Featured Headlines:

ACE Enhancements for the Craft Beverage Modernization Act (CBMA)

USTR Reveals Additional Investigations into Section 301 Tariffs

Have You Heard about CBP’s e-Allegations Program?

Potential Shortage of Air Freight Security Dogs

ACE Enhancements for the Craft Beverage Modernization Act (CBMA)

On April 6th, U.S. Customs and Border Protection (CBP) will deploy enhancements to the Automated Commercial Environment (ACE) related to the Craft Beverage and Modernization Act (CBMA).

For anyone needing a refresher, CBMA allows for reduced rates or credits on 92 tariff numbers under Chapter 22 of the U.S. Harmonized Tariff Schedule (HTSUS). As part of the upcoming enhancements, filers will be required to transmit certain data elements for CBMA claims.

What Will Change and What Will Importers Need To-Do?

Once the enhancements go into effect on April 6th, filers (Customs Brokers) will be required to provide seven (7) CBMA-related data elements at the entry summary line-item level for eligible alcohol articles (i.e., the CBMA Product Detail). These data elements include:

- Controlled Group Name

- The name that will be used for purposes of CBMA to identify this controlled group (e.g., parent company name).

- Foreign Producer Identifier

- The identifying code for the foreign producer/assigning entity named as foreign producer.

- Foreign Producer Name

- The name of the foreign producer/assigning entity as it appears on the assignment certification, or the Food and Drug Administration (FDA) manufacturer name as specified on the FDA Message Set.

- Allocation Quantity

- The total annual assignment to the Importer by the foreign producer/assigning entity for the alcohol type and rate.

- The value, in barrels (for beer), gallons (for wine or cider), or proof gallons (for spirits).

- Flavor Content Credit Indicator

- When the article is spirits, an indication that the importer used an eligible flavor content credit rate when determining the actual effective tax rate and the overall tax amount.

- CBMA Rate Designation Code

- An ACE code that specifies a Tax and Trade Bureau (TTB) product/tranche/rate.

- TTB Tax Rate

- The TTB Tax Rate in U.S. dollars ($). This data element is used as confirmation of the TTB product/tranche/rate selected.

On March 16th, CBP published CSMS #46628395, which stated that, at the time the entry summary is filed, ACE will validate the estimated CBMA internal revenue tax amount on a line item. Line items will be rejected where the importer’s CBMA internal revenue tax estimate is incorrect.

CBP notes that users are not required to submit CBMA claims on imports of alcohol. If CBMA is not requested, the standard tax rate from the HTSUS will be used, and the revenue and applicable accounting class code will be reported.

Want more information? Please reach out to [email protected].

USTR Reveals Additional Investigations into Section 301 Tariffs

Last week, as a result of the ongoing digital service tax (DST) investigations, the Office of the U.S. Trade Representative (USTR) announced the possible imposition of additional Section 301 tariffs of up to 25 percent on goods imported from Austria, India, Italy, Spain, Turkey, and the UK.

Should the duties go into effect, the items subjected to additional tariffs would be drawn from a preliminary list of goods for each country, which include, but are not limited to the following:

- Austria: leather articles, textile products, ceramic articles, stemware, glassware, glass fibers, copper alloys, printed circuit assemblies, and various instruments

- India: seafood, rice, bamboo articles, corks, cigarette paper, wool yarn, bras, pearls, precious stones, precious metal articles, and furniture

- Italy: seafood, perfumery, travel and leather goods, apparel, footwear, spectacle lenses, and optical elements

- Spain: seafood, handbags, belts, footwear, hats, and glassware

- Turkey: textile floor coverings, bed linen, curtains, stone and ceramic articles, precious metal articles, and imitation jewelry

- UK: personal care and cosmetic products, apparel, footwear, ceramic articles, precious metal articles, imitation jewelry, refrigeration equipment, industrial robots, furniture, and games

According to the USTR, it will proceed with the public notice and comment process on possible trade actions to preserve procedural options before the conclusion of the statutory one-year time period for completing the investigations. Comments are due by April 30, 2021.

Click HERE to view the official Federal Register notices.

Shapiro will continue to monitor the situation and provide updates as they become available.

Attention Importers: Request for Export Documentation by Foreign Entities and Foreign Governments Is Not Allowed

Historically, when there is a transition in the U.S. Government, or any other foreign government for that matter, requests for copies of the Electronic Export Information (EEI) increase. The U.S. Census Bureau is the official source for U.S. export and import statistics and is responsible for issuing the regulations that govern all export shipment reporting from the United States. The Census Bureau is responsible for maintaining and keeping statistics confidential.

Forwarders are not allowed to share confidential EEI filing information with foreign entities or foreign governments that request copies of the EEI for exports from the United States, as EEI information is strictly confidential.

The Foreign Trade Regulations (FTR), Title 15, Code of Federal Regulations, Section 30.60 states that the information in the EEI may not be disclosed to anyone except the U.S. Principal Party in Interest (USPPI) or their authorized agent. Furthermore, this information can only be disclosed when such a copy is needed to comply with United States official legal and regulatory export control requirements.

This also applies to the USPPI. The EEI shall not be disclosed by the USPPI, authorized agent, or representative of the USPPI, either in whole or in part, or in any form including but not limited to electronic transmission, paper printout, or certified reproduction to foreign entities or foreign governments.

Last year, the Census Bureau issued another letter advising of the confidentiality of the EEI information.

Click HERE to access the complete memorandum from Census Click.

Have You Heard about CBP’s e-Allegations Program?

Approximately 15,000 allegations were reported to U.S. Customs and Border Protection’s (CBP) e-Allegations Program between its inception in 2016 and June 2019.

There are several examples of various types of allegations that can be reported. From an importer’s perspective, it would be appropriate to review these categories to be sure that you understand what they are to ensure you are practicing diligence and compliance in all areas.

Please refer to the category of violations that are listed below:

- Forced Labor Violations

- Duty Evasion Violations: Anti-Dumping and Countervailing Duty (AD/CVD)

- Duty Evasion Violations: Other than AD/CVD – such as:

- Safeguards/Trade Remedy

- Undervalued merchandise

- Falsely Described Merchandise

- Misclassified Merchandise

- False Country of Origin Declaration

- False Trade Agreement Claim

- False Preferential Treatment Claim

- Tariff Quota Evasion

- False Drawback Claims

- Merchandise Violations: Counterfeit/Fake Goods (IPR)

- Merchandise Violations: Import Safety and Others – such as:

- Health and Safety-Violative Merchandise

- Fake, Counterfeit or Expired Drugs/Pharmaceuticals

- Environmental Crimes

- Dog and Cat Fur Products

- Conflict/Blood Diamonds

- Endangered Species

- Illegal Drug Paraphernalia

- Stolen Cultural Artifacts or Cultural Property

- Merchandise from Embargoed Countries

- Shipping Violations:

- Smuggling

- Tobacco Smuggling

- Jones Act Violation

- Transshipment Violation

- Diversion of In-Bond Merchandise

- Miscellaneous Violations:

- Unauthorized Import or Export of Defense Articles or Items with Military or Proliferation Applications

- Customs Broker Violations

- Consumer Complaints

- CBP or DHS Employee Suspected of Illegal Activity

- OTHER: Unlisted Violations

Click HERE to see the complete information and explanation of various types of violations available on CBP’s website.

How can we help? We would hate to see one of your ex-employees or a competitor file an e-allegation report against you because there was a lack of understanding or reasonable care on your part. If you do not understand, or have any concerns regarding your filings, please contact Shapiro’s Compliance Experts for assistance.

The Aftermath of EVER GIVEN

On Tuesday, March 24th, the Ever Given ran aground in the Suez Canal en route to Rotterdam. The ship sat sideways corked into the Canal, blocking any further traffic from transit until Monday, March 29th. At the time of its dislodging, container lines were projecting the backlog to be cleared within four to six days. The long-term effects are expected to ripple across the already strapped container shipping industry, which has not seen a sustained break in volume since May 2020.

The most immediate effect felt by shippers will be the delays to cargo already on the water. Almost 10% of the world’s international cargo passes through the canal. When the ship was finally dislodged, at least 367 vessels of all kinds were waiting to transit; 96 of them were container ships.

Please note that the vessels that decided to make the week-long detour around the coast of Africa were not counted in this number. In addition to the transit delay, this journey results in a second great effect – cost. In the short term, the carriers will need to make up for the additional fuel burned. In the longer term, carriers will continue to combat high demand, congestion, and slow vessel turn times.

Prior to the interruption, nearly all container vessels had already been deployed to manage the heightened demand. Between the prevailing global container shortages and port congestion, the effects of the EVER GIVEN have begun to seep further into U.S. and international ports. While some ports may see a short break in the clouds due to late arrivals, this will quickly end when the cascade of incoming ships arrive all at once. Carriers have already begun using blank sailings as a tool to retain schedules when ships return late from their rotations. It is now very possible that this event could allow for more of the same conditions.

How can Shapiro help? Should you require any assistance in successfully booking your cargo during this turbulent time, or additional information about current rates, please reach out to our Transportation team today.

Potential Shortage of Air Freight Security Dogs

The International Civil Aviation Organization (ICAO) has mandated that, effective June 30, 2021, member states screen 100% of cargo flown on commercial aircraft or implement a policy that screens/applies security controls to supply chains. As we approach this date, the Transportation Security Administration (TSA) has announced it is working to develop a framework to achieve this requirement set by the ICAO.

One such measure was to implement a third-party canine screening program in 2018, which has been used primarily for passenger flights to date and has resulted in over 200 explosive-sniffing dogs screening cargo in approximately 25 U.S. airports.

Now, the TSA is seeking to expand on this program to achieve the 100% screening mandate. But there are some challenges that have been identified. As demand for explosive-sniffing dogs is expected to increase significantly within the airfreight market, an impending shortage of the canines seems all too probable. By June 2021, TSA officials plan to more than double the number of operational canines and their teams. However, with a 60-to-90-day training regimen, this could result in some strain on the supply of fully trained canine teams available to achieve this goal.

As of March 2021, shippers are still pending a full implementation plan by the TSA that details exactly how it will meet the 100% cargo screening mandate from the ICAO. With the deadline quickly approaching, the TSA has requested that the ICAO extend the deadline due to the impact COVID-19 had on the airfreight industry.

Our Expert Shapinion

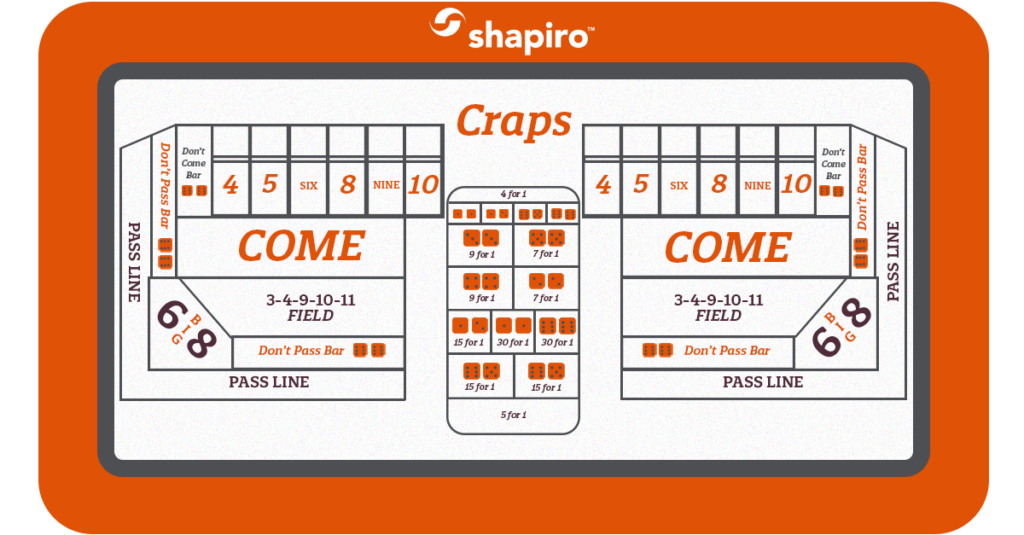

7 Reasons Importers Might Just Roll a ‘7’ in the Shipping Game of Craps in ’21

In 2020, every importer became a gambler. You high-rollers know that rolling a ‘7’ at the Craps table is great on your opening roll (called the ‘come-out roll’) but is deadly thereafter. And, let’s face it, could there be a better metaphor for what is happening today than ‘Craps’…?!

So today, we’ll look closely at the circus of economic possibilities, the carnival of carrier realities, and the casino of 2021 freight negotiations to understand who might have the hot hand, the best cards, or the all-powerful ‘ace in the hole’.

The Argument for a Winning 7 in Shipping Craps:

- All bets were off in the US services economy during the pandemic as Americans placed our purchase power wagers on goods (especially durable goods). In normal times, we put our money where our mouth is – restaurants – and double down on travel, entertainment, gyms, etc. and spend $8.5 trillion on services annually. Placing our chips on services should slow demand for goods (which grew to $4.5 trillion in 2020).

- In 2020, importers of personal protective equipment (PPE) hit the jackpot, as all of us in the global casino donned masks and wrung our hands with sanitizer (to say nothing of the equipment and medical supplies needed by the heroes in the medical field). The smart money is on a diminishment in PPE for 2021.

- Somewhat quietly, manufacturers have been forced to bet the farm on raw materials with costs doubling for many essentials. This will certainly up the ante on the costs for imported goods.

- Ironically, the steamship industry’s hot hand on rates and playing the percentages on capacity controls essentially doubled ocean shipping costs. As retail rates rise, US consumers will eventually say ‘no dice’ and reduce consumption.

- Three true tycoons of the Global Gaming House aspire to have the tallest stacks of chips on planet Earth…Maersk, MSC, and COSCO. And very quietly these fat cats, and others, have announced new services or upgrade plans for existing strings. Aspirations to be #1 must eventually sweeten the pot of capacity – and that pot is already being slowly sweetened in 2021.

- Economists are playing the percentages that the US dollar will weaken in 2021. This is a lousy luck of the draw for the relative cost of imported merchandise.

- The US federal deficit is at record levels as a percentage of GDP; this very well could stack the cards against consumers through high taxation and a sputtering broader economy.

Speed Round Reasons for a Losing 7:

- Yesterday’s demand is still with us in the form of cargo backlogs.

- $1400 stimulus checks are hitting US bank accounts at just the right time for consumer spending.

- Get rid of those sweatpants (PLEASE!); apparel should boom again.

- Auto parts and other parts and accessories should rise to compliment increased travel.

- As the restaurant trade wakes up, booze and food imports will remain strong.

- Ecommerce shipping is here to stay, and imports fuel that segment.

- Americans are still moving, selling houses, buying houses, deciding where to live…this tends to propel sales of furniture, appliances, household goods, and home repair items.

It is a safe bet that we will be paying more to stay at the shipping table in 2021 than we THOUGHT we’d be paying in 2020. But, if you play your cards right, you will pay significantly less than you ACTUALLY PAID in 2020. Your aces in the hole are keeping a percentage of cargo for FAK side bets later in 2021 and learning all the gaming rooms in the casino.

In 2021, you need more carriers and more NVOs in the mix to improve your odds for cost and cargo flow success. We are down to the wire on contract season at a time that is undeniably in the ocean carriers’ favor. However, you can be Cool Hand Luke by not over-committing to a bad hand… in fact, you might just be the winner, winner chicken dinner in this madhouse shipping casino.

Interested in reading more articles like this in the future? You can sign-up to receive the next edition of Supply Chain Reactions via our Subscription Center. (And did we mention it’s FREE?!)

Employee of the Month

As previously featured in Shap Talk, Shapiro has been sharing with you the names of employees who have been recognized for their exceptional efforts and contributions to our Company. At Shapiro, we continually work to develop, challenge, and inspire all of our employees to grow individually and with the Company.

This month, we would like to recognize GENIA BLADES, SR. IMPORT ANALYST.

Genia Blades was nominated and recognized as Employee of the Month for her dedication and persistence on behalf of our customers. A coworker was recently copied on an email where Genia very diligently chased MSCU for a solid 4 months for a large refund that was due to one of our customers. It was not a quick battle on her part, but she was persistent and on top of it. Her service and dedication to the overall customer experience was impressive and it is something to be applauded. Based on the persistent follow-up she displayed in the email communications, it is clear that this was not an isolated incident and that Genia is someone who truly embodies and exemplifies our core values in Customer Service, Diligence and Integrity. Congratulations, and thank you, Genia!

We encourage you to provide us with employee feedback! Please email us at [email protected].