New Year, New Compliance Goals

The start of a brand-new year is a great opportunity to wipe your compliance slate clean and introduce positive actions to ensure a successful program. The main objective is to evaluate what’s working and what’s not, and the guide below should assist in keeping you on the straight and narrow. Resolution # 1: Your Own […]

Continue Reading »Simply VAT Guest Blog: HRME Is Clamping Down on Non-Compliant Non-UK Online Retailers. Have You Been or Are You Going to be Affected?

What you need to know? HMRC are currently approaching both sellers directly and via the marketplaces such as Amazon and eBay searching for non-VAT compliant non-UK sellers. What are they looking for? If you are a non-resident UK business and hold stock in the UK, either in a 3PL center such as Amazon FBA, you […]

Continue Reading »Is Your Product Subject to Participating Government Agencies?

Participating Government Agencies, more commonly known as PGAs, regulate commodities imported into the United States. To avoid problems in the clearance of your merchandise, we strongly recommend that you familiarize yourself with policies and procedures prior to importing your goods. Unfortunately, figuring out if your specific product is regulated by one of these agencies can […]

Continue Reading »Be Prepared and Skip the Fines: A Guide to What Should be in Your Compliance Toolbox

If U.S. Customs decides to pay you a visit, will you be prepared? If you’re not complying with applicable laws and regulations, you could be facing some hefty monetary fines, seized shipments and maybe even jail time. No one wants to be in that situation, and now more than ever it’s imperative that importers and […]

Continue Reading »EINs and CAINS: These Numbers are Driving Me Insane!

Freight quote. Check! Duty rate. Check! Commercial Documents. Check! As importers tick items off their shipment checklist, one of the most important tasks is purchasing a Customs bond – and setting it up right. Customs bonds are required for all importers and are necessary for you to act as the importer of record for your […]

Continue Reading »What’s in a Set? Breaking Down Set Breakdowns

Importing set breakdowns to the United States comes with its own set of customs requirements; Shapiro is set on making this easy for you! See what we did there? Customs requires importers to not only declare the set within their Customs entry, but also each component of the set. Shapiro needs to know the weights […]

Continue Reading »Don’t Let Wood Packing Material (WPM) Violations Slow Down Your Supply Chain!

If you’ve been living under a rock since 2005 or aren’t fluent in compliance geek, you’re likely not aware of the International Standards of Phytosanitary Measures (ISPM 15) Regulation of wood packaging material in international trade, which we wanted to bring to your attention as U.S. Customs has plans to start issuing lofty violations against […]

Continue Reading »Importer Clarity for FDA’s FSVP Program

To our fellow food importers, Many of you may have heard that FDA is imposing yet another program in 2017 called Foreign Supplier Verification (FSVP) Program. Don’t stress. Shapiro is here to make sure you are compliantly prepared. We’re guessing you have some questions, so we’ve compiled an FSVP FAQ guide to help: What is FSVP? […]

Continue Reading »Shapiro Centers of Excellence Design Aligns with CBP

Customs now has a solid new platform of visibility called Automated Commercial Environment (ACE). They also have established commodity specialists and developed commodity Centers of Excellence and Expertise (CEE). These entities have much more access to information—and are extraordinarily informed about commodities—much, much more informed than they have ever been. This is especially true because […]

Continue Reading »Beware of Customs Bearing Gifts: Informed Compliance Letters!

It’s the ole’ Trojan horse scenario. Just when you think Customs is being helpful sending out Informed Compliance Letters to your business with information to “assist” your company with ensuring compliance, they will state in the document that since this information has been provided to your company, violations that may occur in the future could […]

Continue Reading »Why Duty Calculators Are Not Created Equal

Technology is wonderful. No one will deny that. It allows us to shift black-and-white tedious work to a program, so we can focus on what is truly complicated and worthy of our delightful human brain. Let’s talk about freight calculators for a moment. We move cargo from point A to point B (like human airfare […]

Continue Reading »Examining the Issue (Part Deux): Customs Inspection Questions Answered!

NO! WHY ME?! Just a few phrases you may use when a shipment gets pulled for a customs examination, or if you’ve been in this industry long enough, it’s more like a slew of curse words that you wouldn’t dare speak in front of your mom. But don’t worry, Shapiro is here to clear things up. […]

Continue Reading »11 Essential Questions To Ask Before You Consider Self-Filing Your Customs Entries

So there you are, going about your (crazy) business, and out of nowhere, your boss asks, “Hey, what if we started to self-file our Customs entries and did it all in-house? Wouldn’t that save us a lot of money?” Your world seems to temporarily collapse and you can’t breathe properly. How do you even begin […]

Continue Reading »Fun Facts You Did Not Know About Importing

After three decades providing Customs brokerage services, I’ve come across some strange shipments (at my first employer, we had regular shipments of sand to Saudi Arabia) and stranger people, but that’s for another day. In this blog, I’d like to share some of the more fascinating and odd facts of our import world. Did you […]

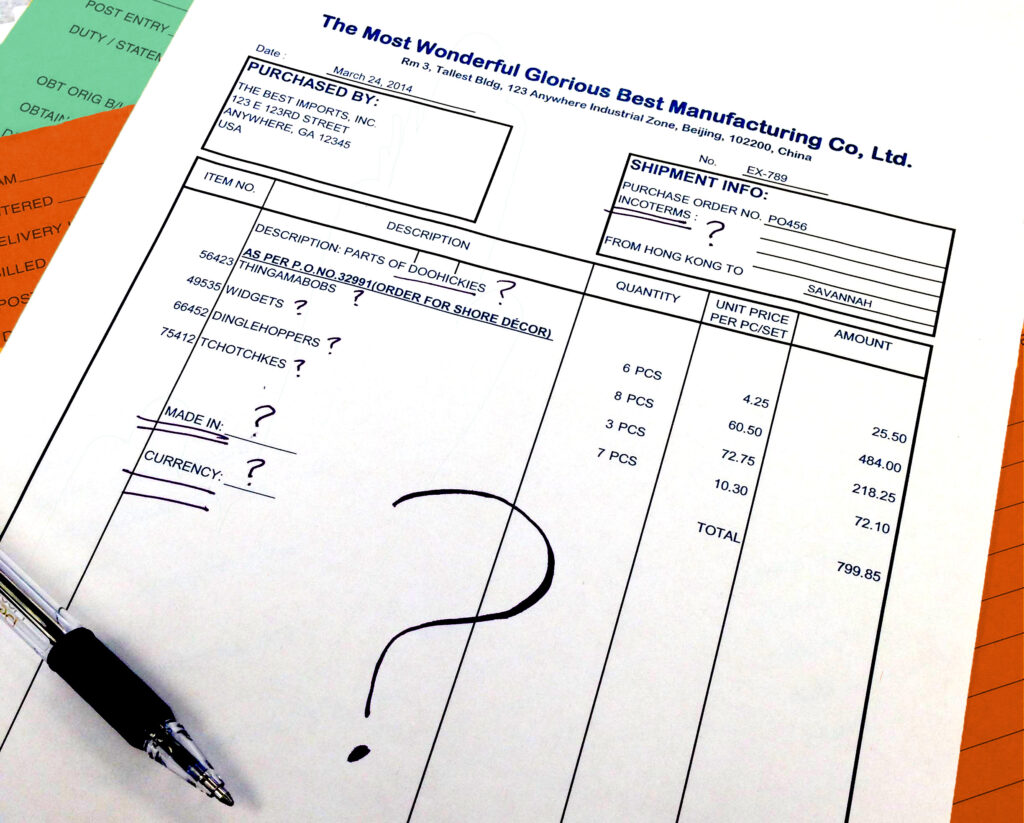

Continue Reading »The Anatomy of a Perfect Commercial Invoice: 11.5 Point Checklist

Importing can be tough. There are so many rules and regulations for importers to keep track of that it can be easy to forget all of the information that’s required for a Customs entry. One of the most important documents brokers need for writing entries is the commercial invoice. Without an invoice, we would have […]

Continue Reading »Top 3 Reasons to Review Your Import/Export Trade Compliance Program NOW!

When was the last time you took a long, hard look at your trade compliance program? What compliance program? Perhaps you work for a company where you wear multiple hats – purchasing, logistics, and oh yes, take care of that Customs stuff, too. Your priorities may depend on your reporting structure. If you report to […]

Continue Reading »Do Exporters Have to Keep Records, Too? A Guide to the Ins and Outs of Export Recordkeeping

I sincerely hope this does not shock anyone but recordkeeping is not only for importers! Exporters must maintain records as proof of compliance with U.S. government regulations for a minimum of 5 years. If Customs and Border Protection (CBP), or the Bureau of Industry and Security (BIS), Census, or any other U.S. Government Agency that […]

Continue Reading »Importer Security Filing: 7 ISF Best Practices You Shouldn’t Ignore

The Importer Security Filing (ISF) began in January 2009 with a one-year introductory phase-in period. Full enforcement began in January 2010, but Customs and Border Protection (CBP) maintained a flexible and measured enforcement stance. Penalty guidelines were published in July 2009, but Customs held off doing anything until July 2013 when they announced they would […]

Continue Reading »A Wine Enthusiast’s Step-by-Step Beginner’s Guide to Importing Wine

As a lover of all wines good and as a budding hobbyist and neophyte collector of Italian (Piedmont, Tuscany, and Umbria regions), French (Rhone region), Spanish (Murcia and Rioja regions), and Washington State (Columbia Valley) varietals, I can’t seem to get enough of the culture, industry personalities, and business mechanics of my new found passion. […]

Continue Reading »Are Your Competitors Paying Duty? The Truth Behind Trade Data Confidentiality

“My competitors don’t pay duty.” Boy, if I had a dollar for every time I have heard this over my career, I would not need to worry about my kids’ college tuitions. How does an importer know for sure that the competition is not paying duty? Customs entry information is strictly confidential and not even […]

Continue Reading »