Featured Headlines:

Are You Ready to Start Filing Fish & Wildlife in ACE?

Why Are Intellectual Property Rights a Priority Trade Issue?

New Process for Softwood Lumber Assessment Collection

Manifest Confidentiality Requests – New Portal and Email

Goods from Hong Kong to be Marked as ‘Made in China’

USTR Investigating the Possibility of Additional Modifications of Section 301 Duties on EU Products

Section 301 Exclusion Monitoring – What You May Have Missed!

Transpacific Capacity in the COVID-19 Era

‘Preighter’ Services Begin to Phase Out

Are You Ready to Start Filing Fish & Wildlife in ACE?

On April 4, 2020, the U.S. Fish and Wildlife Service (FWS) began a three-month limited pilot within the Automated Commercial Environment (ACE) in order to test changes that were made to streamline the FWS Implementation Guide in November of 2019.

During this trial period, FWS worked closely with a limited number of registered participants, who submitted entry data through the FWS Message Set in ACE. As a result of the program’s success, all importers will be able to file FWS entries in ACE beginning July 6, 2020.

Filing will be open to all ACE filers at current FWS designated ports of entry, and non-designated entry points upon authorization. Required supporting documents can be provided via paper or DIS, but original permits must still be submitted via paper.

The new ACE filing process greatly reduces the number of HTS subheadings flagged for FWS within ACE from over 2,000 to approximately 250. Although it will not be mandatory until December 2020, it is a great opportunity for users to become familiar with the changes and requirements before they are officially enforced.

What changes should filers expect to see?

In general, all wildlife (live, parts and products) require FWS declaration and clearance per 50 CFR14. Currently, the declaration is made using the FWS electronic filing system called Electronic Declarations (eDecs) or through paper. While filers will still have the option to file declarations through eDecs, filing in ACE should eliminate many timing headaches encountered before the official implementation date.

At this time, data must be transmitted to and cleared by FWS before the CBP entry is filed. Now, filers will be able to submit both entry and FWS data at the same time, and the shipment will not be released until both FWS and CBP clear the shipment. This should promote integration and automation, making the filing of both data sets more efficient.

Please note: All ACE filers must have an eDecs filer account, which must be included in the PGA message set in ACE. This is will allow users to keep submitting monthly payments via eDecs through their corporate account.

Should you have any questions about FWS filings, please don’t hesitate to contact [email protected].

Why Are Intellectual Property Rights a Priority Trade Issue?

Priority trade issues are high-risk areas that can cause significant revenue loss, harm to the US economy, or threats to the health and safety of the American people. The Office of Trade protects American Intellectual Property by interdicting violative goods and leveraging enhanced enforcement authorities.

Intellectual Property Rights (IPR) are comprised of three types of infringements: Trademark, Copyright and Patent.

Trademark infringement is one of the most common types of IPR violations because it includes counterfeit markings, copy or simulating marks and ‘gray market’ articles.

- Counterfeit items are defined as a spurious mark that is identical with, or substantially indistinguishable from a federally registered and recorded trademark.

- Copy or simulating marks is when a mark or trade name resembles a recorded mark that the public may well associate the copied mark/name with the recorded mark/name

- Gray market goods are foreign made goods bearing a genuine trademark or tradename of a recorded US citizen/corporation/association without the proper authorization.

‘Fake goods’ is a term that is often thrown around when discussing IPR violations. This phrase has become increasingly popular with US Customs and Border Protection (CBP) as IPR violations continue to rise year after year, thereby remaining an omnipresent Priority Trade issue.

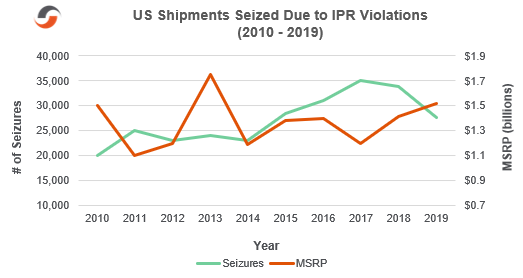

In 2019, US Immigration and Customs Enforcement (ICE) and CBP officials saw 27,599 shipments seized nationwide due to IPR violations. While the number of seized shipments is an improvement from the 33,810 seized shipments of 2018, the Merchandise Suggested Retail Price (MSRP) of 2019 totaled $1.5 billion in comparison to $1.4 billion in 2018. The inflation of MSRP has been steadily rising since 2017 though it is lower than 2013 when roughly 24,000 seized shipments had an estimated MSRP of $1.75 billion.

What many people do not realize is that the current trade dispute with China involves their entanglement in IPR violations. Specifically, the US has accused China of ‘bad faith trademarking’ and ‘substantial infringement’ following the results of its Section 301 Investigations. In the past year alone, goods originating in China made up 66% of the total MSRP for seized cargo.

After months of negotiating, the US and China signed the first phase of an economic and trade agreement on January 15, 2020. Phase one covers IPR concerns brought up during the initial investigation – which include trade secrets, patents, trademarks, pirated and counterfeit goods. The agreement provides an action plan for China to make structural changes, in addition to strengthening the protection and enforcement of IPRs in China.

As of July 1st, CBP has seized over 13,600 counterfeit goods, with an MSRP of $730 million this year. While COVID-19 brought many industries to a screeching halt, CBP officials found themselves working in overdrive to ensure that unsafe drugs and medical devices were not entering the consumer market. Counterfeit facemasks, test kits, anti-virus products and medical tablets are just some of the items stopped by officials in recent months. CBP is fully aware that the importation of “fake goods” is not likely to stop anytime soon.

For more information on IPR and how to avoid violations, reach out to [email protected].

New Process for Softwood Lumber Assessment Collection

US Customs and Border Protection (CBP) announced a new process that will collect assessments on imported softwood lumber covered under the Softwood Lumber Checkoff (CSMS #428944 78). The Checkoff is a mandatory program administrated by the Softwood Lumber Board (SLB), with oversight by the US Department of Agriculture. Under the Checkoff program, assessments are collected from importers of record and US manufacturers of softwood lumber.

Effective July 1st, the Checkoff will be collected by CBP from all importers of record. The current assessment rate is $0.35/thousand board feet, and all companies are exempt from paying assessments on their first 15 million board feet (mmbf) shipped to, or within, the US.

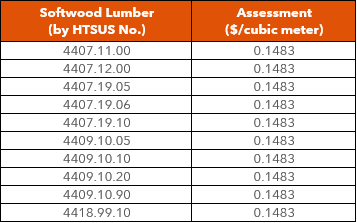

The HTSUS categories and assessment rates on imported softwood lumber are listed in the table below, which can be found in section 1217.52(h). A factor shall be used to determine the equivalent volume of softwood lumber in thousand board feet. The factor used to convert one cubic meter to one thousand board feet is 0.423776001. Accordingly, the assessment rate per cubic meter is as follows:

Refunds will be issued to importers of record based on company names and addresses in the CBP database.

Large importers of record (those shipping 15 mmbf or more annually to the US) will receive a refund from the SLB on assessments paid on their first 15 mmbf shipped. Furthermore, the submission of a quarterly report, from large importers to the SLB, will no longer be necessary.

Small importers of record (those shipping less than 15 mmbf annually to the US) will receive a refund from the SLB on all their assessments collected by CBP. However, they may also apply for a Certificate of Exemption. This process will help the SLB ensure the accuracy of information.

Click here to view additional details on the application process.

Manifest Confidentiality Requests – New Portal and Email

On May 22, 2020, U.S. Customs and Border Protection (CBP) announced both a physical mailing address and an e-mail address that can be used to submit requests for the confidential treatment of vessel manifest certifications in the following Federal Register notice.

CBP also revealed a new way to submit requests for confidential treatment of vessel manifest certifications, which can be made via the Vessel Manifest Confidentiality Online Application, an online portal on www.CBP.gov. This new portal allows CBP to review confidentiality requests more efficiently by automating the submission process, thereby reducing the processing time to as little as 24 hours in most cases. This is welcomed news for the trade community!

The process where parties can request that CBP keep certain manifest information confidential is described in 19 CFR part 103.31. For an inward manifest, an importer or consignee may request confidential treatment of its name and address, including identifying marks and numbers. For an outward manifest, a shipper, or authorized employee or official of the shipper, may request confidential treatment of the shipper’s name and address.

For CBP related inquiries, contact: Vessel Manifest Program Manager, Office of Trade (Mail Stop 1354), US Customs and Border Protection, 1801 N Beauregard Street, Alexandria, VA 22311; or via [email protected].

Questions? Please reach out to [email protected].

Goods from Hong Kong to be Marked as ‘Made in China’

On July 14th, President Donald Trump signed an Executive Order officially revoking preferential economic treatment for Hong Kong in response to mainland China’s enforcement of a controversial security law on July 1. In a White House statement, President Trump stated that Hong Kong will be treated “the same as mainland China, no special privileges, no special economic treatment and no export of sensitive technologies”.

Hong Kong, a major global financial center, has enjoyed special trade status with the US since 1992. Because it has been treated separately from mainland China on customs and travel related matters, the territory has been spared from the punitive Section 301 trade tariffs applied by the US on China.

Following Trump’s announcement, products in Hong Kong will be marked as ‘Made in China’; however, exports from Hong Kong will NOT be subject to any Section 301 duties that may apply to those products.

We learned on July 23, 2020 that, according to a senior administration official, “the July 14, 2020 Executive Order on Hong Kong Normalization does not provide for new US tariffs on goods from Hong Kong. The Administration will continue to evaluate and adjust our policies as conditions warrant.”

In response to Trump’s announcement, the Chinese government vowed it will retaliate and make any necessary responses to protect its legitimate interests, which may include the imposition of sanctions on relevant US personnel and entities. However, it has yet to elaborate on any such actions.

Shapiro is actively monitoring the situation and will provide status updates as they become available. To receive the latest updates, subscribe to our Shap Flashes.

If you have any questions about this development, please reach out to [email protected].

USTR Investigating the Possibility of Additional Modifications of Section 301 Duties on EU Products

As you are already aware, the Office of the U.S. Trade Representative (USTR) imposed Section 301 tariffs on $7.5 billion worth of European goods in response to the European Union’s (EU) subsidization of Airbus in October 2019. Although the USTR previously modified the list of EU products subject to additional tariffs in February of this year, officials also issued a warning that they were still considering whether the current rate of additional duty should be increased to as high as 100% going forward.

Now, the USTR has announced that they are seeking comments from the trade community to help determine whether further modification is needed.

The official notice published in the Federal Register contains three Annexes:

- Annex I contains the list of products currently subject to additional duties.

- Annex II contains a list of products, originally published in April and July 2019, that are still under consideration, but not currently subject to additional duties.

- Annex III contains a new list of products being considered for imposition of additional duties.

With respect to products listed in Annex I, USTR invites comments on whether specific products of current or former EU member States should remain on or be removed from the list, and if a product remains on the list, whether the current rate of additional duty should be increased to as high as 100 percent.

With respect to products listed in Annexes II and III, USTR invites comments on whether specific products of specific current or former EU member States should be included on a revised list of products subject to additional duties, and the rate of additional duty (as high as 100 percent) that should be imposed.

If the U.S. Trade Representative determines to modify the action being taken in the investigation, the final list of products subject to additional duties in the action may be drawn from the list of products contained in Annex I, II and III.

All submission requests must be sent electronically via the USTR Comment Portal by July 26, 2020; the docket number is USTR–2020–0023.

Section 301 Exclusion Monitoring – What You May Have Missed!

The Office of the U.S. Trade Representative (USTR) has issued several rounds of products excluded from Section 301 tariffs in recent weeks. Please refer to the following timeline for more information regarding each exclusion:

- June 9, 2020:USTR releases its 33rd round of product exclusions. The notice contains (2) HTS subheadings completely excluded from List 4A tariffs and (32) partially excluded subheadings, which cover 55 separate exclusion requests.

- June 23, 2020:USTR releases its 34th round of product exclusions. The notice contains (1) HTS subheading completely excluded from List 3 The notice also includes five updates to previously announced List 3 exclusions.

- July 6, 2020:USTR announces that 12 products from the sixth round of exclusions on List 1 goods will retain their exclusionary status from additional tariffs until December 31, 2020.

- July 7, 2020:USTR releases its 35th round of product exclusions. The notice contains (61) partially excluded subheadings completely excluded from List 4A tariffs, which cover 86 separate requests.

- July 20, 2020: USTR releases its 36th round of product exclusions. The notice contains (11) HTS subheadings completely excluded from List 4A tariffs and (53) partially excluded subheadings, which cover 242 separate exclusion requests.

The USTR is also seeking comments regarding the extension of certain sets of products previously excluded from Section 301 tariffs, which are set to expire in the coming weeks and months. Each round of extensions would add up to an additional year of validity to the current product exclusions. However, thus far, most of the exclusions have only been extended through December 31, 2020. It’s important to remember that it is very likely that not all products/HTS subheadings that were originally granted exclusions will receive extensions.

List 2 – Round 2:

The second round of List 2 exclusions covers 89 HTS subheadings. Originally granted on September 20, 2019, this round of exclusions is currently set to expire on September 20, 2020.

Please refer to the schedule below for all consideration and comment deadlines:

- July 1, 2020: Online portal will open for submissions beginning at 12:01 am ET

- July 30, 2020: All written comments must be submitted by 11:59 pm ET

All submission requests must be sent electronically via the USTR Comment Portal; the docket number is USTR–2020–0025. The official USTR notice can be found HERE.

List 2 – Round 3:

The third round of List 2 exclusions covers 111 HTS subheadings. Originally granted on October 2, 2019, this round of exclusions is currently set to expire on October 2, 2020.

Please refer to the schedule below for all consideration and comment deadlines:

- July 1, 2020: Online portal will open for submissions beginning at 12:01 am ET

- July 30, 2020: All written comments must be submitted by 11:59 pm ET

All submission requests must be sent electronically via the USTR Comment Portal; the docket number is USTR–2020–0026. The official USTR notice can be found HERE.

List 4A – Rounds 1-5:

The first five rounds of List 4A exclusions were issued between March 10, 2020 and June 12, 2020. These rounds of exclusions are currently set to expire on September 1, 2020.

Please refer to the schedule below for all consideration and comment deadlines:

- July 1, 2020: Online portal will open for submissions beginning at 12:01 am ET

- July 30, 2020: All written comments must be submitted by 11:59 pm ET

All submission requests must be sent electronically via the USTR Comment Portal; the docket number is USTR–2020–0027. The USTR notice can be found HERE.

List 4A – Rounds 6 and 7:

The sixth round of List 4A exclusions covers 61 HTS subheadings. Originally granted on July 7, 2020, this round of exclusions is currently set to expire on September 1, 2020.

The seventh round of List 4A exclusions covers 64 HTS subheadings. Originally granted on July 20, 2020, this round of exclusions is currently set to expire on September 1, 2020.

Please refer to the schedule below for all consideration and comment deadlines:

- July 15, 2020: Online portal will open for submissions beginning at 12:01 am ET

- August 14, 2020: All written comments must be submitted by 11:59 pm ET

All submission requests must be sent electronically via the USTR Comment Portal; the docket number is USTR–2020–0029. The USTR notice can be found HERE.

For issues with online submissions related to Section 301, please contact: Assistant General Counsels Philip Butler or Benjamin Allen, (202) 395–5725.

How can we help? Please reach out to [email protected] for assistance with renewing your filings!

Shapiro will continue to monitor and provide status updates on our Section 301 Tariff News page as they become available.

Transpacific Capacity in the COVID-19 Era

With Transpacific trade approaching its peak season, rates are high, space is tight, and cargo rolls are frequent. On July 1st, many carriers announced a General Rate Increase (GRI), which marked the third slated increase within a 30-day period. Carriers previously filed for rate increases on June 1st and June 15th, despite a reported 10% reduction in volume, according to PIERS.

What caused the supply chain reaction(s)?

The answer is complicatedly simple. Over the past few months, the industry has had to deal with the continued effects of COVID-19, which have caused a ripple effect across the transportation industry. Current capacity trends can be largely attributed to a combination of the following events:

- January – February: The lockdown in mainland China halts the production and manufacturing of goods.

- March – April: The US lockdown adds fuel to the fire with additional production delays and order cancelations, pushing carriers to cut capacity by nearly 20%.

- May – June: A surge of import bookings causes vessels to become overbooked, resulting in rolls across the board.

- July: Carriers begin to reinstate much of the capacity that had been reduced in March; only four services remain blanked.

What’s ahead?

While shippers hope that the increase in sailing capacity will provide a little R&R (rate and roll) relief in the near future, they are left to grapple with delays and cost increases now.

Though it’s nearly impossible to predict the future of Transpacific capacity in the long term, carriers and importers alike agree that it will heavily depend on US consumers and economic recovery domestically.

Interested in staying up to date on Transpacific capacity? Visit our Subscription Center to sign-up to get the latest industry alerts delivered right to your inbox!

‘Preighter’ Services Begin to Phase Out

Back in early May, passenger flights were reduced dramatically, which had a significant impact on Airline capacity for cargo. The International Air Transport Association (IATA) estimated that capacity had dropped by 22.7%. One of the ways the airlines sought to address this reduced capacity was to convert their passenger aircraft to ‘Passenger—Freighters’ or ‘Preighters’, as coined by the Airline Lufthansa.

With passenger aircraft being grounded due to the pandemic, airlines needed to find a way to increase their cargo capacity to address the rising demand for important cargo – such as personal protective equipment (PPE). Airlines, including Lufthansa and Delta, began converting some of their grounded passenger aircraft to Preighters, where in some cases the seats would be removed from the aircraft to make room for cargo. Preighters quickly became the major way in which airlines sought to address the limited cargo capacity available, to address the rising demand for cargo space.

Although Preighters helped increase cargo capacity, it appears they will soon be phased out of existence and reverted to passenger aircraft. Both Lufthansa and Cathay Pacific have advised that the peak for Preighter service occurred in May of this year, but with rising fuel costs and more frequent freighter services, we should expect to see Preighter flights become less frequent. Furthermore, passenger flights continue to enter back into the market, which is helping to increase demand there.

All in all, because of the increased demand resulting from returning passengers and decreasing airfreight rates, we can anticipate that Preighter services will begin to phase out of the market.

Questions? Don’t hesitate to contact our airfreight specialists with any and all questions related to capacity and rates.

SUPPLY CHAIN REACTIONS

This bi-weekly review of the supply chain world is a combination of our COVID-19 Supply ‘Pain’ News (CSPN) and Freight Report. It provides key insights into the many things that have been affected by and during the pandemic. From the U.S. trucking industry conditions to global airfreight, Shapiro touches on the pressing news that logistics managers need to know. Check our Coronavirus News page to ensure that you don’t miss key industry insights that are constantly evolving!

EMPLOYEE OF THE MONTH

As previously featured in Shap Talk, Shapiro has been sharing with you the names of employees who have been recognized for their exceptional efforts and contributions to our Company. At Shapiro, we continually work to develop, challenge, and inspire all of our employees to grow individually and with the Company.

This month, we would like to recognize Rich Lucas, Corporate Recruiter.

Having previously been a member of the operational side of the company, during a global pandemic, Rich was very quick to offer his knowledge, skills, and abilities wherever they could help Shapiro the most. He quickly found himself thrust into the world of credit and collections, a pretty big deal to a self-proclaimed non-numbers guy. Rich jumped in with both feet and didn’t miss a step. He has been able to accomplish something many people struggle to do, which was to completely pivot his focus from his recruiting role to be an integral player within the accounting team. Rich is the epitome of “Employee of the Month” displayed long before this crazy environment we all find ourselves. Congrats Rich!