USTR Releases Official List 2 Exclusion ProcessUSTR Releases Official List 2 Exclusion Process

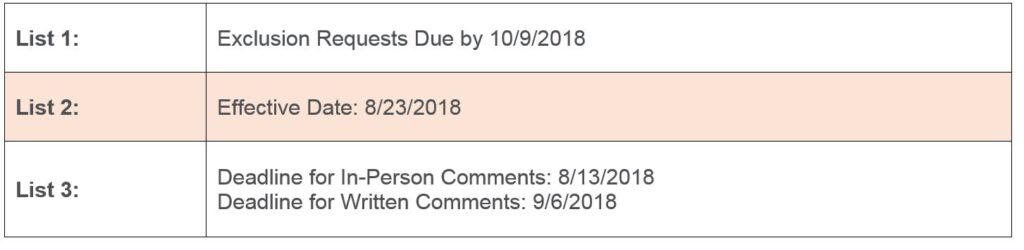

The office of the United States Trade Representative (USTR) officially published the List 2 exclusion process on Tuesday, September 18th. The official notice and exclusion process can be found HERE. Please take note of the following key points as they relate to the exclusion filing process: The final list of Section 301 tariffs affected by […]

Continue Reading »List 3 Tariffs on $200 Billion Worth of Chinese Imports to Take Effect on Monday, September 24thList 3 Tariffs on $200 Billion Worth of Chinese Imports to Take Effect on Monday, September 24th

We are sorry to report that the (dreaded) day has finally arrived… In the Administration’s continued attempt to bolster U.S. manufacturing, Section 301 List 3 tariffs have been finalized—and are set to take effect next Monday, September 24th. Affected importers should expect to pay an additional 10% in tariffs through the remainder of the […]

Continue Reading »Miscellaneous Tariff Bill Becomes Law and Reduces Tariffs on Nearly 1,700 ItemsMiscellaneous Tariff Bill Becomes Law and Reduces Tariffs on Nearly 1,700 Items

The Miscellaneous Tariff Bill (MTB) became law on September 13th, 2018 and will go into effect on October 13th, 2018, following a 30-day grace period. The bill provides tariff reductions on roughly 1,700 items through 2020 and was originally proposed by the International Trade Commission (ITC) as a means of maintaining and enhancing the competitiveness […]

Continue Reading »List 3 Tariffs Could go into Effect as Early as Friday, September 7thList 3 Tariffs Could go into Effect as Early as Friday, September 7th

We are hearing from the media—and you may be as well– that tariffs on List 3 could go into effect as early as Friday, September 7th. We find this hard to believe, but feel it is important to share what we are thinking: The period for public comment on List 3 tariffs is officially ending on Thursday, September 6th. One would […]

Continue Reading »President Trump Announces the “United States–Mexico Trade Agreement”President Trump Announces the United States–Mexico Trade Agreement

The United States Trade Representative (USTR) has released three U.S.-Mexico Trade Fact Sheets announcing that the United States and Mexico have reached a preliminary agreement, in principle, to update the 24-year-old NAFTA with modern provisions representing a 21st century, high-standard agreement. The updated agreement will support mutually beneficial trade leading to freer markets, fairer trade, […]

Continue Reading »List 2 Section 301 Duties to go into Effect on August 23rdList 2 Section 301 Duties to go into Effect on August 23rd

On Monday, August 7th the office of the United States Trade Representatives (USTR) published its finalized second list, officially known as “List 2”, of Chinese products; these tariffs will be subject to additional duties effective August 23rd. In its final iteration, “List 2” places additional duties of 25% on $16 billion of Chinese products, spanning […]

Continue Reading »China Retaliates, No Sign of Trade War EndingChina Retaliates, No Sign of Trade War Ending

On Friday, August 3rd, China announced that they will impose their own set of tariffs on $60 billion worth of U.S. goods if President Trump moves forward with his plan to further increase tariffs. Last week, the Trump administration announced they are considering an increased tariff rate on List 3 items from 10% additional duty […]

Continue Reading »Trump Considers Increasing Proposed Tariffs From 10 Percent to 25 Percent Against Chinese GoodsTrump Considers Increasing Proposed Tariffs From 10 Percent to 25 Percent Against Chinese Goods

President Trump has announced that he is considering increasing the tariff rate percentage from 10% additional duty to 25% on List 3 items, which is an additional $200 billion worth of goods from China. This would be applied to approximately 6,000 tariff lines from China. A complete list of the products subjected to the tariffs […]

Continue Reading »USTR List of Tariffs on $200 Billion in Chinese Goods ReleasedUSTR List of Tariffs on $200 Billion in Chinese Goods Released

President Trump took another stab at the ongoing trade war between the United States and China on Tuesday, as the U.S. Trade Representative released a list of tariffs on $200 billion in Chinese products. The proposed list consists of a 10 percent tariff on 6,031 8-digit tariff lines. This announcement comes after President Trump threatened […]

Continue Reading »Apply for Your Product Exclusion for Chinese Products Subject to Section 301 Tariffs

The U.S. Trade Representative (USTR) announced a process to obtain product exclusions from the additional tariffs in effect on certain products imported from China (Section 301 tariffs). The Text of the Federal Register notice outlining the criteria and process for a product exclusion request and public requests, responses, and replies will be received via Regulations.gov. […]

Continue Reading »Section 301 Tariffs Going into Effect FridaySection 301 Tariffs Going into Effect Friday

Trump officially announced last month that the United States is moving forward with imposing tariffs of $50 billion on Chinese products that contain “industrially significant technologies.” As the trade war between the US and China looms, the United States will begin to enforce a 25% percent tariff on 818 Chinese products, valuing $34 billion worth […]

Continue Reading »Craft Beverage Modernization and Tax Reform Act of 2017 ImplementationCraft Beverage Modernization and Tax Reform Act of 2017

Under the CBMA, reduced tax rates and/or tax credits are applicable to importations of certain limited quantities of distilled spirits, beer, or wine imported from each qualifying foreign producer. Further, the foreign producer must have affirmatively assigned those rates or tax credits to an importer or importers, and the quantity assigned to all importers by […]

Continue Reading »Trump Follows Through with Imposing Tariffs on $50 Billion of Chinese GoodsTrump Follows Through with Imposing Tariffs on $50 Billion of Chinese Goods

Early Friday, President Trump officially announced that the United States would impose tariffs of $50 billion on Chinese goods, in retaliation against China for intellectual property theft. In April, the White House announced the planned tariffs and released a list of possible goods subjected, but had a deadline until today, June 15th, to unveil a […]

Continue Reading »Tariffs on Steel and Aluminum for U.S. Allies Take Effect by End of DayTariffs on Steel and Aluminum for U.S. Allies Take Effect by End of Day

President Trump has announced that tariffs imposed on three of the U.S.’s biggest trading partners will go into effect by the end of the day, Thursday, May 31st. Earlier this year, Trump announced a 25% tariff on steel and 10% on aluminum imports for the European Union, Canada, and Mexico, but agreed to give an […]

Continue Reading »Update: China Customs Advanced Manifest (CCAM) Launched June 1stChina Customs Advanced Manifest (CCAM) Launched June 1st

On June 1st, 2018, China Customs launched a new advanced manifest effort for imports and exports to expedite clearance for both air and ocean shipments. The new manifest process requires electronic manifest submission 24 hours prior to loading at the port of export, which must accurately and completely reflect the goods under the bill of […]

Continue Reading »U.S. Going Ahead with 25% Tariff on $50 Billion Worth of GoodsU.S. Going Ahead with 25% Tariff on $50 Billion Worth of Goods

On Tuesday, May 29th, the White House announced that the Trump administration will go forward with a 25% tariff on $50 billion worth of products coming from China. This comes just 10 days after Treasury Secretary Steven Mnuchin announced a hold on Section 301 tariffs to delay a possible trade war with China and allow […]

Continue Reading »Attention Importers: Send Your Steel and Aluminum Product Exclusion Numbers ASAPSend Your Steel and Aluminum Product Exclusion Numbers ASAP

On March 19, 2018, the Department of Commerce (DOC) published in the Federal Register (FR) the process for parties to submit requests for exclusions from Presidential Proclamations 9704 and 9705 on Adjusting Imports of Steel and Aluminum into the United States under section 232 of the Trade Expansion Act of 1962. See 83 FR 12106. […]

Continue Reading »U.S. and China Agree to Put Section 301 Tariffs on Hold, According to Treasury Secretary, or Not..?U.S. and China Agree to Put Section 301 Tariffs on Hold, According to Treasury Secretary, or Not..?

As you are aware, earlier this year, the U.S. proposed new tariffs on $50 billion worth of products from China due to a Section 301 investigation. On Sunday, Treasury Secretary Steven Mnuchin said that the proposed new tariffs on Chinese imports will be put on hold while the United States and China are in the […]

Continue Reading »President Trump Issues Last Minute Proclamations Adjusting Regulations on Imports of Steel and AluminumPresident Trump Issues Last Minute Proclamations Adjusting Regulations on Imports of Steel and Aluminum

Imports of all steel and aluminum articles from Canada, Mexico, and the member countries of the EU shall remain exempt from the additional duty established until 12:01 a.m. eastern daylight time on June 1, 2018. Steel: Imports of all steel articles from Argentina, Australia, Brazil, and South Korea* shall be exempt from the additional duty […]

Continue Reading »GSP Renewed Until December 31, 2020GSP Renewed Until December 31, 2020

The renewal of the Generalized System of Preferences (GSP), which was signed by President Trump in late March, went into effect April 22, 2018. Importers should continue to flag GSP-eligible importations as SPI “A” and expected to pay normal duty rates until duty payments subsided on April 22nd. U.S. Customs and Border Protection (CBP) will […]

Continue Reading »