Brazil and member countries of the European Union (Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden and the United Kingdom

With Additional Tariffs, Will Your Import Bond be Sufficient?

When President Trump announced the additional duties on steel (25%) and aluminum (10%), did you think about how this may impact your import bond?

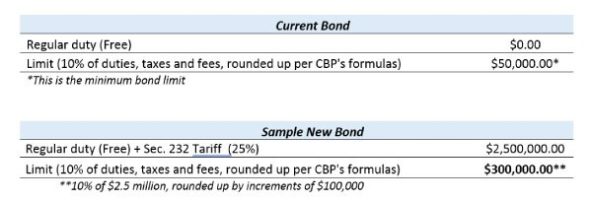

At this point, we don’t know how long these additional duties will be in effect, but please don’t lose sight of how additional duties can and will impact your import bond limit. Customs uses duties, taxes and fees based on the previous 12 months to evaluate the sufficiency of your bond. All duties must be considered to calculate your bond limit. Below is an example of how the import bond limit may increase for an importer of steel valued at $10 Million for a 12-month period:

A $300,000.00 bond may require a new bond application, indemnity and financial records for the surety to review.

While the additional tariffs are in place, bond sufficiency should be monitored by the importer closely. An importer does not want to be surprised if Customs deems their bond insufficient and a shipment is delayed while the importer gathers the information required for the surety. This will definitely cause more headache and cost for importers on top of the additional tariffs. Importers must be proactive and review their bond amount for sufficiency. Reach out to Shapiro or your surety for guidance with your specific situation.

Forced Labor

Did you know that the Bureau of International Labor Affairs listed 139 commodities from 75 different countries as goods produced by Child Labor or Forced Labor? CBP prohibits the importation of merchandise mined, produced or manufactured, wholly or in part, in any foreign country by forced or indentured child labor. The term forced labor is used for all work or services that are exacted from any person under the menace of penalty for its nonperformance and for which the worker does not offer himself voluntarily (19 USC 1307). How do you know that your manufacturer isn’t using forced labor or child labor?

If your shipment is questioned upon entry as to whether or not forced labor was used in production, the Commissioner of the CBP will issue a Withhold Release Order to the Port Directors who will then detain your shipment. It will then be your responsibility as the importer to submit proof that the goods were not manufactured using prohibited labor. To do this, you will need to submit a Certificate of Origin and a detailed statement advising how the merchandise was produced. A good example of a detailed statement is a supply chain audit report. All of this must be submitted within 3 months of importation. If the proof is not sufficient to release the cargo, the Commissioner will publish a formal finding to the Customs Bulletin and Federal Register. From there, you have one last chance to submit revised documentation before your cargo is seized for being in violation.

To better prevent forced labor, CBP has advised that you implement an ethical supply chain with a social compliance system. Supply chain audits are also recommended to evaluate risks. For more information on how to set up your social compliance system, please visit https://www.dol.gov/ilab/child-forced-labor/.

There are currently 24.9 million people being forced into labor with 73% of them being female and 25% being children. If you have any reason to believe that merchandise is being produced by forced labor, you should contact any Port Director or the Commissioner of CBP.

If you have any questions, please reach out to us at [email protected]

Supply Chain Cybersecurity Threats Set to Increase in 2018

Following the NotPetya cyber-attack on logistics giant A.P. Moller – Maersk last summer, which delayed APM terminal operations and caused backlogs and disruptions across supply chains directly and indirectly linked to the company, consultancy Booz Allen Hamilton has warned that this event is unlikely to be a one-time occurrence. Booz Allen has expressed significant concern over “indirect supply attacks” impacting larger corporations and their partners, pointing to NotPetya as an example. NotPetya actually originated as an attack on Ukrainian tax software provider M.E.Doc, which then spread through partner firms to impact larger corporations, like Maersk. While a firm may have significant protections against a direct cyber-attack, data feeds to partner firms may be significantly less protected and could be more easily compromised.

While supply chain cybersecurity is already a concern for Shapiro clients, Booz Allen’s comments should also serve as a warning that cybersecurity supply chain disruptions are likely here to stay and that any major carrier could be impacted, either directly or via their alliance or vessel sharing partners. Worried about the potential impact of these disruptions on your supply chain? Contact your Shapiro team to help you navigate the waters (or skies) of today’s logistics market. We can assist you in mitigating these disruptions on your operations as they happen, not weeks later.

ILA, USMX Report ‘Significant Progress’ on 6-year Extension

The International Longshoremen’s Association (ILA) and United States Maritime Alliance (USMX) have been experiencing noteworthy progress in bargaining on a six-year extension of their East and Gulf Coast labor contract.

The ILA-USMX master contract includes wages, medical benefits, carrier-paid container royalties, and additional port-specific issues. Bargaining regarding local and regional contracts are addressed separately.

Before recent discussions, ILA and USMX negotiations came to a halt after a discrepancy over the automated terminals’ contract definitions. However, according to ILA President, Harold Daggett, they are confident that the most recent negotiations will ultimately lead to a six-year contract that will bring solidity and advancement to the industry.

Beneficial Cargo Owners (BCOs) are especially eager for a final agreement. They remain hopeful that the final arrangements will occur well before the expiration of the current coastwide agreement on September 30th.

The ILA received word from USMX that their concerns regarding automation have been sufficiently handled. This provides assurance to BCOs that they will come to an agreement well before the contract expiration date.

In a statement, the National Retail Federation and over 100 other organizations encouraged the union and employers to promptly continue negotiations. They urged swift action to avoid having to place expensive contingency plans on BCOs. Timing is a critical element for BCOs negotiating with container lines in the trans-Pacific trades.

The West Coast port labor contract extension to mid-2022 looked to reassure despondent BCOs that have faced years of labor strife. This includes a 2002 lockout idling West Coast ports for 10 days, along with work slowdowns.

Many BCOs distributed their cargo throughout multiple port gateways to shield against supply chain risks. The West Coast’s portion of US containerized Asian imports fell by over 50 percent last year.

Ocean Carriers Not Immune to Rising Drayage Costs

As ELD requirements and driver shortages continue to challenge the US drayage market, shippers may look for solutions with ocean carrier door moves. Traditionally, ocean carriers performing the drayage portion have offered benefits to shippers seeking sharper rates who are willing to give up a certain amount of control of their delivery. However, ocean carriers performing these services are faced with the same issues (drayage capacity, congestion and rising costs) that are affecting the rest of the industry.

Traditionally safe carrier door moves may soon be subject to additional fees or will soon be eliminated as a service offering. As of late March, the following carriers have announced an additional EIS (Emergency Intermodal Surcharge). Below, please find a summary of carriers’ door move offerings and subsequent surcharges. Please note that these positions may change.

| Carrier | Door offer | EIS |

| COSCO | Yes (Case by case) | No EIS |

| APL | Suspended | |

| PIL | Suspended | |

| ZIM | Suspended | |

| CMA-CGM | Yes | $300/cntr. CHI/HOU/SAV/MEM/CMB effective 4/16 |

| EVERGREEN | Yes (BCO only) | No EIS |

| HAPAGLLOYD | Suspended | |

| SML | Suspended | |

| HYUNDAI | Yes | $300/cntr. Effective 4/6 |

| YANG MING | Yes (existing contracts only) | No EIS till now, adjust IHC instead** |

| HAMBURG SUD | Suspended | |

| OOCL | Suspended | |

| MATSON | Suspended | |

| WANHAI | Suspended |

2018 Changes to Amazon FBA Inventory Storage Fees and Policies

Some big changes will be impacting Fulfillment By Amazon (FBA) sellers in the next few months. To encourage sellers to have a more robust inventory rotation and facilitate the delivery of products to Amazon shoppers with increased rapidity, Amazon is initiating new fees and policies in regard to storage and inventory management in their fulfillment centers. In case you missed the update, Amazon released a list of FBA Inventory Storage Fees and Policy changes (you will need to log into your Seller Central to see the updates linked throughout this article).

Come April 1st, Amazon will increase the cost of monthly inventory storage fees by 5 cents per cubic foot for standard and oversized items. Starting July 1st, Amazon will be using an ‘Inventory Performance Index’ (IPI) to measure the performance of FBA sellers’ inventory management. It will use those calculations to justify the reduced limit on the number of units that sellers can store in an FBA fulfillment center. These limits will be evaluated quarterly and could cause additional issues with fees based on overstocked inventory after storage limit assessments. It is important for sellers to understand the different variables that Amazon is measuring for the IPI, such as reducing excess inventory, making sure inventory is in stock, and keeping listings in working order so that products are able to be purchased (more here on IPI).

Amazon states that it will notify you of the potential storage reduction, but it is good to keep in mind that you have options! You can always remove your product from Amazon’s warehouse and export to a different location or market. Just make sure that you stay informed about Amazon’s Product Removal needs and any requirements for importing to new countries.

DRIVE – Safe Act To Lift Restrictions on Inter-State Driving for 18-21-Year-Old Truckers

Will the new DRIVE – Safe Act entice enough young drivers to alleviate shortages in drayage trucking? This answer is both yes and no.

On March 31st, Rep. Duncan Hunter (R-Calif) and Rep. Trey Hollingsworth (R-Ind.) introduced a bill that would lift inter-state driving restrictions on truckers between the ages of 18 and 21 with the hopes of encouraging more young drivers to the industry and reducing the overall shortage in trucking. Currently these younger drivers can haul from Houston to El Paso, or San Diego to San Francisco, but cannot drive five miles from Arlington Virginia to DC or haul from Kanas City, MO to Kansas City, KS. Lifting this restriction should encourage more young people to join the trucking fleet as OTR (Over the Road) interstate hauls typically pay more and provide more experience than strictly local deliveries.

How does it work? The new regulations require young drivers to complete performance evaluations in addition to obtaining a CDL. They must then log 400 hours of on-duty time, with 240 hours driving time alongside an experienced trucker. All trucks used under this program require aftermarket upgrades including active braking collision mitigation systems, video event equipment, and a governor limiting top speed to 65 mph. Once completed these drivers would have access to interstate hauls. So how will this affect drayage trucking?

Let’s start with the bad news – This bill isn’t likely to affect port and rail drayage… at least not in the short term. Large brokers, shippers, and forwarders rely on small companies and owner-operators to handle containerized freight. These drayage companies currently have an unofficial “industry standard” requiring a minimum age of 25 with at least two years of experience. Young, aspiring owner operators remain stymied by exorbitant insurance costs with providers who cancel policies for even minor violations. Even if DRIVE – Safe legislation passes, young drivers need to look to another segment of the industry for employment.

These drivers face another major challenge preventing them from hauling containers: getting hired at all. Trucking forums are full of young drivers with fresh CDLs from major driving schools looking for a job. Currently the most successful method involves going to a “Mega Carrier” CDL school and getting hired by the same company once licensed. Mega companies carry their own insurance programs and receive federal assistance for their licensing programs. These jobs typically pay less and currently are restricted to intra-state hauls.

How will the DRIVE -Safe Act help alleviate the current trucking shortage? While the food and restaurant industry could see benefits shortly after the legislation passes, containerized freight may take longer to reap the rewards, but they will come. Over the Road and interstate hauls pay more than local food and beverage deliveries (more miles more money). Long hauls allow for more driving hours and more experience. Once this surge of younger drivers develop their skills and a safe driving record, insurance companies should have more information to calculate risks, hopefully reducing premiums for 18-21-year-old drivers. Drayage companies would be smart to then start dipping below their 25-year-old requirement and hire these younger, less expensive drivers. So, while the industry may see more truckers soon, it may take a couple of years before they spread to all facets of domestic trucking. Now, who’s going to go chase those chassis?

Getting Ready for the Mega-Vessels at the Port of NY/NJ

Crane operators at the Port of NY/NJ are being trained on how to become proficient in operating the 8 highly technical cranes, which have been ordered to support the off-loading of cargo related to the expected surge in mega-vessel calls, utilizing 3 state-of-the-art simulators.

According to the JOC, “So far, 33 longshoremen in the port have completed the [roughly] 12-hour course on the NYSA simulators, before moving on to operate real equipment, and nine more are taking the training at present.” Two of the simulators are located at a training facility at Maher Terminals, and one is located at the Port Newark Container Terminal.

The 8 new cranes represent part of a collective $700 million investment (along with the raising of the Bayonne Bridge) to allow both the APM and Maher Terminals to support the anticipated arrival of the new mega-vessels. According to the JOC, the additions will increase the port’s existing pool of 70 cranes by 15 percent.

Employee of the Month

As previously featured in Shap Talk, Shapiro has been sharing with you the names of employees who have been recognized for their exceptional efforts and contributions to our Company. At Shapiro, we continually work to develop, challenge, and inspire all of our employees to grow individually and with the Company. This month, we would like to recognize Edna Hovanisian ,Sr. Pricing Analyst in Baltimore for her outstanding performance and contributions.

We encourage you to provide us with employee feedback! Please email us at [email protected].

Automated Commercial Environment (ACE) Import Workshop

Are you familiar with CBP’s ACE portal?

Do you feel like you are maximizing its functionality?

Are you finding ACE not quite as intuitive as you had hoped?

Let us help you!

We will be hosting a webinar on May 2nd at 1 PM EST. that we hope will demystify the experience.

Topics to be covered:

- Getting an ACE account – Instructions on how to set up your account for the first time and how to change your password

- Adding & Modifying Users – Learn to create new contacts, create users, assign access privileges and deactivate accounts

- Uploading NRBS – Learn how to upload non-reimbursement statements to the portal

- PE Reports

- Liquidation Reports

- Responding to 28 & 29s

- ADD/CVD Queries

Date and Time: Wednesday, May 2, 1:00 – 2:00 PM EST

Cost: $99

Shapiro Freight Report

This high-level, monthly review of the U.S. import freight market to provides key insights into the tumultuous world of international shipping. From carrier alliances to labor strikes, Shapiro covers the pertinent information logistics managers need to know. Check back monthly to ensure you don’t miss key industry insights!

All eyes are focused on potential escalations or diminishments in the current saber rattling over trade between the U.S. and China, with close to 7% of Transpacific import ocean volume already on the table. It is difficult to imagine worse timing for the steamship lines as they are already face the enormous challenge of matching growing supply to questionable demand.

The potential “good news” for carriers is that the commodities currently targeted by U.S. tariffs are of high value and often travel by airfreight. The initial list of products being considered for tariff hikes is valued at $50B a year and includes commodities from the following sectors: aerospace, information and communication technology, robotics, machinery products, and steel/aluminum.