Top 3 Reasons to Review Your Import/Export Trade Compliance Program NOW!

When was the last time you took a long, hard look at your trade compliance program? What compliance program? Perhaps you work for a company where you wear multiple hats – purchasing, logistics, and oh yes, take care of that Customs stuff, too.

Your priorities may depend on your reporting structure. If you report to Logistics, the priority is usually to get the freight here quickly. If you report to Finance, the priority is usually to get the product here the most cost effective way. If you report to Legal, now we’re talking, and someone somewhere might be concerned with compliance.

Why is Trade Compliance Important?

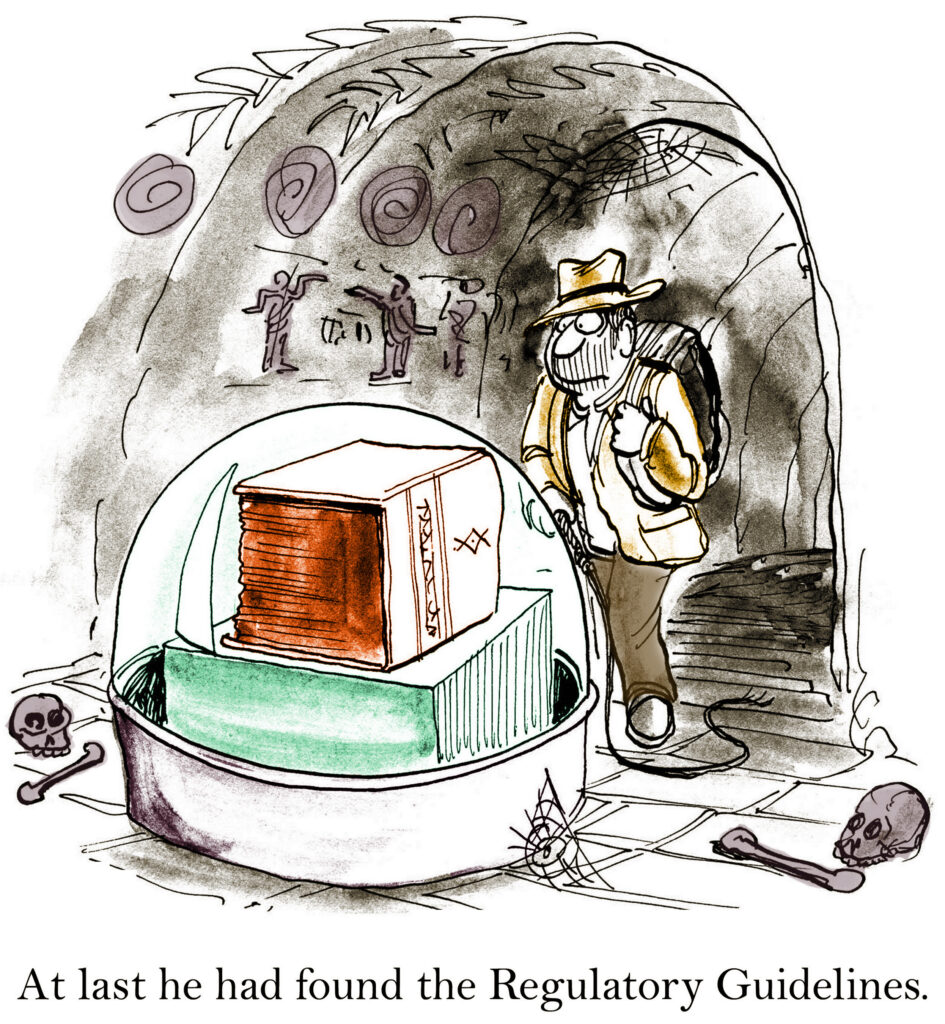

Trade compliance should be the goal of every importer and exporter to ensure all personnel know the rules and regulations, how to abide by them, and how to manage them. Compliance promotes integrity within the company and upholds your company standards. Think of a compliance program as a security blanket that protects the company and its employees by having a structure in place.

Here are the top 3 reasons you need to review (or worse, implement) your import and/or export trade compliance program:

#1. Import/Export Compliance Sets the Tone

A trade compliance program lays the groundwork for how you need to behave and ensures you are meeting your legal obligations with Customs and other government agencies. How do you know if your company is adhering to what it is supposed to do? Have personnel been adequately advised or trained in import or export compliance matters?

Compliance can be a moving target with constant regulatory changes in economic, industry, and operating conditions. That’s why a continuous process is needed.

#2. No Compliance Program = Higher Risk

Not having a trade compliance program increases your exposure to penalties. An established compliance program goes a long way towards mitigating any penalties you do receive. Don’t wait for a violation to occur! The larger the company, the greater the expectation by Customs that you have a functioning program in place.

Did you know that a first Importer Security Filing (ISF) offense can cost you $5,000 per bill of lading? How about a second offense that runs you $10,000? Go ahead and take a minute to calculate how many errors it would take to put you out of business. That’s just one type of penalty, and trust us, there are plenty more where that came from.

#3 – Trade Compliance Saves You Money

You heard it right here. Saves. You. Money. It will help you avoid audits, penalties, and border delays. When your shipment is held up for an exam, it can affect your cost margin and your relationship with your customer when a delivery is delayed, which directly impacts your bottom line (for more on Customs exams, check out Examining the Issue: A Behind the Scenes Look at Customs Inspections).

You can also take advantage of duty savings under duty reduction programs such as GSP, NAFTA, and other free trade agreements (for more duty saving ideas, check out our whitepaper library and download A Guide for Reducing Customs Duties Effectively (and Legally)). Not having regulatory impediments to your business will lower your costs and ensure your product moves to market faster and more effectively.

Trade Compliance Program Mistakes

Trade compliance should never be an afterthought. And it won’t happen on its own. In most cases, you should consider outsourcing this function so that experts can put the pieces of the compliance puzzle together for you. Compliance experts can advise you what your obligations are as an importer and/or exporter and show you how to comply with them.

By understanding the regulatory risks your company faces, you can put into place the necessary policies and procedures. This should be the foundation of any compliance program. The only way to know if your compliance program is working is to assess it and evaluate it. Lowering your risks and ultimately lowering your costs will be the end result.

Unfortunately, some importers and exporters don’t even consider hiring outside assistance with their compliance program. Why? While it’s hard for us, compliance fanatics, to understand, here’s a compilation of what we’ve heard over the years – and here are the reasons why these are myths and not facts:

- It’s too expensive. The cost of penalty actions will far outweigh the costs of putting a compliance program into place. Remember that ISF penalty we just talked about? We’re sorry to let you know that level of penalty is on the (very) low side. Penalties for negligence and gross negligence have been issued in the millions of dollars. Export penalties easily reach 7 or more figures.

- It takes too much time. There is a time investment to establishing a compliance program, but once in place, your shipments will move more quickly and that’s where you will see the time savings. Once the program is implemented, you’ll just need to maintain it.

- It takes too much time. I know we just said this, but you should also know that a Customs audit, known as a Focused Assessment, takes about six months when no issues are found. If you do not have a compliance program in place, expect that audit to take much, much longer with Customs auditors spending lots of time in your office. But don’t take our word for it. If you’d like to understand how painful a Focused Assessment really is, talk to an importer that has been through it. We promise you’ll be terrified. Don’t let that be you.

- Customs doesn’t bother us. You can’t fly under the radar forever. Customs has a program of Quick Response Audits that can target any size importer on a single issue. And it’s surprising to see how many penalties are issued to long-established importers.

- Our broker takes care of everything. As the importer of record, under 19 USC 1484, you hold the legal responsibility for all aspects of the entry. The broker is only a conduit to Customs on your behalf. You cannot outsource the responsibility.

Get Export/Import Compliance Help!

We’ve scared the bejesus out of you and we sincerely apologize for that, but we are only looking out for your best interest. There’s an easy solution to this: If you don’t have a compliance program, get one started now. If you do have one in place, make sure it is reviewed by an expert.

If you work with a Customs broker, they could be a great resource for this type of consulting. Some companies go as far as evaluating the services of a Customs attorney; however, Customs brokers are licensed by Customs and are usually more cost effective.

You’re even able to find companies that will do an assessment of your program and advise you on whether you need further help. For example, Shapiro offers Import or Export Compliance Appraisal services. Contact us if you’d like more information or just need a kind ear to listen to your trade compliance worries.

P.S. Feel free to leave us a comment below to share any focused assessment horror stories or tips on how you keep your compliance program in tip top shape.

robert ronning says:

Nice article, I did not understand before, regarding the compliance rules that occurred in international trade import export. This is important for the international businessman. one level of difficulty of the import-export trade is the situation and the different rules of each country. and this requires agency and integrated program to be accepted by any existing policy. nice article. references to support services exports and imports in http://ies.orangefield.com/services/trade-services/import-and-export-support-services … thanks for the share.

Shapiro says:

Hello Robert,

We’re glad the article was able to inform you on trade compliance! A comprehensive import/export compliance program is a competitive advantage in today’s economic landscape.

Should you have any questions or need further guidance, please don’t hesitate to reach out.