Low Sulfur Surcharge: High Confusion and High Costs

The maritime industry has been through quite a lot in the past few years, from carriers leaving the chassis business, to U.S. East and West Coast labor issues, to the introduction of mega-vessels, to atypical peak seasons, and rate fluctuations. And yet, another surcharge is about to take center stage. Say hello to the Low Sulfur Surcharge.

What is it?

Known by many names, the Low Sulfur Surcharge (LSS), Low Sulfur Bunker Surcharge, or Low Sulfur Fuel Surcharge (LSF), stems from an International Maritime Organization (IMO) regulation initially agreed upon in 2012 to reduce the amount of sulfuric fuel emissions being burned by cargo vessels near ports and populated coastlines. High sulfur content fuel contributes to a significant amount of sulfur dioxide emissions, known to be hazardous to public health.

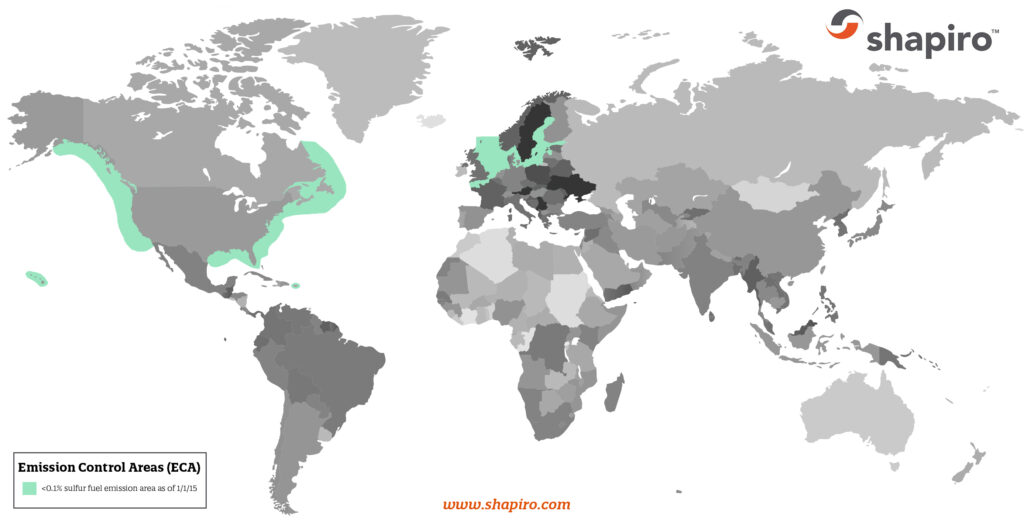

Starting January 1, 2015, carriers will require vessels traveling through designated Emission Control Areas (ECA) to use fuel with sulfur content of 0.1% or less, a drastic decrease from the 1.0% concentration fuel used in maritime shipping today. Emission Control Areas (ECA) that will begin enforcement in 2015 include the Baltic Sea, English Channel, North Sea, and 200 nautical miles off of U.S. and Canadian coasts.

Compliance

Carriers can comply with ECA regulations through two options: switching to low-sulfur marine gas or buying a “scrubber.” Low sulfur emission fuels are highly filtered and can cost up to four times that of regular bunker fuels. Scrubbers can cost up to $14 million USD for a large vessel and take up to two years to install. Some have pointed to liquid natural gas as a third alternative; however (and somewhat ironically) the natural gas supply chain is not yet stable enough to meet the demand and vessels would still need expensive retrofitting.

The issue of compliance is also in debate. Enforcement is in the hands of each European Union member country, and so are penalties. Fines have not been announced, nor has a monitoring procedure to ensure compliance. Penalties could range from fines all the way up to vessel detention.

Low Sulfur Surcharge Fees

Now that you know what the LSS is, let’s break down how this charge is going to be levied and how much it’s going to really cost. Maersk estimated regulations will result in over $200 million in fuel cost increases per carrier.

To keep things interesting, the LSS charge is not a fixed amount; it varies by carrier and routing, ranging from $30 to $110 per 20’container and $60 to $220 for a 40’ container. Drewry Maritime Research compiled LSS charges in the following handy chart:

Routing | Low Sulfur Surcharge Range(Based on FEU, in USD) |

| Northwest Europe/New York | $50-150 |

| Baltic/New York | $150-260 |

| Northwest Europe/Savannah | $100-200 |

| Baltic/Savannah | $150-300 |

| Northwest Europe/East Coast, Canada | $80-260 |

| Baltic/East Coast, Canada | $180-370 |

| China/Northwest Europe | $30-50 |

| China/Baltic | $130-150 |

| China/West Coast, US | $35-150 |

| China/East Coast, US | $50-60 |

At the moment, the biggest problem for carriers are high-volume, direct contracts with ‘no surcharge’ clauses. How they will make up for the deficit is undetermined at the moment; however, shippers may have the charge added to their contracts depending on the terms, or applied to their current bunker charges. For non-direct contracts, the charge will either be included in an all-in rate, or listed as a separate line item.

With so much information still up in the air, no pun intended, it’s important to look at this situation from all sides. Yes, shippers are tired of increasing costs and turmoil, but, in this case, carriers are also facing higher operational costs. What should bring us some comfort is that, at the end of the day, all of us will benefit from a cleaner, healthier environment.

Do you have any concerns about this new surcharge? Talk to us below by leaving a comment.

Love this blog? Click here to subscribe with only your email address.

lura Beaver says:

What is the difference between the LSS and the ECA surcharge?

Shapiro says:

Hi Lura,

Thanks for reaching out!

The ECA is not a surcharge, but rather an area in which carriers have to use fuel with a sulfur content in the range stated. The LSS is not a fixed amount and varies based on the lanes/locations that the carriers call. If the carrier you used is specifying an ECA surcharge, they more than likely meant low sulfur surcharge.

Please let us know if you have any other questions.

Eric Chu says:

LSS comes under the FOB charges or ocean freight charge?

Shapiro says:

Hi Eric,

Thank you for checking out our blog!

FOB and all other terms of sale each have associated ocean freight charges. LSS is charged by carriers and should appear on a copy of your rated bill of lading or invoice.

We hope this information is helpful and please let us know if you have any other questions.

Tun Tun Win says:

Thank you, Olga Lyakhovetskaya for your advice.

Rgds

Tun Tun Win

Joe Espinosa says:

Have any carriers developed a formula to determine LSS surcharge per 20′ & 40′ containers?

Maura Perry says:

Hi Joe,

Thank you for reading our post! Unfortunately, the LSS is not a fixed amount or formula, as it varies by carrier and routing. However, many major carriers have released projected costs for shippers, based on average fuel consumption per day, fuel type and fuel prices at sea and total containers carried. For example, Maersk predictions show the current cost of low-sulphur fuel at $364 per metric ton higher than standard high-sulfur marine fuel by the start of the IMO rule. If you have any other questions, please don’t hesitate to contact us!

Anna says:

Who pay the freight if use FOB item? Carrier ask export to pay or inport? If Indonisia supplier need pay also even export paid already?

Maura Perry says:

Hi Anna,

Thank you for contacting Shapiro! Free on Board (FOB) means that the seller is responsible for transportation of the goods to the named port of shipment and the cost of loading. This means that the buyer has to bear all costs and risks of loss of or damage to the goods once the goods are loaded at the originating point. The FOB term requires the seller to clear the goods for export. This term is valid for vessel shipments only. If the cargo is delivered to the carrier by the seller before the goods are loaded on board the vessel, then the FCA term should be used. Best of luck with your shipment!

Johnson Francis says:

What about the Low Sulfur Surcharge cost for shipment from Asia to the Indian subcontinent.

Please advise.

Maura Perry says:

Hi Johnson,

Thanks for reaching out to Shapiro! While there are many factors that go into the price of shipping, it appears the Low Sulfur Surcharge cost for shipping from Asia to the Indian Subcontinent typically falls (on average) between $100-200 USD per container. We hope this helpd and best of luck with your shipment!

Jenny says:

Hello! We have an argument regarding “who is responsible for LSS under FOB terms contract”. Some forwarders say that the shipper has to bear LSS while the others say it is buyer’s responsibility..! Which is correct?

Maura Perry says:

Hey Jenny,

Thanks for reaching out to Shapiro! Technically speaking, neither side is wrong. When shipping FOB, responsibilities between the forwarders and the shipper are agreed upon from the get-go, however exact responsibilities will ultimately differ from contract-to-contract. You may want to check out our recent IMO 2020 Blog for additional information on LSS. We hope this helps and best of luck with your shipment!

Gabriel says:

Hello there,

I have a situation (FOB Shipment) where the exporter is being charged LSS/GSF charges at the origin. Is there any regulation that we can use to sustain that LSS/GSF charges are part of Ocean freight composition and therefore should not be charged at origin as local charges?

Maura Perry says:

Hello Gabriel,

Thanks for getting in touch with Shapiro! This information should already be defined in the shipping contract that was signed between the parties involved. We would recommend reading through these thoroughly in order to evaluate whether or not any breaches occurred. Hopefully this helps and best of luck!

John R Sices says:

I ship from Germany to NY and for a single 40′ FCL was charged $300 in mid-November 2019. Is this reasonable or should I challenge my Forwarder?

Maura Perry says:

Hi John,

Thanks for reaching out to Shapiro.

According to our IMO 2020 Surcharge Summary Shap Flash, LSS charges for 40’ FCL ranged anywhere from $120 to $1000 depending on the carrier and route as of December 1, 2019. Although your shipment was in November, many of the carriers began implementing LSS months in advance in order to make up for the costs associated with compliance, such as retrofitting vessels (not just the cost of gas itself).

However, it appears that the alliances are charging different LSS surcharges than their counterparts who are operating the same size vessels, which indicates that there is still a lack of pricing uniformity and transparency in place among carriers. Because of this, many shippers like yourself may be convinced that carriers may be jacking up rates to help cover their own higher costs. We would recommend contacting your freight forwarder directly in order to ensure the contract rate matches your invoice to see if further action is needed.

We hope this helped and best of luck with your shipment!