CBP Issues Proposed Changes to De Minimis Import Process

US Customs and Border Protection (CBP) recently announced proposed changes to the de minimis import process. If you’re involved in international shipping or global trade, you simply must slow down and pay attention! But don’t worry… we’re here to break it all down for you in a way that’s as easy as 1-2-3…or, better yet, 3-2-1.

What is the De Minimis Import Process?

Let’s start with the basics. In international trade, “de minimis” refers to the threshold value of goods under which no duties or taxes are applied at the border. Historically, it has made importing small-value goods easier and faster.

The Customs Administrative Act of 1938 amended the Tariff Act of 1930 by adding section 321 and establishing the administrative exemption at $1 in order to limit the ‘‘expense and inconvenience’’ of collecting duty when ‘‘disproportionate to the amount of such duty.’’ The value of these shipments was deemed to be so minimal that they were not subject to the same formal customs entry procedures and extensive data requirements as higher-value shipments entering the United States.

Congress has since raised the value of the administrative exemption to $5 in 1978, $200 in 1993, and most recently, to $800 in 2016. Translation: Goods valued under $800 can enter the United States without the need for formal customs clearance or payment of duties. For perspective, $800 is higher than 99.9% of the rest of planet Earth (the EU is about $150, for example).

Why is CBP Proposing Changes?

The de minimis threshold is an important part of customs clearance. As currently implemented, the de minimis program extinguishes not just standard import duties on eligible items, but duties imposed under Sections 201 and 301 of the Trade Act of 1974 and Section 232 of the Trade Expansion Act of 1962. Despite its prevalence over the past few decades, there are several reasons why de minimis is under “de microscope” now. The biggest factors? E-Commerce (looking at you Temu and Shein) and Congress.

Increasing Volume of Low-Value Shipments

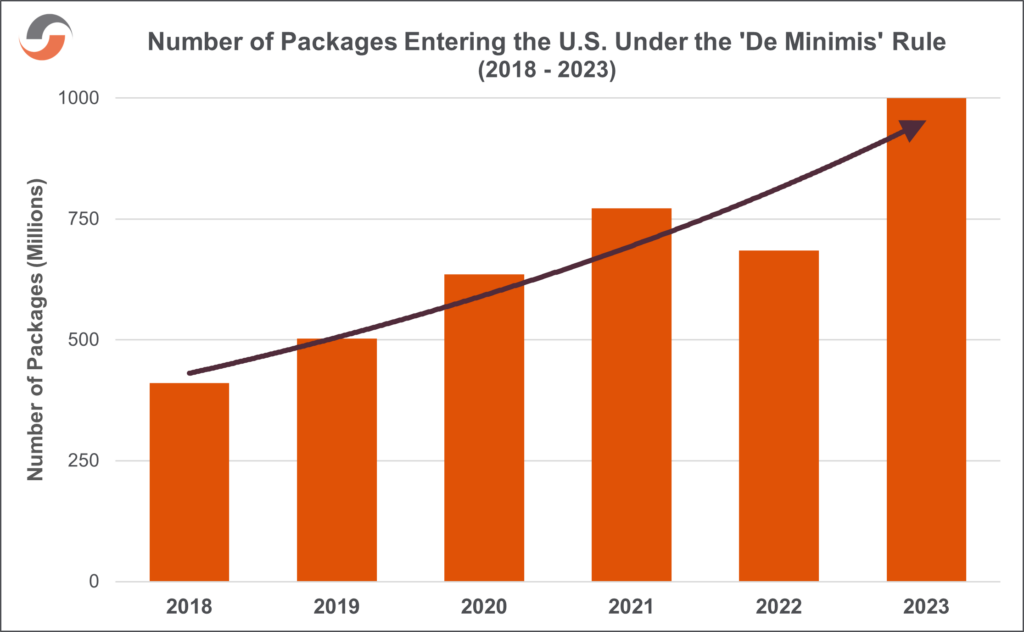

With the boom in e-commerce, there’s been a surge in the number of low-value shipments entering the U.S. In 2013, 140 million shipments utilized the exemption. Just a decade later, that number has spiked significantly—and now encompasses over one billion shipments (that’s a more than 700% gain!). The current process wasn’t designed to handle this volume, so CBP is looking for ways to streamline and manage these imports more effectively.

CBP estimates 77% of shipments claiming the exemption in fiscal year 2023 would have been assessed for additional duties under Section 201, 232 or 301 tariffs if they had not received de minimis treatment.

Concerns About Compliance and Security

Then there are the twin troubles of compliance and security. Policymakers have expressed significant alarm over the potential for the exemption to facilitate unlawful shipments of narcotics (including fentanyl), dangerous merchandise, counterfeits, and products made with forced labor. Raising de minimis/changing the rules should strengthen national security, protect domestic industries and address “discriminatory or unreasonable practices that restrict or burden U.S. commerce,” according to the proposal. Specifically, they shine a bright spotlight on the e-commerce industry–which is particularly vulnerable to imports from China claiming that exemption.

CBP also needs to ensure that all goods entering the country, regardless of value, comply with U.S. regulations. By revisiting the de minimis import process, CBP aims to tighten security measures without creating unnecessary bottlenecks in the shipping process.

What are the Proposed Changes?

This month, government officials released two proposals to introduce potential changes to certain products subject to the de minimis treatment when entering the US. If implemented, these would eliminate the ability for goods valued below $800 covered by Section 201, 301, and 232 duties from eligibility for entry (without an entry!).

It would also create two methods for entering de minimis shipments: the “basic entry process” and the “enhanced entry process.” Shipments claiming the exemption will be required to provide tariff classification numbers under both entry processes, allowing CBP to better determine whether the merchandise is eligible for de minimis treatment or not.

While these awaiting final approval, here is a quick review of what they might entail.

Track #1: The Basic Entry Process

The basic entry process maintains the existing entry process for de minimis shipments with some modifications to the data required to be provided to CBP, such as requiring the name and address of the person claiming an administrative exemption and the final person to whom the merchandise is delivered. CBP will also require the ten-digit classification of the goods under the Harmonized Tariff Schedule of the United States (HTSUS).

The “basic entry process” will be required for bona fide gifts and will be available for all other low-value shipments unless they are shipped through international/U.S. mail, or are goods regulated by agencies other than CBP (such as pharmaceuticals).

Track #2: The Enhanced Entry Process

The enhanced entry process, which will be optional for goods other than mail importations and products regulated by other agencies, would require the submission of data to CBP about the contents, origin, and destination of the shipments prior to the arrival of the goods in the United States. The required time frame to file for an enhanced entry would vary by mode (e.g., air, ocean, land) of transportation by which the goods arrive to the United States.

Additionally, for all shipments made under the enhanced entry process, the following additional data would be required to be transmitted for all shipments:

- Clearance tracing identification number

- Country(s) of origin and export

- 10-digit HTSUS classifications for the merchandise seeking to be entered

- One or more of the following:

- URL to the marketplace’s product listing

- Product picture

- Product identifier

- Shipment x-ray or other security screening report number verifying completion of foreign security scanning of the shipment

- Seller and purchaser names and addresses

- Advertised retail product description

- Marketplace name and website or phone number

- Any other data and documents required by other government agencies

Enhanced Data Collection, Technology and Automation

CBP is also considering enhanced data collection requirements for de minimis shipments. This could involve collecting more detailed information about the shipper, receiver, and the nature of the goods being shipped. Enhanced data collection would aid in risk assessment and help ensure that imported goods comply with U.S. laws.

To manage the increased volume of low-value shipments, CBP is looking into improving technology and automation within the customs clearance process. This could mean faster processing times and improved efficiency, reducing the burden on both CBP and importers.

How These Changes Might Impact You

If you’re in the shipping or global trade industry, you’re probably wondering how these changes might affect your operations.

Potential for Increased Costs

One of the most immediate impacts could be an increase in costs. CBP’s proposal said its “main estimates” find that consumers will bear the full price of increased tariffs stemming from the rule change.” The primary costs of the proposed rule are consumer surplus losses resulting from increased duties and possibly increased processing fees, resulting in higher prices for imported goods paid by U.S. consumers on imported goods.”

A lower de minimis threshold might mean more shipments require formal customs clearance, which can be more costly and time-consuming. Enhanced data collection could also require additional resources and technological investments.

Changes in Shipping Strategies

They could also impact your shipping strategies. You might need to adjust how you handle low-value shipments, perhaps by consolidating shipments to reduce the number of entries or by reevaluating your supply chain to ensure compliance.

Eliminating the exemption for goods subject to Section 201, 232 and 301 tariffs would likely incentivize importers to consolidate orders into bulk shipments, as they would no longer be concerned about exceeding the $800 de minimis threshold. This shift in behavior would benefit CBP, as multiple identical items could be reviewed by officers simultaneously.

Greater Focus on Compliance

With enhanced data collection and tighter security measures, compliance will be more important than ever. Ensuring that your shipments comply with U.S. regulations will be key to avoiding delays and penalties.

Preparing for the Future

The recent announcements marked the final efforts in the Biden-Harris administration’s response to the evolving landscape of international trade. While the changes are designed to improve security and compliance, they also present challenges for those in the shipping and global trade industries. While these changes are still in the proposal stage, it’s never too early to start preparing.

Here are just a few of the ways that you can start to prepare for what’s to come:

- Submit a Comment. CBP is inviting interested persons to submit comments related to the economic impact of removing eligibility for goods subject to Section 301, Section 232, and Section 201 duties; the deadlines for filing under the enhanced entry process; and the practicability of the new information requirements across both the proposed basic and enhanced entry processes.

- Please refer to the below for important details regarding comment submissions and related deadlines.

- All submissions received must include the agency name and docket number for this rulemaking.

- All comments must be submitted via the Federal eRulemaking Portal; and will be posted as is accordingly (including any personal details provided).

- Please refer to the below for important details regarding comment submissions and related deadlines.

| FR Notice | Docket No. | Publication Date | Comments Due | |

| Proposal 1 | 2025-00551 | USCBP-2025-0002 | 1/14/25 | 3/17/25 |

| Proposal 2 | 2025-01074 | USCBP-2025-0003 | 1/21/25 | 3/24/25 |

- Stay Informed. Keep up-to-date with the latest news from CBP and other regulatory bodies. Understanding the nuances of the proposed changes will help you better prepare for their potential impact.

- Evaluate Your Supply Chain. Take a close look at your supply chain and identify any areas where you might need to make adjustments. This could involve working more closely with your logistics partners or investing in technology to enhance compliance.

- Train Your Team. Ensure that your team is well-versed in compliance and customs clearance procedures. Providing regular training and updates will ensure that everyone is on the same page and ready to handle any changes that come their way.

By staying informed, evaluating your supply chain, and focusing on compliance, you can navigate these changes effectively and continue to thrive in the ever-changing world of international trade. Keep an eye on further announcements, as these changes could soon become a reality!

Additional Resources: