A Tarrify-ing Trade Reality: How Did We Get Here?

Ah, tariffs—the economic equivalent of a schoolyard “keep away” game, but with more paperwork and fewer scraped knees. Following President Donald Trump’s inauguration in January, the US and its global pals have been hard at work (and play) tossing tariffs around like hot potatoes.

This post breaks down the tariff rollercoaster of 2025 thus far; and covers the following topic areas: Section 232 (Steel & Aluminum), Automobiles & Parts, De Minimis, Reciprocal (Global, China), Technology & Pharmaceuticals, Digital Service Tax, and Venezuelan Oil. Whether you’re a policy nerd or just trying to figure out if your imported coffee grinder is about to cost 49% more, you’re in the right place.

Steel and Aluminum: The Heavy Metal Showdown

Action:

- February 10, 2025: President Trump imposed a 25% tariff on all imported steel and aluminum. This was a blanket measure: no exemptions, just raw economic power chords.

Reactions:

- Canada: Retaliated with 25% tariffs on $20.8B of U.S. goods by March 4.

- EU: Followed with tariffs on $28.33B of U.S. exports, effective April 1.

Current Status:

- Tariffs are in full effect and expected to remain. With other metals (like copper and rare earths) under review, more may be added soon.

Automobiles and Parts: The Bumper-to-Bumper Brawl

Action:

- March 26, 2025: The U.S. imposed a 25% tariff on imported passenger vehicles and light trucks, plus parts like engines and transmissions.

Reactions:

- Canada: On April 9, Canada fired back with a 25% tariff on non-USMCA-compliant U.S. vehicles. Auto parts were spared (for now).

Current Status:

- These tariffs are live, but automakers are lobbying hard. Talks on carve-outs for electric vehicles and shared platforms are ongoing.

De Minimis No More: Bye-Bye Freebies

Action:

- April 8, 2025: The U.S. will eliminate the $800 de minimis threshold for imports from China effective May 2—meaning no more duty-free small packages.

Current Status:

- Implementation expected May 2. US Customs is preparing for higher volume inspections, and Chinese e-commerce giants are bracing for a cost hike.

Liberation Day Tariffs: The Blanket Approach

Action:

- April 2, 2025: On “Liberation Day,” The U.S. introduced a 10% tariff on imports from all trade partners (100+ countries) effective April 5, while others would receive higher rates beginning April 9.

- The full list of country-specific rates can be found in Annex I.

- Note: Previously tariffed goods and critical minerals not produced in the US are exempt.

Reactions:

- US: On April 9, President Trump reversed course and announced a 90-day postponement of the country-specific reciprocal tariffs to allow more time for trade negotiations. During the pause, all countries, other than China, will still be subjected to the lower baseline tariff of 10%.

- EU: Initially announced retaliatory tariffs on specific US goods beginning April 15; but elected to postpone the implementation because of the 90-day pause.

Current Status:

- Country-specific reciprocal tariff rates have been postponed until July 9 for all countries—other than China. During this time, all products imported into the US will be subject to a lower baseline rate of 10%.

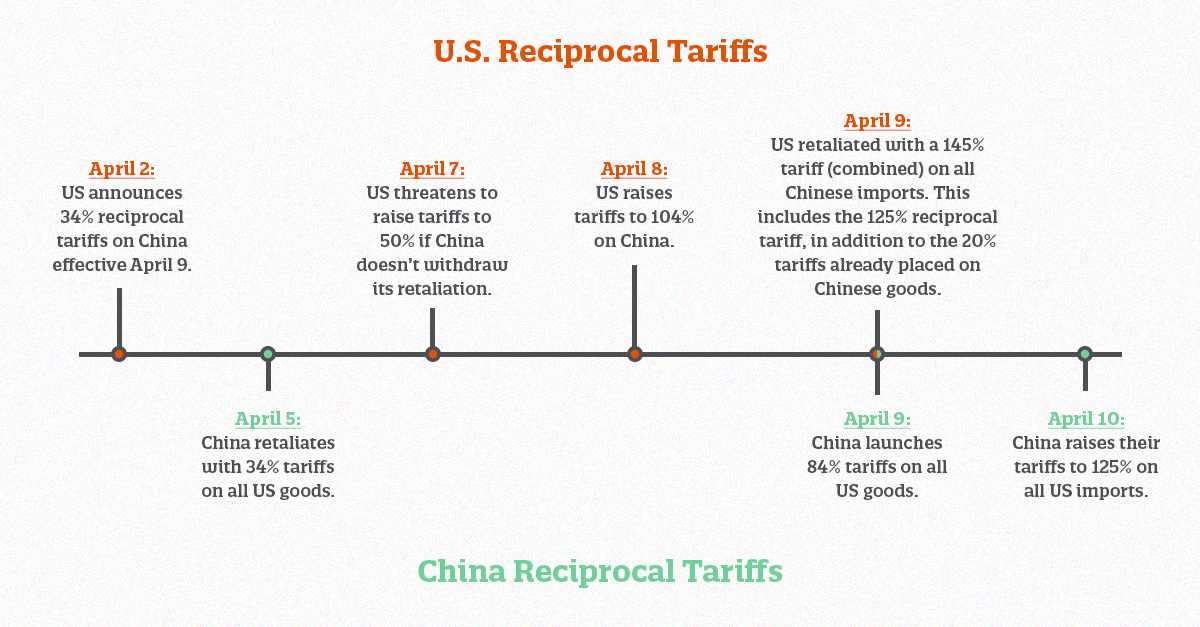

The Empire Strikes Back: China Retaliates

Most of the duties applied to products from China have already been covered elsewhere in this blog. However, we decided to create a separate section to review the escalating U.S.-China trade war.

U.S.-China:

As tensions and retaliations continue to escalate between the US and China, it’s important to understand exactly what tariffs apply to Chinese products and how they are calculated.

Section 301: Tariffs imposed on Chinese goods addressing unfair trade practices.

- Originally put into effect during Trump’s first term (7.5% and 25%).

- Most exclusions are set to end on 5/31/25, unless extended by the current administration.

De Minimis:

- April 2: US announced the elimination of de minimis treatment for imports from China and Hong Kong beginning May 2—an action threatened by President Trump earlier this year.

International Emergency Economic Powers Act (IEEPA): Duties imposed to target fentanyl precursors and rectify trade imbalances (reciprocal).

- Fentanyl:

- March 4: US imposes 20% tariffs on goods from China and Hong Kong.

- Reciprocal Tariffs: U.S.-China (April):

Current Status:

- Trump postponed reciprocal tariffs an additional 90 days for every country besides China. US-China tariffs are escalating rapidly, with no talks scheduled yet.

Tech and Pharma: The Looming Cloud

Action:

- February 14, 2025: The White House floated 25% tariffs on pharma, semiconductors, and foreign-made EVs. It hasn’t happened yet—but it’s not off the table.

Current Status:

- Not enacted—yet. These remain high-risk categories, especially if China or the EU escalate digital or industrial policy tensions.

Digital Services Taxes: A Cyber Spat Brewing

Action:

- February 21, 2025: The U.S. launched a Section 301 investigation into France, Austria, the UK, and others over their digital services taxes (DST) targeting U.S. tech giants.

Current Status:

- Still in the investigation phase. A ruling could trigger targeted tech-related tariffs by late spring or summer.

Venezuelan Oil: The Slippery Slope

Action:

- March 24, 2025: A 25% tariff was slapped on imports from any country buying Venezuelan oil—a geopolitical move more than an economic one.

Executive Order:

Current Status:

- Active and politically charged. Countries sourcing from Venezuela are under pressure. This may intensify if Maduro ramps up exports.

The Trade Horizon: What’s Next for Tariffs?

It’s only April, but 2025 is already shaping up to be the most tariff-packed year on record. US officials have gone broad and bold; but China continues to pushback. As for the rest of the world, countries are stuck in the middle—anxiously awaiting Trump’s next announcement. As international trade spins out beneath a complicated web, global supply chains are left in turmoil. With reciprocal tariffs, digital taxes, pharmaceuticals, and semiconductors still on the table, the next few weeks will undoubtedly bring even more calamity.

But one thing is for certain: we are all in the same boat! Shapiro will continue to follow the twists and turns of Trump’s tariffs; and will post all future updates to our Tariff News webpages. For now, all we can do is sit back and ride out the storm together.