4 Reasons Lower Bunker Fuel Prices Don’t Mean Lower Shipping Rates

Importers and exporters checking gas pump receipts have been looking around and scratching their heads… If gasoline is so cheap, why haven’t shipping rates decreased?

Since 2008, carriers have cited the rising cost of fuel for increases in shipping rates. This made sense since fuel surged by a whopping 279% from 2008 through 2014, but where are the cost savings now? If fuel charges are one of the largest variable costs, why hasn’t the industry seen decreased shipping rates to mirror the dramatic price drops in the last few months?

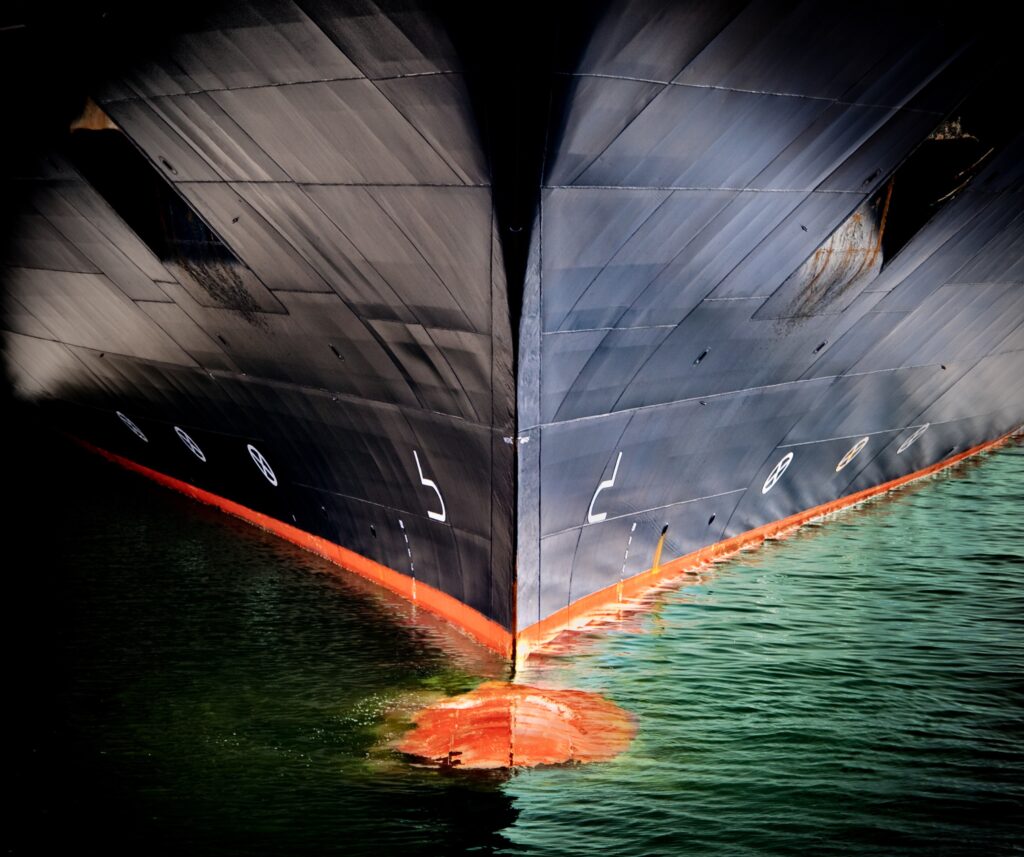

To start, let’s all get on the same page. What is bunker fuel? Bunker fuel is simply the name given to liquid fuel distilled from crude oil. Within the maritime industry, bunker fuel has five common names and standard classifications; marine gas oil (MGO), marine diesel oil (MDO), intermediate fuel oil (IFO), marine fuel oil (MFO), and heavy fuel oil (HFO). The price of fuel varies depending on the degree of refining each must go through.

There is some good news! Starting with rates effective April 1st, shippers will see reduced fuel charges on contracts and rates which have a separate line item for the Bunker Adjustment Factor (BAF) as well as charges built into the general freight rate. However, before everyone runs off to calculate their savings, there are a few reasons why these reductions aren’t permanent.

- Marine fuel is not crude oil. There is not a 100% direct price correlation between the two. Marine fuel is the residue left over after more valuable fuels have been extracted. MFO burns poorly and has a high sulfur content. Talk about scraping the bottom of the barrel!

- Marine fuel is not easily transportable making the rate vary from port-to-port. Fuel tends to be more expensive at smaller ports that have reduced refinery capacity. Rate changes will vary by trade lane whereas crude oil prices range in accordance with daily adjustments for “sweet crude oil.”

- Quarterly calculations. Ocean carriers calculate fuel charges quarterly by using the weekly average rate on each lane for previous months and adjusting the charge at the beginning of the next quarter. This means fuel charges are always reacting after-the-fact. As crude oil rates drop, you can expect a reduction the following quarter; in reverse, as oil prices rise, you can expect in increase during the following quarter.

- New regulations. On January 1, 2015, implementation of the Low Sulfur Surcharge (LSS), an International Maritime Organization (IMO) regulation, began. Simply stated, when ocean carriers travel through designated Emission Control Areas (ECA) they are to use fuel with sulfur content of 0.1% or less, a drastic decrease from the 1.0% concentration fuel used in maritime shipping today. While ECAs are concentrated in the U.S., Canada, and northern Europe, as other countries adopt the standard, carriers will be forced to use this higher cost fuel. Read more about the LSS in Shapiro’s Low Sulfur Surcharge: High Confusion and High Costs Blog.

So, where does this leave the industry? Beyond pricing, shippers should see decreased bunker fuel costs help with on-time carrier performance. Vessels falling behind will have the flexibility to speed up to meet tight berthing schedules, the result of backlogged port terminals from chassis and labor-related issues. We should see lower fuel charges in the coming second quarter, but the volatile crude oil market and unknown implications of LSS leave the shipping industry with only a hazy forecast.

Thank you Paul Yankelunas, Shapiro’s Pricing Manager, for providing the data and helping to identify all the key issues.

Ben Metcalf says:

First, great post. Second, is date it was published posted somewhere?

Thanks,

Ben

Shapiro says:

Hi Ben,

We are glad you liked the article!

This blog post was published on Apr 6, 2015.

Please let us know if you have any other questions.

Luc Huysmans says:

Hi Jeff,

I would like to share this article with my colleague network members. We are the Atlas Logistic Network, operating since 1998 and this valuable analysis is interesting to all of us.

Tks yr confirmation

Grtz

Luc

Shapiro says:

Hi Luc,

We’re glad to know you found this article to be helpful!

Please feel free to share with your colleagues using the share/subscribe icons at the bottom of the blog.