Featured Headlines:

US Department of Commerce Delays Implementation of New AIM System

Criteria for Deducting Foreign Inland Freight Charges from the Price Paid

APHIS Core Message Set Full Implementation Started January 25

US Amends List of Designated State Sponsors of Terrorism

US and UK Formally Recognize CTPAT and AEO Programs

Container Shipping Outlook Through Chinese New Year

LA/LB Port Congestion Continues to Cripple West Coast

IATA Introduces Travel Pass to Assist in COVID-19 Management Efforts

US Department of Commerce Delays Implementation of New AIM System

In December 2020, the US Department of Commerce (Commerce) announced the creation of the Aluminum Import Monitoring and Analysis (AIM) system—a system that will enable Commerce to collect and publish data on aluminum imports. Commerce is said to have modeled AIM on its successful Steel Import Monitoring and Analysis (SIMA) program.

Under AIM, importers will be required to obtain a free, automatic import license for each harmonized tariff number before they import aluminum products. According to the Federal Register notice published in December, companies must report the following information to acquire the import license:

- Volume

- Value

- Country of origin

- Country of most recent cast

- Any additional information requested by Commerce officials

In addition to the above, after a one-year grace period, Commerce will require importers to report the country where imported aluminum products were smelted. Commerce will provide an additional opportunity to comment on this and other aspects of the licensing requirements in the coming months.

Although the new AIM system was originally scheduled to go into effect on January 25, 2021, officials announced last week that it would be delayed until March 29, 2021 to allow incoming Biden Administration officials additional time to review all relevant documentation prior to its implementation.

Click here to access the list of affected HTS numbers and products.

Click here to view the AIM FAQ page.

Click here to learn more about the AIM License System, including how to register for a virtual video demo.

For more information on the new AIM system, please reach out to [email protected].

Criteria for Deducting Foreign Inland Freight Charges from the Price Paid

With Section 301 and 232 affecting the total duties paid to CBP on imported goods, knowing when the foreign inland freight can be deducted from the price paid can make a huge difference.

In a recent ruling (HQ H312640), CBP explained that the foreign inland freight costs in the country of export can only be deducted from the price paid or payable when:

- There is proof of sale for export to the United States

- There is a “through” shipment from the factory

- The cost is identified separately

CBP regulations allow for foreign inland freight to be considered incident to shipment, and therefore deductible, if they are “identified separately and they occur after the merchandise has been sold for export to the United States and placed with a carrier for through shipment to the United States.”

If those conditions are not met, the foreign inland freight should be included in the transaction value of the imported merchandise and cannot be deducted.

It is also important to note that certain deductions are only appropriate if they are included in the price actually paid or payable.

A bill of lading may be provided as proof of a “through” shipment from the factory. There documents are known as “through bill of ladings” and clearly show the foreign inland freight portion of the shipment. If a bill of lading only shows the shipment of merchandise from port to port, no deduction may be made for foreign inland freight costs, as there is no evidence of through shipment from the factory to the US.

We all know that valuation is a complex matter. Certain charges can be deducted from the value, but each should be analyzed carefully, and deductions should only be made according to CBPs regulations.

For more information or additional assistance, please reach out to [email protected].

APHIS Core Message Set Full Implementation Started January 25

As you may already know, effective Monday, January 25, 2021, the Animal and Plant Health Inspection Service (APHIS) requires the mandatory filing of the PGA Message Set in the Automated Commercial Environment (ACE) when a Customs entry is filed for APHIS regulated plants, plant products, animal products, or live dog imports.

APHIS has flagged more than 2,000 HTS subheadings that may contain APHIS-regulated products. Even if your company does not import articles of an agricultural nature, your products may be flagged for APHIS Core Message Set.

As an importer, we recommend that you understand the APHIS Core regulatory requirements of your products. The good news is that Shapiro is here to help you navigate through the complicated details of this program!

For additional assistance, we recommend a visit to the APHIS Core Message Set Questions and Answers page, which covers some of the most frequently asked questions about importer submissions.

You may also want to consider using APHIS eFile for more information on obtaining any permits, registrations and licenses required to import your commodities.

How can we help? We encourage any importers with questions related to APHIS Core filings to contact the Shapiro Compliance Team.

US Amends List of Designated State Sponsors of Terrorism

Addition of Cuba

On January 12th, the US State Department announced that Cuba would be designated as a State Sponsor of Terrorism (SSOT) for “repeatedly providing support for acts of international terrorism in granting safe harbor to terrorists.”

Cuba joined three other countries on the list: Iran, North Korea, and Syria.

Click here to view the list of State Sponsors of Terrorism from the US Department of State.

Rescission of Sudan

On January 14th, the Bureau of Industry and Security (BIS) amended the Export Administration Regulations (EAR) to implement the rescission of Sudan’s State Sponsors of Terrorism (SSOT) designation.

The US Secretary of State previously rescinded this designation in accordance with established statutory procedures effective December 14, 2020. Accordingly, BIS amends the EAR by removing Anti-Terrorism (AT) controls on the country and by removing Sudan from Country Group E:1 (Terrorist supporting countries).

Click here to read the official Federal Register notice.

US and UK Formally Recognize CTPAT and AEO Programs

On January 21st, US Customs and Border Protection (CBP) announced that the United States and the United Kingdom (UK) have concluded an agreement formally recognizing each other’s supply chain security programs.

The UK will acknowledge Customs Trade Partnership Against Terrorism (CTPAT) – a voluntary, public-private partnership US program – to protect the supply chain and implement specific security measures and best practices.

In return, the US recognized the Authorized Economic Operator (AEO) status is an internationally accepted quality mark that confirms your business’s role in the international supply chain is secure and has customs control procedures that meet AEO established standards and criteria.

This mutual recognition arrangement builds on the Customs Mutual Assistance Agreement (CMAA) that the US and UK concluded in December 2020. CMAAs are bilateral agreements that provide a legal framework for the exchange of information and evidence to assist countries in the enforcement of customs laws, including duty evasion, trafficking, proliferation, money laundering and terrorism-related activities.

“This arrangement will take U.S.-UK cooperation on supply chain security to the next level,” said William A. Ferrara, Executive Assistant Commissioner of the U.S. Customs and Border Protection Office of Field Operations. “Mutual recognition of the U.S. and UK authorized economic operator programs will mitigate risks, improve information sharing, and eliminate red tape for our partners in the trade community.”

Click here to view the official CBP notice.

Please reach out to [email protected] for assistance.

Container Shipping Outlook Through Chinese New Year

With Chinese New Year (CNY) on the horizon, equipment shortages and port congestion continuing to crush ports worldwide, importers are facing what amounts to booking gridlock.

Here are the main things every importer should know about the current state and long-term outlook:

- China will be closed from February 11 to 17 for the CNY holiday; Vietnam will be closed from February 10 to 16 for the Lunar New Year holiday.

- Hong Kong, Indonesia, Malaysia, Singapore, and Taiwan will also have CNY/Lunar New Year at this time.

- Vessels departing before and during CNY are already full. The majority of importers paid for premium services to get space on these vessels.

- In mid-January, small coronavirus outbreaks in Beijing and Tianjin caused local lockdowns that have significantly slowed the movement of goods within China.

- Typically, carriers remove capacity to accommodate for the reduction in goods production during holiday factory closures. However, only 2% of capacity has been strategically removed this year. Unfortunately, an additional 9% of capacity has been withdrawn through “unintentional blank sailings” because vessels are not returning to China fast enough (especially from LA/Long Beach where more than 40 vessels are anchored awaiting a berth).

- Gridlock will continue immediately after the CNY. While space constraints should improve, vessels are expected to remain full through March and April (which are normally slower months).

How can Shapiro help? Should you require any assistance in successfully booking your cargo during this turbulent time or additional information about current rates, please reach out to our Transportation team today.

LA/LB Port Congestion Continues to Cripple West Coast

On January 25th, more than forty ships were waiting at anchor outside of the Los Angeles and Long Beach (LA/LB) port complexes. At times, some vessels have had to wait up to two weeks after their arrival at the port before they can berth. Although a situation such as this can be frustrating for shippers, it was not entirely unexpected following a cumulative volume increase that began in earnest in late October. Experts have speculated that such growth was caused by an unyielding peak season that saw record-breaking volumes each month since July 2020.

What does this mean for importers? Mostly a lot of uncertainty and a suddenly unreliable estimated times of arrival (ETAs).

Meanwhile, on land, all twelve terminals are struggling to keep up with the volume. Operators are unable to unload the containers fast enough. When they are able to do so, container dwell times hover around seven days and trucker turn times average around ninety-three minutes, according to the Harbor Trucking Association. The labor shortages resulting from COVID-19 at the ports, trucking companies and warehouses alike is also compounding supply chain restraints.

Importers should expect these problems to continue in the coming months.

Interested in staying up to date on Transpacific capacity? Visit our Subscription Center to sign-up to get the latest industry alerts delivered right to your inbox!

IATA Introduces Travel Pass to Assist in COVID-19 Management Efforts

The International Air Transport Association (IATA) has been working to launch Travel Pass, a free and secure solution designed to act as a digital health credential for airlines and passengers alike. Based on the premise of a phone app, this initiative will help passengers manage verified certifications for COVID-19 tests and vaccinations.

Estimated to be ready to use in March 2021, IATA officials have said the new Travel Pass will be “a global and standardized solution to validate and authenticate all country regulations regarding COVID-19 passenger travel requirements.” Teams have been working around the clock to get the platform up and running to help government officials authenticate a passenger’s identity and test results, as well as open borders without mandated quarantines.

With Travel Pass, passengers will have access to accurate information on required tests, authorized testing and vaccination sites, and the ability to securely provide their information to airlines and border authorities. In turn, airlines will have one source to disperse information, such as specific country requirements and flight itineraries/schedules. Finally, the platform will offer an easier way to verify that any requirements were met by passengers, as well as a process for labs to issue certificates.

Although Travel Pass was created in wake of the coronavirus, the evolution towards developing this type of platform was already in motion before COVID-19 wreaked havoc on air travel. Prior to the pandemic, IATA had partnered with Evernym to make a contactless identity app, as well as a separate travel document verification service to manage health requirements called Timatic, which served as a base model for developers.

Cargo capacity from passenger flights is currently down 57% compared to 2019 levels, which is actually a much-welcomed improvement for the beleaguered airline industrty. Though a rise in passenger travel has added much-needed cargo belly capacity as of late, the industry still has a long way to go before they will fully recover.

Our Expert Shapinion

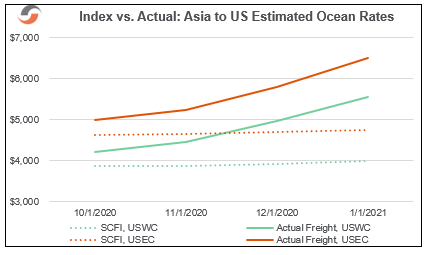

The Shanghai Containerized Freight Index is Meaningless

Since 2005, most importers and forwarders have been using the Shanghai Containerized Freight Index (SCFI), and most of us have come to trust the index to help us understand if our contracts and rates are competitive. In fact, many importers establish contract rules with NVOs and forwarders that depend on our trusted friend – the Shanghai Index.

Now, it seems that the unprecedented shipping realities that have grappled the industry since October 2020 and have powerfully accelerated through December and into 2021 have claimed another victim. Therefore, the SCFI is currently meaningless.

How can it be? How can one of our truly beloved market tools become irrelevant in a mere two or three months?

The answer, my friends, is blowing in the wind of premium surcharges. And “surcharge” is the key word here.

Somewhat cleverly, ocean carriers have rebranded ocean freight as a premium surcharge. Not only does this remove some governmental scrutiny over rates, but it also helps importers feel that they are receiving something special for their (piles and piles of) money. At the end of the day, however, premium surcharges are just a form of ocean freight. And frankly, only two or three ocean carriers should be allowed to call what they are selling a premium service.

Two things have happened to make the SCFI all but irrelevant:

- We now see over 60% of the container volume moving on premium services (with premium surcharges), with approximately 30% still moving on historically high FAK rates and 10% on fixed rate service contracts.

- Those premium surcharges have tripled in the last two months.

So, at present, the SCFI is a valid measure for less than one third of imports from China, and our reliance on the index is misleading since it masks the true state of shipping from Asia as we begin to dive into 2021.

Peter Tirschwell recently characterized today’s reality as “the global deceleration of container flows”, and boy is he right. Therefore, it is essential that we really understand that we are paying for the right to sit still and accumulate surcharge after surcharge (and delay after delay) in our supply chains.

Chart of the Issue:

Please note our best estimates for the true cost of shipping from greater Asia below:

Interested in reading more articles like this in the future? You can sign-up to receive the next edition of Supply Chain Reactions via our Subscription Center. (And did we mention it’s FREE?!)

Employee of the Month

As previously featured in Shap Talk, Shapiro has been sharing with you the names of employees who have been recognized for their exceptional efforts and contributions to our Company. At Shapiro, we continually work to develop, challenge, and inspire all of our employees to grow individually and with the Company.

This month, we would like to recognize RAKHEE RALPH, ACCOUNTS PAYABLE SPECIALIST.

2020 was quite the rollercoaster ride. In addition to the global pandemic, the accounting department was challenged with turnover, creating and adapting to new  processes and managing unprecedented (and unexpected!) volumes. Rakhee, with a smile on her face and the most positive attitude, was quick to fill the gap in Accounts Payable – an area she had limited exposure to. Her commitment to getting and staying current with our obligations while providing exceptional customer service to all internal and external customers is what makes Rakhee incredibly deserving of “Employee of the Month”. We’re so lucky to have her on the team! Congratulations, and thank you, Rakhee!

processes and managing unprecedented (and unexpected!) volumes. Rakhee, with a smile on her face and the most positive attitude, was quick to fill the gap in Accounts Payable – an area she had limited exposure to. Her commitment to getting and staying current with our obligations while providing exceptional customer service to all internal and external customers is what makes Rakhee incredibly deserving of “Employee of the Month”. We’re so lucky to have her on the team! Congratulations, and thank you, Rakhee!

We encourage you to provide us with employee feedback! Please email us at [email protected].