Fun Facts You Did Not Know About Importing

After three decades providing Customs brokerage services, I’ve come across some strange shipments (at my first employer, we had regular shipments of sand to Saudi Arabia) and stranger people, but that’s for another day. In this blog, I’d like to share some of the more fascinating and odd facts of our import world.

Really, take a look. It’s not there. This is one of the most interesting parts of the HTS – the part that is missing! The developers of the HTS brilliantly left an open chapter in the event that somewhere in our universe there is a substance that cannot be covered in any other chapter. Chapter 77 happens to fall in the metals section as this yet to be discovered product may likely be a metal. So one day when this new substance is found below the ocean floor, deep inside a remote mountain range, or even from outer space, it will have a home in the Harmonized Tariff Schedule.

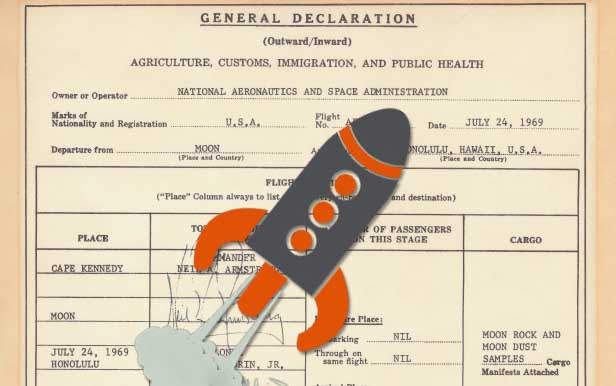

Speaking of outer space, did you know that the Apollo 11 crew had to file a Customs declaration when they returned from the moon? The form is currently known as a Form 7507 General Declaration Agriculture, Customs, Immigration and Public Health. The Apollo 11 form lists the flight routing as “Cape Kennedy, Moon, Honolulu.” That’s quite an itinerary! The cargo was declared as “moon rock and moon dust samples.”

Fortunately, no tariff classification is required for moon rocks. “Articles returned from space” are exempt from entry. Other exemptions include:

- Corpses, together with their coffins and accompanying flowers (Customs will still look inside to ensure there is no contraband);

- Telecommunications transmissions (can you imagine having to file a Customs entry for every phone call, fax, and email you receive from overseas?!);

- Records, diagrams and other data with regard to any business, engineering or exploration operation whether on paper, cards, photographs, blueprints, tapes or other media (that flash drive you tucked in your pocket at the trade show in Japan with the latest toy design);

- Articles exported from the United States which are returned within 45 days after such exportation from the United States as undeliverable and which have not left the custody of the carrier or foreign customs service (uh-oh, Billy Bob shipped the purple widgets instead of the yellow widgets and we need to bring them back);

- Any aircraft part or equipment that was removed from a United States-registered aircraft while being used broad in international traffic because of accident, breakdown, or emergency, that was returned to the United States within 45 days after removal, and that did not leave the custody of the carrier or foreign customs service while abroad (Note it says U.S. registered aircraft only. If you plan to bring in aircraft parts and equipment from a foreign-registered aircraft, entry will be required.)

Our last strange but true factoid that we’ll throw out concerns switchblades. The importation of switchblades is against the law, but is allowed when in the possession of a person with only one arm.