Ah, tariffs—the economic equivalent of a schoolyard “keep away” game, but with more paperwork and fewer scraped knees. Following President Donald Trump’s inauguration in January, the US and its global pals have been hard at work (and play) tossing tariffs around like hot potatoes.

This post breaks down the tariff rollercoaster of 2025 thus far; and covers the following topic areas: Section 232 (Steel & Aluminum), Automobiles & Parts, De Minimis, Reciprocal (Global, China), Technology & Pharmaceuticals, Digital Service Tax, and Venezuelan Oil. Whether you’re a policy nerd or just trying to figure out if your imported coffee grinder is about to cost 49% more, you’re in the right place.

Steel and Aluminum: The Heavy Metal Showdown

Action:

- February 10, 2025: President Trump imposed a 25% tariff on all imported steel and aluminum. This was a blanket measure: no exemptions, just raw economic power chords.

Reactions:

- Canada: Retaliated with 25% tariffs on $20.8B of U.S. goods by March 4.

- EU: Followed with tariffs on $28.33B of U.S. exports, effective April 1.

Current Status:

- Tariffs are in full effect and expected to remain. With other metals (like copper and rare earths) under review, more may be added soon.

Automobiles and Parts: The Bumper-to-Bumper Brawl

Action:

- March 26, 2025: The U.S. imposed a 25% tariff on imported passenger vehicles and light trucks, plus parts like engines and transmissions.

Reactions:

- Canada: On April 9, Canada fired back with a 25% tariff on non-USMCA-compliant U.S. vehicles. Auto parts were spared (for now).

Current Status:

- These tariffs are live, but automakers are lobbying hard. Talks on carve-outs for electric vehicles and shared platforms are ongoing.

De Minimis No More: Bye-Bye Freebies

Action:

- April 8, 2025: The U.S. will eliminate the $800 de minimis threshold for imports from China effective May 2—meaning no more duty-free small packages.

Current Status:

- Implementation expected May 2. US Customs is preparing for higher volume inspections, and Chinese e-commerce giants are bracing for a cost hike.

Liberation Day Tariffs: The Blanket Approach

Action:

- April 2, 2025: On “Liberation Day,” The U.S. introduced a 10% tariff on imports from all trade partners (100+ countries) effective April 5, while others would receive higher rates beginning April 9.

- The full list of country-specific rates can be found in Annex I.

- Note: Previously tariffed goods and critical minerals not produced in the US are exempt.

Reactions:

- US: On April 9, President Trump reversed course and announced a 90-day postponement of the country-specific reciprocal tariffs to allow more time for trade negotiations. During the pause, all countries, other than China, will still be subjected to the lower baseline tariff of 10%.

- EU: Initially announced retaliatory tariffs on specific US goods beginning April 15; but elected to postpone the implementation because of the 90-day pause.

Current Status:

- Country-specific reciprocal tariff rates have been postponed until July 9 for all countries—other than China. During this time, all products imported into the US will be subject to a lower baseline rate of 10%.

The Empire Strikes Back: China Retaliates

Most of the duties applied to products from China have already been covered elsewhere in this blog. However, we decided to create a separate section to review the escalating U.S.-China trade war.

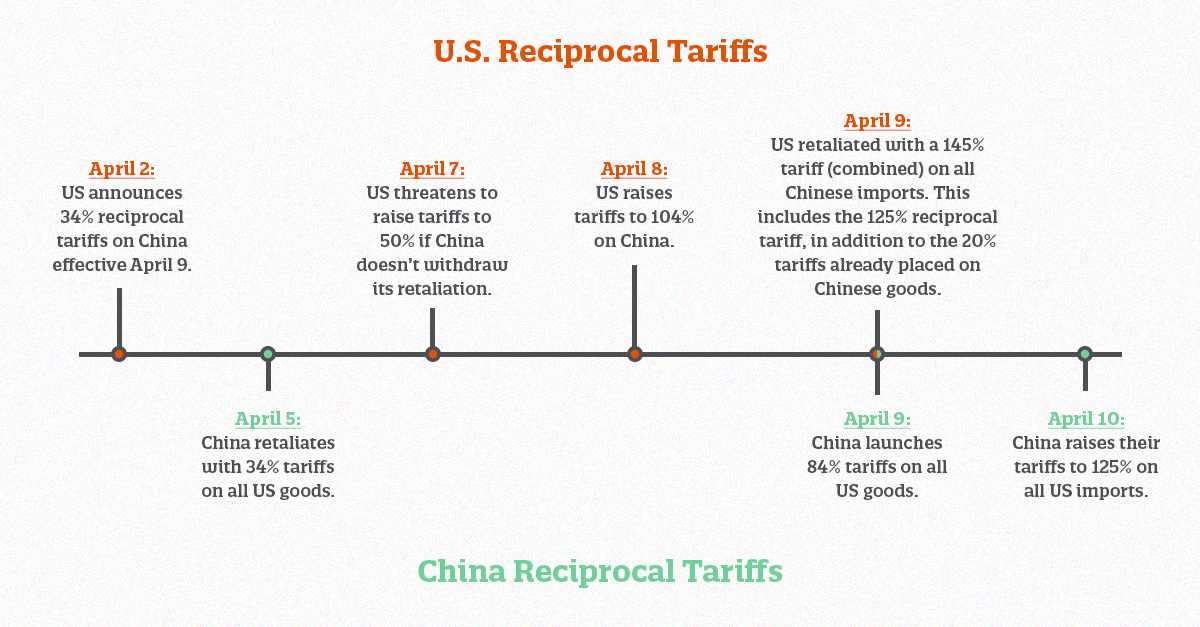

U.S.-China:

As tensions and retaliations continue to escalate between the US and China, it’s important to understand exactly what tariffs apply to Chinese products and how they are calculated.

Section 301: Tariffs imposed on Chinese goods addressing unfair trade practices.

- Originally put into effect during Trump’s first term (7.5% and 25%).

- Most exclusions are set to end on 5/31/25, unless extended by the current administration.

De Minimis:

- April 2: US announced the elimination of de minimis treatment for imports from China and Hong Kong beginning May 2—an action threatened by President Trump earlier this year.

International Emergency Economic Powers Act (IEEPA): Duties imposed to target fentanyl precursors and rectify trade imbalances (reciprocal).

- Fentanyl:

- March 4: US imposes 20% tariffs on goods from China and Hong Kong.

- Reciprocal Tariffs: U.S.-China (April):

Current Status:

- Trump postponed reciprocal tariffs an additional 90 days for every country besides China. US-China tariffs are escalating rapidly, with no talks scheduled yet.

Tech and Pharma: The Looming Cloud

Action:

- February 14, 2025: The White House floated 25% tariffs on pharma, semiconductors, and foreign-made EVs. It hasn’t happened yet—but it’s not off the table.

Current Status:

- Not enacted—yet. These remain high-risk categories, especially if China or the EU escalate digital or industrial policy tensions.

Digital Services Taxes: A Cyber Spat Brewing

Action:

- February 21, 2025: The U.S. launched a Section 301 investigation into France, Austria, the UK, and others over their digital services taxes (DST) targeting U.S. tech giants.

Current Status:

- Still in the investigation phase. A ruling could trigger targeted tech-related tariffs by late spring or summer.

Venezuelan Oil: The Slippery Slope

Action:

- March 24, 2025: A 25% tariff was slapped on imports from any country buying Venezuelan oil—a geopolitical move more than an economic one.

Executive Order:

Current Status:

- Active and politically charged. Countries sourcing from Venezuela are under pressure. This may intensify if Maduro ramps up exports.

The Trade Horizon: What’s Next for Tariffs?

It’s only April, but 2025 is already shaping up to be the most tariff-packed year on record. US officials have gone broad and bold; but China continues to pushback. As for the rest of the world, countries are stuck in the middle—anxiously awaiting Trump’s next announcement. As international trade spins out beneath a complicated web, global supply chains are left in turmoil. With reciprocal tariffs, digital taxes, pharmaceuticals, and semiconductors still on the table, the next few weeks will undoubtedly bring even more calamity.

But one thing is for certain: we are all in the same boat! Shapiro will continue to follow the twists and turns of Trump’s tariffs; and will post all future updates to our Tariff News webpages. For now, all we can do is sit back and ride out the storm together.

Welcome to the exciting and educational game show, “Is it THIS or is it VAT?!” There have been rumblings of confusion when it comes to all of the taxes and levies floating around so hold onto your cargo containers as we set sail on a TAX-travagant adventure!

Meet Our Contestants:

Before we jump into the rounds, let’s meet our contestants—each representing different taxes and levies commonly encountered in global trade. Get ready to know them better, so you can keep your shipments sailing smoothly!

VAT (Value Added Tax)

VAT arrives confidently, reminding us it’s a tax collected at every stage of production and distribution, right down to the final sale. It’s like the freight forwarder of taxes—guiding the goods through every stop in the supply chain. Value Added Tax is especially popular in European Union countries and many other nations globally, including Canada, Australia, and India.

Tariffs

Tariffs step forward with protective gear, emphasizing that they’re specifically taxes on imported goods, designed to shield domestic businesses from foreign competition or the boost of government subsidies. Collected at the border, tariffs are a customs checkpoint specialty, often used strategically in trade negotiations worldwide.

Customs Duties

Customs Duties swagger in with international flair. Similar to tariffs but broader, these duties can apply to both imports and exports, calculated based on the goods’ total customs value, including cost, freight, and insurance. Customs duties play a significant role in regulating international trade across nearly every country.

Excise Tax

Excise Tax enters the game specifically targeting particular goods like alcohol, tobacco, or fuel. This tax is often embedded directly into the product price, acting like the hidden handling fees of the tax world. Excise taxes are common globally, used widely in the U.S., U.K., and throughout Asia to influence consumer behavior and generate revenue.

Sales Tax

Sales Tax makes its case clear and simple, collected only once at the point of final sale, typically governed by local jurisdictions. It’s like the straightforward local delivery service of taxes, primarily found in the United States and parts of Canada.

Round 1: VAT vs. Tariffs

VAT applies throughout every step of production and sale, making it more complex but also providing opportunities for businesses to reclaim some tax paid. Tariffs, on the other hand, are simpler and apply strictly at the border to imported goods. They aim primarily to protect domestic industries or influence international trade policies.

Who Wins?

VAT is more complex and embedded throughout business operations, while tariffs excel at protecting domestic markets by imposing clear, straightforward costs on imports.

Round 2: VAT vs. Customs Duties

VAT is primarily domestic, impacting the pricing and financial planning of businesses throughout the supply chain, often reclaimable by businesses. Customs duties differ significantly because they focus strictly on international trade, calculated on the comprehensive value of imported or exported goods. Customs duties serve more as regulatory tools for trade balance rather than consumption taxes.

Who Wins?

Customs Duties are versatile, managing trade flows across borders. VAT’s strength is internal, managing economic activity within national borders.

Round 3: VAT vs. Excise Tax

VAT covers nearly all goods and services, applying broadly across various sectors of the economy, whereas excise tax is highly specialized and selective, targeting specific goods such as tobacco, alcohol, and gasoline. Excise taxes aim to curb consumption of certain products or generate revenue specifically from targeted goods, unlike VAT’s broad economic focus.

Who Wins?

Excise Tax captures the niche product-specific tax segment clearly, while VAT remains the universal player affecting a broader array of products and services.

Final Bonus Round: VAT vs. Sales Tax

Sales tax is relatively straightforward—collected only once, at the final retail sale, and easy to understand and manage at the point of sale. VAT, however, applies incrementally throughout the entire production and distribution process, requiring more detailed accounting and providing potential tax credit benefits for businesses.

Who Wins?

Sales Tax wins on simplicity and ease of implementation, while VAT triumphs due to its comprehensive economic influence and built-in mechanisms for reclaiming taxes within business operations.

And Today’s Big Takeaway Is…

Navigating taxes in international logistics doesn’t need to feel like guessing container weights at the port. Whether you’re dealing with VAT, tariffs, customs duties, excise tax, or sales tax, clarity is your strongest asset.

Thanks for joining another thrilling episode of “Is it THIS or is it VAT!” Stay tax-savvy, and remember—knowing your taxes keeps your business sailing smoothly across international waters!

When it comes to ocean freight, it can be easy to observe the competitive nature of shipping rates, service loops and trade lanes and label it market share dog-eat-dog. However, the shifting landscape has affected most ocean carriers in similar ways—which has led to a paradoxical emergence of alliances between carriers.

Shipping alliances are an essential facet of international logistics, promoting efficiency in a complex global trade environment. As these alliances evolve, understanding their background, structure, and implications becomes crucial for stakeholders in the shipping industry.

First, let’s dissect the basic alliance science—or as we like to call it…. Astro-logistics!

Astro-Logistics: The Basic Science Behind the Alliance

What are ocean shipping alliances?

Shipping alliances are collaborations among various shipping lines that enable them to operate collectively on specific routes. By pooling resources, these alliances can optimize vessel usage, reduce costs, and offer more competitive services.

The primary benefits of shipping alliances include stabilized freight rates, increased capacity management, and enhanced operational efficiencies. They enable carriers to share costs, minimize redundancies, and provide customers with a wider range of services.

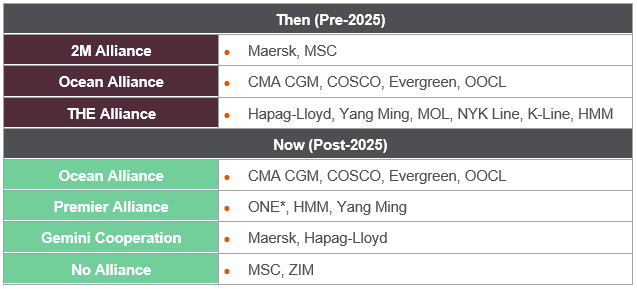

Carrier Compatibility Charts: Then & Now

Here is a “berth chart” containing a brief overview of the recent major shipping alliances from their origins, evolutions, and a brief introduction to the new alliance structures entering the market this year. We will review each one individually in the next section.

*Ocean Network Express (ONE) is a consolidated partnership of K-Line, NYK, and MOL, former members of THE Alliance.

Shipping Alliance Cosmologies: Key Changes in 2025

Now that we’ve laid the foundation, it’s time to align our planets and delve a little deeper. With the 2025-26 contract season on the horizon, it’s important to take the time to retrograde back and refamiliarize yourself with the various shipping alliances between carriers—both past and present. That way, you and your business will be in the right cosmic position, armed with the information and data needed to ensure a diversified and well-rounded variety of options available in the upcoming year.

The Dissolution of the 2M Alliance

The 2M Alliance, formed in 2015 by Mediterranean Shipping Company (MSC) and Maersk, was designed to optimize transpacific shipping routes and facilitate global trade. However, this alliance is set to dissolve in 2025, potentially leading to significant shifts in the market. The dissolution of the 2M Alliance may result in short-term volatility in freight rates. Both MSC and Maersk are likely to establish independent pricing models, influencing the overall market dynamics.

The decision to dissolve the partnership was primarily driven by Maersk’s shift towards an integrated logistics model, which focuses on providing end-to-end supply chain solutions, while MSC is concentrating on expanding its fleet and pursuing independent operations. Additionally, increasing market competition and regulatory scrutiny have prompted carriers to reconsider traditional alliances, favoring more flexible partnerships instead. As a result, both Maersk and MSC now have greater operational flexibility, allowing them to tailor their services without the constraints of an alliance.

Ocean Alliance Remains Unaltered

The Ocean Alliance (OA)—which includes CMA CGM, Evergreen Line, COSCO Shipping and OOCL (a subsidiary of COSCO)—was established in 2017. Last year, it extended its contract agreement through 2027 and then again to 2032. The Ocean Alliance continues to emphasize the Asia-Europe and Trans-Pacific trade lanes, solidifying its presence as a major player in these critical markets.

Members of the alliance are also boosting their fleets and expanding their service offerings, pooling more vessels and enhancing their overall portfolios. This collaboration leads to greater market stability, as shippers can rely on long-term partnerships that offer more predictable rates and routes. Unlike the Gemini Cooperation, Ocean Alliance is increasing their number of direct port calls.

THE Alliance Reemerges as Premier Alliance

Founded in 2017, THE Alliance initially included Hapag-Lloyd, Yang Ming, Hyundai Merchant Marine (HMM), Mitsui O.S.K. Lines (MOL), K-Line and NYK Line. Hapag-Lloyd will exit the alliance in 2025, marking a pivotal change in its structure. While the bulk of the existing membership will remain moving forward, the group will enter the network under a new name in 2025: The Premier Alliance (PA). The newly dubbed Premier Alliance includes Yang Ming, HMM, and Ocean Network Express (O.N.E.)—which combines NYK Line, MOL and K-Line.

The members of the Premier Alliance will focus on major East-West trade routes, linking Asia with the US West Coast, US East Coast, the Mediterranean, Northern Europe, and the Middle East. Additionally, the group announced a slot exchange agreement with MSC for nine Asia-Europe services, as MSC chooses where to operate independently and where to combine forces.

The Debut of Gemini Cooperation

The highly anticipated Gemini Cooperation (GC), set to launch in 2025, forges a new partnership between behemoths Maersk and Hapag-Lloyd. After jumping ship (literally) from their respective alliances, the duo will join forces to address key concerns for global shippers. Their network aims to improve service and transit reliability by using the hub and spoke method to offer better schedule integrity, streamline operations by optimizing port rotations and reduce congestion.

Fewer ports of call also allow the Gemini to emphasize the use of Maersk-owned terminals; this will allow the alliance to mitigate costs while commanding priority loading/unloading services.

Both companies are also heavily investing in digital freight solutions, enhancing cargo tracking and logistics management for a more seamless experience for customers.

The Independents

Lastly, MSC, previously part of the 2M Alliance, along with ZIM, will operate independently in 2025. The free agents will offer a new range of market options and ignite the carrier-shipper competition overall. MSC is now the largest carrier on planet Earth; watch out!

Reading Between the Shipping Lines

Now that you know the science behind the alliance, as well as some of the partnership changes set to re-balance the market in 2025—let’s talk about what this might mean for you.

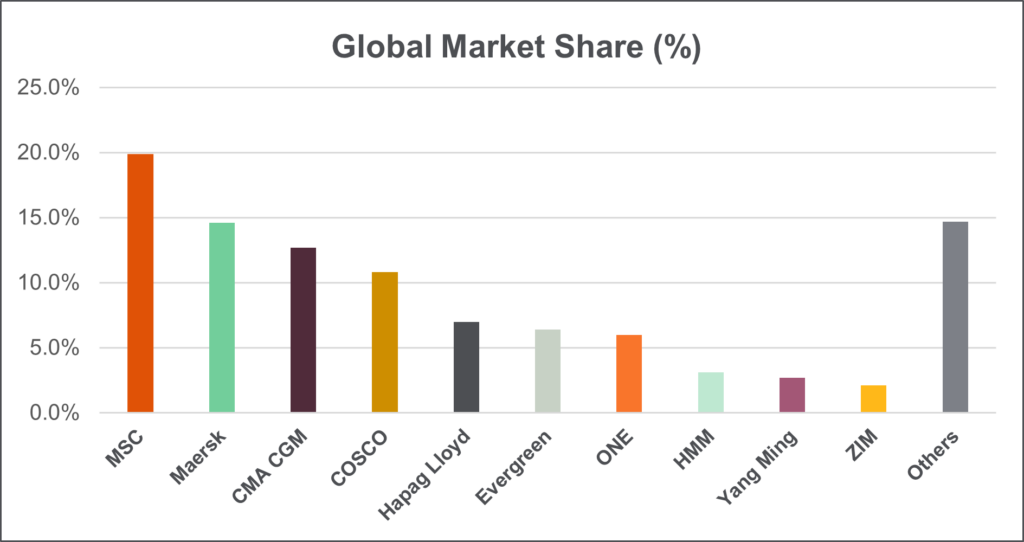

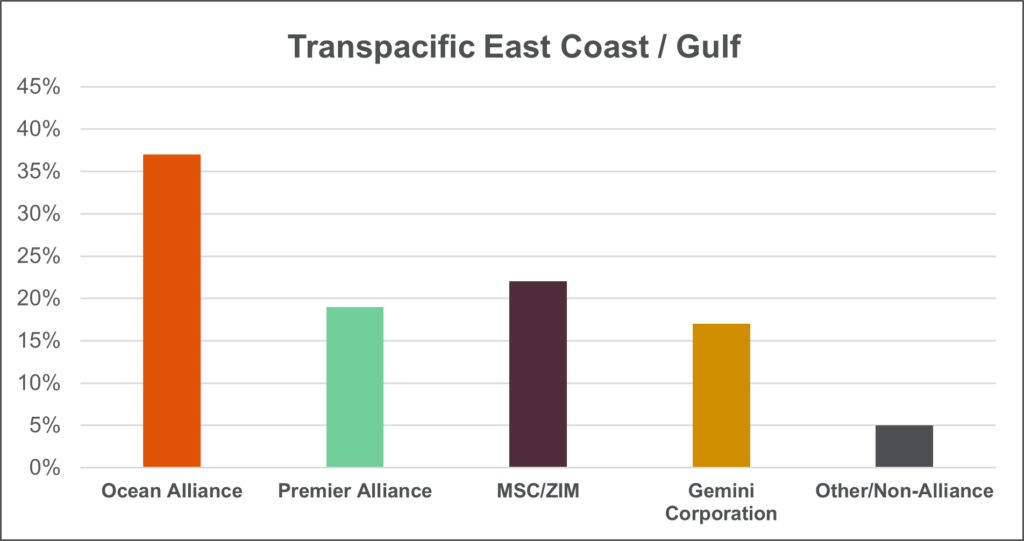

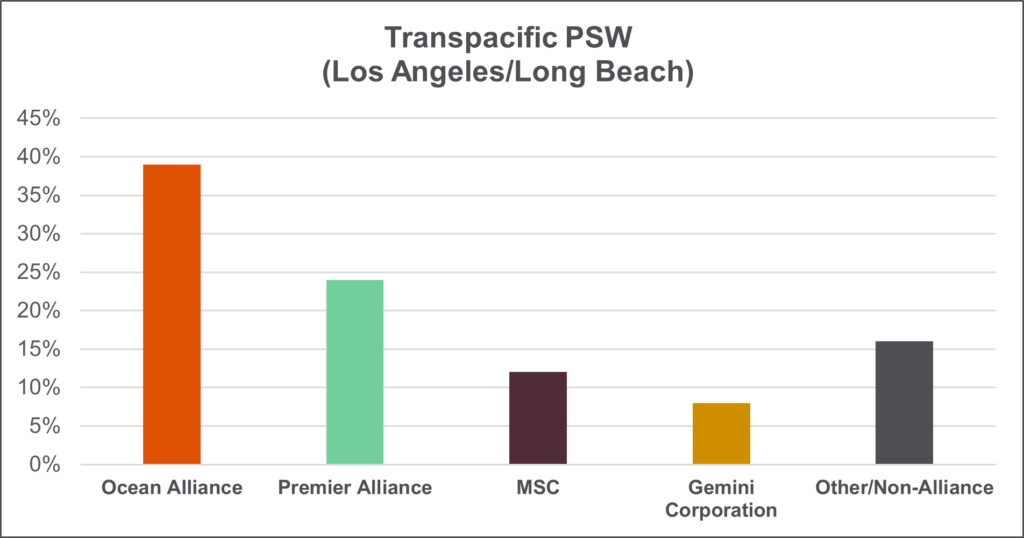

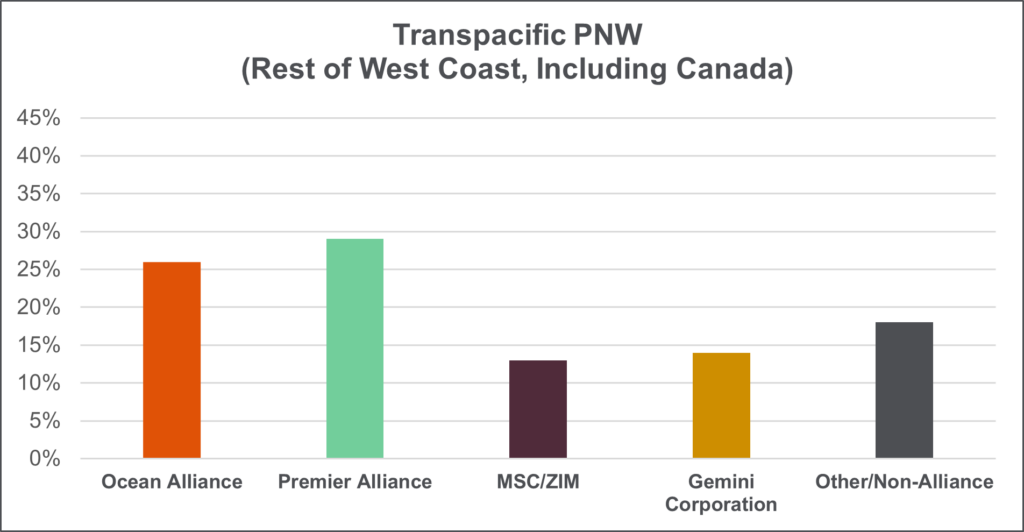

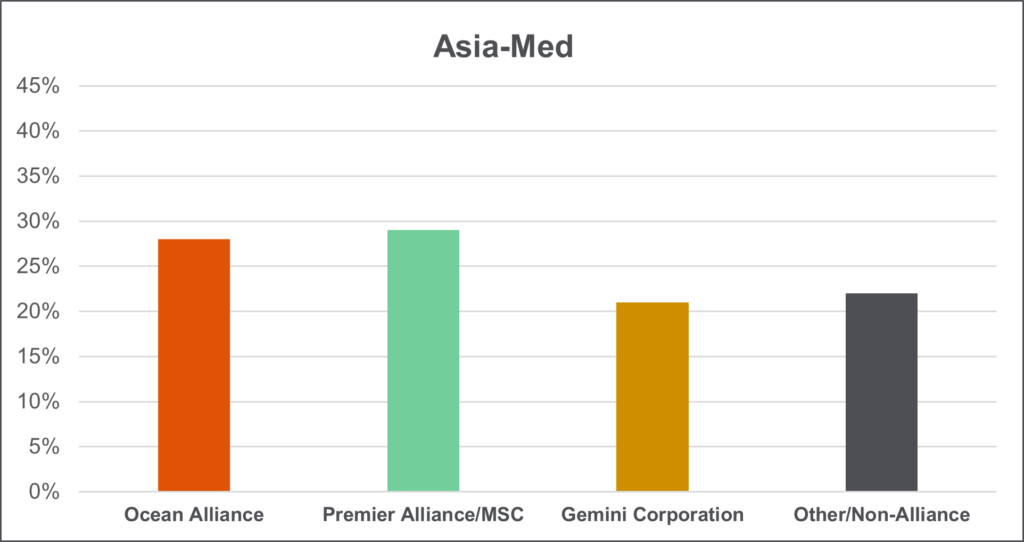

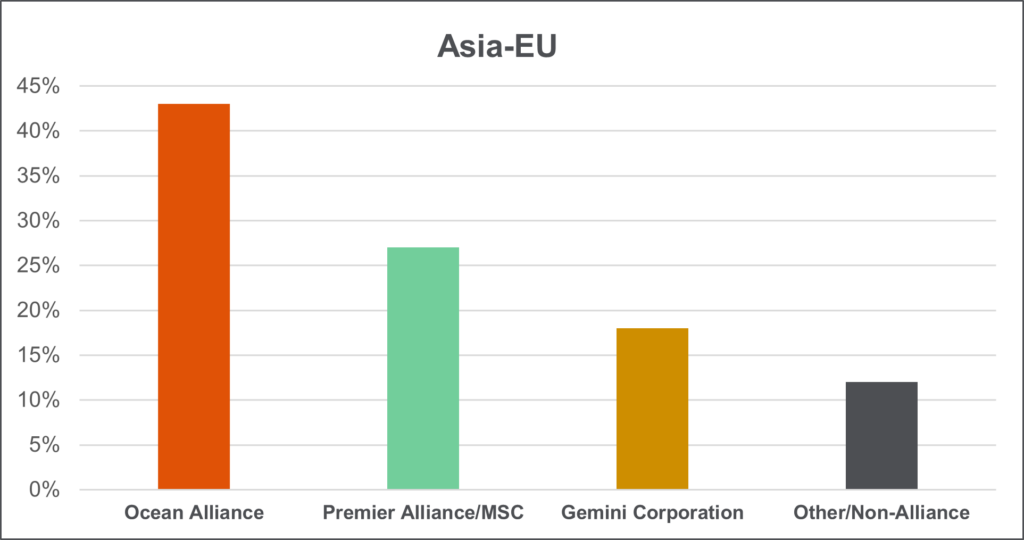

Carrier Constellations: Tracking the Market Shares

Between the shifting alliance structures and service changes, global supply chains need to take a hard look at the new playing field. We thought it might help to break down the carrier market shares in more relative terms. The following charts depict the market share of each alliance by trade lane.

Alliance Alignment: Signs of the Trade

Finding Your Perfect Contract Match

Matchmaker, matchmaker; make me a [contract] match! Here are a few things to consider when perfecting your contract methodology in the upcoming season:

- Contract Renegotiations. The emergence of new partnerships will necessitate renegotiations of contracts. Shippers may need to explore alternative route options due to increased contract costs, with reports indicating transpacific carrier contracts could rise by up to 20% for 2025-26. This uncertainty might render shippers hesitant to commit, particularly with the looming questions regarding global trade and tariffs.

- Access to All Alliances (and MSC!). With an abundance of capacity from new vessels and the eventual return to Suez use, most pundits expect a buyer’s market in 2025. As Gemini focuses on transit predictability, they are cutting direct service calls. As MSC makes use of their massive collection of vessels, they will likely do the opposite. Our other friends, Premier and Ocean, are well-positioned to offer a solid blend of service versatility and reliability. In today’s game, bigger shippers need to combine BCO contracts with solid NVO options in case the FAK market crashes and in case back-up options are needed in peaks. Smaller shippers can typically gain access to all alliances by choosing the right forwarder/NVO (we know one that starts with the letter S!).

- Leverage Logistics Technology. Alliances like Gemini and Ocean are placing an enhanced emphasis on digitalization and operational efficiency. Supply chain managers should leverage these tech-driven logistics solutions to optimize their operations. Shapiro has spent the greater part of this decade working to enhance our existing logistics technology. After some initial experimentation, we are set to launch our new Shapiro 360 product, to help make our customers’ technological dreams come true.

Avoiding Potential Horror-scopes

In navigating the future of international shipping, staying informed about alliance changes is essential for industry stakeholders. It is prudent to diversify partnerships to ensure that portfolios include multiple carrier contracts, protecting against potential limitations in options—after all, you don’t want to be tied to a single star in a vast constellation of opportunities. Additionally, contract strategy adaptations to incorporate flexible terms will be vital to respond to fluctuating market conditions and prepare shippers for potential rate increases soon. By adopting a proactive approach, companies can align their star carriers to position themselves favorably in a changing global trade environment.

And there you have it…you are officially an Astro-logistics-ist. Congratulations!

US Customs and Border Protection (CBP) recently announced proposed changes to the de minimis import process. If you’re involved in international shipping or global trade, you simply must slow down and pay attention! But don’t worry… we’re here to break it all down for you in a way that’s as easy as 1-2-3…or, better yet, 3-2-1.

What is the De Minimis Import Process?

Let’s start with the basics. In international trade, “de minimis” refers to the threshold value of goods under which no duties or taxes are applied at the border. Historically, it has made importing small-value goods easier and faster.

The Customs Administrative Act of 1938 amended the Tariff Act of 1930 by adding section 321 and establishing the administrative exemption at $1 in order to limit the ‘‘expense and inconvenience’’ of collecting duty when ‘‘disproportionate to the amount of such duty.’’ The value of these shipments was deemed to be so minimal that they were not subject to the same formal customs entry procedures and extensive data requirements as higher-value shipments entering the United States.

Congress has since raised the value of the administrative exemption to $5 in 1978, $200 in 1993, and most recently, to $800 in 2016. Translation: Goods valued under $800 can enter the United States without the need for formal customs clearance or payment of duties. For perspective, $800 is higher than 99.9% of the rest of planet Earth (the EU is about $150, for example).

Why is CBP Proposing Changes?

The de minimis threshold is an important part of customs clearance. As currently implemented, the de minimis program extinguishes not just standard import duties on eligible items, but duties imposed under Sections 201 and 301 of the Trade Act of 1974 and Section 232 of the Trade Expansion Act of 1962. Despite its prevalence over the past few decades, there are several reasons why de minimis is under “de microscope” now. The biggest factors? E-Commerce (looking at you Temu and Shein) and Congress.

Increasing Volume of Low-Value Shipments

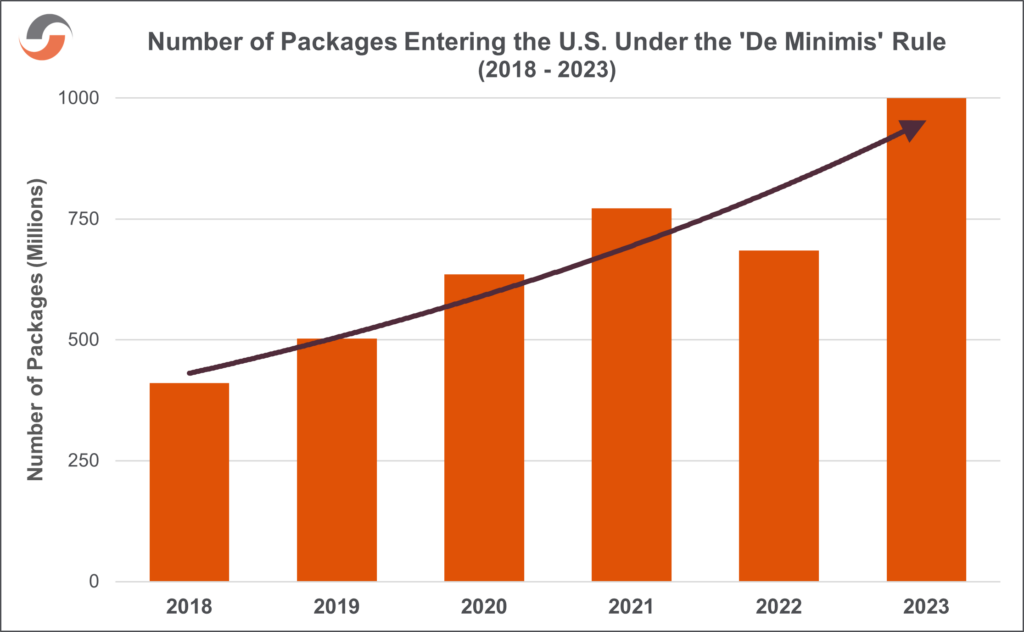

With the boom in e-commerce, there’s been a surge in the number of low-value shipments entering the U.S. In 2013, 140 million shipments utilized the exemption. Just a decade later, that number has spiked significantly—and now encompasses over one billion shipments (that’s a more than 700% gain!). The current process wasn’t designed to handle this volume, so CBP is looking for ways to streamline and manage these imports more effectively.

CBP estimates 77% of shipments claiming the exemption in fiscal year 2023 would have been assessed for additional duties under Section 201, 232 or 301 tariffs if they had not received de minimis treatment.

Concerns About Compliance and Security

Then there are the twin troubles of compliance and security. Policymakers have expressed significant alarm over the potential for the exemption to facilitate unlawful shipments of narcotics (including fentanyl), dangerous merchandise, counterfeits, and products made with forced labor. Raising de minimis/changing the rules should strengthen national security, protect domestic industries and address “discriminatory or unreasonable practices that restrict or burden U.S. commerce,” according to the proposal. Specifically, they shine a bright spotlight on the e-commerce industry–which is particularly vulnerable to imports from China claiming that exemption.

CBP also needs to ensure that all goods entering the country, regardless of value, comply with U.S. regulations. By revisiting the de minimis import process, CBP aims to tighten security measures without creating unnecessary bottlenecks in the shipping process.

What are the Proposed Changes?

This month, government officials released two proposals to introduce potential changes to certain products subject to the de minimis treatment when entering the US. If implemented, these would eliminate the ability for goods valued below $800 covered by Section 201, 301, and 232 duties from eligibility for entry (without an entry!).

It would also create two methods for entering de minimis shipments: the “basic entry process” and the “enhanced entry process.” Shipments claiming the exemption will be required to provide tariff classification numbers under both entry processes, allowing CBP to better determine whether the merchandise is eligible for de minimis treatment or not.

While these awaiting final approval, here is a quick review of what they might entail.

Track #1: The Basic Entry Process

The basic entry process maintains the existing entry process for de minimis shipments with some modifications to the data required to be provided to CBP, such as requiring the name and address of the person claiming an administrative exemption and the final person to whom the merchandise is delivered. CBP will also require the ten-digit classification of the goods under the Harmonized Tariff Schedule of the United States (HTSUS).

The “basic entry process” will be required for bona fide gifts and will be available for all other low-value shipments unless they are shipped through international/U.S. mail, or are goods regulated by agencies other than CBP (such as pharmaceuticals).

Track #2: The Enhanced Entry Process

The enhanced entry process, which will be optional for goods other than mail importations and products regulated by other agencies, would require the submission of data to CBP about the contents, origin, and destination of the shipments prior to the arrival of the goods in the United States. The required time frame to file for an enhanced entry would vary by mode (e.g., air, ocean, land) of transportation by which the goods arrive to the United States.

Additionally, for all shipments made under the enhanced entry process, the following additional data would be required to be transmitted for all shipments:

- Clearance tracing identification number

- Country(s) of origin and export

- 10-digit HTSUS classifications for the merchandise seeking to be entered

- One or more of the following:

- URL to the marketplace’s product listing

- Product picture

- Product identifier

- Shipment x-ray or other security screening report number verifying completion of foreign security scanning of the shipment

- Seller and purchaser names and addresses

- Advertised retail product description

- Marketplace name and website or phone number

- Any other data and documents required by other government agencies

Enhanced Data Collection, Technology and Automation

CBP is also considering enhanced data collection requirements for de minimis shipments. This could involve collecting more detailed information about the shipper, receiver, and the nature of the goods being shipped. Enhanced data collection would aid in risk assessment and help ensure that imported goods comply with U.S. laws.

To manage the increased volume of low-value shipments, CBP is looking into improving technology and automation within the customs clearance process. This could mean faster processing times and improved efficiency, reducing the burden on both CBP and importers.

How These Changes Might Impact You

If you’re in the shipping or global trade industry, you’re probably wondering how these changes might affect your operations.

Potential for Increased Costs

One of the most immediate impacts could be an increase in costs. CBP’s proposal said its “main estimates” find that consumers will bear the full price of increased tariffs stemming from the rule change.” The primary costs of the proposed rule are consumer surplus losses resulting from increased duties and possibly increased processing fees, resulting in higher prices for imported goods paid by U.S. consumers on imported goods.”

A lower de minimis threshold might mean more shipments require formal customs clearance, which can be more costly and time-consuming. Enhanced data collection could also require additional resources and technological investments.

Changes in Shipping Strategies

They could also impact your shipping strategies. You might need to adjust how you handle low-value shipments, perhaps by consolidating shipments to reduce the number of entries or by reevaluating your supply chain to ensure compliance.

Eliminating the exemption for goods subject to Section 201, 232 and 301 tariffs would likely incentivize importers to consolidate orders into bulk shipments, as they would no longer be concerned about exceeding the $800 de minimis threshold. This shift in behavior would benefit CBP, as multiple identical items could be reviewed by officers simultaneously.

Greater Focus on Compliance

With enhanced data collection and tighter security measures, compliance will be more important than ever. Ensuring that your shipments comply with U.S. regulations will be key to avoiding delays and penalties.

Preparing for the Future

The recent announcements marked the final efforts in the Biden-Harris administration’s response to the evolving landscape of international trade. While the changes are designed to improve security and compliance, they also present challenges for those in the shipping and global trade industries. While these changes are still in the proposal stage, it’s never too early to start preparing.

Here are just a few of the ways that you can start to prepare for what’s to come:

- Submit a Comment. CBP is inviting interested persons to submit comments related to the economic impact of removing eligibility for goods subject to Section 301, Section 232, and Section 201 duties; the deadlines for filing under the enhanced entry process; and the practicability of the new information requirements across both the proposed basic and enhanced entry processes.

- Please refer to the below for important details regarding comment submissions and related deadlines.

- All submissions received must include the agency name and docket number for this rulemaking.

- All comments must be submitted via the Federal eRulemaking Portal; and will be posted as is accordingly (including any personal details provided).

- Please refer to the below for important details regarding comment submissions and related deadlines.

| FR Notice | Docket No. | Publication Date | Comments Due | |

| Proposal 1 | 2025-00551 | USCBP-2025-0002 | 1/14/25 | 3/17/25 |

| Proposal 2 | 2025-01074 | USCBP-2025-0003 | 1/21/25 | 3/24/25 |

- Stay Informed. Keep up-to-date with the latest news from CBP and other regulatory bodies. Understanding the nuances of the proposed changes will help you better prepare for their potential impact.

- Evaluate Your Supply Chain. Take a close look at your supply chain and identify any areas where you might need to make adjustments. This could involve working more closely with your logistics partners or investing in technology to enhance compliance.

- Train Your Team. Ensure that your team is well-versed in compliance and customs clearance procedures. Providing regular training and updates will ensure that everyone is on the same page and ready to handle any changes that come their way.

By staying informed, evaluating your supply chain, and focusing on compliance, you can navigate these changes effectively and continue to thrive in the ever-changing world of international trade. Keep an eye on further announcements, as these changes could soon become a reality!

Additional Resources:

- Unpacking Temu’s Tariff Dodging: The De Minimis Deluge Shadowing Forced Labor

- Common Terminology: Government Sponsored Security/Compliance Programs & Initiatives

- Shapiro’s Regulatory Compliance and Consulting Services

Tricks of the Trade: Why Shippers Need Cargo Insurance

Shipments in transit are subjected to numerous perils; goods may be damaged in a storm or fire, stolen by ghosts in the night, involved in a collision, or just plain mishandled, much like the ill-fated journey in “Deliverance.” To help protect against financial loss or another frightful travesty, shippers should consider obtaining Shipper’s Interest Cargo Insurance.

Many folks mistakenly believe that standard carrier insurance will protect their shipments, but this is not always the case. Carriers do not pay claims unless they directly cause or contribute to the loss. Even when carriers are legally liable for loss or damage, the amount they will pay is limited based on the mode of transport, leaving shippers vulnerable to the lurking dangers of the logistics world—where the only thing scarier than a horror movie is an uninsured shipment!

Ocean Freight

The Carriage of Goods by Sea Act (COGSA) governs carrier liability for goods shipped via ocean to/from the United States. Recovery is limited to $500 per customary freight unit, and only when the carrier is negligent. A “freight unit” can vary from one container to one pallet.

International Air Freight

For air carriers, two liability conventions exist:

- Warsaw Convention: Limits liability to $9.07 per pound or $20 per kilogram.

- Montreal Convention: Used in the United States, this convention changes the limitation to 22 Special Drawing Rights (SDRs), or about $30 per kilogram.

Domestic Shipping

Many domestic air, intrastate road carriers, and warehouse operators limit their liability to $0.50 per pound or $50 per shipment, based on their bill of lading or warehouse receipt. Interstate truckers are governed by the Carmack Amendment, which dictates full value but allows limitations of liability in bills of lading, tariffs, or contracts. Some carriers will also have inadequate or no liability insurance and may be unable to fund a loss out of pocket.

Trick-or-Trade: Declared Value vs. Cargo Insurance

Declaring value to a carrier is not the same as having Cargo Insurance. In order to submit a claim against a carrier, the shipper must prove that the cargo was damaged while in the carrier’s care, custody, or control. The carrier then has multiple defenses to prove they weren’t liable, making recovery extremely difficult. Cargo Insurance provides protection without having to prove carrier liability. This is particularly important in instances where a loss is attributable to an “Act of God,” which seems to be a regular occurrence in recent years.

| Examples of Claims | Description of Loss | Declared Value for Carriage | Cargo Insurance |

| Lightning Strikes a Truck | While a trucker was en route, the truck was struck by lightning, causing a fire and resulting in a total loss of the cargo. | Even if a value is declared, there would be no automatic right or recovery because the trucker did not act negligently. The loss was considered an “Act of God.” | This type of claim would be paid under “All-Risk” Cargo Insurance coverage. |

| Heavy Weather at Sea | Several days after an ocean vessel left the port, it ran into heavy weather. A large wave hit the vessel, and containers were washed overboard. | “Heavy Weather” is excluded under COGSA. The ocean carrier would deny liability, and no payment would be forthcoming. | This type of claim would be covered by “All-Risk” Cargo Insurance, as well as With Average (WA) coverage. |

The Haunting Truth: Why Cargo Insurance is Essential

Cargo Insurance not only covers loss or damage but also protects against General Average, pays for the costs to minimize a loss (lawsuit and labor), and pays for damage inspection (survey). Carriers have limited liability and are provided legal defenses that can absolve them of responsibility entirely. Cargo Insurance pays covered claims without the need to prove fault.

What is General Average?

Before we answer our own question, a history lesson! The concept of General Average began when sailing the oceans blue was a very hazardous journey in smallish “sailboats.” When there wasn’t a shipowner to be found to move valuable goods, the risks of those voyages had to be shared by shipper merchants and vessel owners. Despite the relative safety of today’s commercial flotilla, though a vessel a day still sinks (!), General Average is alive and well and has been since the Greeks and the Romans ruled the Earth,

General Average is a principle incorporated into virtually all ocean bills of lading. It is used when a voluntary sacrifice is made to save the vessel, cargo, or crew from a common peril (e.g., jettison of cargo to extinguish a fire or maintain balance in a storm). All shippers on-board contribute to the loss based on their cargo’s value. If the cargo isn’t insured, it won’t be released until the shipper posts a guarantee (cash, bank guarantee, or bond). If the cargo is insured, the insurance company will handle all arrangements on the shipper’s behalf.

For a more in-depth look at General Average check out our blog.

Cargo Theft

Estimates of cargo theft in the United States range from 15 to 35 billion dollars (USD) annually. Officials estimate that nearly 80% of cargo thefts involve employee collusion. Drivers are often paid to leave their truck unattended at a specific place and time.

Statistics:

- Within 24 hours of theft: The goods are already delivered to an alternate location. Thieves are no longer in possession of the merchandise.

- Within 48 hours of theft: Cargo is split into about five consignments and distributed.

- Within 72 hours of theft: Goods are being marketed and sold.

Spooktacular Cargo Insurance Coverage Options

Shapiro offers comprehensive “All-Risk” coverage for cargo in transit, including Free of Particular Average (FPA) and With Average (WA) alternatives.

“All Risk”

Provides the broadest form of protection available. Goods are covered for loss or damage without the need to prove liability. An easy way to remember “All-Risk” coverage is “everything is covered, except what is excluded.” Typical exclusions include improper packing, inherent vice, or rejection of goods by Customs.

Free of Particular Average (FPA)

Offers less protection than “All-Risk” coverage but is a good option for commodities like used goods, waste materials, and scrap metal. A good way to remember FPA coverage is “the only covered losses are specifically named.” Perils covered under FPA include sinking, collision, General Average, fire, and washing overboard, to name a few.

With Average (WA)

Extends FPA to cover heavy weather. Many shippers choose to add theft, pilferage, and non-delivery to WA and FPA.

In a nod to the season, we wanted to end on a “ghoul” note. If you or your business have fallen into one of the perilous pitfalls mentioned above—or simply avoid them all together—consider “trick-or-trading” in your Cargo Insurance provider for Shapiro!

Additional Resources:

- Cargo Insurance: What is General Average

- Cargo Insurance: 4 Common Misconceptions Debunked

- Cargo Insurance Coverage Options

Imagine receiving a message from an ocean carrier notifying you that all the cargo aboard a vessel, including yours, has been impounded—and the only way you can retrieve it is a boat load of cash or a guarantee at the very least. Sounds like extortion, right? Well, it’s actually a very common event in maritime shipping known as General Average. Understanding General Average, its implications, and how to protect yourself as a shipper is crucial in the world of ocean freight shipping. So, let’s dive right on in…!

What is General Average?

General Average is a principle of maritime law establishing that all cargo owners on a vessel share liabilities and losses that may occur. This means if a shipper’s cargo is involved in such an incident, even if their goods are not damaged, they must still contribute financially to the loss.

The Basics of General Average

General Average may be declared when an intentional sacrifice is made to preserve the common safety of the ship, persons, or property while at sea. For example, if a ship is in peril and the crew jettisons some cargo to lighten the vessel and save it from sinking, the losses incurred are shared among all cargo owners with a financial interest in the voyage.

The Financial Implications

When General Average is declared, all shippers on a vessel must contribute to the loss, regardless of whether their cargo was directly affected. The amount they’re expected to contribute is based upon the total value of the ship’s cargo.

Here’s an example scenario for you:

- Total value of the voyage: $200 million

- Total loss (cargo and vessel repairs): $20 million

- Percentage of loss: 10%

- Cargo owner’s contribution: 10% of the value of their cargo.

Given the above example, if a shipper has cargo valued at $100,000, they will need to contribute $10,000 to get it released.

Recent Examples

The principle of General Average is not just theoretical; it happens in real life. And it happens more often than you think. The two most prominent cases in recent memory are the Ever Given and the Dali.

Ever Given: On April 1, 2021, the Ever Given’s vessel owner, Shoe Kisen, declared General Average. In case you might’ve forgotten, the Ever Given ran aground in the Suez Canal on March 23, 2021. With the assistance of 13 tugboats and dredgers, the vessel was successfully refloated on March 29th. The incident caused a blockage of the Suez Canal and halted cargo traffic, delaying billions of dollars’ worth of shipments. The vessel was held for three months by the Suez Canal Authority while they worked to determine total liabilities. General Average was declared at 25%. Once the financial dispute was settled between the shipowners and the Suez Canal Authority, the vessel was allowed to leave.

Dali: Grace Ocean Private Ltd, the owner of the Dali—the infamous ship that knocked down the Francis Scott Key Bridge in Baltimore in March 2024—declared General Average a month after the initial incident. At the time of the crash, there were over 9,000 TEUs onboard the vessel, which became stuck inside the Port of Baltimore for several weeks. It will likely take some time for a value to be declared as cargo and damages must be fully inspected. But you can bet your bottom dollar that the figure isn’t going to be pretty!

Protecting Yourself: The Role of Cargo Insurance

Uninsured Cargo: If your cargo isn’t insured, you will not be able to retrieve it until you post a guarantee, which can be in the form of a cash deposit, bank guarantee, or bond. This can significantly impact cash flow and delay your business operations.

Insured Cargo: Having marine cargo insurance can mitigate the financial strain of a General Average declaration. When General Average is declared:

- Immediate Notification: Notify your marine cargo insurer immediately.

- General Average Guarantee: The insurance company will post the General Average Guarantee to meet your contribution and facilitate the release of your cargo.

Insurance can be a make or break in this situation. Not only does it ensure the quick release of your goods, but it also protects and insures you from the financial burdens associated with unexpected maritime events.

Why Shippers Need to Be Aware

Understanding General Average and the role of cargo insurance is essential for any shipper involved in international trade. This knowledge can prevent financial losses and ensure smoother business operations in the face of maritime accidents.

Also, many shippers are under-insured, especially for maritime events. Please do not presume your property policy’s marine clause fully protects you!

Most companies offer cargo insurance, but how many offer you assurance? Whether your cargo is on-shore or off-shore, Shapiro procures, ensures, endures and assures. That might sound like a mouthful to you, but that mouthful could save your bacon—and your bottom line!

Helpful Links:

- Cargo Insurance: What is General Average

- Cargo Insurance: 4 Common Misconceptions Debunked

- Cargo Insurance Coverage Options

Pay attention, Agents…

Your mission, should you choose to accept it, involves decoding the latest updates to U.S. Customs Bonds—the unofficial and secret weapon that U.S. Customs and Border Protection (CBP) and other Partner Government Agencies (PGA) have at their disposal to safeguard our national trade interests.

Much like the legendary MI6 Agent 007 from across the pond, James Bond, Customs bonds operate behind the scenes to protect and serve. But fear not fellow agents, for this mission briefing won’t require any covert spy operations, stirred pots, or shaken martinis for that matter.

The License to Bond

First off, let’s revisit the basics. Like any experienced spy, Customs bonds are all about security. They guarantee that all duties, taxes, and fees owed to the government will be paid. In the complex world of international trade, you can consider these bonds your “license to ship”—without them, your cargo can’t clear Customs.

From 1991 with Love

The story of Customs bonds can be traced back to 1991, when the original guidelines were first codified. However, like any good spy gadget, periodic updates are essential to keep pace with the ever-evolving threats and changing landscape of today’s world.

Since 2020, CBP has embarked on a top-secret revision mission, spurred by the need to adapt to new economic realities and technological advancements. These necessary changes reflect a forward-thinking approach, propelling the bond process to become more transparent and adept to meeting the needs of current trade volumes.

After all, even “Q” knew it was necessary to continually upgrade his gizmos to keep up with the challenges of modern espionage—erm, we mean international trade, that is.

A Quantum of Updates

Highly anticipated by the international trade community, the latest batch of updates aims to “mind the gaps” and clarify some of the murkier waters of bond coverage. Some of these key changes include, but are not limited to:

- eBond Upgrades: CBP officials now embrace modern technology with electronic bond (eBond) transmissions—making them fast (but not furious), efficient, and ready at the click of a button.

- Dangerous Merchandise: A new section in Appendix A identifies special classes of merchandise that pose risks—spelling out the required bond amounts for hazardous cargo.

- Bond Increments: All continuous bonds are now set in increments of $10,000 up to $100,000; capping at $100,000 for larger bonds.

- Minimum Bond Hikes: The minimum C3 and C4 bond amounts doubled from $25,000 to $50,000.

A Mission Debrief on Your Gadgets & Resources

If you have any questions, you are not alone! Never fear—Shapiro is never one to lead you astray.

For those of you agents who feel the need to dive deeper into the intricacies of these updates, you may want to consider a quick visit to the CBP Bonds website, which boasts a summary of changes and other detailed guidance. But beware—this is your detailed dossier, so handle it wisely.

We also encourage you to reach out to CBP’s Trade Policy and Programs, Drawback and Revenue Branch at [email protected] with any burning questions. These folks play the role of “M” in our Bond scenario…so don’t be afraid to reach out to these experienced agents for more guidance.

The Trade World is Not Enough

In our modern international trade world—where the flow of goods never sleeps and threats to efficient trade loom large—staying informed about Customs regulations is not just important, it’s mission critical. Updates to Customs Bonds are not just bureaucratic red tape; they’re enhancements to the tools that keep our trade operations alive and well.

In closing, remember—much like the suave hero of our favorite spy films (or spy novels if they float your boat), staying cool, calm, collected, and informed under pressure is the hallmark of a successful logistics and shipping professional today. So, gear up, for the magical and prolific world of Customs Bonds awaits. And as always, keep your shipments moving and your wits about you!

…Until next time, Agents.

Helpful Links:

Lately, the international trade newsroom has cast a bright spotlight–or should we say dark shadow–on some of the shadier business practices allegedly leveraged by certain popular e-commerce platforms.

If you were one of the 123 million viewers that tuned into Superbowl 58, chances are you caught a glimpse of at least one of the six commercials aired by Temu, an e-commerce retailer based in China.

But how did Temu manage to allocate such a hefty sum towards its marketing budget given its rock-bottom prices on everything from 3D chicken nugget pillows to seasonal holiday decorations? Simple. It’s likely the result of the retailer taking advantage of a US import tax loophole known as de minimis.

Maximizing the De Minimis Exception

Before we kick-off, let’s take a moment for a quick warm-up stretch to jog our muscle memory. If you’re wondering what the de minimis loophole is, think of it this way:

You have a piggy bank in your room. Every time you deposit more than five coins, you have to give one extra coin to your mom or dad for taxes. However, you don’t have to pay the additional tax on any deposits made containing five or fewer coins. Instead of making one large deposit of say, 20 coins, you could make four individual deposits of five coins to avoid paying the additional tax.

Some e-commerce companies are running a similar game when it comes to de minimis shipments.

If an importer brings goods valued at more than $800 into the US, they are typically taxed by the government. However, retailers like Temu and Shein attempt to circumvent import taxes by shipping directly to the consumer, thereby avoiding the additional duties levied by US Customs and Border Protection (CBP) and/or other Participating Government Agencies (PGA) at entry.

In addition to skirting tariffs, there is growing concern that this loophole allows for shipments of goods produced from forced labor to enter the US more easily, given the fact that they bypass the rigorous exams, inspections, and duties that the majority of brick-and-mortar–and even some online competitors–cannot dodge.

The Unintended Dark Side of De Minimis

Initially intended to facilitate smoother trade and Customs processes, this provision may now enable a more dubious practice: the potential for these tariff-dodging shipments to include goods produced through forced labor. This concern is not unfounded, given the complexities and opacities of global supply chains, especially those rooted in regions with poor labor rights records.

In 2022 alone, a staggering 685 million shipments imported into the US benefited from the de minimis exemption. Reports suggest that Temu and Shein combined are responsible for more than 30% of this volume. Now more than ever, consumers are attuned to the origins of the products they purchase and are demanding assurances that their spending does not endorse, or support forced labor.

The de minimis loophole underscores the critical need for transparency, accountability, and ethical considerations in global commerce. US lawmakers are now watching this performance with a critical eye, concerned not just about the loss of tariff revenue but also its darker implications.

Finding the Light at the End of the Legal Loophole

As the discussion around the de minimis provision and its unintended consequences unfolds, it’s clear that any path forward will require a collaborative effort. Lawmakers, businesses, and consumers alike must engage in an open dialogue to ensure that the benefits of e-commerce growth and international trade do not come at the expense of human rights.

The narrative surrounding Temu and the de minimis loophole serves as a poignant reminder of the intricate link between commerce, ethics, and legislation. While we navigate this playbook, let’s strive for a future where trade not only thrives economically, but also upholds the fundamental values of fairness, transparency, and respect for human dignity.

Helpful Links

By the dawn’s early light on March 26, we all saw that the Francis Scott Key Bridge had lost its perilous fight with the Maersk Dali. And then we viewed countless videos of the violent carnage, somehow almost graceful, surely caused by bombs bursting in air and not a bump from a boat!

Our second response was that this was certainly a hoax, a child’s trick using an erector set (do they still exist?) in a bathtub, right? Or was this the work of Russia, Iran, North Korea, or our new friends in Yemen? Fake news intended to frighten us? No.

The realities gave proof through that first night and day. This horror was all too real.

How did the Francis Scott Key Bridge collapse?

A vessel weighing more than a 20-story building, heavier than 1 million NFL football players, crushed a bridge pillar setting off a disastrous chain reaction. In their illustrious 28-year history, the Ravens have put about 1000 players on the field; it would take almost 300,000 years to collect one million Ravens to compete with the sheer bulk of the Maersk Dali.

Shapiro is proud to call Baltimore home for 109 years, and we know a few folks by now. So, the messages first came by phone, by text, by email, by Teams, by Linked-In, and by pony express. Was Shapiro’s flag still there? Is everyone okay? How many motorists perished? Was this all real?

After these heartfelt and almost primal inquiries, I expected to be asked about some of the following:

Are all terminals affected?

What will happen to the containers on port?

How many unladen vessels?

What is the trucking rate from Norfolk?

How much will the repair cost?

How quickly can the debris be removed?

Was that bridge safe?

Local road congestion realities?

Instead, I kept hearing versions of “is the sky falling, Rob?” Is the sky falling for the world, for the international supply chain, for Baltimore?

While I can’t begin to guess about the world’s fate (though I pray we remain the “land of the free”), I can give it a college try for the supply chain and for Charm City.

Okay, since 2017 more than 50 bridges have collapsed worldwide, Hanjin failed, labor unrest has steadily increased globally and in the US, the Ever Given put our business on the map, COVID changed ALL the rules for two years, the Panama Canal got thirsty, and the Houthis have entered our vocabulary by taking aim at anything that floats in the Red Sea. Frankly, my list here is astonishingly incomplete especially if we add the alarming violence of Mother Nature to the mix.

However, we must note that human ingenuity, determination, and genius is on full display with even a casual glimpse at the global supply chain. The Maersk Dali holds 10,000 TEUs of cargo and is less than half the size of the largest of mega vessels! Rail transport in many countries whizzes by at over 200mph. Manufacturing has never been more creative or systematic. Port equipment is not only energy efficient but “smarter” than ever. The distribution centers of today are absolute miracles of design and ingenuity. And, all the while, supply chains emit less sulfur and have begun to tackle our giant carbon problem (perhaps too sluggishly, but steadily).

Assessing Supply Chain Reactions

We are in the presence of unbelievable feats of engineering and human potential every single day. And I like to think that the human beings supporting global supply chains have never been more versatile, innovative, and connected. We are harnessing the powers of technology in more and more sophisticated ways on what feels like an hourly basis. The pace of change may be daunting, but it is also intensely inspiring if you take a deep breath and look at the bigger picture.

This leaves us with the final question, “is the sky falling for Baltimore?”

Let’s start with the Francis Scott Key Bridge itself. The bridge was not just a visual stunner, but it was a true wonder of engineering. It was the third longest continuous truss bridge on the planet, it took five years to build, 32,000 vehicles crossed it per day, and the full length of the construction was 1.6 miles. Bridge nerds have their rules, so only 15% of the bridge’s length counts as a truss. Today, the bridge looks like the ramparts o’er which Scott Key jotted notes, but the history is a proud one.

While we remember the rockets’ red glare over Fort McHenry, there was a notable lack of “red glares” on the bridge when it collapsed. We are devastated for the loss of the six construction workers, and we ache for their families; but local pilots called out the mayday, and the Maryland DOT blocked access to the bridge with lightning speed. The first vessel power loss was but five minutes before impact. If it had occurred at rush hour with no mayday, we might well be talking about hundreds of deaths.

Let’s move on to “The Star-Spangled Banner.” Written in Baltimore in 1814, our national anthem is all about the strength, courage, and the resiliency of Baltimoreans. Full stop. Francis Scott Key’s character has been challenged since he owned slaves, but his poem is an undiluted tribute to the great city of Baltimore.

When the great Key Bridge accepted her first vehicle in 1977, Baltimore City was still almost one million souls with about 70% of the total local population still in the city vs. the suburbs and surrounding areas. By 1980, the population of the city was down 17% from 1950’s peak. Today, we are down 40%. Yet, all the while the suburbs and surrounding areas have grown in population; the city is just over 20% of the area’s population today. Like it or not, we have been and are still abandoning Baltimore City.

Why? Well, a lowly forwarder with his modest margins ought to be careful here! Some people think the fate of the city was sealed when Maryland abandoned Baltimore and made her an independent city in 1851 (Charm City is still the nation’s largest independent city). Others may point to the creation of an expressway that separated the city, or to several recessions and at least four drug epidemics and counting. Some of the brave from the home of the brave believe that racism continues to play its pernicious part.

Yet today, we see so many signs of a vibrant eclectic population and culture from the arts to cuisine, to state and local government. And, all the while, Baltimore’s port has served up so much human variety and influence as to make Baltimore a poster child for America’s claim of “melting pot.”

Because Baltimoreans are proud, I shouldn’t risk this, but one easily finds the established splendors of African, German, Polish, Greek, Italian, Irish, Lithuanian (!), and Russian cultures among many others. Recent immigrants from Asia, Latin America, Africa, and the Middle East only add to the diversity and deep flavors of this melting pot.

Let’s drill down a little more and mention that the supply chain professionals in this region, those who are the heart and soul of Baltimore’s maritime identity, are a remarkable bunch of people. They say it takes a village, and we are a vocal, engaged, and caring village to say the least! From the dock workers at the port of Baltimore to the truckers and warehousemen to the railroads to the bridge repairmen to the shippers to the port executives to the AMAZING brokers and forwarders, to the government officials to the countless specialists like harbor pilots, to Michele Nickoles (yeah, I said it!), this is a remarkable community, an exceptional village!

This is NOT the twilight’s last gleaming for Baltimore. We have the broad stripes of an ethnic melting pot since 1729, and the bright stars to revive our vital role in global supply chains. We must remember to be very proud indeed from where we hail. We proudly hail from Baltimore, people!

Oh say, can you see a revitalized Baltimore, courageous and proud? Yes. Oh say, can you see a city and a port that is greater as a whole than the pieces we represent? Hell Yes! We are gallantly streaming to a better future, and we are doing this as a family, as a village, and as a great city.

Logistics contingency plans are just a fancy way of conveying the importance of businesses being prepared when the ship hits the fan—like if the Ever Given lodges itself at the Suez Canal or a viral pandemic hits planet Earth like a meteor, somehow super-charging global consumerism.

In 2021, an estimated 40% of all global ocean bookings were delayed or rolled from March to May, which caused carriers to deploy wave after wave of blank sailings to help get vessels back into their proper rotations. Covid was one gigantic contingency plan: global shippers placed their contracted cargo with their intended carriers just 50% of the time, and they paid the rates they expected for just 10% of all bookings! 2023 saw a return to stability and rational planning, but here comes 2024…!

Currently, we see two main assaults to your well-crafted supply chain plans, scholarly shippers: Panama and Suez Canal-sequences and ILA Labor Pains.

Panama & Suez Canal-sequences

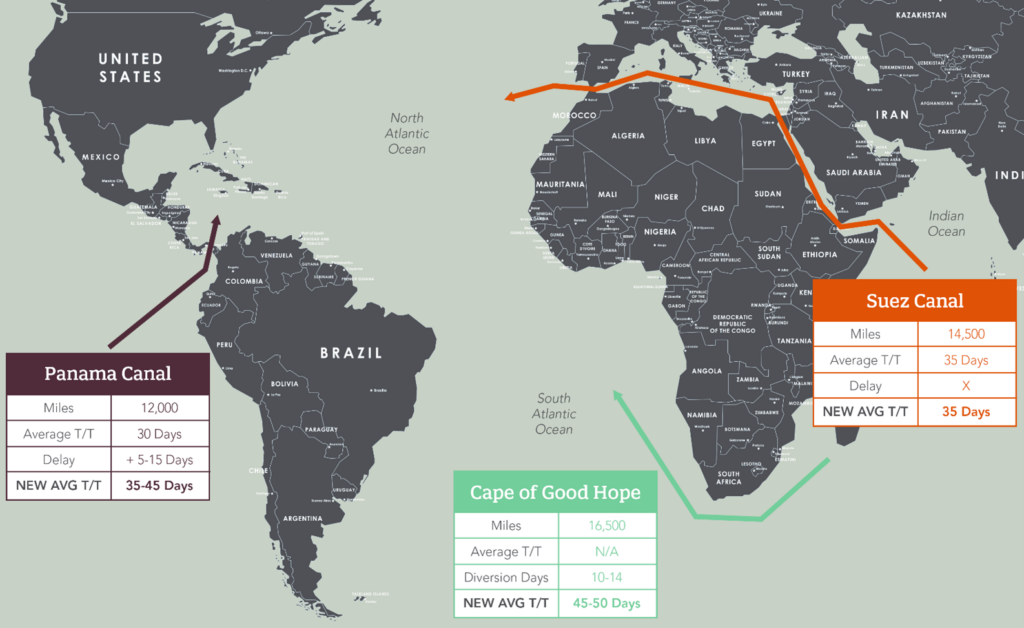

Please have a look at the global ocean routing map and supporting data points below, comparing expected transits from Base Ports in Asia to Base Ports on the US East Coast (USEC):

- Approximately 30% of global cargo volume transits the Suez.

- In normal times, about 35% of USEC volumes utilize the Suez.

- Ocean rates have doubled in a month, despite only modest seasonal demand growth.

- Not to mention the Emergency Risk (Suez) and Emergency Drought (Panama) Surcharges…oh my…!

- 17 of the 23 main service routes from Asia to US utilize Panama.

- Of the 17 services, 4 have returned to Panama after attempting Suez routing.

- 24 ships may transit Panama’s locks each day—which is just 67% of normal capacity.

So, what are we all going to do if Iran continues to fund the Houthis in the Red Sea and Mother Nature continues to deprive Panama of her ship carrying rains?

ILA Contractions & Labor Pains

Early news reports of International Longshoremen’s Association (ILA) contract renewal demands for the US Gulf and East Coast indicate very high wage and benefit expectations and zero automation tolerance. What can we do in the case of a major strike?

After prayer, meditation, and yoga, we have to begin with these fundamental questions:

- What happens to my production lines and inventory levels if my shipments are delayed?

- What additional fees might be imposed on my shipments by the lines?

- What if I can’t secure cargo space?

- What are the pros and cons of alternative cargo routings?

- Does my insurance cover delayed or rerouted shipments?

- What can I expect for ocean freight levels after Chinese New Year?

- Am I prepared to move some of my cargo by airfreight?

- Do I have the right partners in my supply chain who can give me access to both canals and all ocean carrier alliances?

- Have I investigated alternate product sourcing options with avoiding canals in mind?

- Should the ILA strike, what USWC options have I established in advance?

- Have I budgeted for contingencies? For example, if I ship zero containers over the West Coast through August, how will I expect to get space there after a strike?

The current global political and climate realities make it clear that proactive planning is crucial. But how does one go about creating an effective contingency plan?

Things to Consider When Creating Your Contingency Plan

Let’s dive into the practical steps and considerations that should be evaluated for your unique situation:

- Risk Assessment of Supply Routes: Assess risk by identifying potential vulnerabilities in your supply chain. Consider factors like geographical positioning and risks, political stability of trade routes, and dependency on key channels like the Suez or Panama Canal.

- Inventory Management: Determine the optimal level of safety stock for key products to buffer against supply chain disruptions. Diversify your supplier base to avoid disruptions in the event of trade tensions as recently seen with the US and China. Forecast demand of product to adjust inventory levels ahead of important seasons.

- Scenario Planning: Develop scenarios for various types of disruptions, ranging from natural disasters to geopolitical tensions. Consider the likely impacts on your routes, timelines, and costs.

- Alternative Routes and Modes: Map out alternative shipping routes and modes of transport. Evaluate the feasibility, cost implications, and transit times of each alternative. A mix of options is crucial as plan B can often become unavailable as we are seeing today with the Suez Canal.

- Contract Flexibility and Insurance/Liability: Negotiate contracts/deals with carriers/NVOs that allow for route flexibility and ensure that you have a comprehensive understanding of insurance coverage and the liabilities you have connected to the delivery of product.

- Leverage Technology: Technology, like Shapiro 360°, plays a pivotal role in being able to track shipments in real-time to reroute cargo and manage schedules as soon as possible. These indispensable tools help mitigate the risk of disruptions.

Contingency Consequences & Conclusions

Developing a comprehensive plan is important but it’s equally important to ensure your plan remains relevant and effective. Normally, reviewing your plan on a semi-annual or annual basis does the trick. For 2024, we recommend monthly reviews—especially considering the on-going canal concerns. This will give you the opportunity to update your tactics and strategies in concert with the latest market trends, technological advancements, and changes in trade policies (to say nothing of global geopolitics and Mother Nature…!).

We understand that the complexities of contingency planning can be overwhelming. If you feel daunted by the prospect of developing or updating your contingency plan, you don’t have to go it alone. Shapiro’s team of experts is here to guide you through every step of the process. Contact us for personalized support and guidance to be prepared for any challenge that may arise.

Helpful Links/Related Topics:

- Navigating the Suez Blockade: A Trade Tirade (ShapBlog)

- Panama and Suez Canal-sequences (ShapTalk)

- Hot News Page | Labor Strikes

Chinese New Year (CNY) is just around the corner—which means the mundane rhythm of everyday life will soon give way to a vibrant celebration of family and cultural traditions. Beginning Saturday, February 10, 2024, not a single soul will be found in factories or offices, as the Chinese workforce enjoys a week (or more) of respite—oftentimes away from the large, bustling cities. Instead, the streets of China will be transformed and adorned with red lanterns, children’s paper decorations in every window, and parades in honor of “The Year of the Dragon.”

With the number of “Made in China” tags embroidered and/or stamped on so many global products, you probably won’t be surprised to learn that China accounts for approximately 11-14% of all U.S. imports (depending on your data source). Why are we telling you this, you might ask? Because the annual CNY shutdown leads to a temporary, yet notable slowdown in manufacturing, and more importantly—affects exporting activities.

Typically, CNY falls anywhere between January 21 and February 21, though the specific timeframe varies from year to year depending on the lunar calendar. However, regardless of the specific dates, there is always a noticeable surge in manufacturing and shipping activity out of China leading up to the holiday, as exporters scramble to find available bookings and shipping capacity before the hiatus begins.

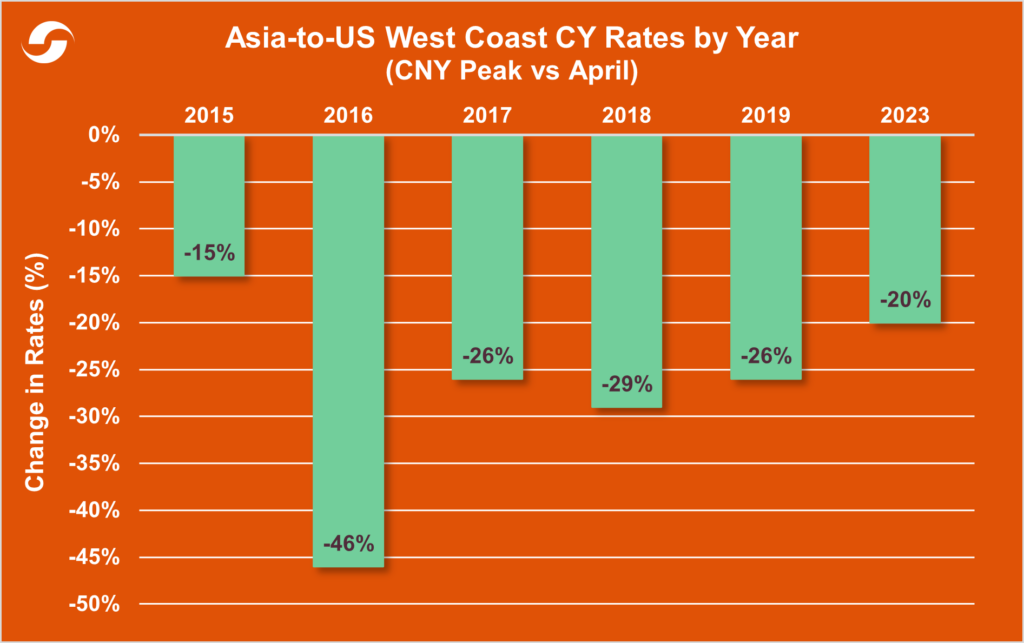

Although one can never take trends as gospel in the shipping world, there is value in observing past data. Let’s take a quick peek at some of the peaks (rather troughs) of post-CNY rate changes over the past decade—minus the messy period we call COVID-19.

Long story short: If you can avoid the pre-CNY shipping parade, you’ll likely be able to score some unused container space at a nice post-holiday “discount.” So, be sure to mark your calendars well in advance and prepare to ship smarter—not harder. Because in our business, it can really pay-off to know not just how to make your move, but when.

Editor’s Note: First, let us say that the humanitarian impacts and terrifying possibilities of a raging geopolitical storm leading to a global conflict are what really matter when eyeing Gaza. That is a concern well beyond this blog! We write this in the spirit of the annual budgets we are preparing (or will soon be preparing), and our businesses.

What the heck are we international shippers all going to do when the Suez Canal is blocked or compromised by the current and broadening conflicts in Gaza, Israel, and beyond?

Let’s start this tirade in Panama—the slightly more famous canal among the proud Americans who financed that impressive project back in 1914. Yikes! First, the Panama Canal Authority (PCA) lowered the maximum (max) draft levels from 50 to 44 feet, which limits max vessel sizes. Since then, the PCA has already reduced the number of vessel transits per day from 36 to 32 (in July) to 24 (in November), followed by an announcement that the daily max will drop to 18 by February 2024!

Hey, no problem, we’ll just pay a few dollars more to wait a few days longer for Suez routings, right? …Right? …Maybe wrong.

Here are a few fun facts to help put things into perspective for us:

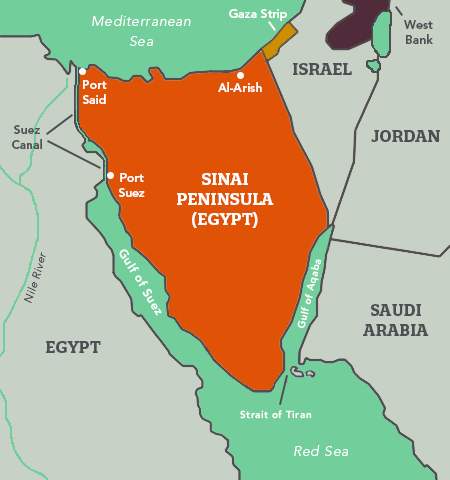

- Philadelphia is farther from Washington DC than the Gaza Strip is from the Suez Canal.

- 130 slender miles separate the infamous Refah border crossing in Egypt’s Sinai and the busiest and eldest major canal on planet Earth.

- Al-Arish Airport, the primary hub for humanitarian shipments for Gaza is 28 miles from the Refah border, separating the Gaza Strip from Egypt.

- The Suez is not only 45 years older, but also 244% busier than our darling Panama Canal!

- Remember, both sides of the noble Suez sit on Egyptian soil.

So, we are all in trouble obviously! Have you considered a world where Iran, Egypt, and Saudi Arabia gang up on Israel, and the Suez is closed indefinitely?

…Not so fast, reactionary readers. You don’t want to be “Egypted” off when seeking your supply chain information!

Enter Egypt

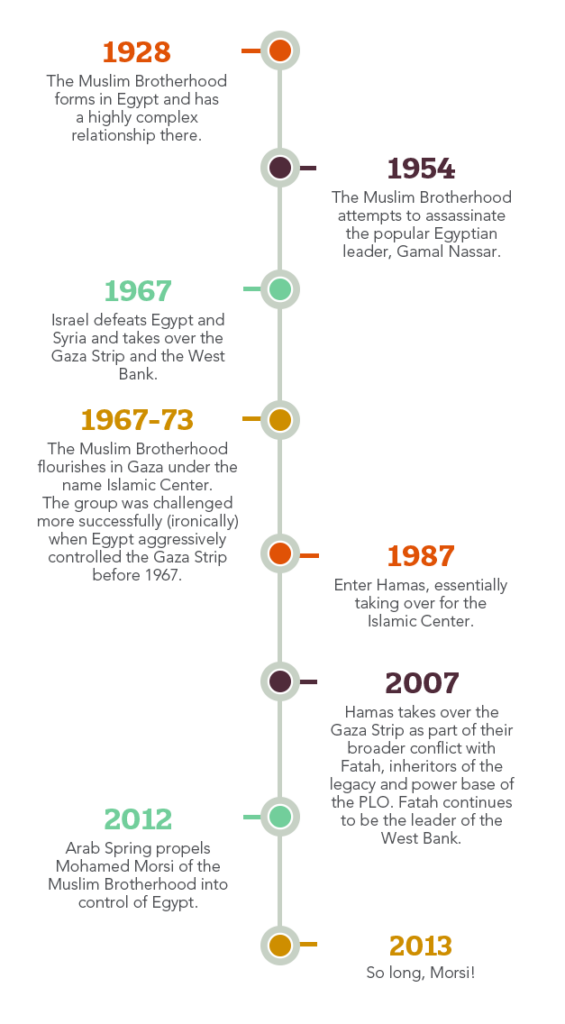

Before we delve into the current situation, let’s briefly review a few of the region’s defining moments over the past century that helped shape the present political context at hand:

Analysis of the Hamas-Egypt Relationship

Today, it is said that the official position of Egypt is negative toward Hamas because they are literally the offspring of the Muslim Brotherhood. This organization has done much harm to Egypt in the eyes of many after what’s amounted to nine years of military rule under Abdel Fattah el-Sisi. That said, there is tremendous popular support for Hamas among the people—and most Egyptians would not like to see Palestinians, perhaps even members of Hamas, suffer.

Egypt is also closely allied with both the United States and Israel, and these connections run deep and wide, as they pertain to financial aid and developmental support for Egypt. A telling example of this cooperation is the ongoing blockade of vessels to and from the Gaza Strip. And, frankly speaking, the Suez Canal is a huge economic contributor for Egypt. It is very hard to imagine Egypt attacking Israel any time soon. They now have many ties that bind, and Hamas is hardly seen as saintly in the eyes of Egypt.

Wild Card: Freight Rates

What happens if Iran or her many “seedlings” like Hezbollah take aim at the Suez?

The short-term consequence—especially if Panama is as dry as a desert—is that we all get to know (and love) the Cape of Good Hope around South Africa. Our freight prices will increase by 100% and our transits will extend by as much as 50%, but we’ll still be in business. As of today, that seems like the worst-case shipping scenario; though, if we get there, the world is in CONTAINERLOADS of trouble.

Suez Blockade Tirade Conclusions

What’s Shapiro’s outlook on the matter?

We feel that it’s likely that some Panama Canal business would start to move by rail from Cristobal to Balboa if the Suez is blocked and rendered useless. Our bet is it is a 1% chance. However, if it comes to that reality, just know that Panama’s rail connections from the Pacific to the Atlantic have never been faster, more reliable, or more affordable than today. By hook and by crook, even if we must use western Mexico, we’ll be routing freight to every single boy and girl in the US.

Again, our point is not to diminish the anguish occurring in the Middle East. An unprovoked attack followed by even more human suffering: it is impossible to label this anything but a tragedy. But it would be foolish not to consider potential dire developments. Shifting our focus to commerce, we’re betting on a resourceful global supply chain in 2024!

Itching to weigh in on our little tirade and/or rant about your current escapades? Contact Shapiro today!

Helpful Links/Related Topics:

- More Global Shipping Delays After Suez Canal Saga

- The Worst Suez Market Allocation ‘Ever Given’

- Everything You Need to Know About the Vessel Blockage at the Suez Canal

- The Vessel Blocking the Suez Canal has been Dislodged

- You Can’t Ship Out In a Drought

- The Portly Problem of Climate Change

- Nautical Nose-to-Tail At The Panama Canal